![]() This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

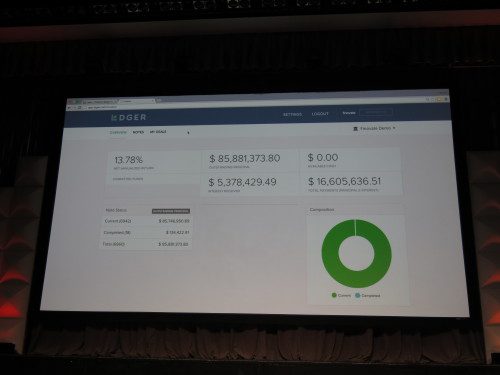

Our next demonstration comes courtesy of Ldger.

To address the gap in the innovation cycle, Ldger has built a powerful and flexible structuring and cash-flow-automative platform that permits investors in, and originators of, marketplace-originated credit to build and market customized tranches of risk exposure against marketplace credit cash-flows.

Presenters: Miles Cowan, CEO, founder; Hyung Kim, co-founder, financial markets

Product launch: Target Q4 2015

Product distribution strategy: Direct to business (B2B); through financial institutions; through other fintech companies and platforms

HQ: New York City, New York

Founded: March 2014

Website: ldger.com

Twitter: @ldgerinc