- Lighter Capital raised a $130 million credit facility.

- The company will use the facility to continue funding early-stage companies.

- Lighter Capital recently surpassed the milestone of distributing $350 million in growth capital via more than 1,000 rounds of financing.

Revenue-based financing fintech Lighter Capital has closed a $130 million credit facility this week. Today’s funds come from ATLAS SP Partners, i80, the Victorian Government, and iPartners.

The credit facility will be used to fund early-stage companies, something Lighter Capital has been doing since its launch in 2010. In fact, the company recently surpassed the milestone of having distributed $350 million in growth capital to more than 500 startups across the U.S., Canada, and Australia through more than 1,000 rounds of financing.

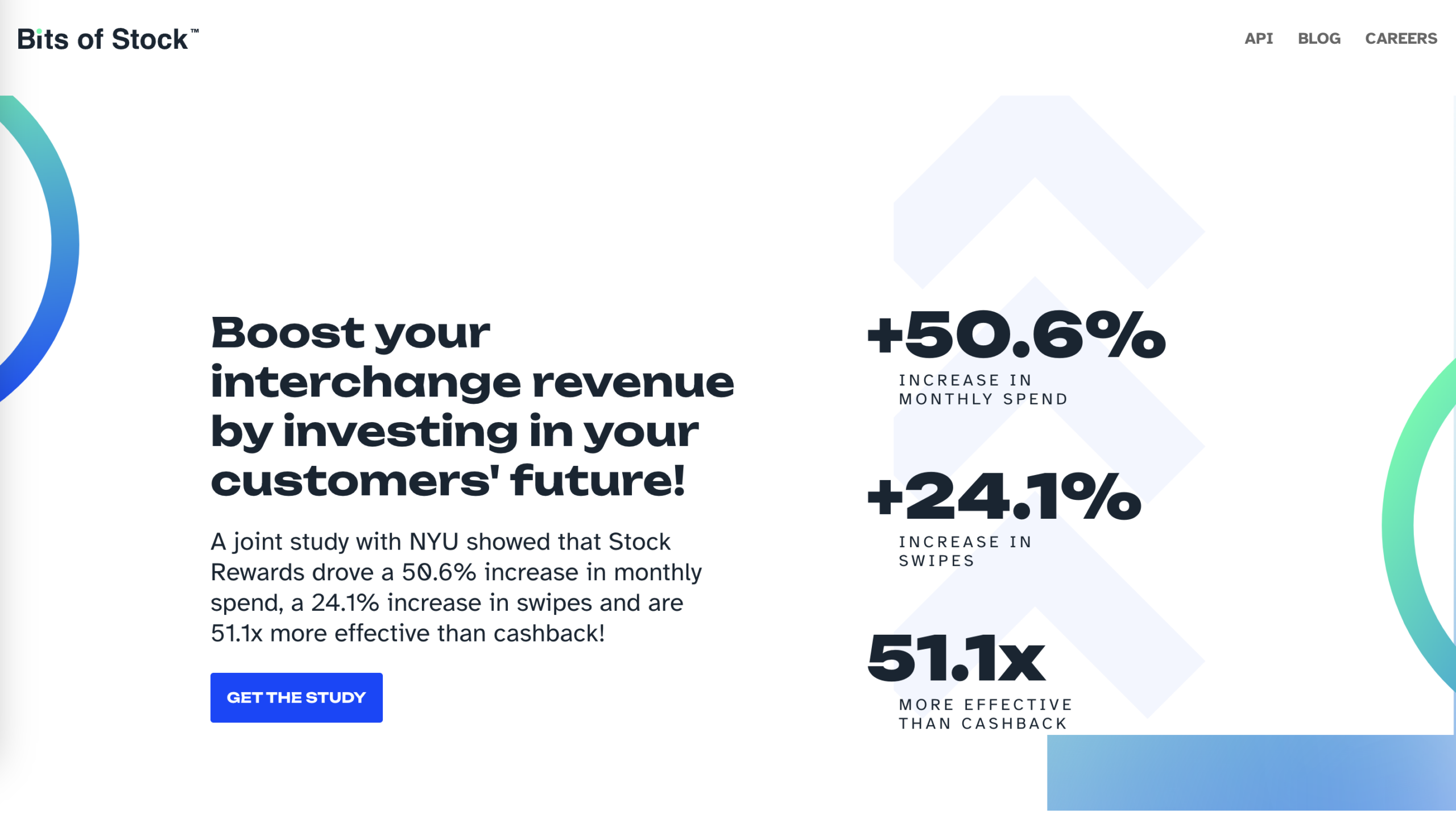

Lighter Capital’s revenue-based financing model helps startups that offer SaaS, technology services, subscription services, and digital media to access up to $4 million in growth capital without selling equity.

“Lighter Capital’s model is so innovative — a debt provider that’s essentially a VC partner,” said Qnary Founder and Chairman Bant Breen. “We get the financial rigor, network, and strategic guidance that a VC would give us, and that’s been incredibly helpful.”

Recently, the Seattle-based company has opened new offices in Australia, unveiled more non-dilutive funding options, and launched an online networking community for startup CEOs.

“After more than a decade in business, 2022 was our best year in the company’s history,” said company CEO Melissa Widner. “It’s a great privilege to help founders achieve their dreams on their terms by providing funding that doesn’t require selling equity or giving up control.”

Lighter Capital and other alternative financing startups are experiencing a moment in the fintech spotlight. That can be attributed to two factors. First, because VC funding is in decline, it is difficult to obtain equity financing. Additionally, banks have started to tighten their lending standards because of economic uncertainty and decreased collateral values.

An early Finovate alum, Lighter Capital’s most recent Finovate demo was at FinovateFall 2013, where then-CEO BJ Lackland demonstrated how the company’s small business lending platform leveraged CRM data to predict a borrower’s future performance.