“Carta-Connect for Mobile is a turn-key product for issuers and MNOs that brings NFC mobile payments to market with a rapid and low-cost deployment model. Utilizing a virtual account instantly personalized to the mobile phone, consumers can access immediate spending power with any NFC-enabled handset. This introduces a simple and convenient experience for consumer adoption, while limiting exposure of personal banking information.By leveraging underlying technology in place, Carta reduces setup and deployment cost for NFC projects, and minimizes the need to update core systems. Offered as an end-to-end product, or compatible with existing m-wallet applications, the uniquely flexible solution represents a key step in the mass-market adoption of NFC mobile payments.”

Finovera Debuts Bill Management Solution

“The average American household is overwhelmed by more than 20 service provider relationships that require managing dozens of web accounts and passwords. Families are busy, and it’s very easy to miss deadlines and due dates, incur finance charges and hurt your credit rating. Despite the widespread availability of paperless bills, statements and many documents, digitization of household information management has still not taken off – primarily because there hasn’t been any service that was effortless and convenient.

Finovera does all of the work for busy families. Our mission is to bring order to this chaos by automatically downloading and organizing bills and financial statements every month in a secure digital filing cabinet. Using mobile cameras or scanners, consumers can store documents in the cloud. The service reminds users when bills are due, and a one-click ‘Pay Now’ button automatically logs them in to their online accounts on external websites so bills can be paid quickly and conveniently.”

Ignite Sales Launches a Tool to Help FIs Up-Sell and Cross-Sell Products

“Ignite Sales is launching the world’s first Bank Product Concierge which will change the way retail banks are able to sell financial products consistently to consumers and manage their branch network.

The solution is turning bank branches, call centers and websites into account opening machines, helping them easily and cost effectively reach their customers to up-sell and cross-sell products. The Concierge Analytics Dashboard, the first in the industry, provides the only way for bank executives to determine what products should be sold based on Eligibility Data.”

Billhighway Launches Mobile Fundraising App

“Billhighway Give is the best mobile fundraising app on the planet…do more good, faster.

Designed specifically for donor-based nonprofits, Give provides a better way to collect donations.Additionally, Give includes a number of innovations specifically developed for NPOs recognizing their unique needs such as branding, campaign tracking and motivational tools.”

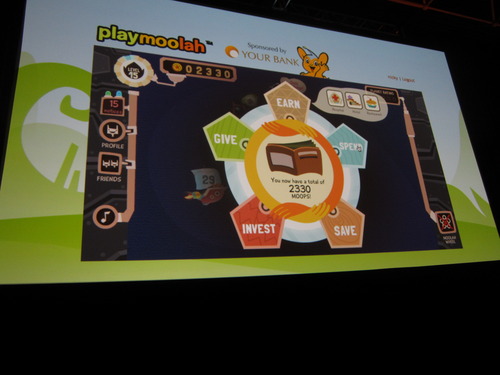

PlayMoolah Fuels Customer Engagement Through Financial Literacy

“With a fun online platform that brings families together, PlayMoolah offers a great way for financial institutions to plug in and improve online customer engagement, account activity, and life-time value of their family customer segments, all while bringing financial literacy to kids around the world.”

Waspit Launches Social Banking for Students

“Waspit’s new platform combines the most innovative payment capabilities students now expect from an FDIC insured account (including mobile payments) with their emerging social media habits.

By syncing Waspit with any of the major social media platforms, users can easily exchange money with friends, benefit from auto-Foursquare and Facebook check-in, and post reviews that create conversation around venues they and their friends have made purchases at – particularly about those good venues and those to avoid. Users are rewarded with points each time they make a purchase, post reviews or introduce friends. Points can be redeemed for gift cards from retailers like Amazon.”

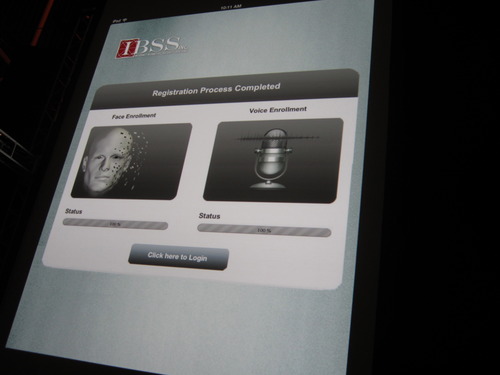

Internet Biometric Security Systems Launches Genesis Enterprise Edition

“IBSS is launching its Genesis Enterprise Edition, representing an advanced, affordable, real-time human identification technology for online financial service transactions.

- Factor 1: Real- time legal identification of end-user personal information.

- Factor 2: Coupled real-time biometric facial authentication.

- Factor 3: Coupled real-time speaker authentication.

- Factor 4: Coupled real-time session biometric monitoring of each online financial transaction event, supported with a scalable biometrically authenticated timeline audit log record.

