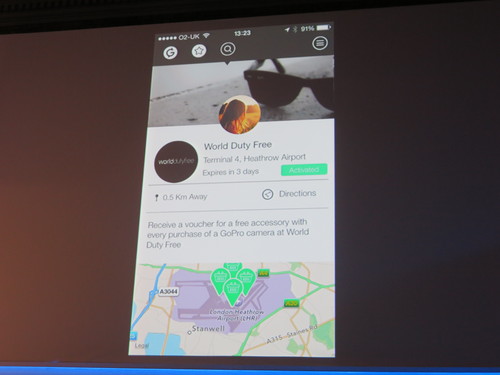

Fiserv is demonstrating what the next generation digital banking interactions will look like, with a heavy focus on the payments-user experience, coupled with value-added services related to the payment. Built on Fiserv’s world-leading Mobiliti platform, the demonstration will include:• Augmented Reality• Merchant Offers• Integrated Payments• Card Management• Proactive BankingThe demonstration is geared towards the consumer and allowing them greater control and transparency over their spending and banking habits.

Author: Julie Muhn (@julieschicktanz)

CPB SOFTWARE’s PROFOS Tool Helps Financial Advisors Meet Client Needs

PROFOS is the app for bankers! Mobile services are up-to-date, comprehensive, intuitive and discreet. PROFOS is more than a common app. It combines your customer’s data with consultancy features supporting advisors skills – highly demanded by your clients!

PROFOS helps your advisors easily show and present deep banking knowledge combined with a better understanding of your clients’ needs. Your conversations with clients will change and at any place requested, your clients will be more attentive and understand more easily. Hence, for you: MORE profit with LESS effort.

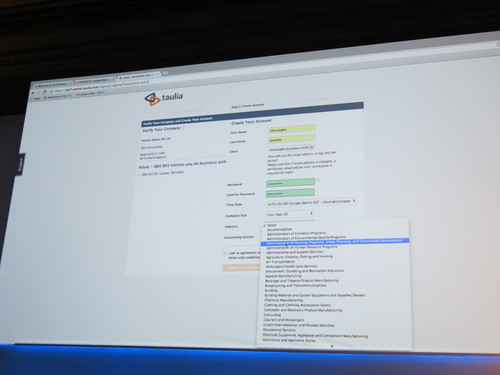

Taulia Debuts Enhanced Discounting

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Taulia Enhanced Discounting (TED) aims to revolutionize the funding of supply chain finance. TED combines the benefits of traditional dynamic discounting – when corporations offer an early payment to a supplier in exchange for a small discount – with a flexible supplier financing programme, which allows organizations to choose to use their own cash or the capital of a third-party financial institution, to capture early payment discounts.

With TED, organizations can offer their suppliers uninterrupted, affordable financing regardless of their own cash positions, operating obligations, or financial forecasts. Taulia is so confident of the value that TED delivers, that it guarantees its customers savings of £1M a year.

Product launch: February 2014

Metrics: $70M in equity raised, more than 200 employees across the globe including offices in San Francisco, London, Düsseldorf, and Sofia; 300,000+ supplier connections on the Taulia network

Product distribution strategy: Direct to Business (B2B) through other fintech companies

HQ: San Francisco, CA, USA

Founded: June 2009

Website: taulia.com

Twitter: @taulia

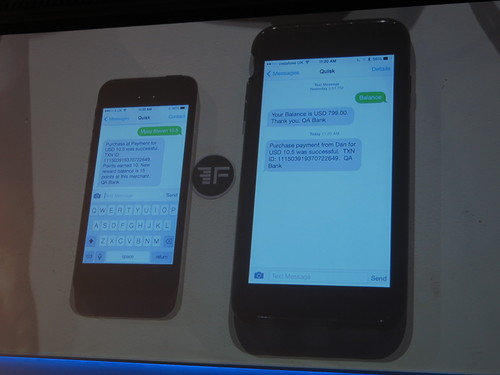

Quisk’s Digital Payment Platform Now Offers Loyalty and Rewards Programs

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Quisk is the next step in the evolution of money.

We are the creator of a new cash-based digital payment type. We enable banks to create a new type of all-digital account, which is accessed by a consumer’s mobile phone number and secure PIN. The Quisk cloud-based digital services platform is technology agnostic, multi-issuer/acquirer, and works with existing core banking and retail POS infrastructure.

