As the titans dominate the smart speaker landscape, Theodora (Theo) Lau — Innovator Technologist and Connector at Unconventional Ventures — discusses what the future might look like for fintech, financial institutions and brands. Join Theo and other panelists for the session titled “Is the future digital interface voice activated?” at the upcoming FinovateSpring in Santa Clara, May 8 through 11, 2018.

As the titans dominate the smart speaker landscape, Theodora (Theo) Lau — Innovator Technologist and Connector at Unconventional Ventures — discusses what the future might look like for fintech, financial institutions and brands. Join Theo and other panelists for the session titled “Is the future digital interface voice activated?” at the upcoming FinovateSpring in Santa Clara, May 8 through 11, 2018.

Advances in voice recognition have fueled substantial growth in virtual assistants and their applications the past few years. According to the latest “Smart Speaker Consumer Adoption Report” released by Voicebot.ai in March 2018, “19.7% of U.S. adults have access to smart speakers today. That is up from less than 1% of the population just two years ago.” Unsurprisingly, Amazon dominates the market share at 71.9%, with Google running at a distant second at 18.4%. With consumers becoming more comfortable with the devices, nearly two-thirds of device owners now use them daily and over three-quarters at least weekly. According to Invoca’s study titled “The Rise of Voice,” it is estimated that the voice opportunity will be worth $18 billion by 2023. Voice has become an important new battleground for brands as they seek to differentiate themselves. It is no wonder that financial institutions are rushing to experiment with the new prospect: Bank of America, Capital One, Royal Bank of Canada (RBC), USAA, U.S. Bank, and Charles Schwab are amongst the many that have announced initiatives leveraging voice technology.

Interestingly, unlike most new digital technologies, users of these virtual assistants are not dominated by just the youngest demographic, but rather, those aged between 33 and 45. And according to Capgemini, 28% of users of voice assistants have already been adopting them for making payments and sending money. It is also predicted that, three years from now, 31% of consumers will use voice assistants instead of visiting a bank branch. Saturday Night Live joined in the hype with a skit on “Silver Echo,” re-imaging how an Echo-like device designed for older adults would behave.

So far, the use cases in financial services have been limited to more basic interactions such as checking account balance, paying bills, and monitoring spending. The next frontier will be to provide more personalized solutions, help consumers make the right financial decisions, and guide them seamlessly between different interfaces (voice/screen). Security must be the top focus for institutions looking to embark on their voice strategy. AI needs to be advanced enough to understand the context and nuances of human dialogues. Most of the virtual assistants still struggle to understand different accents, for example. Given the diversity of our population, this must be resolved to avoid frustrating first time users and for the technology to gain wider appeal.

While we are not (yet) at the stage where we can carry out meaningful conversations with our new digital companions, I believe the potential is there. Talking is also much more liberating when you are no longer constrained by the menu choices in front of you.

What can be done is up to us. Let’s dare to dream.

Presenters

Presenters Brian Milas, CTO

Brian Milas, CTO

Rudd is a 20-year veteran of institutional fixed income sales and trading, and one of the visionaries behind 280 CapMarkets.

Rudd is a 20-year veteran of institutional fixed income sales and trading, and one of the visionaries behind 280 CapMarkets.

Presenters

Presenters Troy Pittock, VP Financial Services

Troy Pittock, VP Financial Services

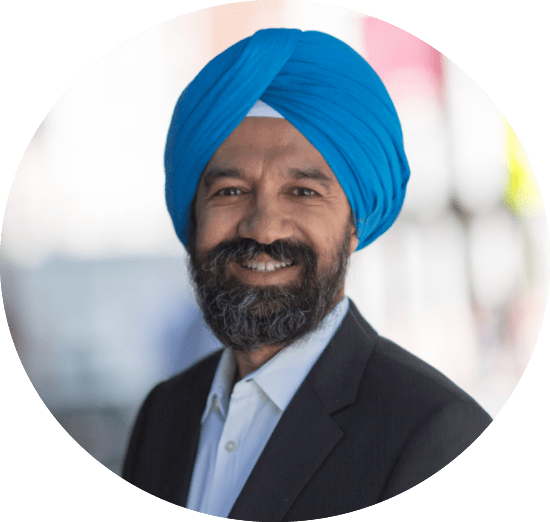

Sankaet Pathak, CEO & Founder

Sankaet Pathak, CEO & Founder

Presenter

Presenter

Presenters

Presenters Jason Hishmeh, CTO

Jason Hishmeh, CTO