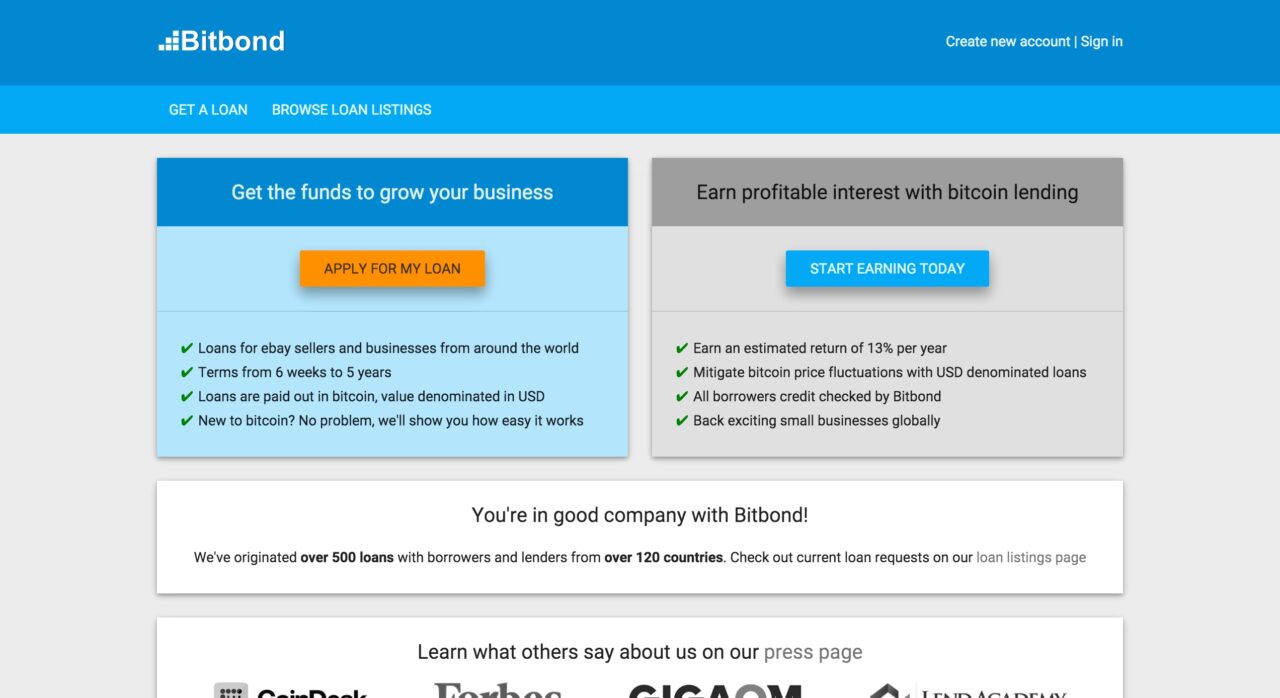

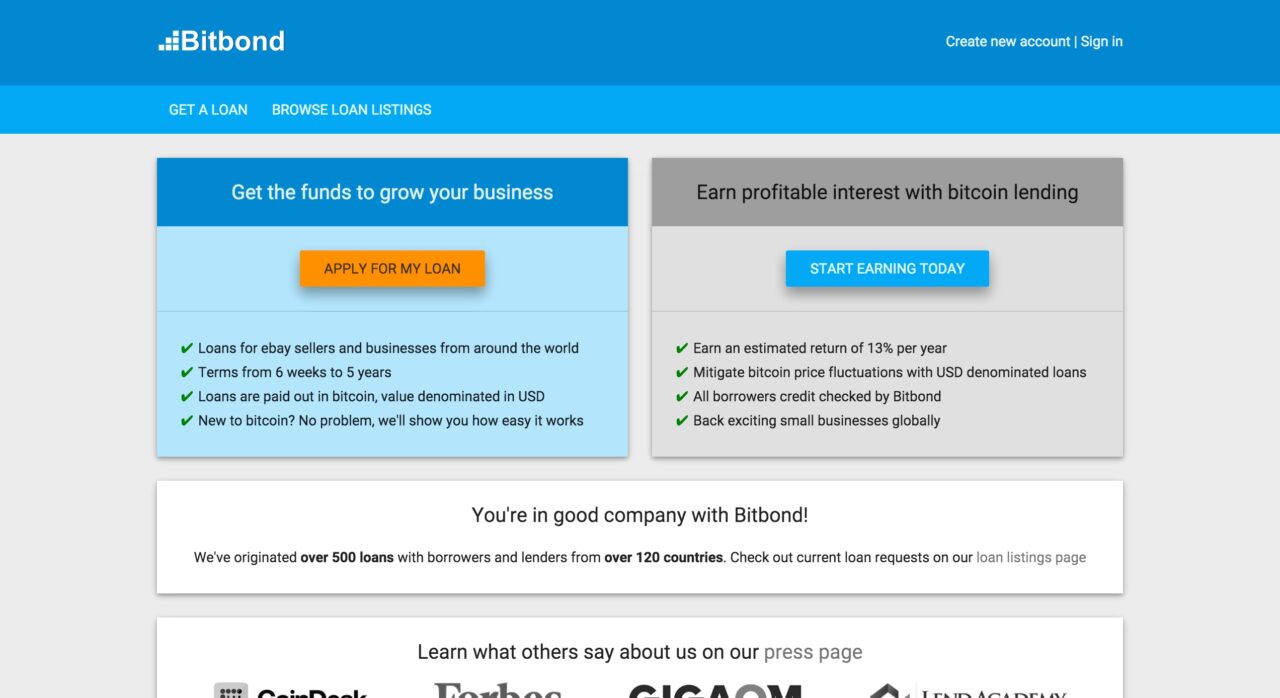

Bitbond’s peer-to-peer bitcoin lending platform connects small businesses looking for loans with lenders in search of a fixed-income investment. Because it uses Bitcoin, Bitbond has three advantages over traditional P2P lending companies:

- Global

Since Bitcoin works across country borders, it doesn’t charge foreign exchange fees.

- Instant

Instead of relying on ACH money transfers, the funds travel at the speed of Bitcoin– instantly.

- No bank account necessary

Unlike traditional P2P lending platforms, users do not need a bank account to borrow or lend.

Though many think of Bitcoin as risky, Bitbond protects users from the digital currency’s volatility by denominating loans in U.S. dollars (USD). With USD as the base currency of the loan, the value is fixed, which mitigates exchange rate fluctuations.

