Having positioned itself as a lending-as-a-service provider, LendKey’s online lending platform connects thousands of banks and credit unions with consumers in a single loan marketplace.

Company facts:

- Used by 310+ lending institutions

- Raised more than $800 million in funding for loans to 35,000+ borrowers

- Raised $23.5 million in equity

- Has 100+ full time employees

- Headquartered in New York City

Using the LendKey Network, borrowers submit a single credit application that reaches multiple lending institutions, resulting in a single hard-credit inquiry into the borrower’s credit score, thereby saving time. In real time, users receive multiple offers for consumer loans. LendKey makes it easy for them to sort and apply for the offers, without ever leaving the platform.

The LendKey Network currently focuses on:

- Student loans

- Auto loans

- Home-improvement loans

Choosing an offer

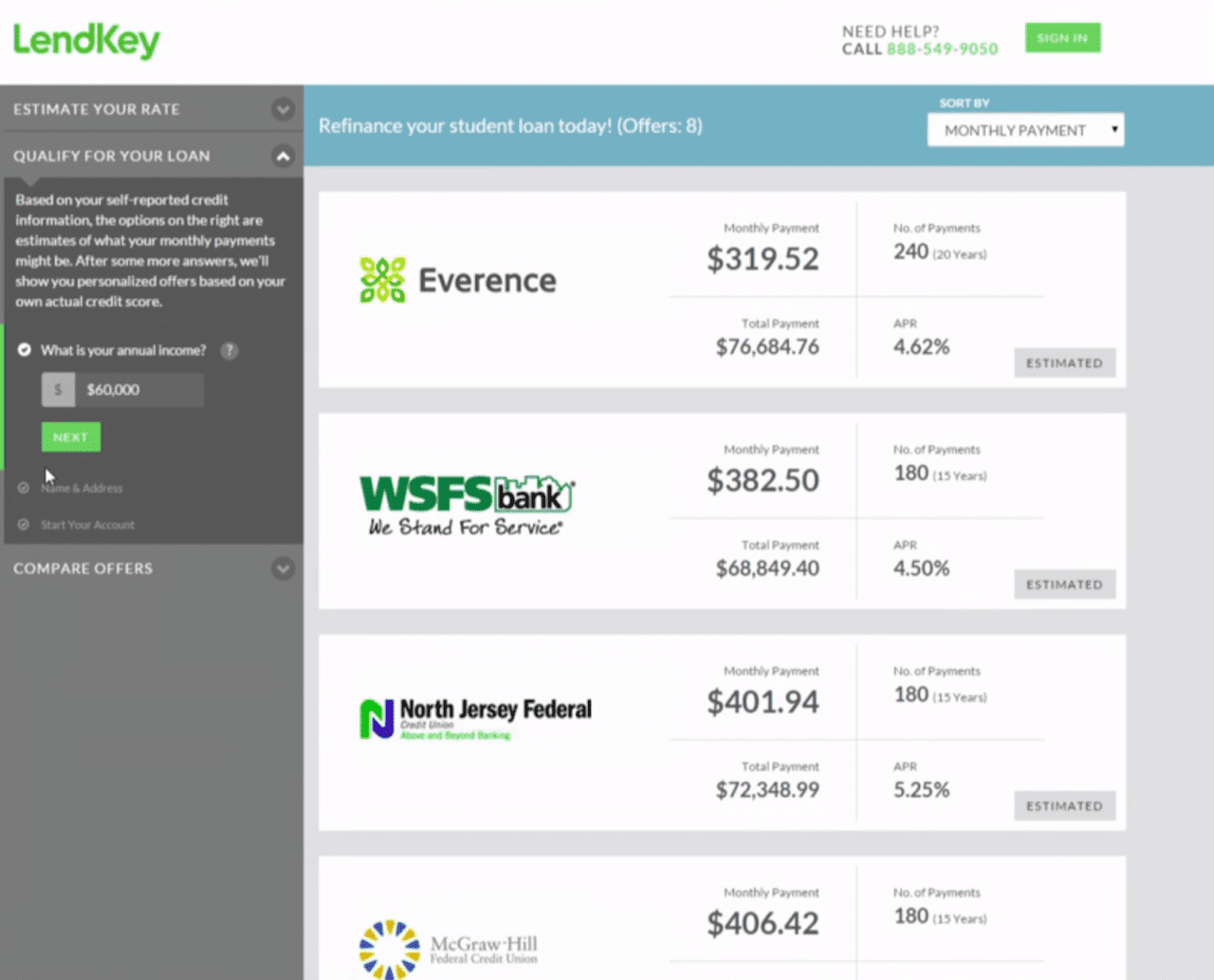

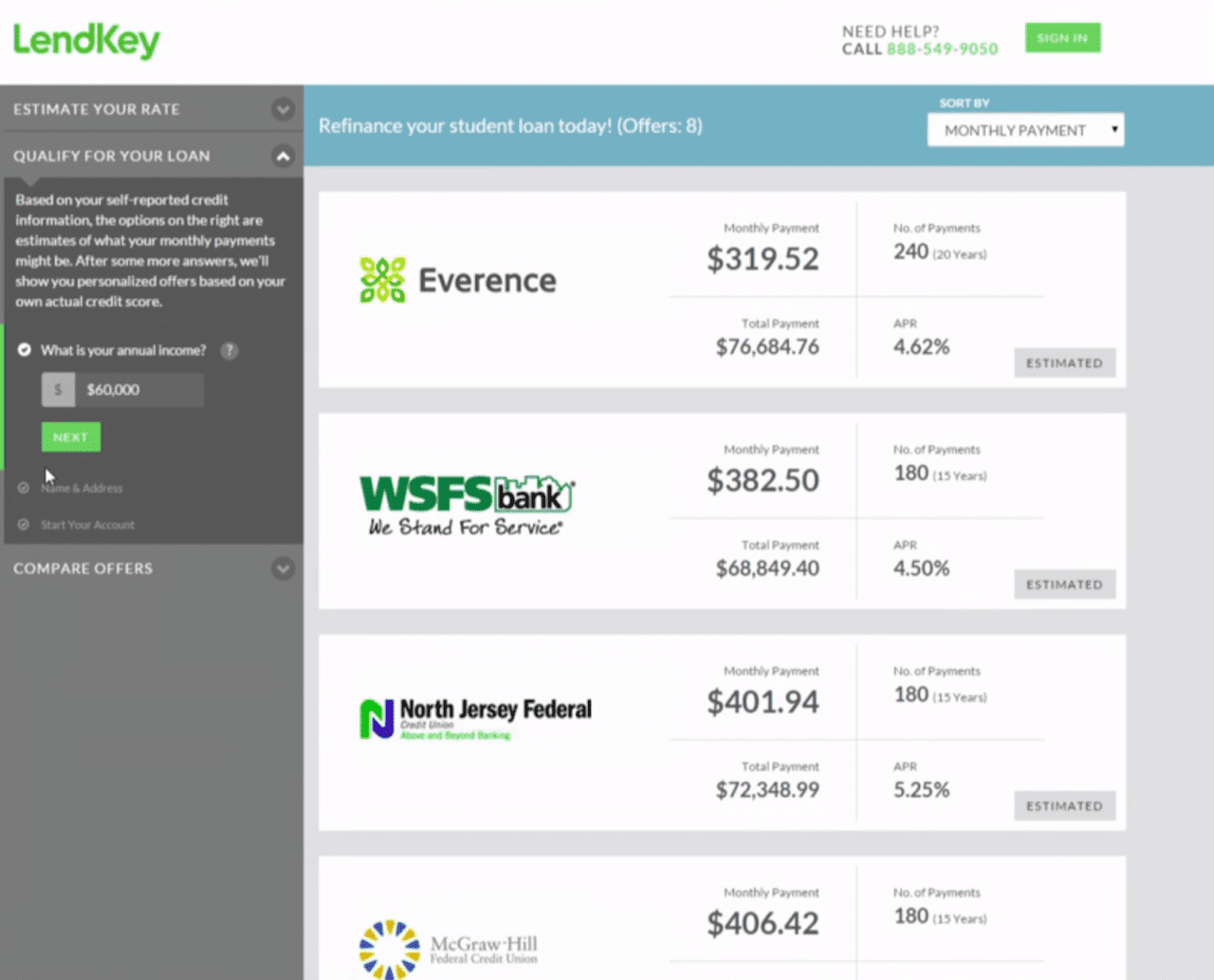

Using a student-loan-refinance example, the user enters the amount of their loan, current monthly payment, credit score, ZIP code, and school attended. Using those pieces of information, LendKey lists loan offers from local, community lenders that they may be eligible for.