Quisk is demonstrating a variety of digital cash transactions: in-store purchases using POS systems, Person-to-Merchant (P2M), Bill Pay, online purchase (eCommerce), and Person-to-Person (P2P) send money. In addition, the Quisk platform enables merchants to offer digital loyalty programs and marketing offers while reducing interchange fees.

Metrics: $20+ million series A round raised, 30 employees, projects currently in four countries

Product distribution strategy: Direct to Business (B2B) through financial institutions

HQ: Sunnyvale, California, U.S.A.

Founded: 2009

Website: quisk.co

Misys’ FusionBanking Takes a New Approach to Digital Banking

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Misys FusionBanking Essence Digital brings a new approach to digital banking, making banking and personal financial management truly frustration-free for consumers.

Misys pioneers the latest innovations in technology and mobile devices. At FinovateEurope, Misys is demonstrating the latest concepts in mobile and online banking: biometric authentication, customizable design, new widgets for ‘net wealth’ and ‘wishes and goals,’ with automatic object recognition and push notifications that bring banking into consumers’ everyday lives.

Nostrum Group Enables Users to Service Accounts When and Where They Want

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

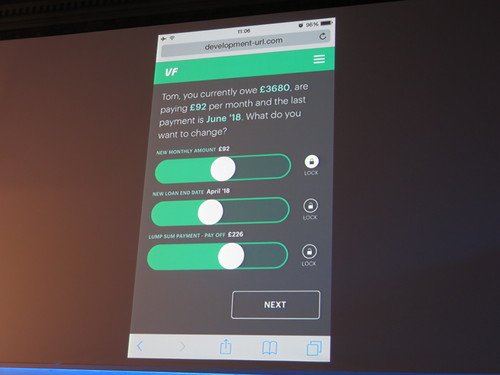

The provision of lending is an inefficient process for both lender and customer. Our research shows that consumers want the ability to service their own accounts where and when they want.

Nostrum is launching the next iteration of its core lending system to satisfy this requirement and lead the market, fitting with our core strategy of making lending cheaper, faster, and safer, reducing operational costs for lenders whilst also providing the required level of support 24/7 when traditional call centres would not be available, allowing consumers to get information immediately whenever they want and, critically, through a secure channel.

HQ: Harrogate, Yorkshire, United Kingdom

Founded: August 2001

Website: nostrumgroup.com

Twitter: @nostrumgroup

C24’s Platform Helps Users Manage Their Finances

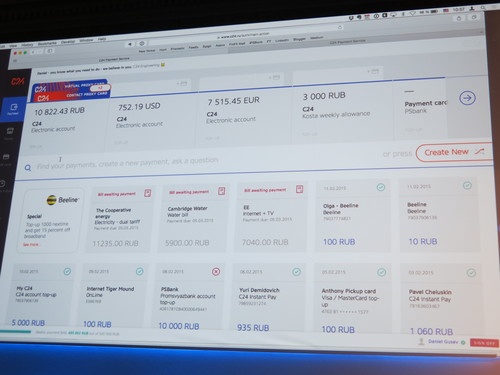

C24 is a multichannel platform that allows end users to connect their accounts with different banks, so that their household financial standing is visible and manageable.

Users can pay bills, set bill payment rules, and use linked “proxy” Visa cards to pay for goods online and offline. API of C24 lets partnering banks securely provide their users with info of accounts within these banks; otherwise, customers can use Visa/MC rails or other standard means of linking their sources of funds.

C24 is a user-experience-driven app, where the complexity of numerous accounts is nowhere to be seen. The impetus for C24 to exist is to automate day-to-day finance routines and advise on the best courses of action.

NICE Systems Leverages Voice Biometrics to Create a Secure Environment for Call Centers

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

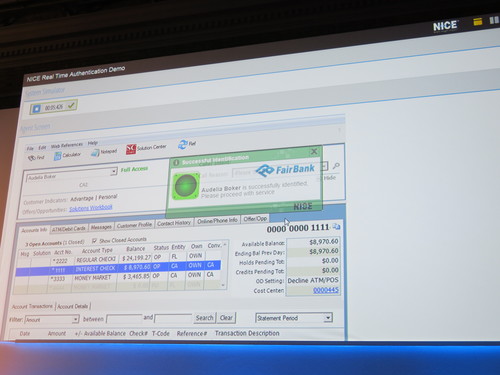

Real-Time Authentication strengthens and streamlines the authentication process by utilizing voice biometrics to authenticate customers in real time during their conversation with an agent. Contact centers can:• Securely authenticate customers in real time with no customer effort• Expedite time to service and free up more time for revenue-generating activities• Passively enroll the vast majority of customers seamlessly• Improve fraud protection on all enrolled accounts