Stats

- $212,000 equity raised

- 4 employees

- 7,000+ registered users from 120 countries

- Originated 500+ loans to date

- Launched in 2013

- Headquartered in Berlin, Germany

Borrowers

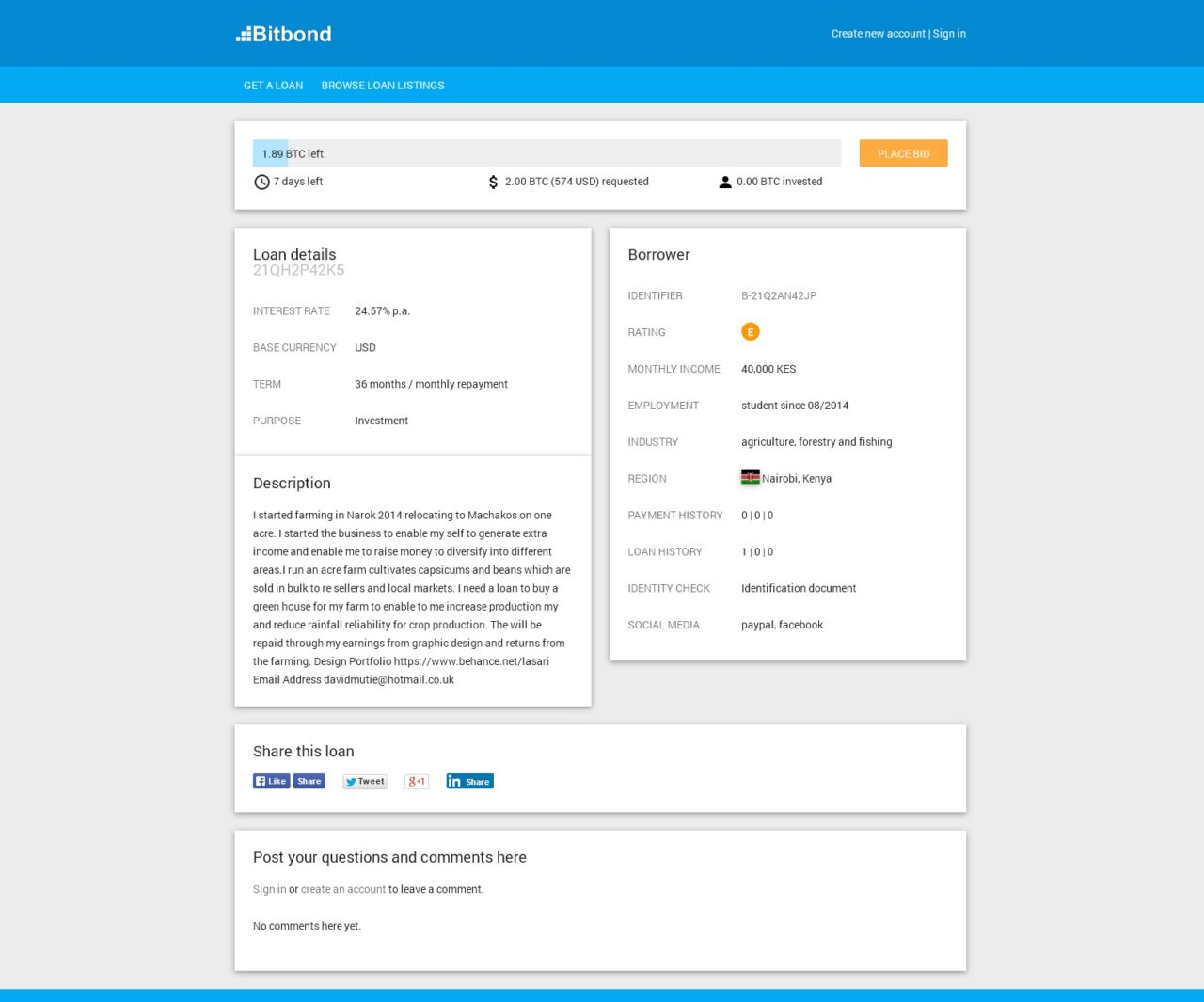

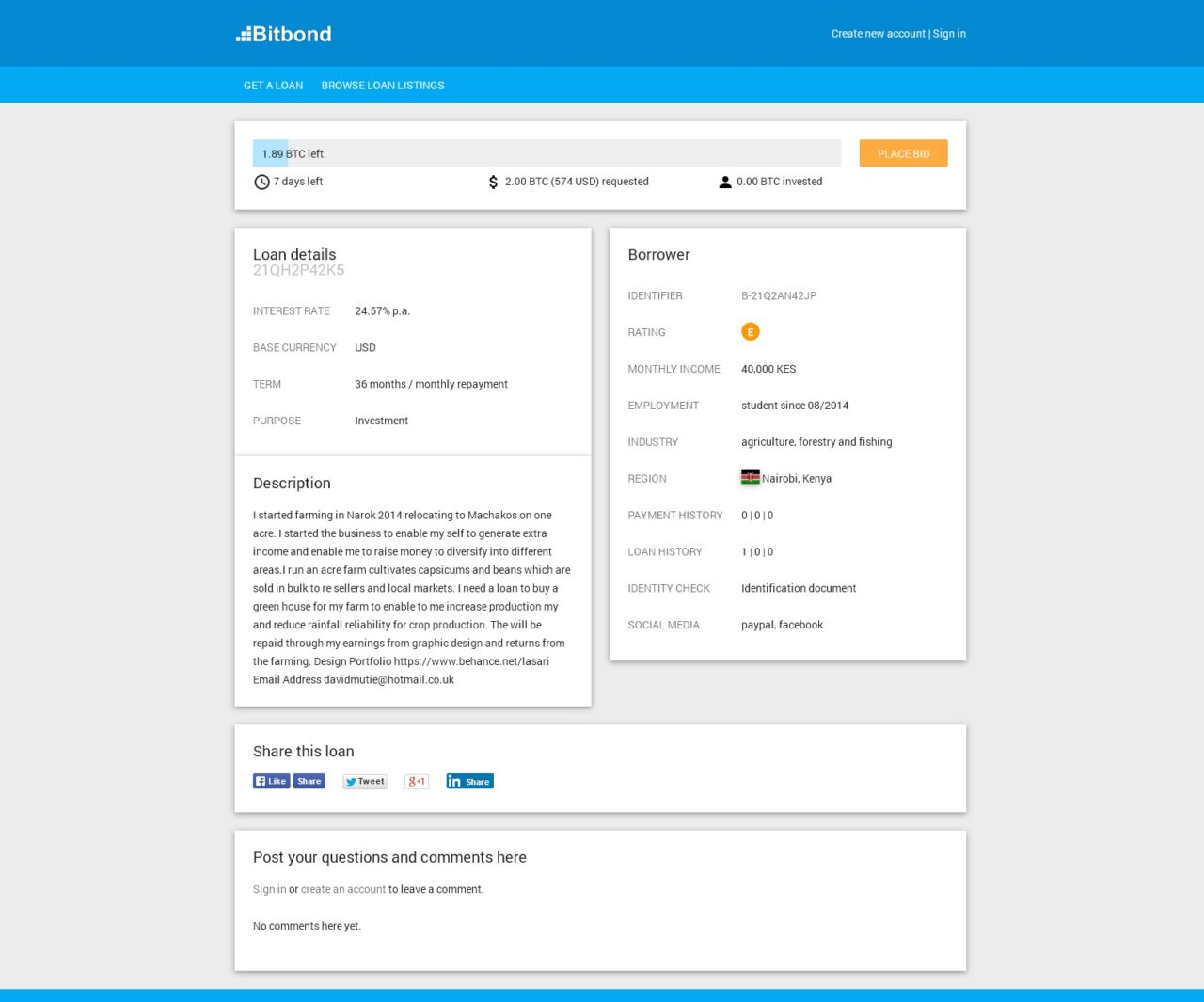

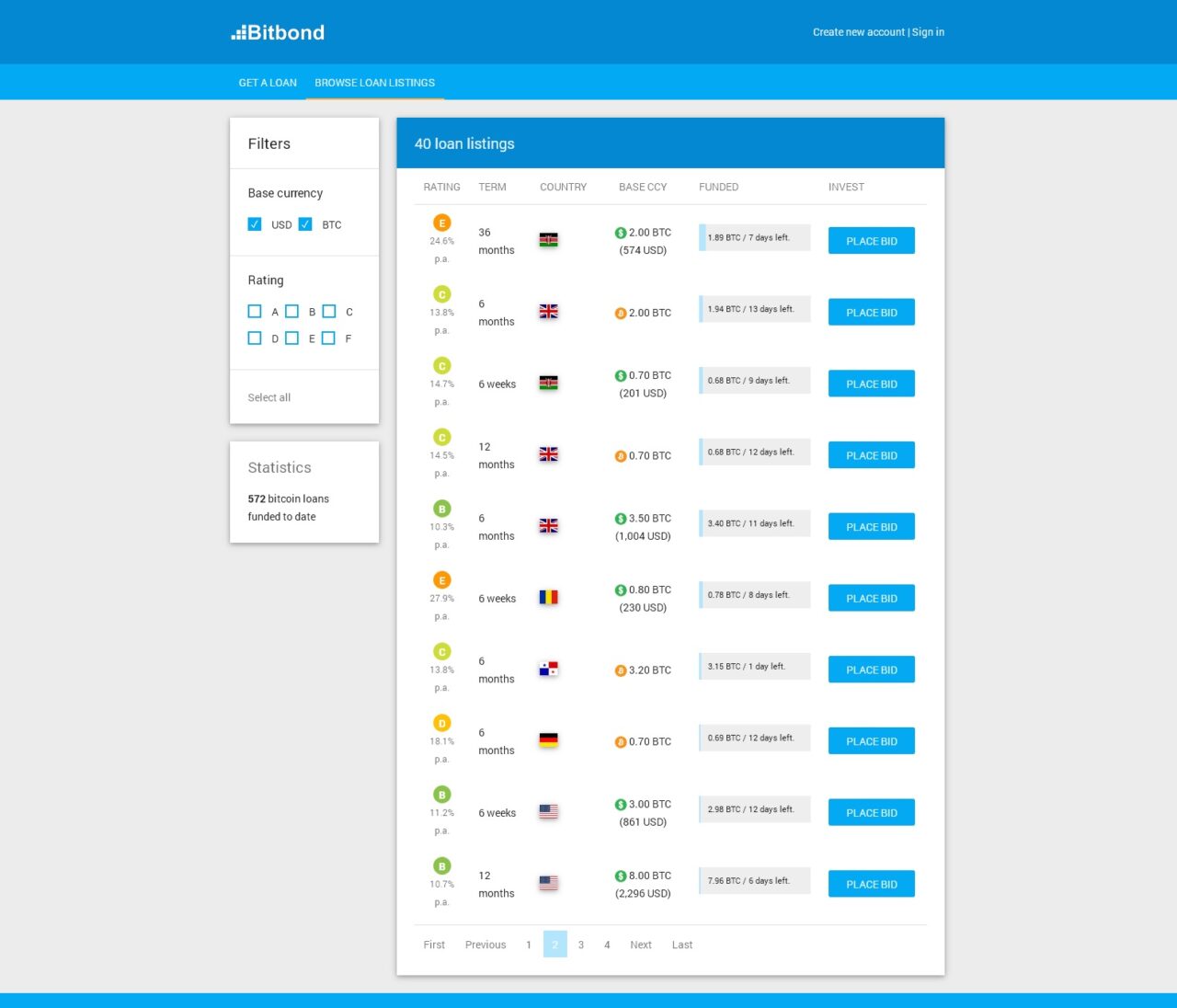

Borrowers create an account and submit a loan request that includes the purpose, along with income, location, and other information. Loan amounts begin at BTC 0.1 ($28)* for a term ranging from six weeks to five years. Borrowers pay a fee between 0.5% to 3% of the loan amount, in addition to interest.

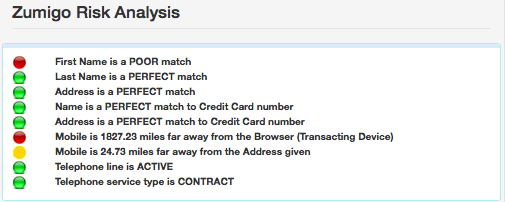

If borrowers want to seem more attractive to lenders, they can pay Bitbond to assess their creditworthiness. The rating ranges from A to F, and depends on factors such as credit bureau rating, type of employment, eBay feedback score, and other applicable factors.

The screenshot below shows a lender’s view of a borrower’s profile page:

Borrower benefits:

- Access to a global lender base

- No bank account necessary

- Lower interest rates

The interest rates range between 8% and 25%, which is often less than local lenders.

