For years it’s been a matter of when, not if, the number of debit card transactions would surpass credit cards for purchases in the United States. Depending on who’s doing the counting and how you define the market, debit surpassed credit:

For years it’s been a matter of when, not if, the number of debit card transactions would surpass credit cards for purchases in the United States. Depending on who’s doing the counting and how you define the market, debit surpassed credit:

a) in 2000

b) in late 2004

c) not yet, but by early 2006

Sources:

a) Dove Consulting as announced in its Oct. 25 news release with The American Bankers Association; includes volume of purchases made in-store only; projections built on research with 3000 consumers

b) The Nilson Report, Sept. 2005 (#842); includes any purchase transaction, in-store, phone, or online; projections built on industry data, much of it provided by the major card brands; credit totals include card purchases made with proprietary cards, such as oil or department stores; debit totals include signature- and PIN-based traditional debit card and prepaid cards

c) SourceMedia’s Cards & Payments, Oct. 2005 citing data from its sister publication, ATM & Debit News; projections built on industry data and like Nilson includes proprietary store cards in the credit totals and signature- and PIN-based transactions in debit

The Numbers

The Nilson Report had debit ending the year with 19.7 billion transactions, 600 million more than the 19.1 billion credit card transactions (see note 1). Market share was 51% for debit, 49% for credit. Whereas ATM & Debit News showed credit transactions still running ahead of debit, with 22.1 billion for credit and 17.5 billion for debit (see note 2). For 2005, they project 23.5 billion for credit and 21 billion for debit. Extrapolating from the growth rates, debit should surpass credit in late 2006.

The total dollar volume of charges will continue to be dominated by credit. With more than double the average transaction size, $84 vs. $37 for debit, the share of total dollars spent was nearly 69% for credit vs. 31% for debit, according to Nilson.

It’s helpful to look at these huge numbers on a per household basis. Across all 108 million U.S. households, the average annual number of debit and credit card transactions is 360 per year, or 30 per month.

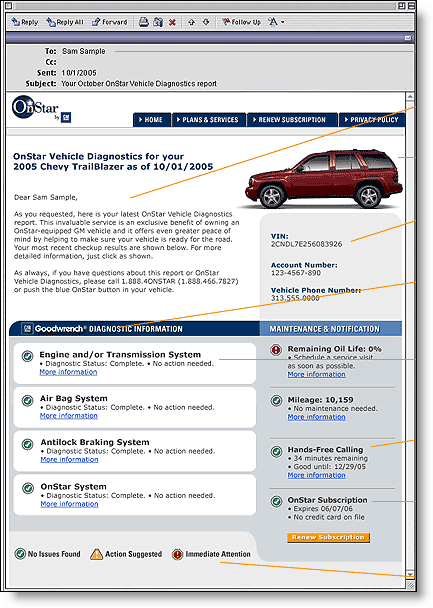

Looking at debit only, the average across all households is 180 transactions per month. But considering that only about 60% of the country is an active debit user, the average per active household is closer to 300 per year, or almost 1 per day. Unlike credit transactions which are divied up among the 12 cards carried by the average customer, many of the debit transactions occur with plastic from the customer’s primary financial institution. This creates a rich data stream for online banking statements and analytics.

Opportunities

As good as this debit data stream is, it’s only half the picture without the credit card transactions, especially since the larger purchases still tend to go on a credit card. This is one of the places where account aggregation could play a key role by offering a simple way to aggregate all card transactions into one online storage facility. The full picture, incorporating all plastic volume, will create an information stream that is highly valued and difficult for competitors to match. And by knowing you customers card habits, you can make successful pitches to steal the receivables from competitors.

- Debit rewards: Although debit card spending is not as lucrative as credit cards, especially with the downward trend in debit interchange, major players are still looking to reward spending. Yesterday we looked at Citibank’s ThankYou Points program that offers 1 point for every $2 of spending on signature debit and 1 point for every $3 spent on PIN-based debit. Assuming that two-thirds of debit spending goes to signature, the average customer would earn about 3000 points per year, valued at $25 if redeemed for a gift certificate or $50 if saved and used towards a $400 coach ticket (25,000 points required).

- Credit line cross-selling: How do you make debit cards as profitable as credit cards? Attaching a line of credit to the account. Overdraft credit lines are extremely popular and are even more desirable with heavy debit users who increased transaction levels increase the chances of overdrafting the account. The increased outstandings could help fund a rewards program, therefore improving retention and increasing interest income at the same time.

- Alerts and other messages: If you are a typical debit user, racking up 25 transactions per month, and with no 25-day grace period like credit card users, you will have a great appreciation for a bank that keeps you informed of your debit transaction flow. Transaction confirmations are the simplest and most valuable message. But there is also demand for more advanced alerts that would inform users when a debit card transaction appears out of character (possible fraud) or if holds from hotels or gas companies may significantly impact checking account balances. These value-added alerts could be packaged with rewards and lifetime statement archives into a premium online banking program priced from $3.95 to $9.95/mo (or $39 to $99 per year).

For more information:

Online Banking Report #96/97, Account Aggregation v3.0

Online Banking Report #118: Lifetime Statement Archives

Online Banking Report #109: Pricing (premium products)

The Nilson Report, #842, September 2005

Cards & Payments, Debit Card Report, Oct. 2005, pp. 22-26

Notes:

1. The Nilson Report credit card volume includes Visa, MasterCard, American Express, Discover, proprietary store cards, and gas station cards. It does not include proprietary T&E cards such as Diners Club, Universal Air Travel Plan, car rental cards, or phone cards

2. SourceMedia’s debit cards include Visa, MasterCard, and cards issued by financial institution and used through EFT networks.

— JB

ING Direct’s <

ING Direct’s <

I

I