This post is part of our live coverage of FinovateSpring 2015.

Moven showcased how it uses customer behavior to incentivize savings and short-term credit:

Moven showcased how it uses customer behavior to incentivize savings and short-term credit:

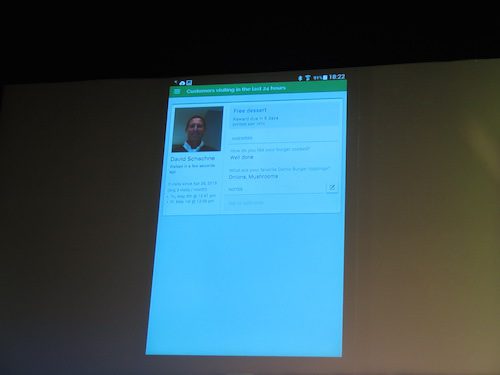

Moven is building real-time contextualized notifications and interactions that create gamified money moments. Today’s demonstration will debut a behaviorally based approach to driving savings and short-term credit. In addition Moven, in partnership with Accenture, will announce a number of additional global banking partners.

Presenters: CEO Brett King and Alexander Sion, Moven President

Product Launch: June 2015

Metrics: $12.5M raised in 2 rounds (Seed/A); 34 employees in New York City and Philadelphia; projected revenue of $5.5M (2015); 500,000 users in two countries (U.S.A./New Zealand)

Product distribution strategy: B2C in the U.S.; B2B2C internationally

HQ: New York City, New York

Founded: April 2011

Website: moven.com

Twitter: @getMoven