This week, Bottomline Technologies, Fifth Third Bancorp, and Payment Processing Inc. were all buying.

Continue reading “Financial Mergers and Acquisition Update – Fifth Third, Bottomline and more”

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

This week, Bottomline Technologies, Fifth Third Bancorp, and Payment Processing Inc. were all buying.

Continue reading “Financial Mergers and Acquisition Update – Fifth Third, Bottomline and more”

This week eBay reported that PayPal’s volumes were above $8 billion for the first time, and the Federal Deposit Insurance Corp. (FDIC) agreed to hold hearings this spring on whether to issue FDIC insurance to Wal-Mart Stores Inc. as part of the retail giant’s application to get a Utah industrial loan corporation.

Both companies are being watched almost microscopically by banks and other payment providers who are afraid that these companies are going to somehow walk away with their payments franchise. Our advice: Relax.

Sure, PayPal is doing well: Net revenues this past quarter grew 48 percent over the same period last year—they were $298 million—and gross volume was up 45 percent by the same measurements. But unnoticed amongst all the heavy breathing was that PayPal user accounts grew 51 percent in the same period. In other words, the growth in volumes and revenues was proportional to the growth of eBay’s core business, not some indication of a sinister plot for world domination.

The hysteria surrounding Wal-Mart’s moves is even worse. The suspicion in the payments industry, of course, is that once Wal-Mart has the license and the insurance, it’ll begin pushing into community banking, driving all those small institutions into the famous Wal-Mart meat grinder and emerging a coast-to-coast financial services colossus. And considering Wal-Mart’s history, it’s easy to succumb to those anxieties.

But we believe Wal-Mart when it says it only wants the license so it can be its own payment card acquirer. For one thing, the move makes sense for it: According to our calculations, it’ll save Wal-Mart at least $650 million a year, based on its 2004 revenues of $172 billion (see Electronic Payments Week, July 26, 2005). And for another, Wal-Mart’s application to the FDIC says on page one that this is their reason for wanting the bank, and we are skeptical that Wal-Mart executives would willingly commit perjury in such a closely-watched event; there’s absolutely no evidence that these guys are stupid.

There may be some logic to our view, but our belief, touching though it may be, hasn’t prevented over 1,500 comment letters to have been sent to the FDIC on the matter, nor has it discouraged the House Committee on Financial Services from scheduling hearings about Wal-Mart’s plans. And the FDIC has already agreed to delay any decision on the insurance application until the issue has been fully aired.

Those hearings will make interesting viewing on C-SPAN, but in our view, banks and payments processors would be better served in the case of both companies by studying what they’re doing, and drawing useful lessons from them. We can understand why the success of PayPal, and the motions of Wal-Mart, would arouse anxieties within the industry: It’s being swept by transformative change, and both companies represent what Harvard professor Clay Christensen calls disruptive technologies.

But aside from finding any irony in the spectacle of capitalists trying to stifle competition, there’s the deeper concern that the industry may be losing faith in itself. Banks began as counting houses, and unless they do something unreasonably boneheaded, they are unlikely to be driven out of their inner redoubt as long as they meet that competition head on.

Our recommendation: Remember what U.S. Grant said at the Battle of the Wilderness. Robert E. Lee had whipped the Union twice before on the same ground, and Grant’s staff was beside itself wondering how Lee would whip them again. “Stop worrying about what he’s going to do to you, and start thinking about what you’re going to do to him,” said Grant. That campaign ended with Lee's surrender at Appomattox.

LendingTree has a prime spot on MSN’s main page today <msn.com>. The eye-catching burgundy ad in the upper-right corner features a 10-second animation ending with the call to action, "Refinance $175,000 now for $729/month." (click on above for closeup).

Clicking through the advertisement leads to a five-question landing page designed to get the prospect engaged in a loan application (click on inset for a closeup). A small link near the top of the landing page takes visitors to a promotional offerings page with disclosures for several loan offers.

Clicking through the advertisement leads to a five-question landing page designed to get the prospect engaged in a loan application (click on inset for a closeup). A small link near the top of the landing page takes visitors to a promotional offerings page with disclosures for several loan offers.

It’s simple and effective online marketing. The slogan on the top of the landing page says it all:

1 Simple Form, Four Real Offers in Minutes.

In the latest in what seems an unstoppable march, DataTreasury Corp. settled its outstanding patent infringement litigation in the U.S. District Court for the Eastern District of Texas with NCR Corp., paying DataTreasury a fee and agreeing to license the Melville, L.I. company’s check imaging technology. DataTreasury said NCR had been infringing on DataTreasury’s patent rights. It’s the latest in a series of settlements stemming from a number of similar suits that DataTreasury filed in 2002.

