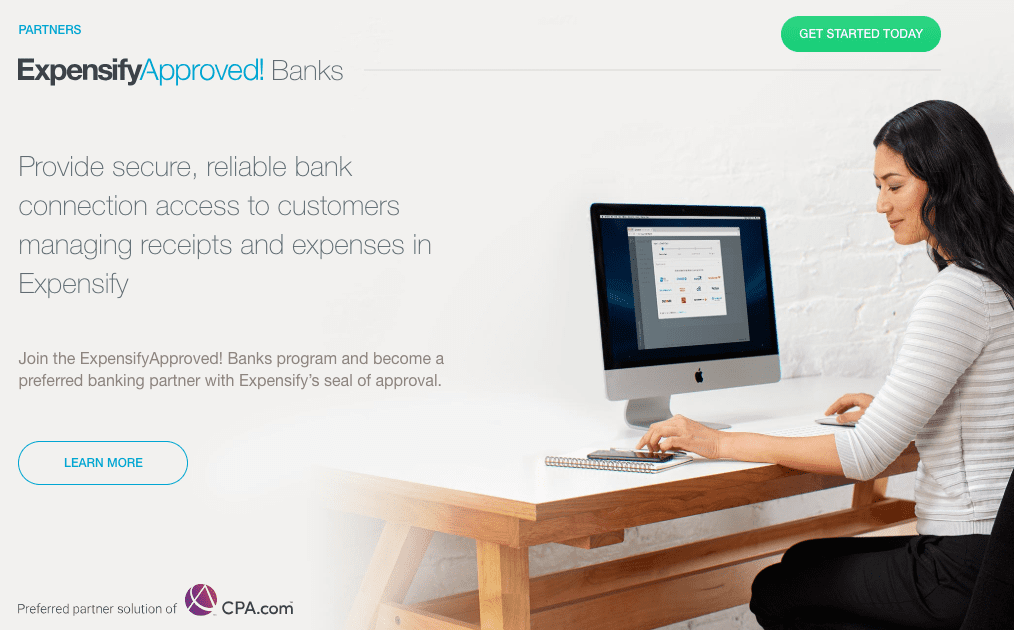

This week, expense reporting app provider Expensify debuted the launch of a deeper bank integration program called ExpensifyApproved! Banks. Wells Fargo, which serves one in three households in the U.S., will pilot the launch.

“Bank integrations have been in the Expensify DNA since day one, and the ExpensifyApproved! Banks program is the next step toward providing a consistent transaction import process for our mutual customers,” said David Barrett, founder and CEO of Expensify. “Wells Fargo has always been a great partner at the forefront of innovation, so it was a natural fit for them to be our first major partner as we launch this exciting new endeavor.”

Expensify users can connect their Wells Fargo bank cards for a smoother expense-tracking experience to help them organize receipts for tax purposes, self-employment expenses, or small business purchases. The ExpensifyApproved! Banks API allows for more secure data sharing between banks and Expensify, and offers banks more control over what data they share with the company.

The new integration offers mutual customers of Expensify and Wells Fargo a faster card setup process, the ability to seamlessly import transactions, access to historical account activity, and a detailed view of transaction data. Ben Soccorsy, Head of Digital Payments for Wells Fargo Virtual Channels said, “With API connectivity, Wells Fargo cardholders in Expensify can trust that they’re getting a smooth and efficient transaction import experience. Robust card connections that run dependably in the background are the perfect complement to fully automated expense reporting in Expensify.”

This launch comes at a time when consumers and businesses are laser-focused on how their data is collected and used. It also coincides closely with the E.U.’s implementation of PSD2, which mandates that banks must open their consumer data stores to third-party providers upon consumer consent. The ExpensifyApproved! Banks API is ahead of the curve on both of these items, and presents an opportunity for U.S. banks to mindfully and securely share consumer data.

At FinDEVr Silicon Valley 2016, Expensify presented Bedrock, an open sourced relational database management system. The company last demoed at FinovateSpring 2013, where Barrett showed off integrated invoicing technology. Earlier this year, Expensify unveiled website enhancements to improve credit card imports and simplify billing currency selections. The company was founded in 2008 and has raised $27.2 million.

To help drive future growth, Unison appointed Cari Jacobs (pictured) as the company’s Chief Marketing Officer. Jacobs most recently served as VP of integrated marketing at ModCloth and has previously driven marketing objectives at well-known brands such as Toyota, Lexus, Procter & Gamble, Intuit, General Mills, Levi’s, Coca-Cola and Prudential Real Estate. The company also appointed Quintin Gomez as the director and head of engineering.

To help drive future growth, Unison appointed Cari Jacobs (pictured) as the company’s Chief Marketing Officer. Jacobs most recently served as VP of integrated marketing at ModCloth and has previously driven marketing objectives at well-known brands such as Toyota, Lexus, Procter & Gamble, Intuit, General Mills, Levi’s, Coca-Cola and Prudential Real Estate. The company also appointed Quintin Gomez as the director and head of engineering.

Adam Cheyer

Adam Cheyer

Mortgagetech company

Mortgagetech company