1) Browse

Lenders show estimated monthly payment, term, and rate, based off the five data points the user furnished. To narrow down the number of offers, the user enters additional information, citizenship status, degree level, graduation date, and income. As additional data is added, the list of offers becomes more customized. This helps consumers get a better understanding of what factors affect their eligibility.

2) Customize

If the user sees an offer they like, they enter additional personal information. LendKey then performs a soft credit-check, which further customizes the rates offered.

Two aspects make this process unique:

- Transparent: User sees all loans and rates for which she is eligible in a single place

- Educational: User sees which personal factors affect the offers extended

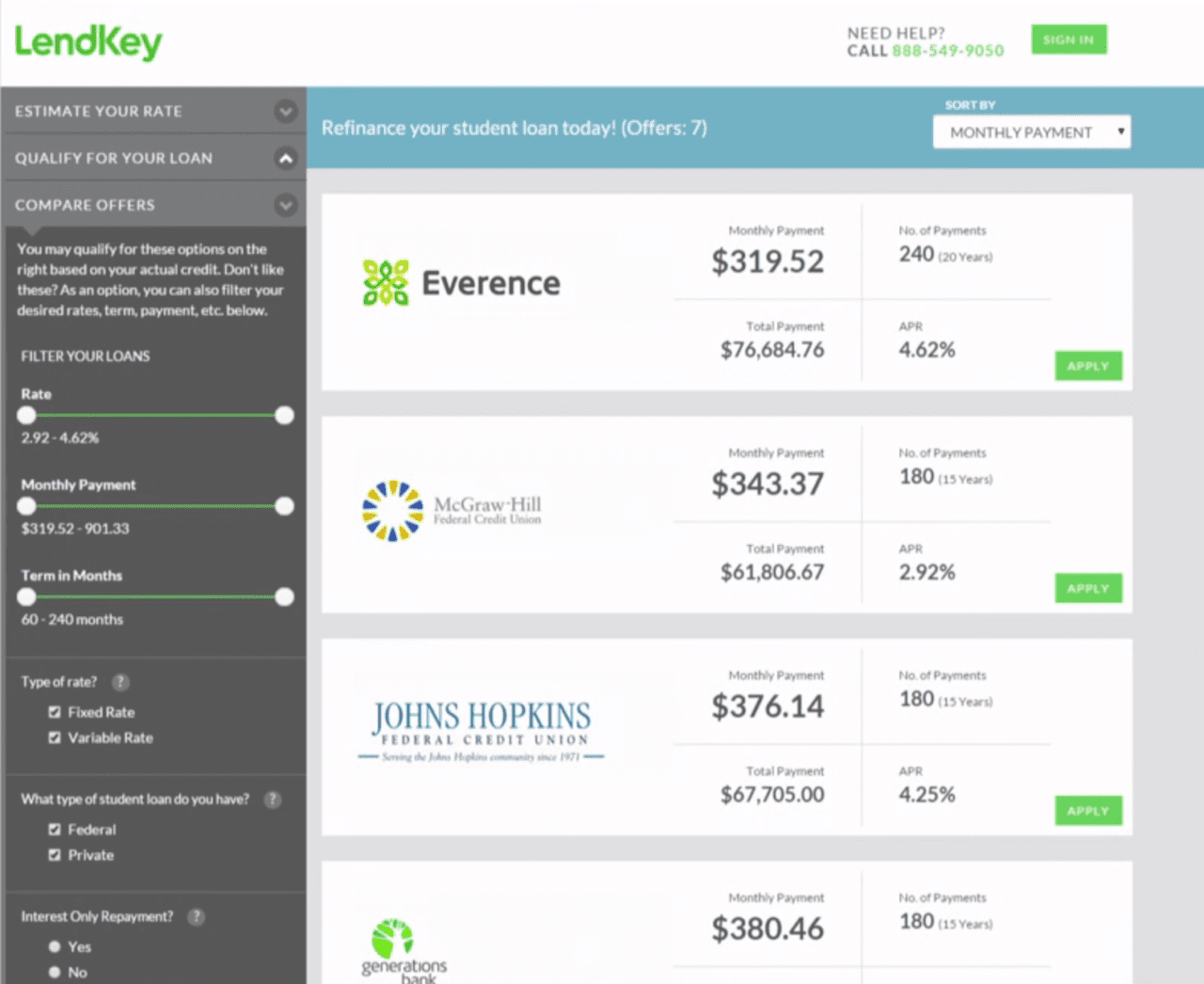

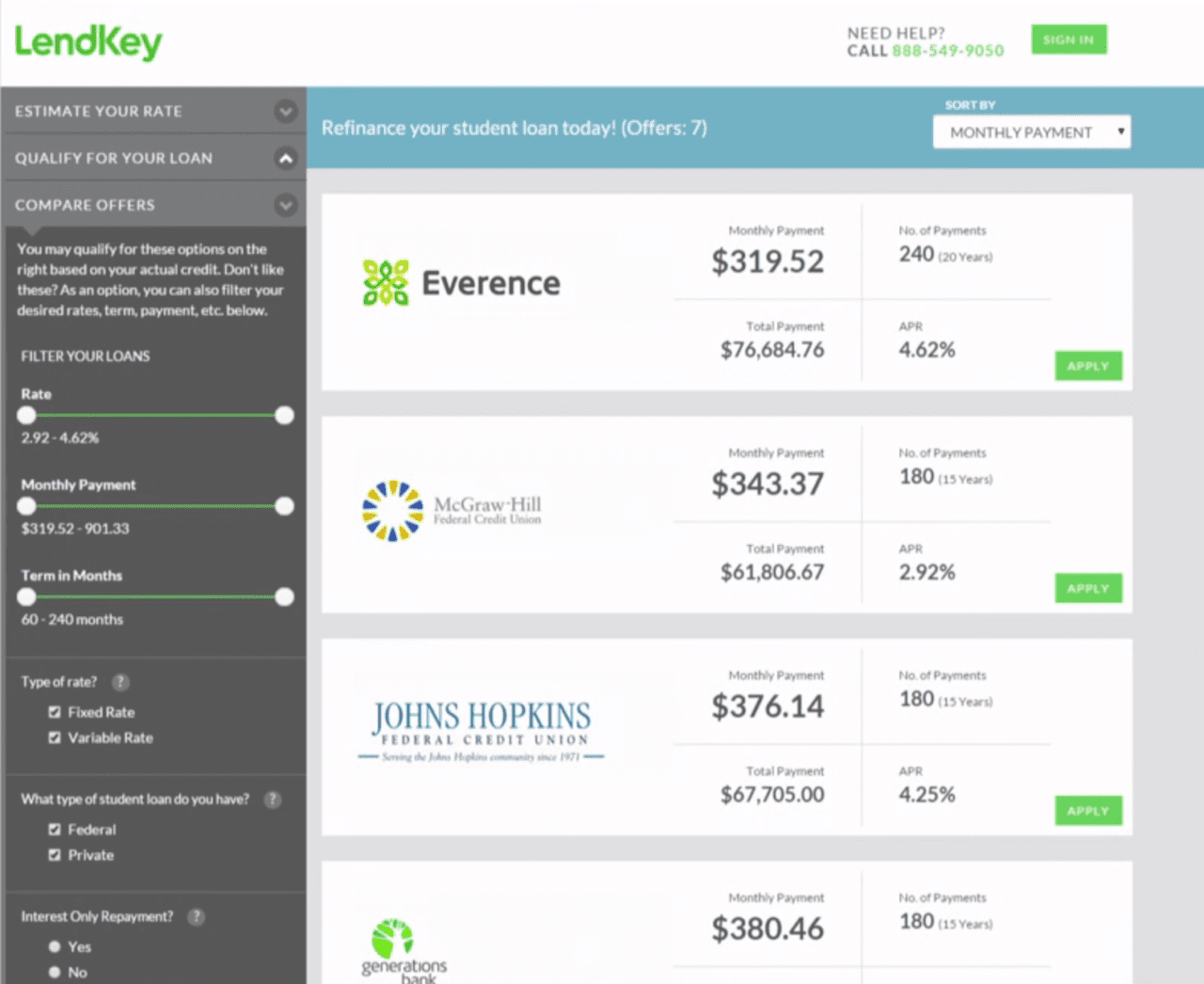

3) Compare

After the soft credit-pull, users can narrow down offers by rate, payment amount, loan term, and type of rate (variable or fixed), and determine if they want a co-signer. Once all fields are entered and the user selects an offer they like, they are ready to apply.

