This post is part of our live coverage of FinovateSpring 2015.

![]() Stratos debuted its digital card issuance platform:

Stratos debuted its digital card issuance platform:

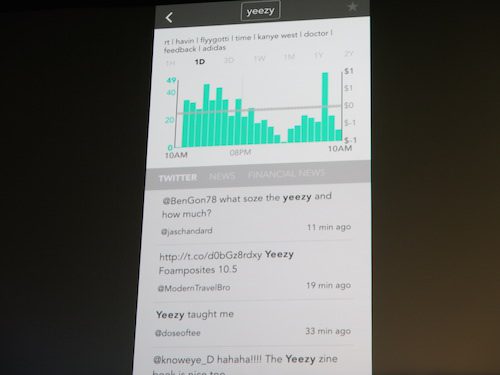

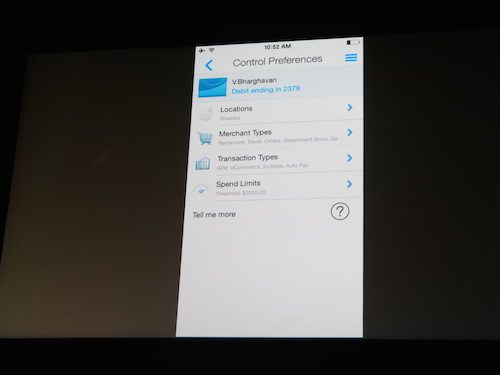

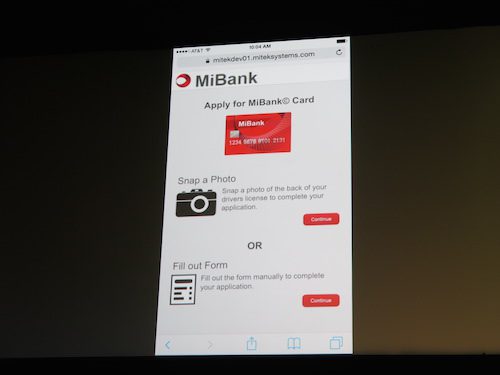

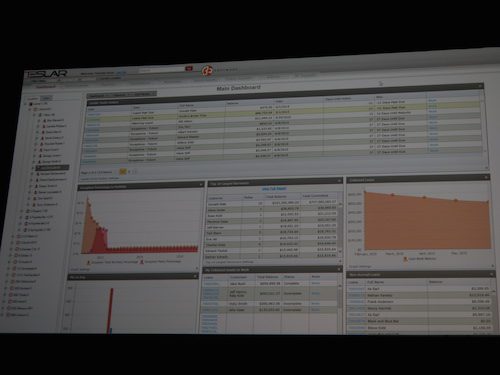

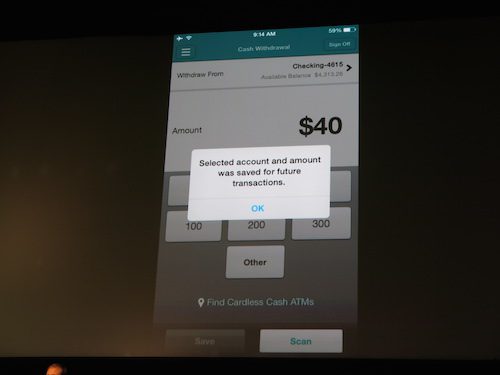

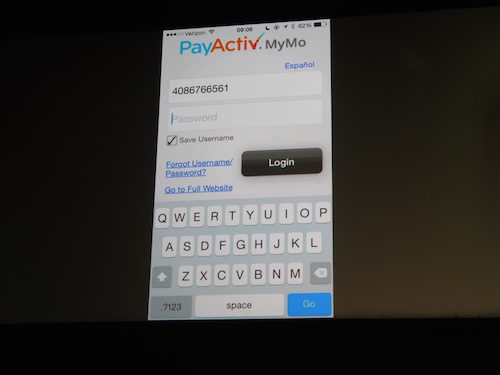

Stratos is reinventing your wallet and cards like the iPod and iTunes reinvented your CD collection. Stratos consolidates your debit, credit, loyalty and gift cards into one dynamic card. Stratos Card works in conjunction with Stratos Digital Card Issuance Platform which will debut virtual card issuance, allowing cards to be downloaded instantly, digitizing the physical fulfillment system that issues billions of cards in the U.S. The platform analyzes card-usage trends and interactively engages card members. Stratos works with the mobile lockscreen, making real-time location or history-based suggestions, and offers patented security card-lockdown and insights for a superior customer experience. Its dual stripe technology ensures 100% compatibility with existing card-acceptance infrastructure.

Presenters: Co-founders Thiago Olson, CEO; Henry Balanon, CTO

Product Launch: The Stratos Card began shipping to consumers in April 2015; however, the Stratos Digital Card Issuance Platform is being announced and demonstrated for the first time at FinovateSpring 2015.

Metrics: Stratos has raised over $7M in funding to-date. The company has more than 50 employees, contractors, consultants and overseas manufacturing teams.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B)

HQ: Ann Arbor, Michigan

Founded: 2012

Website: stratoscard.com

Twitter: @StratosCard