While this week’s total of $160 million ($124 mil equity; $36 mil debt) won’t make headlines, the 14 companies raising money included a number of interesting plays. The biggest amount by far was the $64 million in equity plus $36 million in debt, invested in personal finance portal NerdWallet. And with a little less runway, Istanbul-baseed TravelersBox picked up $500,000 for its system to turn excess foreign currency and coins into gift cards.

While this week’s total of $160 million ($124 mil equity; $36 mil debt) won’t make headlines, the 14 companies raising money included a number of interesting plays. The biggest amount by far was the $64 million in equity plus $36 million in debt, invested in personal finance portal NerdWallet. And with a little less runway, Istanbul-baseed TravelersBox picked up $500,000 for its system to turn excess foreign currency and coins into gift cards.

Two FinovateSpring 2015 presenters landed big rounds:

- Credit Sesame raised $16 million to expand its debt-management and credit-tracking platform

- Vouch landed $6 million to help put the “first P” back in P2P lending

In total, 14 companies raised $160 million (not counting the undisclosed amount Square raked in to fund more alt-lending to its SMB customers). Here are the deals from 9 May to 15 May by size:

NerdWallet

Personal financial information

HQ: San Francisco, California

Latest round: $100 million Series A ($64 million equity; $36 million credit line)

Total raised: $100 million

Tags: Personal finance, advice, financial education, lead generation, Silicon Valley Bank (lender)

Source: TechCrunch

Credit Sesame

Consumer credit management

HQ: Mountain View, California

Latest round: $16 million

Total raised: $35.4 million

Tags: Finovate alum

Source: Crunchbase

Wave

Online accounting and invoicing

HQ: Toronto, Ontario, Canada

Latest round: $10 million Series C

Total raised: $28.5 million

Tags: Accounting, bookkeeping, accounts payable, accounts receivables, SMB

Source: FT Partners

Exchange Corporation

Online lending (Paidy)

HQ: Tokyo, Japan

Latest round: $8.3 million

Total raised: $11.6 million

Tags: Consumer lending, marketplace, underwriting, risk management

Source: FT Partners

Credifi

Data analytics for commercial real estate

HQ: New York City, New York

Latest round: $8 million Series A

Total raised: $8 million

Tags: Real estate, commercial mortgage lending, big data, investing, risk management

Source: Crunchbase

Vouch

Lending social network

HQ: San Francisco, California

Latest round: $6 million Series A

Total raised: $9 million

Tags: Lending, consumer loans, underwriting, social, P2P, peer-to-peer, Finovate alum

Source: Crunchbase

Vested Finance

Next-gen student financing

HQ: Austin, Texas

Latest round: $5 million

Total raised: $5 million

Tags: Student loans, lending, underwriting, youth market

Source: Crunchbase

Trusted Insight

Institutional investor network

HQ: Middletown, New Jersey

Latest round: $2.5 million Series A

Total raised: million

Tags: Investing, social, institutional investors

Source: FT Partners

Wallflower

Insurance company-backed, internet-of-things company

HQ: Charlestown, Massachusetts

Latest round: $1.5 million

Total raised: $2.8 million (includes $300,000 debt)

Tags: Insurance, iOT, safety, American Family Insurance (partner)

Source: Crunchbase

ShareIn

Equity crowdfunding platform

HQ: Edinburgh, Scotland, United Kingdom

Latest round: $1 million Seed

Total raised: $1 million

Tags: P2P, investing, SMB, peer-to-peer

Source: Crunchbase

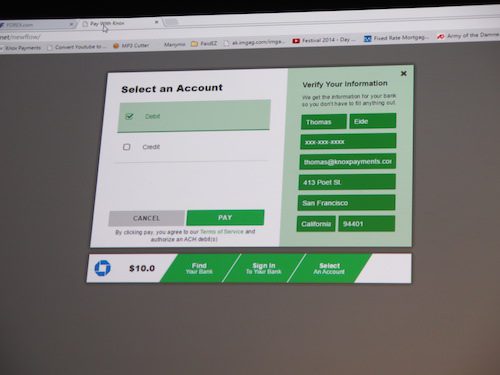

Droplet

Mobile payments & rewards

HQ: Birmingham, England, United Kingdom

Latest round: $890,000

Total raised: $2.4 million

Tags: Payments, rewards, mobile, CrowdCube (investment marketplace used to raise round)

Source: Crunchbase

TravelersBox

Solution for collecting left over foreign currency

HQ: Istanbul, Turkey

Latest round: $500,000

Total raised: million

Tags: Cash, currency, gift cards, rewards

Source: FT Partners

Satoshi Citadel Industries

Building bitcoin ecosystem for the Philippines

HQ: Manila, Philippines

Latest round: $100,000 Seed

Total raised: $100,000

Tags: Bitcoin, cryptocurrency

Source: Crunchbase

Square

SMB payments and financing

HQ: San Francisco, California

Latest round: Unknown “non-dilutive” commitment to Square Capital

Total raised: $591 million

Tags: Payments, mobile, acquiring, SMB

Source: VentureWire

While this week’s total of $160 million ($124 mil equity; $36 mil debt) won’t make headlines, the 14 companies raising money included a number of interesting plays. The biggest amount by far was the $64 million in equity plus $36 million in debt, invested in personal finance portal NerdWallet. And with a little less runway, Istanbul-baseed TravelersBox picked up $500,000 for its system to turn excess foreign currency and coins into gift cards.

While this week’s total of $160 million ($124 mil equity; $36 mil debt) won’t make headlines, the 14 companies raising money included a number of interesting plays. The biggest amount by far was the $64 million in equity plus $36 million in debt, invested in personal finance portal NerdWallet. And with a little less runway, Istanbul-baseed TravelersBox picked up $500,000 for its system to turn excess foreign currency and coins into gift cards.

Alpha Payments Cloud

Alpha Payments Cloud