IBSS’s technology is a full perimeter online access security solution that provides superior end-user identification of the actual banking customer, as well as the actual online financial services representative used in the collaborative sharing of confidential financial information through a common group shared database. IBSS’s superior identification improves bank security for both online consumer transaction activity identification, and equally promotes a higher degree of consumer trust of online bank employee identification integrity by using the same biometric identification standards used by their own customers.”

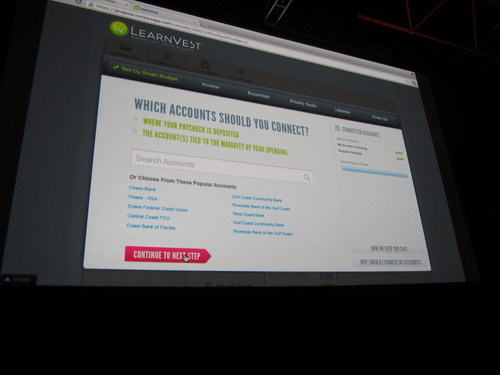

LearnVest Launches Certified Financial Planner and Mobile App

“LearnVest is uniting the Money Center with our unique financial planning platform. We believe that financial plans should be dynamic guides that are central to your everyday decision-making.

There are two key additions: First, premium members can now share a view of their Money Center with their LearnVest planner. This allows the planner seamless access to their clients’ most current financial profiles. Second, LearnVest is introducing a Priorities feature that allows members to set goals (such as debt repayment) and track their progress against them.”

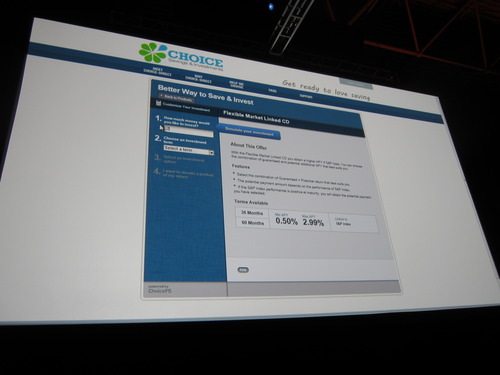

Ideon’s Choice FS Allows Users to Create Their Own Savings Solutions

Then, Ideon showed how its new solution can help users choose the investment opportunity that’s right for them:

Then, Ideon showed how its new solution can help users choose the investment opportunity that’s right for them:

“The CHOICE direct-to-consumer model that is currently in development allows users to create their own savings and/or investment solutions from the convenience of any channel and device by selecting the term, guaranteed minimum rate, liquidity and source of additional potential return, all with the security of FDIC insurance, in a completely transparent, clear and honest manner.

The search for income in a low yield environment creates unwanted risk for many consumers. With CHOICE, that problem is removed. Furthermore, in an improved rate environment, CHOICE is able to offer consumers significantly higher returns than they can obtain through traditional players.”

BSCG Launches Business Hub for Small Businesses

“Business Hub is a cloud-based package that incorporates the most important tools a small business owner needs. For $25 per month, small businesses get access to online accounting software, a website builder, a business planning tool, a legal document creator and online training.Business Hub is delivered via a fully customizable online platform, allowing business owners to manage key functions in one place with a single username and password. The exact suite of applications can be customized for each bank.”

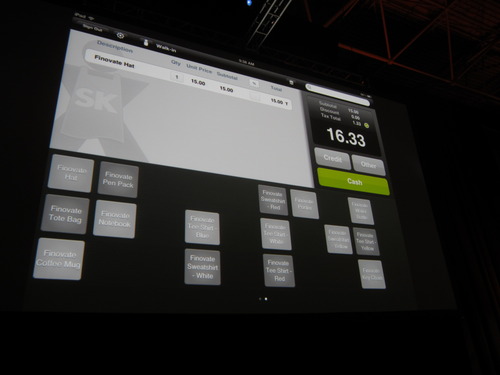

ShopKeep POS’ Solution Enables Merchants to Run a Store from an iPad

“The simplest way to make smarter business decisions, ShopKeep POS is the affordable and complete cloud-based point of sale platform for running a store from an iPad.

Backed by the industry’s best customer care, the ShopKeep POS iPad app rings sales, processes credit cards and mobile payments, prints and emails receipts, and prints orders remotely to the kitchen. Merchants can manage inventory and a customer database and view ClearInsight Reports from any web browser. Plus, they can access real-time sales remotely via a smartphone to make important business decisions even when they are not in the store.”

Segmint Launches One Button SegmintEngage Solution

“Segmint’s new and highly-advanced SegmintEngage feature allows FIs to create online campaigns in less than a minute – targeting the offer, creating a banner and assigning website zones – through a completely automated feature of the application. This “One Button” application empowers FI marketers to deliver campaigns without engaging multiple support partners within their organization, ultimately saving time and resources.”