The alternative lending sector, especially in China, is soaking up funds at an unprecedented pace. This week alone, more than $750 million went to startup lenders, 80% earmarked to China (Lufax $485 million and Jimubox $84 million), while Funding Circle (London, $150 million), EZBob (London, $45 million), Smava (Germany, $16 million), and Assetz (London, $4.5 million) rounded out the sector’s inflow.

The alternative lending sector, especially in China, is soaking up funds at an unprecedented pace. This week alone, more than $750 million went to startup lenders, 80% earmarked to China (Lufax $485 million and Jimubox $84 million), while Funding Circle (London, $150 million), EZBob (London, $45 million), Smava (Germany, $16 million), and Assetz (London, $4.5 million) rounded out the sector’s inflow.

Across the total fintech sector, 18 companies raised $1.03 billion this week. And three new unicorns were officially unveiled: Lufax, Funding Circle, and Oscar, a U.S. health insurance startup.

In addition to EZBob ($45 million), two other Finovate alums brought in new cash this week: eToro which added $12 million to its already-announced $27 million round and SigFig took in another $1 million.

Here are the fintech funding rounds by size between 18 April and 23 April:

Lufax

P2P consumer loans

HQ: Shanghai, China

Latest round: $485 million (at $10 billion valuation)

Total raised: Unknown

Tags: Peer-to-peer lending, crowdfunding, investing, Ping An Insurance (investor)

Source: Wall Street Journal

Funding Circle

P2P consumer loans

HQ: London, United Kingdom

Latest round: $150 million Series E (at $1 billion valuation)

Total raised: $273.2 million

Tags: Crowdfunding, loan marketplace, peer-to-peer, unicorn, P2P, underwriting, investing

Source: Crunchbase

Oscar

Health insurance

HQ: New York City, New York

Latest round: $145 million Series A (at $1.5 billion valuation)

Total raised: $295 million

Tags: Insurance, analytics, healthcare, medical payments

Source: Crunchbase

Jimubox

P2P small business & consumer loans

HQ: China

Latest round: $84 million Series C

Total raised: $131.2 million

Tags: SMB, peer-to-peer lending, underwriting, investing

Source: FT Partners

EZBob

P2P small business loans

HQ: London, United Kingdom

Latest round: $45 million

Total raised: $66.5 million (which includes $11 million of debt)

Tags: Crowdfunding, marketplace lender, underwriting, SMB, investing, Finovate alum

Source: Crunchbase

CompareAsia

Asian financial comparison site

HQ: Hong Kong, China

Latest round: $40 million Series A

Total raised: $46 million

Tags: Financial lead generation, sales, insurance, banking, investing, MoneyHero, MoneyMax, MoneyGuru, Money101, SingSaver, MoneyHalo (brand names)

Source: Crunchbase

Perseus

High-speed global network for trading and other financial services

HQ: New York City, New York

Latest round: $20.5 million

Total raised: $20.5 million

Tags: Network, connectivity, trading, infrastructure, Goldman Sachs (investor)

Source: Crunchbase

Smava

P2P consumer loans

HQ: Berlin, Germany

Latest round: $16 million Series B

Total raised: $29.1 million

Tags: Loan marketplace lender, underwriting, investing

Source: FT Partners

Gravie

Health insurance services for employers

HQ: Minneapolis, Minnesota

Latest round: $12.5 million Series B

Total raised: $25.6 million

Tags: Enterprise, employee benefits, health insurance

Source: FT Partners

eToro

Social trading and investment network

HQ: Limassol, Cyprus

Latest round: $12 million (addition to $27 million round in Nov 2014 of which $10 million is debt)

Total raised: $72.9 million

Tags: Trading, sharing, currency, fx, investment management, investing, CommerzBank (investor), Silicon Valley Bank (creditor), Finovate alum

Source: Finovate

SureCash

Mobile banking platform in Bangladesh

HQ: Bangladesh

Latest round: $7 million Series B

Total raised: $7+ million

Tags: Mobile banking, payments, Hong Kong (investor)