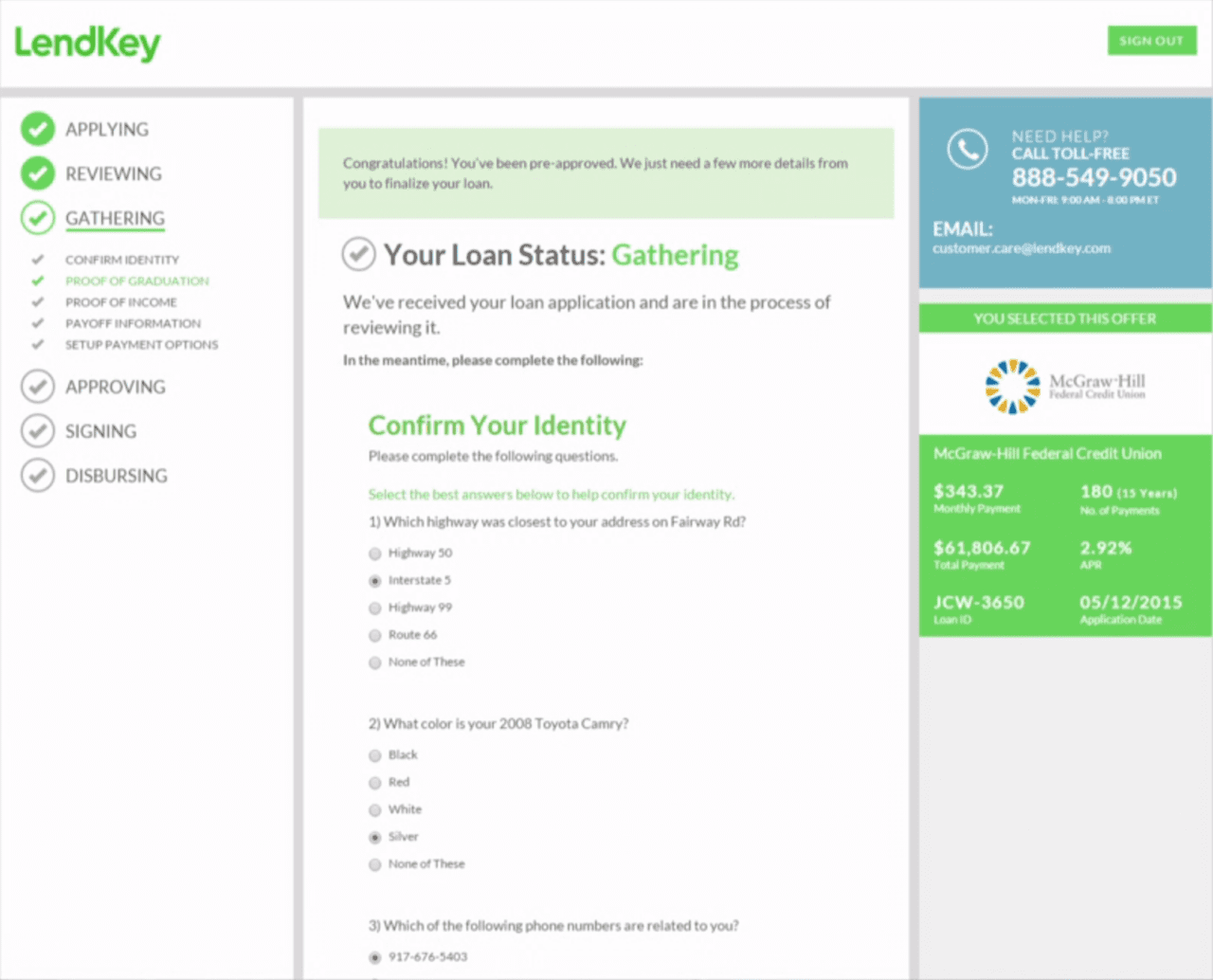

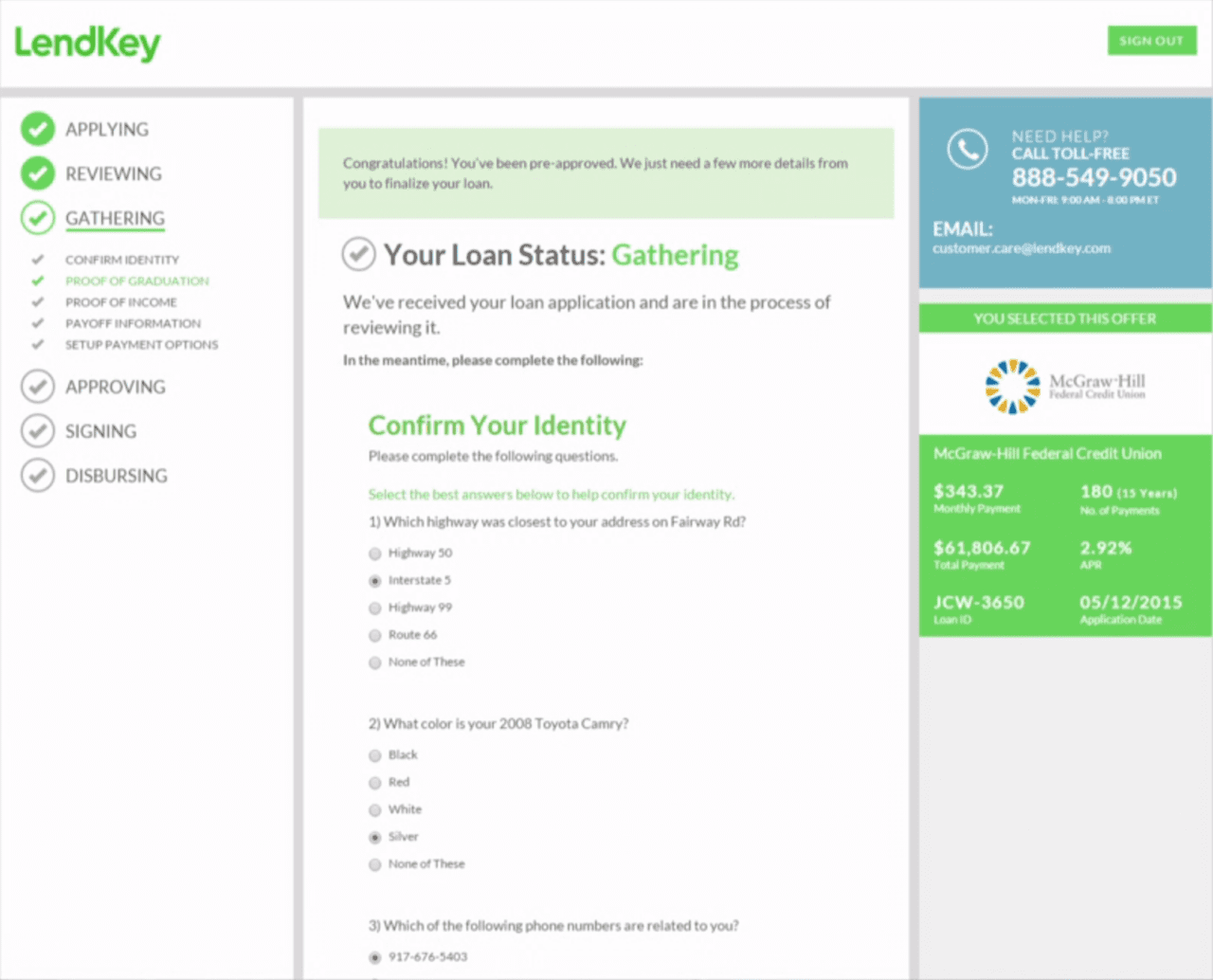

4) Complete

For a seamless experience, the entire loan-application process takes place inside the LendKey site. Here’s the process:

- Fill out application

- Review application

- Answer KDA questions to confirm identity

- Prove graduation and income

- Select which loans to refinance

- Set up ACH payment authorization

- Esign disclosures

Once these steps are finalized, LendKey pays off the user’s existing loans, and the debtor enters into the repayment phase.

