Ten years ago, we advised banks to make sure their listings in Yahoo were up to snuff. Now, the major search engines are so good, there isn't much work needed to appear at or near the top of the results for searches on your company name (see note 1).

Ten years ago, we advised banks to make sure their listings in Yahoo were up to snuff. Now, the major search engines are so good, there isn't much work needed to appear at or near the top of the results for searches on your company name (see note 1).

However, there is one important online database with massive reach that still needs manual maintenance, Wikipedia. As the sixth-busiest Internet property in the world, with 150 million monthly visitors (see note 2), you should make sure your institution's entry is both factual and up-to-date. One of Wikipedia's defining attributes is that anyone is allowed to edit the content. So there is no reason you shouldn't jump right in and change any factual errors right away. You should also consider adding info and links to missing or incomplete listings, but make sure to follow the strict guidelines prohibiting self promotion.

Nor surprisingly, Wikipedia prohibits all forms of advertising. And they'll take down any entry deemed to be made to further sales rather than add to the world's knowledge base.

Wikipedia does allow company listings provided your company is deemed "significant" by Wikipedia. Most financial institutions should qualify. However, don't try to put a listing in for your SuperDoubleNet Gold Card. It won't fly.

Also, copy must be devoid of hype, be totally unbiased, and basically read like an encyclopedia entry (see guidelines for company listings here). That said, the online encyclopedia does allow limited use of logos and pictures, so you want to make sure your entry is attractive without being a brochure. Any violations of Wikipedia's guidelines will be quickly deleted.

Below is the first part of the 1500-word entry for Citibank. Note the use of its current logo and an attractive branch photo.

In comparison the entry for Boeing Employees Credit Union is just 170 words and devoid of graphics.

In addition, you might look for other Wikipedia "marketing opportunities" where your bank could be listed as a service provider or reference. Again, it has to add to the facts of an existing article, not be positioned solely for marketing purposes. Of course, this is as gray an area as you can get, so there is no harm in trying as long as you keep the edits in line with the spirit of the website.

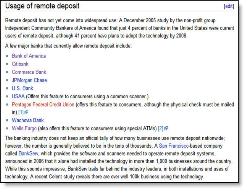

For example, in the Wikipedia listing for "remote deposits", under the sub-heading, "usage of remote deposit," the following financial institutions are listed (see screenshot right):

For example, in the Wikipedia listing for "remote deposits", under the sub-heading, "usage of remote deposit," the following financial institutions are listed (see screenshot right):

- Bank of America

- Citibank

- Commerce Bank

- U.S. Bank

- USAA (Offers this feature to consumers using a common scanner)

- Pentagon Federal Credit Union (offers this feature to consumers, although the physical check must be mailed in)

- Wachovia Bank

- Wells Fargo (also offers this feature to consumers using special ATMs)

If you have a good remote deposit capture service, add your name to this list. It may or may not be accepted, but it's worth a try.

Notes:

- You should make sure your tags and titles are up-to-date and appropriate (see previous article here).

- Worldwide unique visitors in Sep. 2006, according to comScore (press release here)

For example, Singapore's OCBC Bank has a WAP site at

For example, Singapore's OCBC Bank has a WAP site at