If you’ve always wanted to hear top fintech analysts’ take on what’s hot in the industry, now’s your chance. Next month at FinovateFall, we’ll host four fintech research analysts on stage as they pitch what they think is the top opportunity for banks and financial services companies.

Each analyst will have seven minutes on stage (slides allowed!) to describe their thoughts on what’s hot in fintech right now. Here’s who you can expect to see on stage:

Jacob Jegher

Jacob Jegher

Jegher is an experienced fintech executive and digital banking thought leader. He advises clients on emerging technologies and business strategies related to retail, small business, and corporate digital banking. Jegher provides strategic consulting to financial institutions and solution providers on issues ranging from digital strategy to vendor selection. In addition to his client-facing responsibilities, Jacob leads Javelin’s overall strategy, marketing, and product development efforts.

Most recently, Jegher was Vice President of Global Solution Marketing and Head of Analyst Relations at FIS, where he was responsible for marketing strategy efforts across all business units and solutions. He also brings extensive expertise in the banking research and consulting field, having spent over 10 years as a Research Director at Celent.

Alyson Clarke

Alyson Clarke

Clarke is a principal analyst at Forrester. With more than 19 years of financial services industry experience, she is a highly skilled expert with extensive industry experience in both wealth management and banking. Clarke has global expertise, having previously worked at Forrester in the financial services vertical in its Sydney, London, and San Francisco offices. She is now based in New York and specializes in digital and non-digital channel strategy and innovation, in particular the sales, service, and customer experience of financial services and advice across online channels, smartphones, tablets, and branches.

Daniel Latimore

Daniel Latimore

Latimore, CFA, is the Senior Vice President of Celent’s Banking group and is based in the firm’s Boston office. Latimore’s areas of focus include the banking ecosystem, digital and omnichannel banking, and innovation. Underlying each is a keen interest in consumer behavior and technology-enabled strategy. Latimore is a frequent speaker at industry conferences and client gatherings, having addressed audiences ranging from intimate meetings of CEOs and central banks to conference keynotes in more than a dozen countries. He led research groups at Deloitte and IBM, worked in industry Liberty Mutual and Merrill Lynch (where he lived in New York, Tokyo and London), and was a consultant at McKinsey & Co.

Thad Peterson

Thad Peterson

Peterson is a senior analyst with Aite Group, focusing on the evolution of the payment space, the customer payment experience, and merchant acquiring.

Recognized as a global thought leader in payments, Peterson has a proven track record of identifying and developing new opportunities and technologies in payments and financial services. He has relevant expertise in applying customer behavior to the payments ecosystem in both corporate and startup environments. Peterson’s consulting background includes engagements on credit and debit cards, mobile payments, airline payment platforms, consumer and merchant loyalty, payment technology evolution, stored value, and product innovation. He holds patents in customer authentication and real-time mobile-enabled loyalty.

Peterson served as an officer in the U.S. Navy for four years and holds a degree in Special Education from the University of Idaho.

Join us on September 24 through 26 at the Marriott Marquis Times Square in New York to hear these experts talk about the latest in fintech. Register today.