Ixaris Systems’ UI Editor Allows for Easy Customization

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Ixaris is demonstrating a UI editor that banks can provide to a corporate customer so that the entity can safely, and in a compliant manner, customize the instance of the application that the bank has deployed for them.

Critically, this patent-pending technology enables customization to be carried out by non-technical staff, either operational staff or web agency, without compromising security.

In addition to static web-page and cardholder-portal content, the customer can change the way in which transactions and payment instruments are handled. Tools are also provided for the bank to review, approve, and control the entry of changes into production.

Product launch: April 2015

Metrics: $10M in equity finance raised to date; 130 employees; 2013 revenues $15M

Product distribution strategy: Direct to Business (B2B) through financial institutions and through other fintech companies and platforms

HQ: London, United Kingdom

Founded: September 2000

Website: ixaris.com

Twitter: @ixaris

CashSentinel Debuts Escrow Service Combined with a Mobile Wallet

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

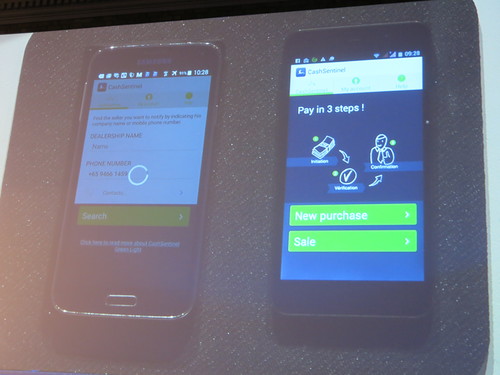

Online secondhand-car fraud was the #2 most common online scam in 2013, according to the European Consumer Centers network. This market represents over 25 million transactions yearly in United Kingdom, France, Germany, Italy, and Switzerland alone.

CashSentinel developed a solution that combines an escrow service and a mobile wallet, dedicated to facilitating and bringing trust to large transactions between parties that do not have a long-lasting, trusting relationship.

CashSentinel concluded a partnership with Swissquote Bank, the leading online bank of Switzerland, and AutoScout24, the leading secondhand-car marketplace. After a successful trial period, the service is set for fully fledged launch and European expansion in 2015.

Presenters: CEO Sylvain Bertolus; Board Director Michael ChailleProduct distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B) through financial institutions

HQ: Yverdon-les-Bains, Switzerland

Founded: December 2012Website: cashsentinel.com

Twitter: @CashSentinel

Trunomi Launches TruMobile to Helps FIs Share Customer Data While Remaining Compliant

This post is part of our live coverage of FinovateEurope 2015.

TruMobile connects customers with banks, helping to monetise and personalise customer’s data experience. Built as a customer-centric “Consent Engine,” TruMobile is backed by multiple patent filings.

It seamlessly creates auditable privacy policies, which for the first time permit the sharing of customer Pii data across platforms, jurisdictions, and business lines in full compliance with global regulatory and privacy standards.

HQ: Bermuda, Dublin and Silicon Valley

Founded: March 2013

Website: trunomi.com

Twitter: @trunomi

Aire Launches API to Help Underwrite Risk of Borrowers with Thin Credit

Aire is launching its Credit API at FinovateEurope 2015. The API enables lenders to use Aire to perform a credit check when traditional data doesn’t exist in the credit bureaus.

The immediate benefit is the ability to re-score applicants when no data exists on their bureau file. This enables lenders to expand the pool of eligible applicants by removing the no-data problem.

The API can also be used as a credit enhancement amongst other use-cases that we are excited to see companies explore. The signup for the API will also open at FinovateEurope for our partners.

Presenters: Cofounders Aneesh Varma and Jon Bundy

Product launch: February 2015

Metrics: Aire is a TechStars company; 7 employees

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B) through financial institutions and through other fintech companies and platforms

HQ: London, United Kingdom

Founded: January 2014

Website: aire.io

Twitter: @airescore