Source: Crunchbase

Assetz Capital

P2P business loans

HQ: London, United Kingdom

Latest round: $4.5 million

Total raised: $4.5 million

Tags: Lending, crowdfunding, peer-to-peer, SMB, underwriting, investing

Source: Crunchbase

Cardfree

Mobile point-of-sale technology

HQ: Scottsdale, Arizona

Latest round: $4 million Series

Total raised: $14 million

Tags: Merchants, payments, acquiring, mobile, POS

Source: FT Partners

OpenFin

Financial services development platform

HQ: New York City, New York

Latest round: $3 million Series B

Total raised: $9.6 million

Tags: Development tools, desktop financial services, investment management, IT

Source: Crunchbase

New Media Insight

Mobile payments (mPaay)

HQ: Phoenix, Arizona

Latest round: $2 million

Total raised: $2 million

Tags: Payments, SMB, acquiring, mobile

Source: FT Partners

CoinTent

Micropayments

HQ: San Francisco, California

Latest round: $1.1 million Seed

Total raised: $1.1 million

Tags: Payments, mobile, micropayments, SMB, digital content

Source: Crunchbase

SimplyInsured

Group health insurance quotes

HQ: San Francisco, California

Latest round: $1 million Seed

Total raised: $1.8 million

Tags: Insurance, healthcare, SMB, lead gen, Y Combinator

Source: Crunchbase

SigFig

Online portfolio/investment manager

HQ: San Francisco, California

Latest round: $1 million Series

Total raised: $16 million

Tags: Robo-adviser, ETF, asset allocation, investing, Finovate alum

Source: Finovate

——–

Related

Not a technology company, but a part of the fintech ecosystem (not included in total funding amount)

untapt

Fintech software developer recruiter

HQ: New York City, New York

Latest round: $3.1 million Series A

Total raised: $4.2 million

Tags: Developers, builders, recruiting, headhunter

Source: Crunchbase

I’ve been a mortgage customer for almost 30 years. And unlike most financial products, the mortgage process has gotten more convoluted in those three decades. There are good reasons for many of the added hassles, but the overall experience leaves a lot to be desired, especially if you are not a standard W2 wage earner. The poster-child for bad UX was last year’s denial of a mortgage to previous Fed chairman, Ben Bernanke. I had similar trouble last Fall, despite almost 20 years in the same home and job. There is still much to be done.

I’ve been a mortgage customer for almost 30 years. And unlike most financial products, the mortgage process has gotten more convoluted in those three decades. There are good reasons for many of the added hassles, but the overall experience leaves a lot to be desired, especially if you are not a standard W2 wage earner. The poster-child for bad UX was last year’s denial of a mortgage to previous Fed chairman, Ben Bernanke. I had similar trouble last Fall, despite almost 20 years in the same home and job. There is still much to be done.

Editor’s note: We are starting a new series showcasing very early-stage

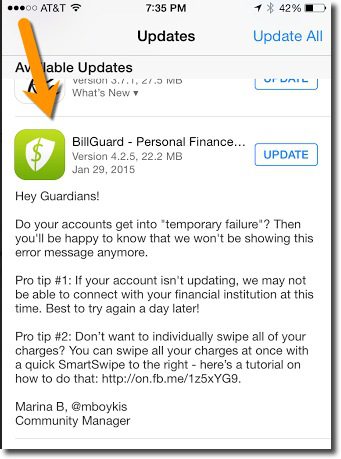

Editor’s note: We are starting a new series showcasing very early-stage Why it’s a good strategic bet for financial institutions: Students and young adults are an attractive, albeit difficult, segment to win over. Yet, they are the future, and could be customers for 70+ years. So helping them with early money-management problems could pay huge dividends over time, assuming you are able to upsell profitable financial products. Furthermore, if a “parent view” could be added to the functionality, the app could be appealing to the income-producing part of the family.

Why it’s a good strategic bet for financial institutions: Students and young adults are an attractive, albeit difficult, segment to win over. Yet, they are the future, and could be customers for 70+ years. So helping them with early money-management problems could pay huge dividends over time, assuming you are able to upsell profitable financial products. Furthermore, if a “parent view” could be added to the functionality, the app could be appealing to the income-producing part of the family. While it wasn’t a

While it wasn’t a

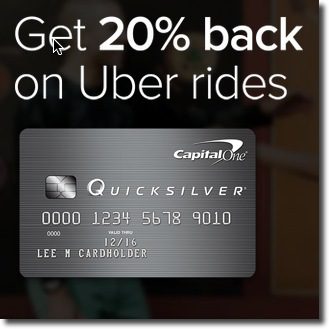

Last week, Capital One launched a national marketing promotion with Uber that provides a 20% rebate on rides for one year. And unlike many (most?) card offers, it’s good for both new and existing Capital One customers. However, the ride-rebate applies only to the bank’s Quicksilver cash-back card, so I’m out of luck with my Capital One Venture card.

