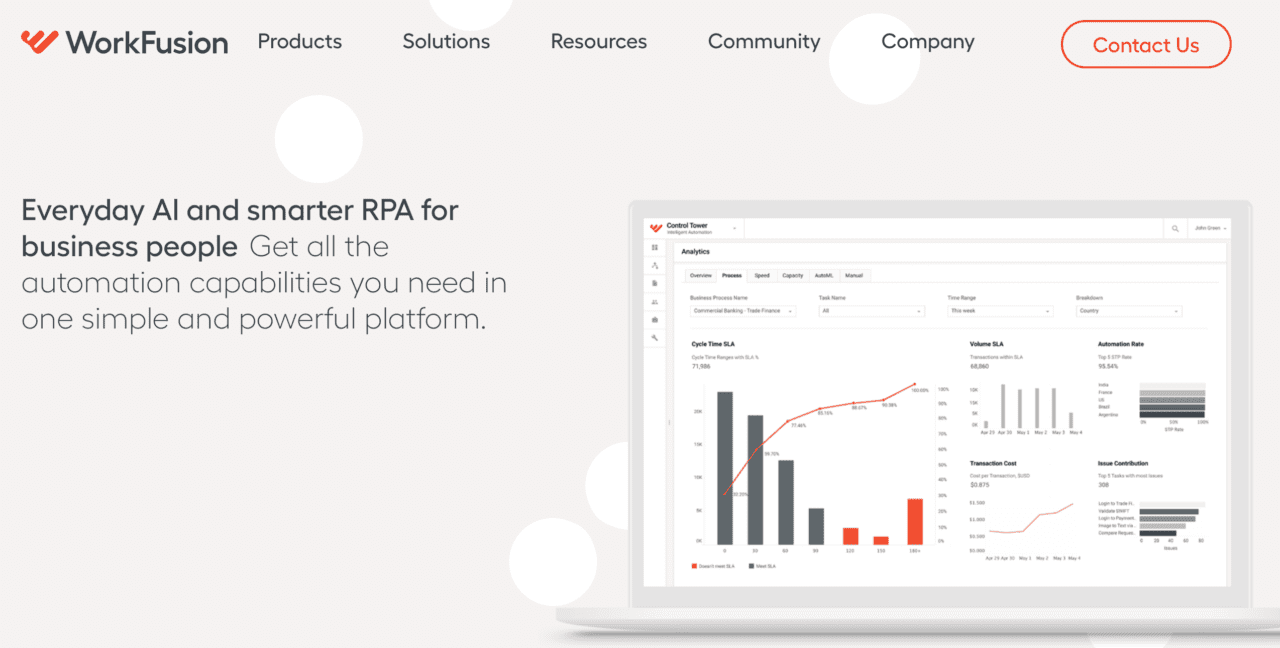

WorkFusion promises what many banks are seeking: to help clients outpace change. And fortunately, the New York-based company has funds to back up that idea. Robotic process automation (RPA) specialist WorkFusion quietly added to the $50 million funding round it received last month. Last week, the company closed on an undisclosed amount of funds from strategic investors including Guardian, New York-Presbyterian, PNC Bank, and Alpha Intelligence Capital.

Pete Cumello, WorkFusion CFO, tells us that the company’s aggregate funding stands at $120 million– and the undisclosed investment boosts the total up over that amount. Cumello also noted that the add-on round added “somewhat” to the company’s value.

WorkFusion’s goal with the new capital is to fuel growth and boost acquisitions. The company was founded in 2010 and offers products for financial services, insurance, and healthcare sectors. Broadly, WorkFusion’s mission is to help firms deal with the rapid rise of AI by reducing the complexity of AI and helping customers exploit the AI opportunity by leveraging products that pair people with the power of robotic software. Specifically, use cases for WorkFusion’s AI-powered RPA include creating a more efficient account opening process, increasing loan booking accuracy, and automating rule-based processes in trade finance.

The company began with a simple question, “What if software could learn to identify high-quality work and manage the people who perform it?” By 2014, WorkFusion had expanded on that idea and at FinovateFall 2014 it demoed Active Learning Automation in New York. The company’s goals for 2018 and beyond are to make software-as-a-service automation products that offer elastic, on-demand capability with the Automation Cloud.