DataTreasury, which has already settled its litigation against JP Morgan Chase & Co., Ingenico Group, and other firms that it says also infringed on its patent rights, is still suing several other big financial services firms– including First Data Corp., Citigroup, SVPCO and Bank of America, among others—on the same grounds.

Continue reading “DataTreasury, NCR Settle Patent Infringement Case”

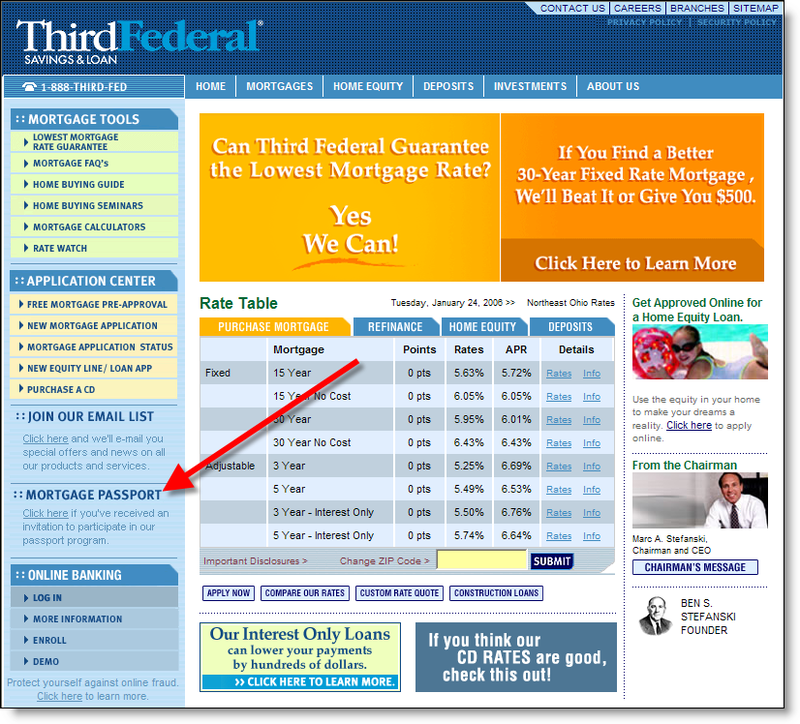

Ohio’s Third Federal Savings & Loan <thirdfederal.com> Mortgage Passport program might be the best relationship program we’ve ever seen. The free program promises a lifetime of preapproved mortgages and/or refinances, subject to a few simple rules:

Ohio’s Third Federal Savings & Loan <thirdfederal.com> Mortgage Passport program might be the best relationship program we’ve ever seen. The free program promises a lifetime of preapproved mortgages and/or refinances, subject to a few simple rules:

—  Owner-occupied housing within the bank’s lending area (all of Ohio and parts of Kentucky and Florida)

Owner-occupied housing within the bank’s lending area (all of Ohio and parts of Kentucky and Florida)

— Maximum LTV of 85 percent for loans less than $650,000; 60 percent for loans higher than $650,000

— Have never declared bankruptcy or been foreclosed on

Features

Analysis

In the age of identity theft, layoffs, and mysterious entries on your credit report, it is reassuring to know that once you’ve joined Third Federal’s Mortgage Passport program, you’ll never have to worry about being approved for a mortgage again. This prevents the sad cases where consumers who’ve lost their jobs are stuck in their oversized house or mortgage because they can’t qualify for new, lower-priced financing.

And talk about engendering loyalty. Would you ever move your banking business away from a company that gives you a preapproved mortgage for the rest of your life! That’s better than free bill payment by just about every measure.

Assuming the underwriting is sound, the only downsides are:

Undermarketed on its website: Again, because of the by-invitation-only nature, the program’s promotional material is low-key so as not to disappoint the majority of visitors not previously qualified for the program. The bank provides a homepage link (click on the inset for a closeup), but the tiny, almost unreadable copy says only, "Click here if you’ve received an invitation to participate in our passport program."

Undermarketed on its website: Again, because of the by-invitation-only nature, the program’s promotional material is low-key so as not to disappoint the majority of visitors not previously qualified for the program. The bank provides a homepage link (click on the inset for a closeup), but the tiny, almost unreadable copy says only, "Click here if you’ve received an invitation to participate in our passport program." —JB

Germany’s federal monopolies body, the Bundeskartellamt, received a legal complaint from the German Retail Association, alleging that interchange fee charged MasterCard and VISA, which average 150 basis points, prevents widespread credit card acceptance in Germany.

