Mobile technology solutions provider Tagit has raised $8.75 million (S$12 million) in funding from Japanese IT specialist, SRA Group. The investment will help both companies grow their market exposure in Asia. Tagit is headquartered in Singapore and was founded in 2004.

Tagit CEO Sandeep Bagaria said the investment would help speed growth in sectors like digital banking and “Smart City” technology. In addition to leveraging the partnership to pursue opportunities in Japan and North Asia, Tagit plans to use the financing to add to its staff in Malaysia and Indonesia.

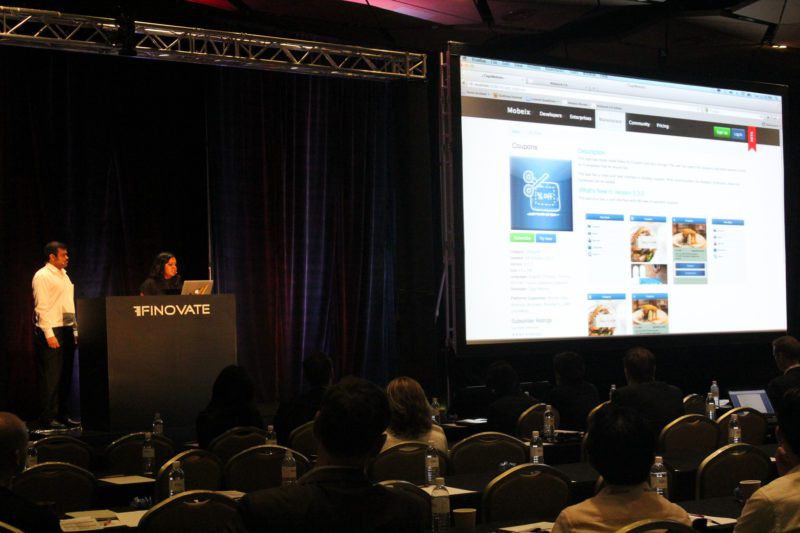

Pictured (left to right): CIO Parikshit Paspulati and CPO Neelima Subramanyam demonstrated Mobeix Open Platform at FinovateAsia 2012 in Singapore.

Tagit builds open-architecture, mobile banking and ecommerce platforms for FIs and other businesses. The company’s signature solution, Mobeix is a mobile middleware platform that helps migrate web-based services to the mobile environment. With customers including Axis Bank, Citibank India, Maybank Singapore, and the Royal Bank of Canada, Tagit demoed its technology at FinovateAsia 2012 in Singapore. Tagit was recognized as a “leader” by Forrester in their Q4 2015 Mobile Banking Solutions report, and was one of the first companies to be accredited by the Accreditation@IDA programme sponsored by the Infocomm Development Authority of Singapore (IDA).

Deal Street Asia’s analysis of the deal suggested that SRA Group’s investment in Tagit was part of a trend of Japanese companies preferring investment in Southeast Asia over China. The article cited a 2014 report that cited Japan as the second biggest investor in the 10 ASEAN nations for the previous three years, a sum that was triple the amount invested in China over the same time. The investment was made via SRA Group’s Singapore subsidiary, SRA IP Solutions (Asia Pacific) Pte Ltd.

From expressing in real-time the “wow effect” of live fintech demos to the way a 140-character limit sharpens the wit of some of our industry’s most clever and insightful, our showtime Twitter feed #Finovate was certainly one of the stars of

From expressing in real-time the “wow effect” of live fintech demos to the way a 140-character limit sharpens the wit of some of our industry’s most clever and insightful, our showtime Twitter feed #Finovate was certainly one of the stars of

Currency Cloud CEO Mike Laven praised Tee’s “deep understanding of the payments industry” which he credited to the diveristy of her executive background. Prior to Intelligent Environments, Tee worked as CFO at Omnico Group, and has held executive positions at MasterCard, Anite, and Mondex International. She is a graduate of the Imperial College London and has an ACA certification from the Institute of Chartered Accountants England and Wales.

Currency Cloud CEO Mike Laven praised Tee’s “deep understanding of the payments industry” which he credited to the diveristy of her executive background. Prior to Intelligent Environments, Tee worked as CFO at Omnico Group, and has held executive positions at MasterCard, Anite, and Mondex International. She is a graduate of the Imperial College London and has an ACA certification from the Institute of Chartered Accountants England and Wales.

Morris emphasized that while the “lack of full disclosure” during the review process was “unacceptable,” he added that the sum involved was “minor” and would have no financial impact on the company. Lending Club’s Q1 results underscored this, with the company reporting year-over-year operating revenue gains of 87% and an increase of more than 137% in year-over-year, adjusted EBITDA.

Morris emphasized that while the “lack of full disclosure” during the review process was “unacceptable,” he added that the sum involved was “minor” and would have no financial impact on the company. Lending Club’s Q1 results underscored this, with the company reporting year-over-year operating revenue gains of 87% and an increase of more than 137% in year-over-year, adjusted EBITDA.