This post is part of our live coverage of FinovateSpring 2015.

![]() INETCO Systems demoes next with its analytics platform to help FIs make the most of omnichannel customer engagement.

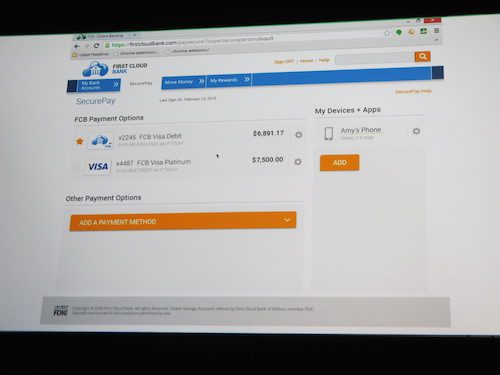

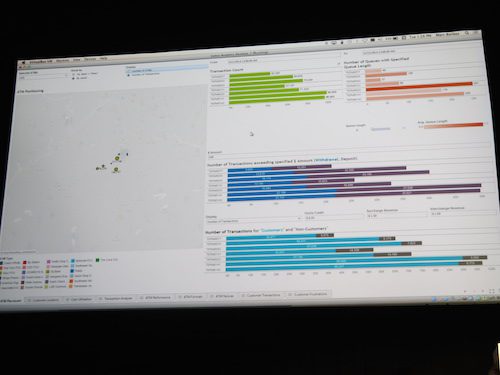

INETCO Systems demoes next with its analytics platform to help FIs make the most of omnichannel customer engagement.

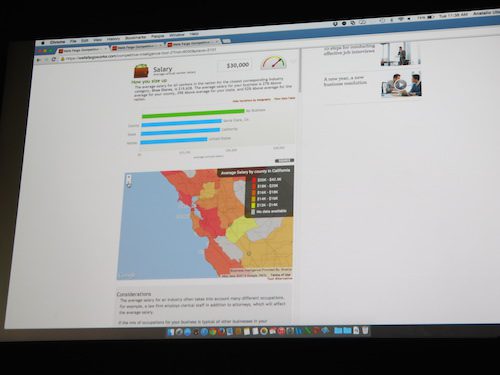

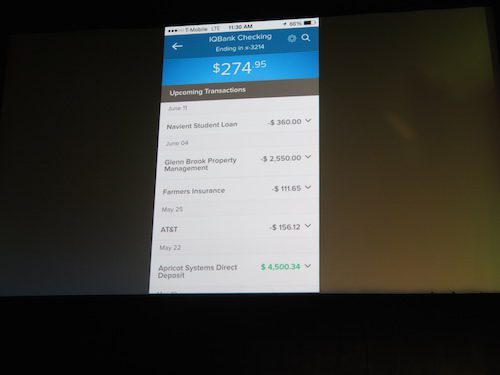

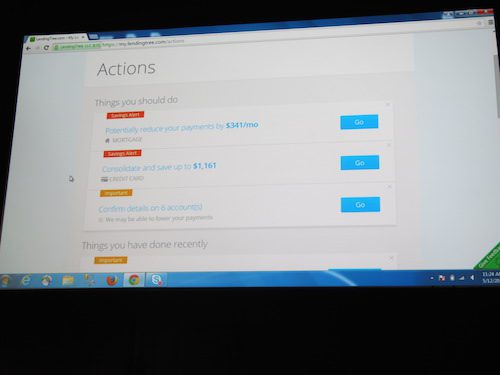

INETCO Analytics provides financial institutions with the game-changing knowledge of where, when and how customers interact with their channels. This application makes it easy for business managers to instantly access the transaction data they need to drive consumer banking engagement strategies and deliver greater profitability across all banking channels.

INETCO presenters: Marc Borbas, VP, product marketing; Dallas Pretty, CFO

Product Launch: January 2015

Metrics: Privately funded; 35+ employees; 100% revenue growth per annum since 2012; global customer base of more than 50 banks, payment processors, telco providers and retailers.

Product distribution strategy: Direct to Business (B2B), through other fintech companies and platforms, licensed

HQ: Burnaby, British Columbia, Canada

Founded: June 1984

Website: inetco.com

Twitter: @INETCOAnalytics