In a statement, the Association, a lobbying group, said that credit card payment account for only 5 per cent of all retail sales in Germany. The complaint calls on the Bundeskartellamt to cut interchange fees and to increase payment card transparency. It claims these steps will improve competition in the credit card sector. Spain, says the group, has ordered a step-by-step reduction of interchange to between 0.54 per cent and 1.10 per cent by 2008.

Oracle Corp. is preparing to wage war with its main rival, SAP AG, to sell the next generation of core computer platforms to large banks worldwide.

Little wonder; the potential market is big. Financial Insights, a unit of International Data Corp., estimates 2005 sales in the U.S. alone to have been about $6 billion a year, and expects it’s primed to grow a compounded four percent a year, for the next three years. And the global market is much larger.

Continue reading “Oracle and SAP Going After Global Core Banking Platform Market”

Doings by American Express, E*Trade, Fiserv and others.

One of the goals of online marketing, especially financial services marketing where consumers may not be comfortable submitting personal data over the Web, is generating leads. According to LeadFusion <leadfusion.com>, the parent of Financenter, the leading financial calculator provider, there are four steps to good online lead generation:

The last step, ACTIVATE, is the key to identifying sales leads. While most major financial institutions have financial calculators available online, how many of them are used to capture leads? Since most customers will not put up with a registration process BEFORE using the calculator, you must entice users to identify themselves at the end of the calculations.

Some common methods:

Subscribe to an information alert: Users sign up to receive email messages when certain events occur, such as rates hitting a certain level; for example, E*Trade's Rate Watch (click on inset to see the sign-up form).

Subscribe to an information alert: Users sign up to receive email messages when certain events occur, such as rates hitting a certain level; for example, E*Trade's Rate Watch (click on inset to see the sign-up form). For more information:

Wow. It’s not often a press release rates an article in BOTH The Wall Street Journal and The New York Times. But that’s exactly what happened today when E*Trade made the relatively innocuous announcement that it wouldn’t hold its brokerage customers responsible when their accounts were defrauded.

Wow. It’s not often a press release rates an article in BOTH The Wall Street Journal and The New York Times. But that’s exactly what happened today when E*Trade made the relatively innocuous announcement that it wouldn’t hold its brokerage customers responsible when their accounts were defrauded.

Consistent with previous innovations, the online brokerage and banking powerhouse wrapped its new message with impressive graphics and copy (see inset above-left for graphic displayed on its homepage today). Clicking on Learn More leads to an impressive security area where E*Trade touts four main protective measures (click on inset above-right for a closeup)*:

Consistent with previous innovations, the online brokerage and banking powerhouse wrapped its new message with impressive graphics and copy (see inset above-left for graphic displayed on its homepage today). Clicking on Learn More leads to an impressive security area where E*Trade touts four main protective measures (click on inset above-right for a closeup)*:

Analysis

It just goes to show you how skittish the public has become about online security. I’d wager that most brokerage customers are sophisticated enough to realize they will eventually get their money back if it’s stolen from their account. So this is a non-event from a financial standpoint. E*Trade even admits that online fraud cost it only $2 million last year, less than the cost of one of their famous Super Bowl ads. The brokerage also said there were "fewer than 50 incidents," implying a fraud loss of approximately $40,000 per incident.

Evidently E*Trade’s marketing department prevailed over its legal counsel and actually put the company’s fraud-protection policies in writing. It’s amazing that makes headlines in 2006 and may say more about the growing need to cover your behind to fend off the class-action bar even if it means scaring off customers.

We hope this prompts other financial institutions to take similar action. One of the main functions of financial institutions is safeguarding assets. Customers, online or otherwise, shouldn’t have to guess whether certain types of fraud are covered. As any good lawyer would say, "Put it in writing."

—JB

*The screenshot displayed here is only the top portion of the security area, to download a screenshot of the entire page, click here.

Twenty product announcements and launches from ACI, VeriFone, First Data and others.

There is nothing like a long run of rate increases to make your deposit customers happier. You might as well take some credit; it probably won’t be long before they move in the other direction.

There is nothing like a long run of rate increases to make your deposit customers happier. You might as well take some credit; it probably won’t be long before they move in the other direction.

So every time you raise rates, make sure to let customers know with an email message. Of course, this assumes competitive rates. If you are increasing from 0.45 percent to 0.65 percent, you probably want to keep that to yourself.

EverBank raised checking account rates Jan. 1 from 3 percent to 3.5 percent depending on balance levels. On Jan. 3, it sent an email with the subject (click on inset for closeup view):

You’re earning more with EverBank – interest rates rise again!

Analysis

EverBank’s message is straightforward. Here’s what they did right:

And a shorter list of improvements:

Grade

Overall, we’ll give it an A-

—JB