Last week, Capital One launched a national marketing promotion with Uber that provides a 20% rebate on rides for one year. And unlike many (most?) card offers, it’s good for both new and existing Capital One customers. However, the ride-rebate applies only to the bank’s Quicksilver cash-back card, so I’m out of luck with my Capital One Venture card.

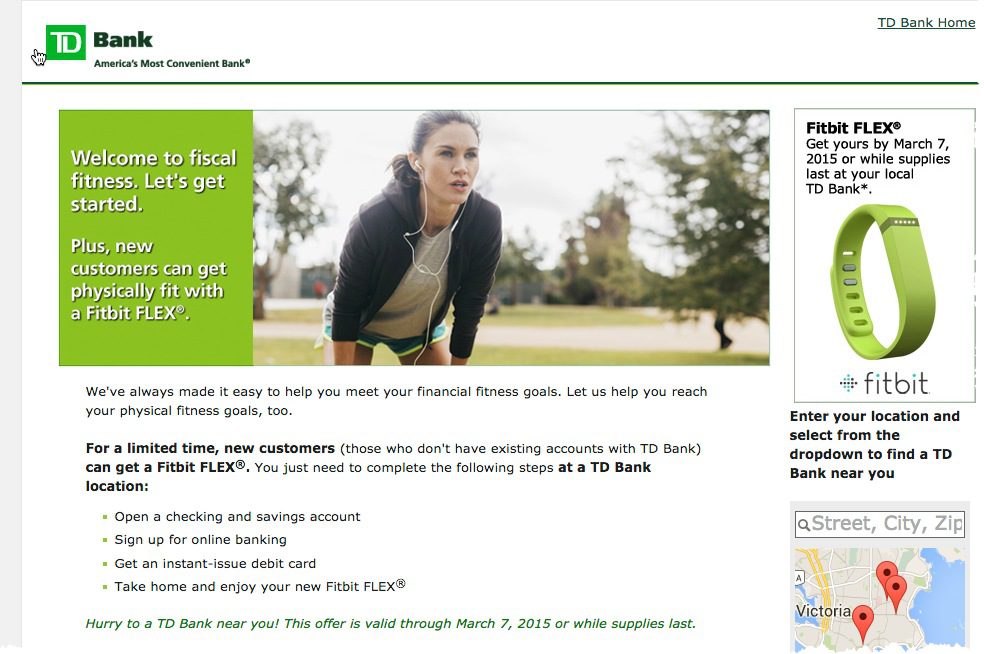

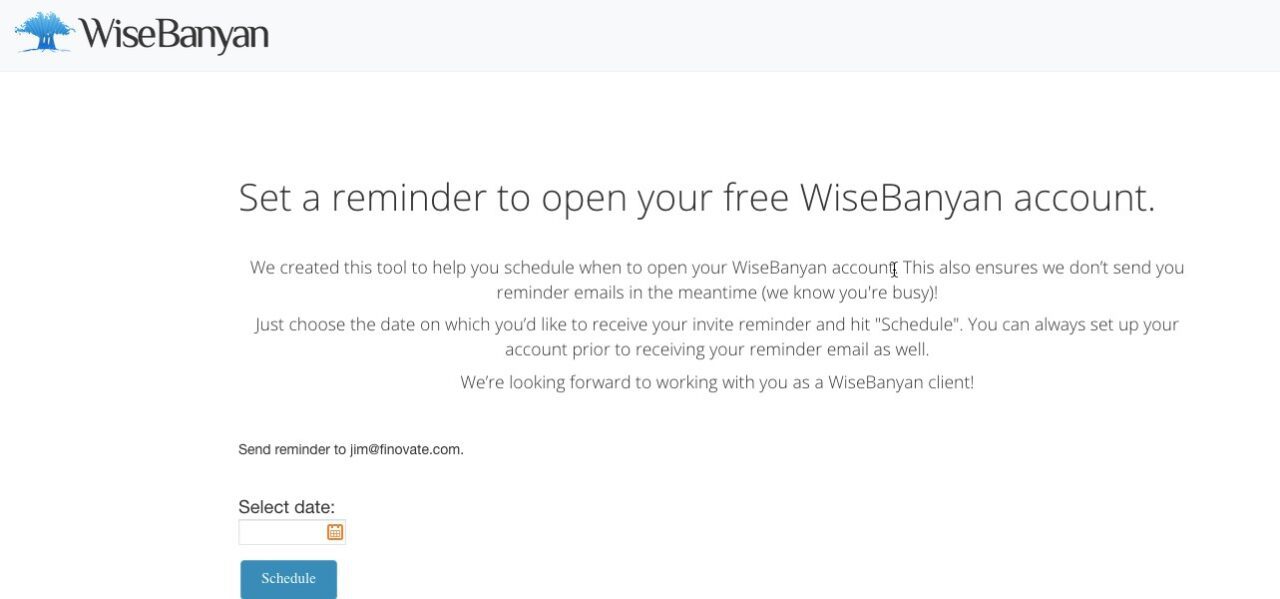

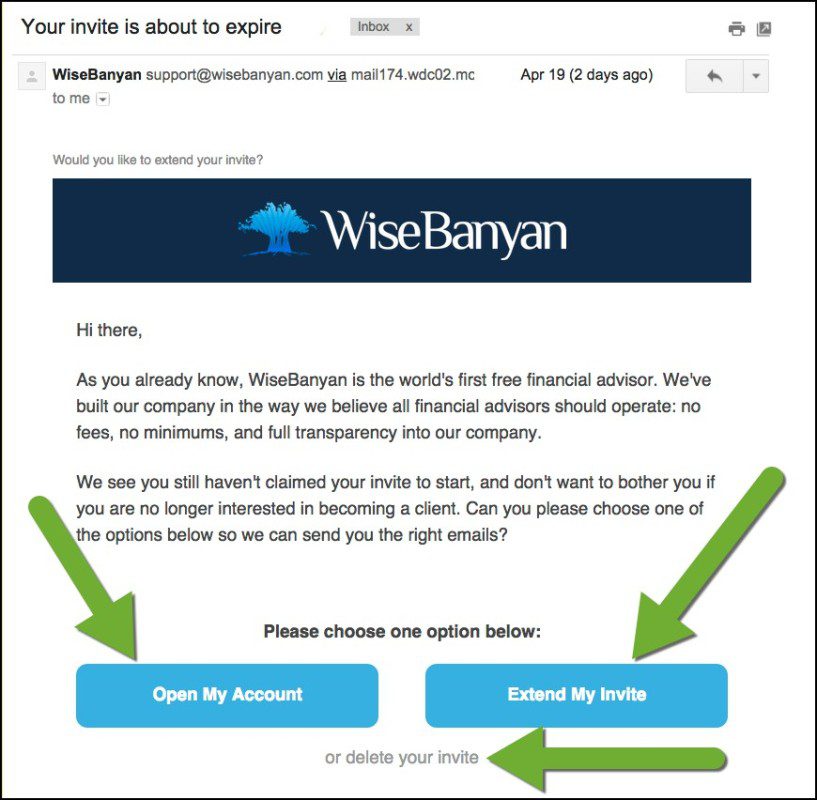

I’ve always been a “wanna be” tracker. I like watching the stats closely, but I also lose interest if the process, either capturing the data or compiling it, becomes tedious. But thanks to mobile (including wearables), the drudgery is disappearing and that has big implications for banking and financial services.

I’ve always been a “wanna be” tracker. I like watching the stats closely, but I also lose interest if the process, either capturing the data or compiling it, becomes tedious. But thanks to mobile (including wearables), the drudgery is disappearing and that has big implications for banking and financial services. 1. Make it easy to use: While Fitibit requires zero maintenance once you get it activated, you do have to remember to keep it on you. The same goes double for a bank’s credit or debit card. You not only have to remember it, but also must choose to use it at the point of sale.

1. Make it easy to use: While Fitibit requires zero maintenance once you get it activated, you do have to remember to keep it on you. The same goes double for a bank’s credit or debit card. You not only have to remember it, but also must choose to use it at the point of sale.