Australian peer-to-peer lending company

Australian peer-to-peer lending company

Inc. 5,000 Europe

Inc. 5,000 Europe

Presenters

Presenters Sara Martins, Business Developer

Sara Martins, Business Developer

Francis Hwang, CEO

Francis Hwang, CEO

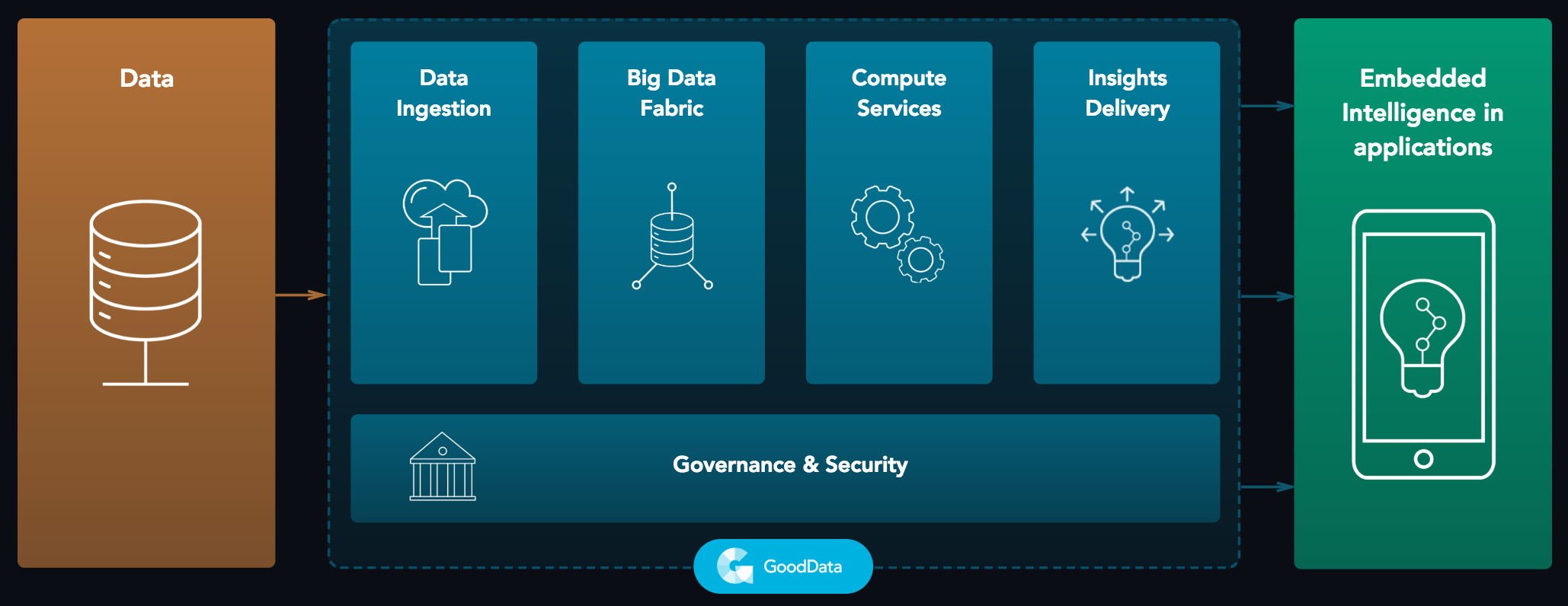

Above: GoodData’s process for transforming raw data into actionable predictions and recommendations

Above: GoodData’s process for transforming raw data into actionable predictions and recommendations Fraud protection

