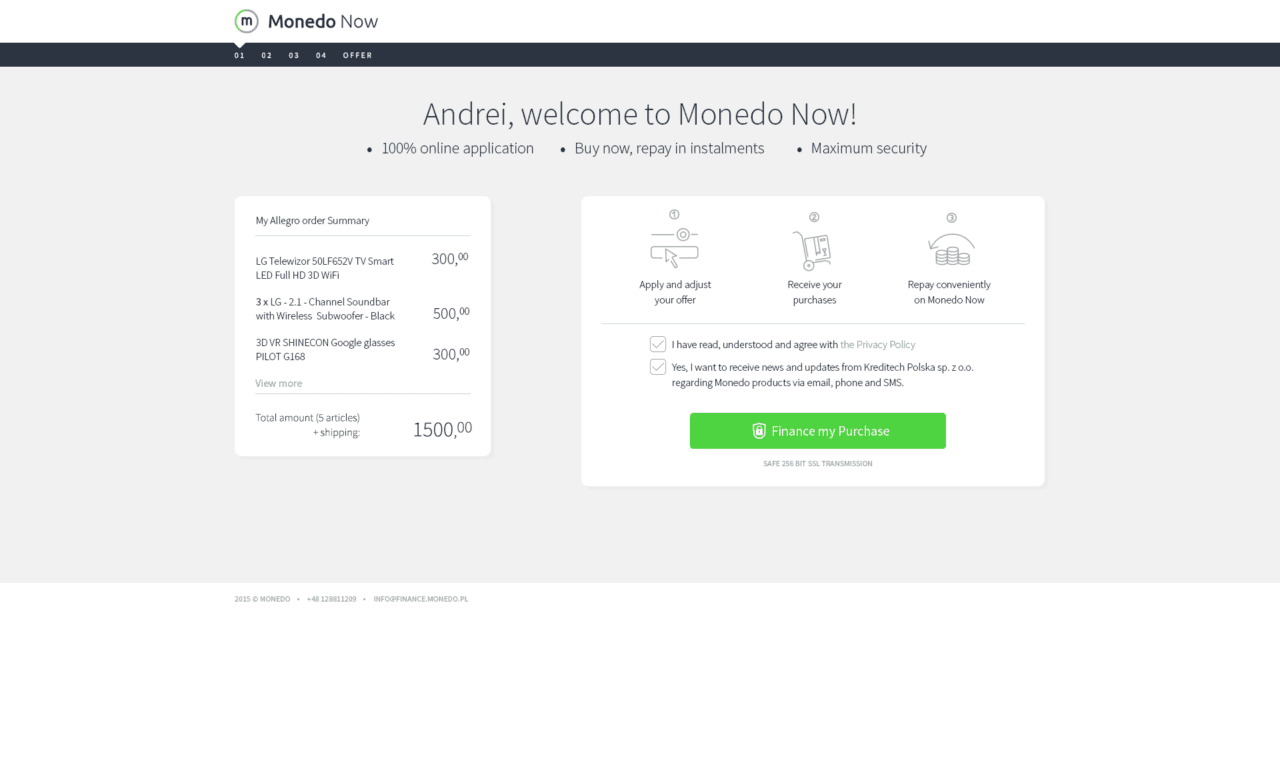

Consumer financing company Kreditech announced a new business line today. In an effort to empower underbanked individuals, the company launched a new POS financing solution called Monedo Now. It gives online shoppers more payment flexibility with instant financing of up to $5,550 (€5,000) for up to 36 months at rates comparable to local banks.

The first partner to go live with the solution is PayU Global, a payment services provider who recently launched a beta test with one of its merchant clients. Kreditech plans to expand the service. Alexander Graubner-Müller, CEO and co-founder said, “We are already in talks with further clients in the e-commerce, travel and other online sectors and look forward to providing our innovative technology as an online payment method in the checkout process.”

Kreditech’s Sebastian Diemer and Alexander Graubner-Müller, presenters at FinovateSpring 2014.

Kreditech’s Sebastian Diemer and Alexander Graubner-Müller, presenters at FinovateSpring 2014.

Monedo Now uses Kreditech’s credit-scoring technology which underwrites risk on thin-file credit clients. At FinovateSpring 2014, the company showed off its algorithm that provides a risk score of the customer by studying their financial situation at the time of their application without pulling in historical data. Kreditech uses 20,000 data points, updated every minute, to offer 24/7 access to credit decisioning for anyone in 35 seconds.

Kreditech plans further integrations with companies using its Credit-as-a-Service API which offers support for financing more than just physical goods at the POS. The company will support financing for online services and travel purchases as well as direct integrations with online wallets, prepaid cards and bank offerings.

In March, Kreditech closed a $103 million Series C funding round from contributors such as World Bank Group’s International Finance Corporation, Blumberg Capital, and Peter Thiel. That round boosted the company’s total funding to $151 million.

Our

Our

CEO Tamlyn Thompson and Dr. Zaher Zaidan, CFO, demoed IDScan Biometrics’ facial recognition algorithm.

CEO Tamlyn Thompson and Dr. Zaher Zaidan, CFO, demoed IDScan Biometrics’ facial recognition algorithm.

Dan Adamson, CEO and founder of OutsideIQ, demoed the DDIQ API at FinDEVr New York 2016.

Dan Adamson, CEO and founder of OutsideIQ, demoed the DDIQ API at FinDEVr New York 2016.

Adam Dolby, Encap vice president of business development, presented at FinovateFall 2015 in New York.

Adam Dolby, Encap vice president of business development, presented at FinovateFall 2015 in New York.

At FinovateFall 2015, Socure’s co-founders Sunil Madhu, CEO, and SVP Johnny Ayers, business development, demoed Perceive (a facial biomentrics solution).

At FinovateFall 2015, Socure’s co-founders Sunil Madhu, CEO, and SVP Johnny Ayers, business development, demoed Perceive (a facial biomentrics solution).