Financial institutions must adopt new safeguards in 2005

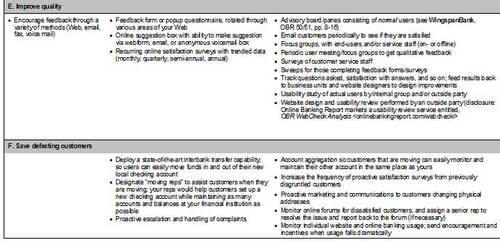

We interrupt the regularly scheduled newsletter for an important bulletin: The industry1 MUST adopt stricter online authentication and monitoring tools or risk a damaging backlash against online banking and payments. To help spur innovation on the security front, we are launching a new effort called the Safe Banking Initiative, or SBI for short. We hope to create an Underwriters Lab (UL) type seal of approval for financial institutions to display on the websites and other marketing material.

BAI Retail Delivery 2004

On the way home from BAI’s Retail Delivery, I always try to reflect on the “themes” from this influential industry conference. This year it was all about integration: interbank (A2A) transfers integrated with bill payment; ATMs integrated with check processing; branches integrated with online banking; everything integrated with industrial strength CRM systems.

My biggest aha! occurred at an unlikely spot. Normally, I skip the hardware displays with their legions of enthusiastic ATM salespeople, and head straight for the booths in the back where I always learn something from the online pioneers. This year my most memorable conversations were with Hill Ferguson, Melanie Flanigan, and the whole crew from Yodlee on the bus back to our hotel; Neil Platt and Sanjeev Dheer from CashEdge on the trade-show floor as they landed a major new bank account; and as always, catching up with long-time industry visionary Matt Lawlor from Online Resources.

But this year, thanks to an effective pitch from its Williams Mills rep, Jamie Stephenson, I found myself chatting with Miles Busby, founder of Source Technologies www.sourcetech.com about his vision of the future branch. Think airport check-in, circa 2004, where rows of touch-screen kiosks greet flyers, run them through the check-in process, and spit out boarding passes. One or two attendants assist with checked baggage and answer questions posed by perplexed travelers using self-service for the first time2.

1We’re referring specifically to U.S. banks; many major banks outside the U.S. have already added rigorous and highly effective authentication processes; one major bank familiar to us has only lost a few thousands dollars year-to-date.

2Alaska Airlines, the first airline to offer kiosk check-in, then later Web-based check-in, is considering eliminating the ticket counter altogether, a concept it is testing in Anchorage.

A Real Automated Teller Machine

Fast-forward to the bank branch of 2007. Customers walk in the door and head directly to teller row, no lines. After swiping an ATM card and entering a PIN at terminals built into the counter, customers feed paper checks directly into the deposit slot. Instantly an image of the check appears on screen along with the amount of the deposit. After confirming, the total is added to the customer’s balance, the original paper s check returned as a receipt, and any cash-back is dispensed from the machine. Finally, the human teller asks, “Did you get that double billing on your credit card resolved

Mr. Poddenstopper?”*

The machines can also handle other routine transactions: loan payments and other bills could be paid by feeding billing statements into the machine, then selecting the account to debit; funds could be transferred within the bank or to accounts outside the bank; money orders, cashiers checks, and prepaid cards could be created right from the machine. Machines could be even be equipped to handle merchants, accepting and dispensing cash and coin, payroll checks, and prepaid employee cash cards.

The beauty of all this, not counting the labor savings, which Busby said could pay for the equipment within a year, is that it all ties in nicely with online banking. Upon return to their home or office, branch self-service users will be greeted with an email summarizing the transactions with links to online banking to view images of any paper checks or statements scanned in the branch, and to take any action related to the in-branch transaction. It’s similar to the way the airline check-in process is spurring travelers to go online and check-in prior to the trip to the airport.

Paperless Banking

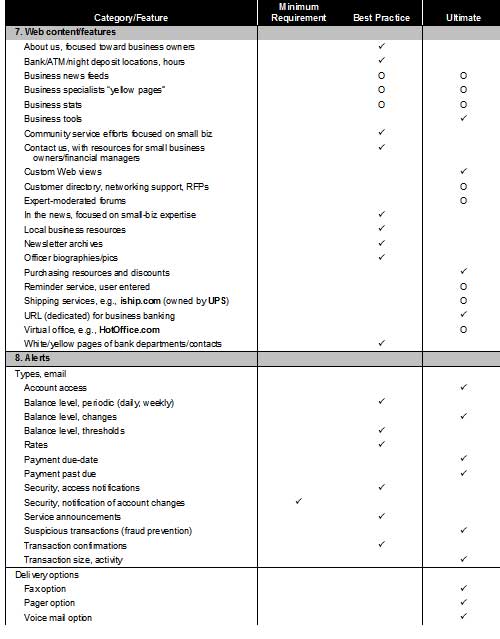

Another chord struck at Retail Delivery was the growing threat to consumer confidence in online banking, and by extension banking in general, due to the proliferation of spyware, worms, Trojans, fake messages, as well as the mixed messages from financial providers, the media, and government regulators. Jim Van Dyke, whose Javelin Strategy www.javstrat.com consultancy is doing pioneering work in this area, presented not one but two sessions on paperless banking. He looked at 44 criteria at 39 leading banks, determining that BofA, Wells Fargo, E*Trade, and Zions had the best total safety rating .

That’s great information on those 40 banks, but what about the other 20,000 U.S. financial institutions? How do consumers determine if they are dealing with a “best practices” bank or credit union? Not to beat our own drum too loudly, but we hope our Safe2Bank certification will go a long way in educating, and, more importantly, reassuring consumers and the media about real fraud threats, both on and offline.

Jim Bruene, Editor & Founder,

*As soon as Mr. P swiped his card, his name, account history, and recent service issues instantly appeared on a screen visible only to the human teller. The customer record could also be enhanced with family names, pronunciations, and even the occasional cross-sell prompt. While this teller-automation technology has been available for years, the typical teller is too busy handling transactions to really converse with the customer