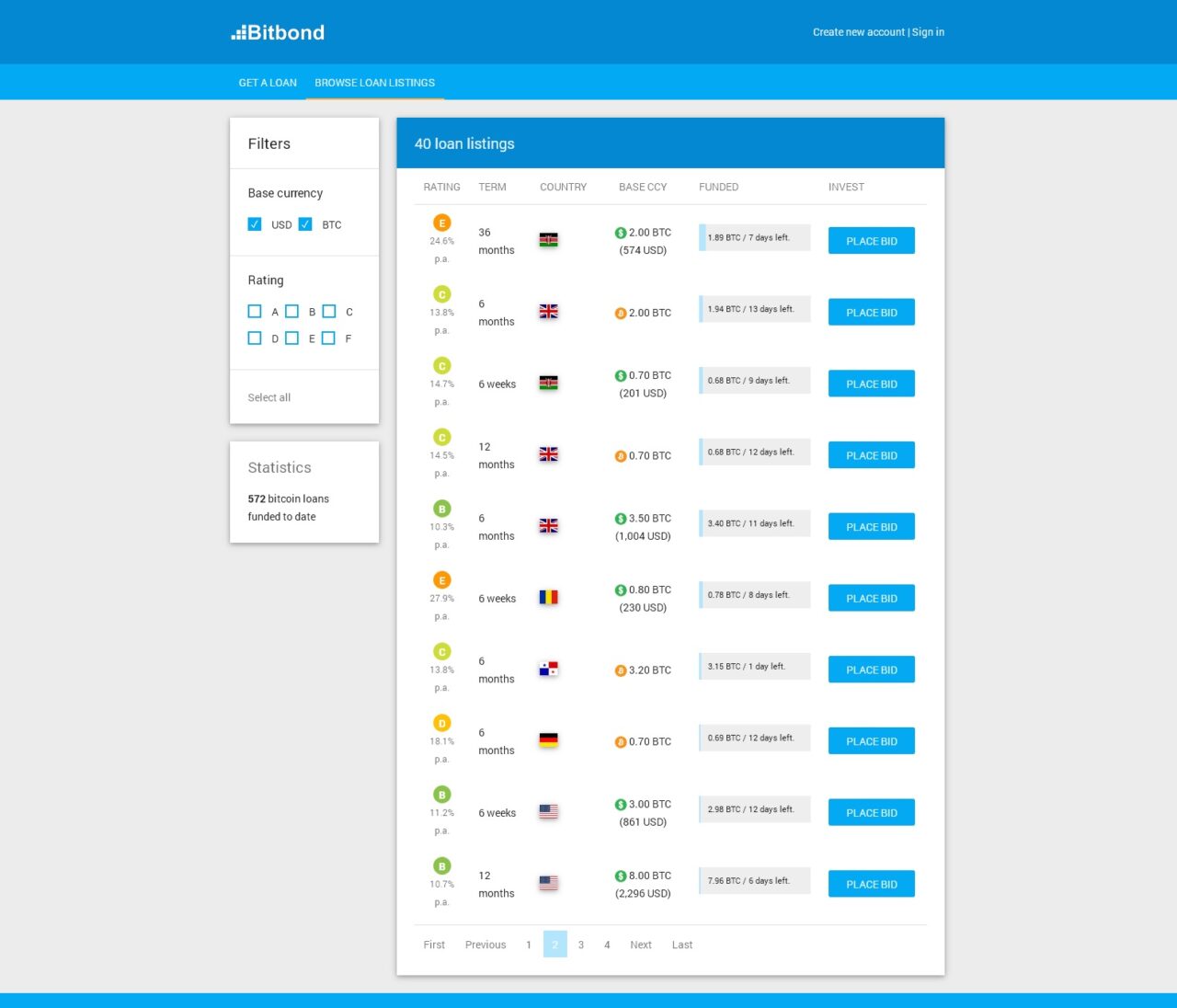

Lenders

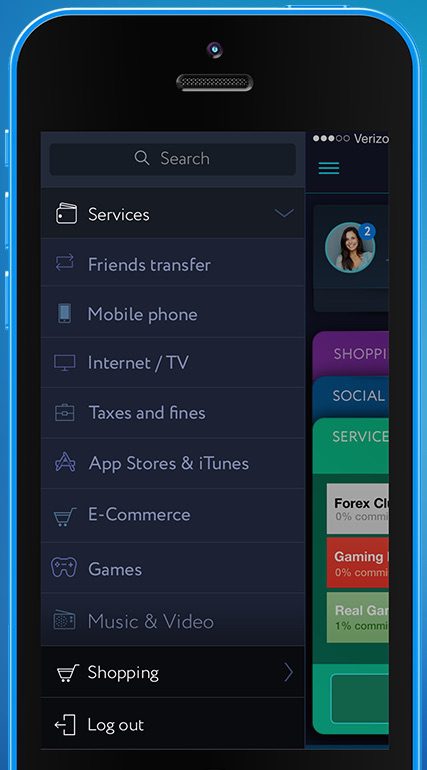

To browse available loan requests, lenders filter listings by rating, term, country, and base currency:

Lender benefits:

- Access to a global, diverse asset class

- Zero fees, lenders pay only taxes

Autoinvest

At FinovateEurope 2015, the startup launched Autoinvest. This new feature does exactly what you would assume: it automatically allocates funds for lenders based on pre-selected criteria: risk, currency, and geographical region.

To begin auto-investing, lenders must:

1) Determine amount to allocate

2) Select U.S. dollar or Bitcoin as the base currency. While all payments are conducted in Bitcoin, if lenders select USD, the value is fixed in dollars and the borrower and the lender mitigate exchange rate fluctuations that are common with the digital currency.

3) Appoint risk rating (Low, Medium, High)

4) Choose up to six different geographical regions

After this process, Bitbond screens and allocates funds for the lender, who has visibility to all investments in their portfolio summary.

Bitbond debuted Autoinvest at FinovateEurope 2015. Check out the live demo.

*based on Bitcoin value as of March 17, 2015