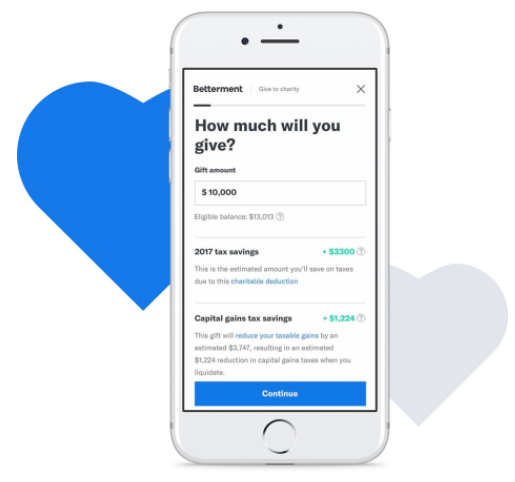

Robo advisory platform Betterment made an announcement today that it is not only making it easier to give to charities, it is also giving consumers more reasons to do so.

Starting November 28, on Giving Tuesday, Betterment investors will be able to donate shares of long-term investments from their taxable accounts directly to charitable organizations. While the act of giving may grant users a warm heart, Betterment has made a point to emphasize the self-serving part of the equation– tax benefits. Investors who donate can eliminate capital gains tax on the contributed shares and can also deduct the value of the gift on their tax return. To make the process as easy as giving cash, the company does four main things:

Tracks how much of your account is eligible to give to charity (i.e., it sorts for stocks that you’ve held for more than one year)

Tracks how much of your account is eligible to give to charity (i.e., it sorts for stocks that you’ve held for more than one year)- Estimates the tax benefits before you complete your gift

- Moves assets of up to $1 million from your account to a charitable organization’s account without any paperwork

- Emails a tax receipt after the donation is complete

At launch, investors can give to eleven charities, including UNICEF USA, Wounded Warriors Family Support, Hour Children, Against Malaria Foundation, DonorsChoose.org, GiveWell, Save The Children, Feeding America, Big Brothers Big Sisters of NYC, World Wildlife Fund, and Breast Cancer Research Foundation. Betterment is soliciting user requests for new charities to be added.

Founded in 2008, Betterment CEO Jon Stein debuted the company’s Multiple Goals feature at FinovateFall 2011. This summer, the New York-based company received a $70 million investment from Sweden’s Kinnevik, bringing Betterment’s total capital to $275 million and boosting it up to a valuation of $800 million.

Presenter

Presenter