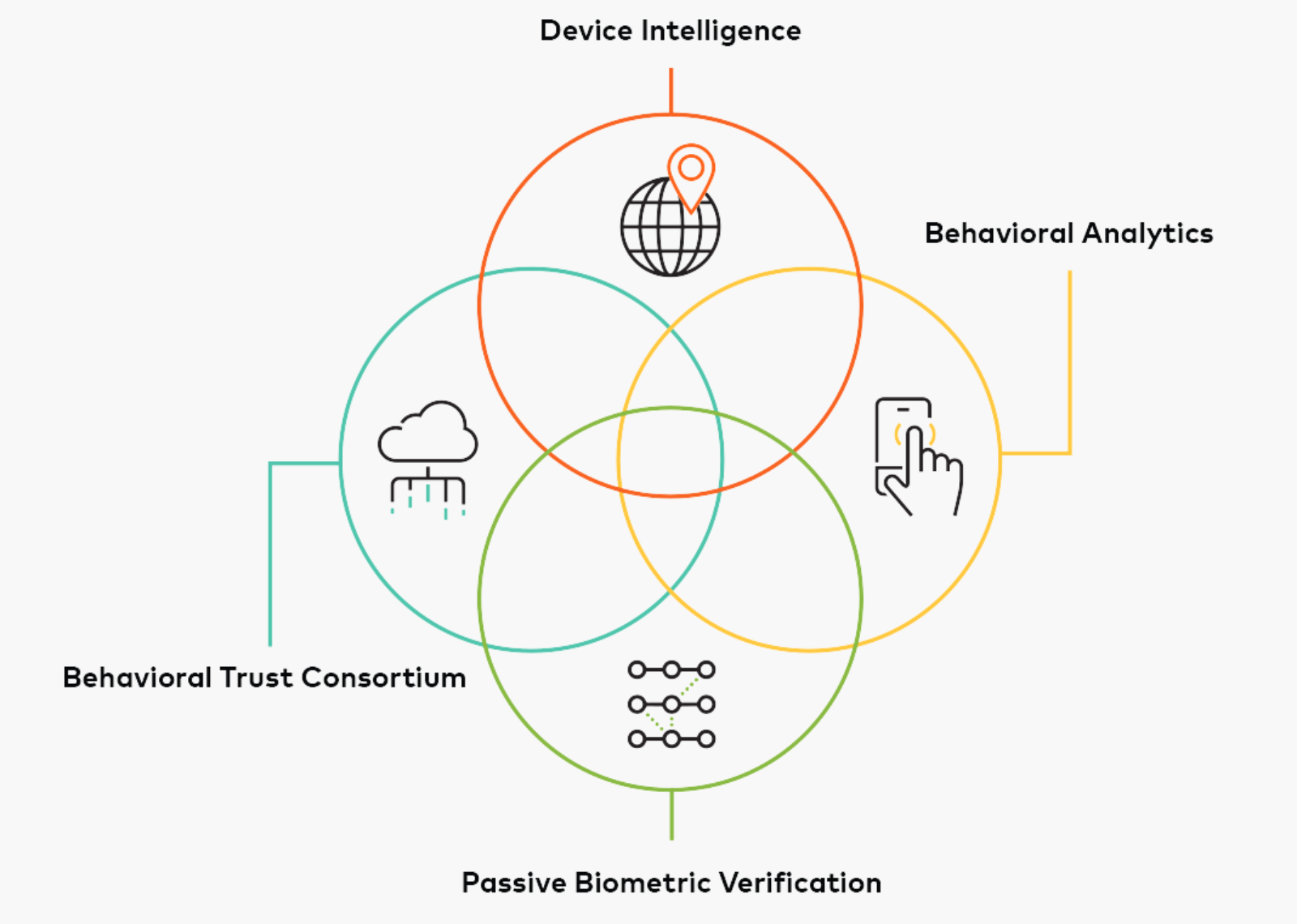

Fraud protection

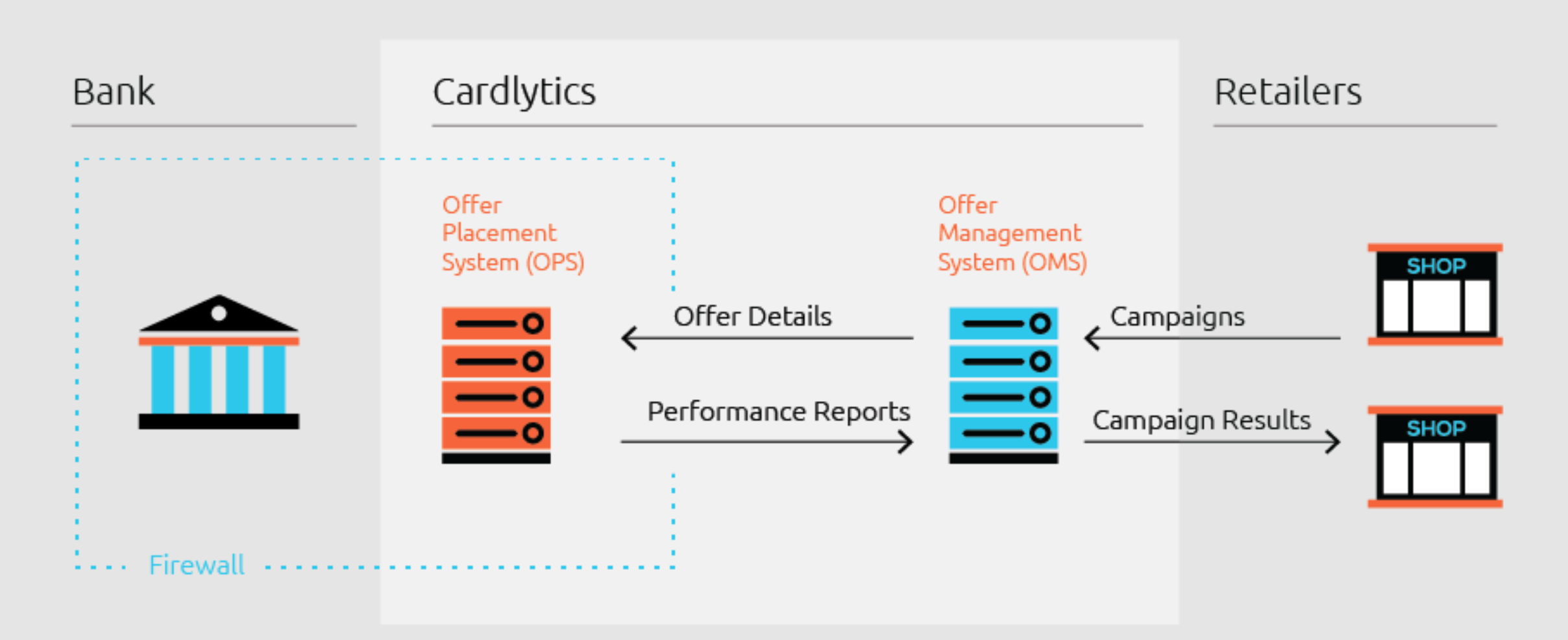

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

Presenters

Presenters