Of the 227 reports I authored at the helm of Online Banking Report, I am proudest of Building the Amazon.com of Financial Services written in mid-1998 (see notes 1, 2). The gist of it was that in the Internet era banks should broaden their offerings beyond checking, savings and loans. And importantly, that many of these opportunities did not require a banking charter. In fact, in many cases it would be better to not have one.

Of the 227 reports I authored at the helm of Online Banking Report, I am proudest of Building the Amazon.com of Financial Services written in mid-1998 (see notes 1, 2). The gist of it was that in the Internet era banks should broaden their offerings beyond checking, savings and loans. And importantly, that many of these opportunities did not require a banking charter. In fact, in many cases it would be better to not have one.

While many of those Amazon-like opportunities are still available today, there is also a massive new one. Amazon Prime which accounts for about $6 billion in annual revenue across 70 million subscribers. And that’s just the subscription revenue. It doesn’t include the sales lift across the Amazon marketplace. Considering that Amazon reported $2.4 billion in net income last year, just 40% of estimated Prime revenue, you can see how important it is.

So banks, where is your Prime program? Not free shipping, of course, but the ever-improving bundle of value-add services available for an annual/monthly fee. The price that your most engaged customers will pay to get the very best services you offer.

It’s a classic marketing strategy, right of Mktg 101 or maybe 201. And one that banks used themselves in the 1980s and 1990s when they created Gold, and then Platinum, credit cards chock full of so-called benefits even their product managers didn’t fully understand.

Retail banking, which has left more than $10 billion on the table by offering digital banking services free of charge, can employ this strategy with a bundle of digital services such as:

- Extra security

- Credit report alerts

- Plain language security guarantees & insurance against account theft/fraud

- Enhanced debit/credit cards

- Free overdraft protection

- Ultra-fast server

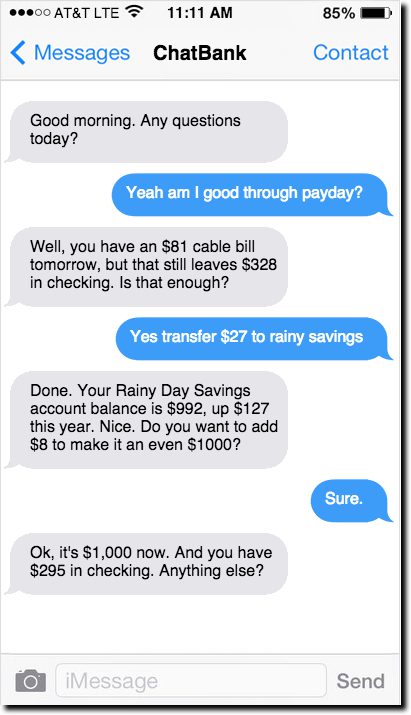

- Same-hour customer service response via text/email/voice

- VIP look-and-feel across all channels

It’s high time to turn digital banking into its own profit center. It will help you properly allocate capital to the growth channels, while investing less in those that are tanking a bit less robust.

Author: Jim Bruene is Founder & Senior Advisor to Finovate as well as

Principal of BUX Advisors, a financial services UX consultancy.

Notes:

- It was that report that prompted Elon Musk to call me out of the blue one day and ask that I help him with his banking startup, X.com, which eventually morphed into PayPal. Although, stupidly I didn’t pursue the job opportunity, I did consult for him during X.com’s first year when they were still trying to buy or build a commercial bank (against all my advice).

- The report was updated in late 2000.

e

e