Banks and credit unions receive a turnkey online lending solution that broadens their portfolio by reaching new borrowers across multiple asset classes. While the bank sets the underwriting rules, LendKey holds the paper on the loan.

Many lenders affiliated with LendKey are new to online lending. LendKey facilitates the lending institutions’ involvement by using in-house expertise to adapt their underwriting for the online audience.

What’s new and next

LendKey expects plenty of future growth in student lending. While the company plans to continue in that space, it recently began offering home improvement and auto loans. It sees lots of room for expansion in all verticals.

In April, LendKey signed Navy Federal Credit Union to power student loan consolidation and private student loan offerings for its members.

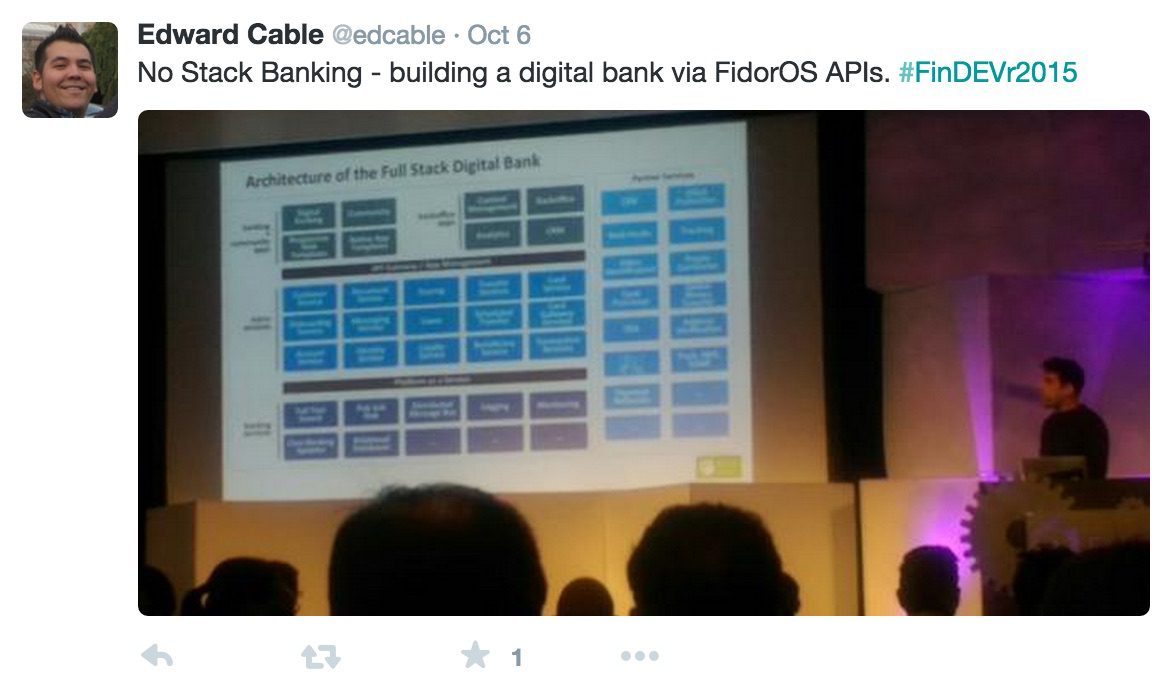

Are you building new financial technology? Be sure to check out coverage from our recent developers conference in San Francisco. We’re taking the fintech developer tool showcase to New York, 29/30 March 2016. Stay tuned for details.

Are you building new financial technology? Be sure to check out coverage from our recent developers conference in San Francisco. We’re taking the fintech developer tool showcase to New York, 29/30 March 2016. Stay tuned for details.