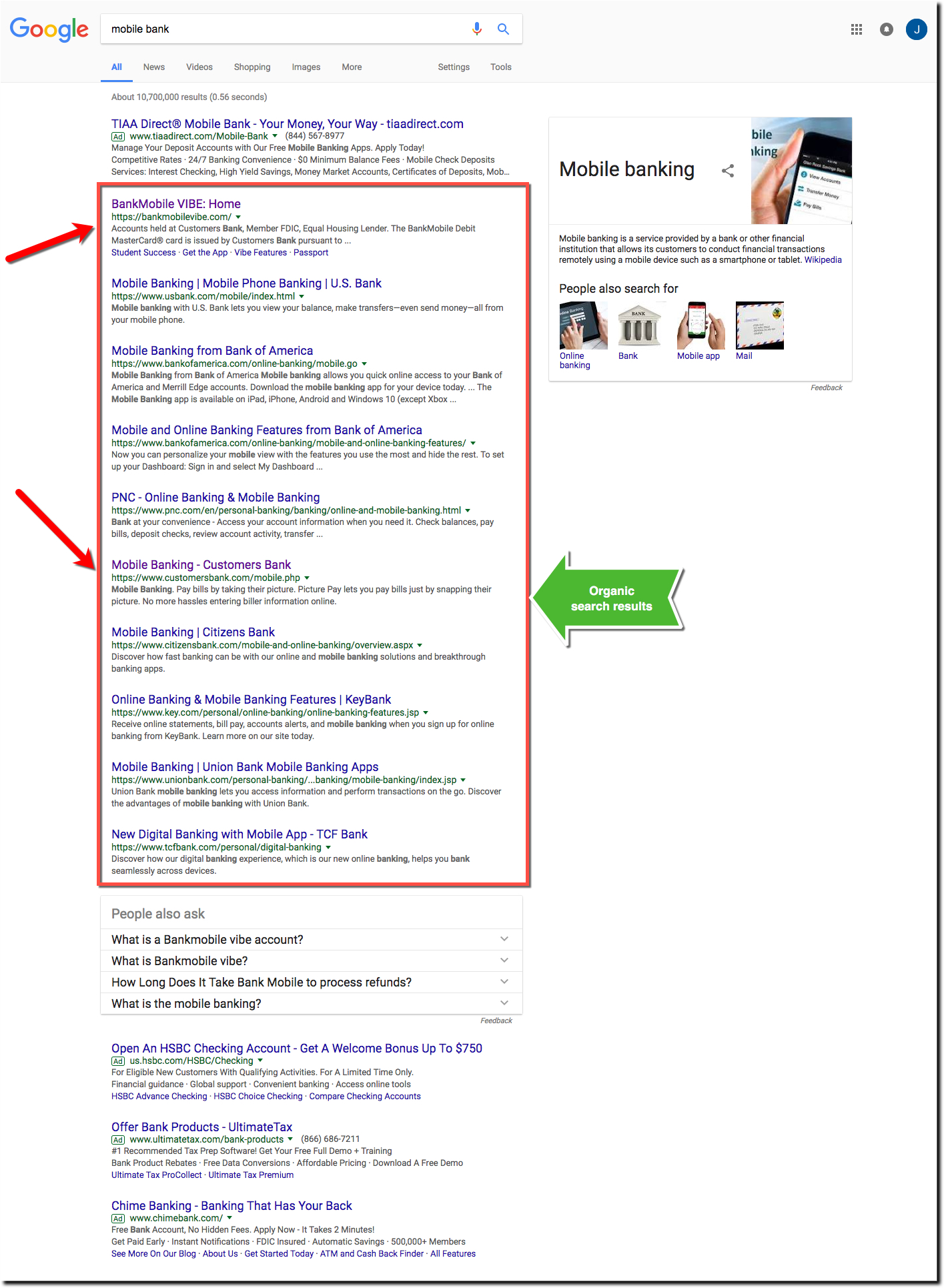

Today, I ran into Google’s new savings-account comparison chart for the first time (see notes 1, 2 and screenshot below, link). The search giant now offers separate pages with financial product comparisons for mortgages, credit cards, CDs, checking, and savings accounts. And the comparison matrices are at times positioned prominently on searches potentially reducing traffic to top advertisers and to organic results as well (see screenshot below).

Today, I ran into Google’s new savings-account comparison chart for the first time (see notes 1, 2 and screenshot below, link). The search giant now offers separate pages with financial product comparisons for mortgages, credit cards, CDs, checking, and savings accounts. And the comparison matrices are at times positioned prominently on searches potentially reducing traffic to top advertisers and to organic results as well (see screenshot below).

Savings account search results

Let’s look at an example search today for “savings accounts.” The results include a blue-chip lineup of paid advertisers. Following is a list of the top 10 paid results compared to their position on the Google comparison page (note 3):

1. American Express (#1)

2. ING Direct (#7)

3. US Bank (#24, 30, 32, 33)

4. BECU (local advertiser)

5. Citibank (#19, 25, 26 )

6. Capital One (#10, 15, 31)

7. Navy Federal CU

8. TD Ameritrade

9. Zions Bank (#4, 5, 22, 23, 27)

10. Discover Bank (#2, 11)

Analysis

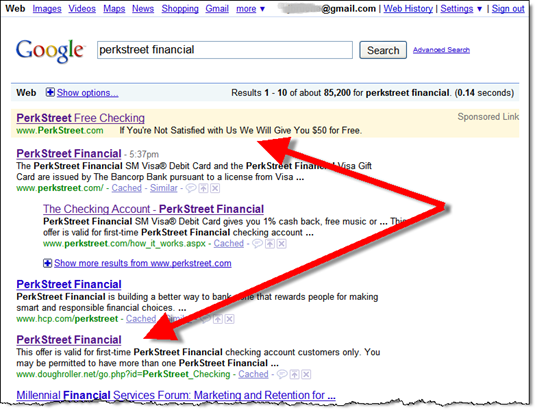

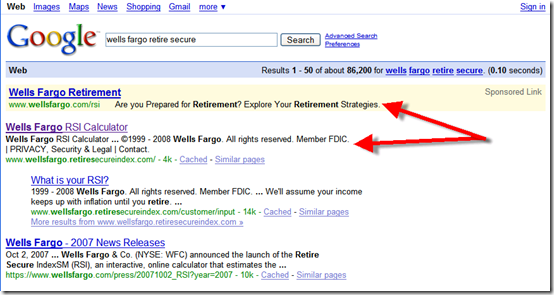

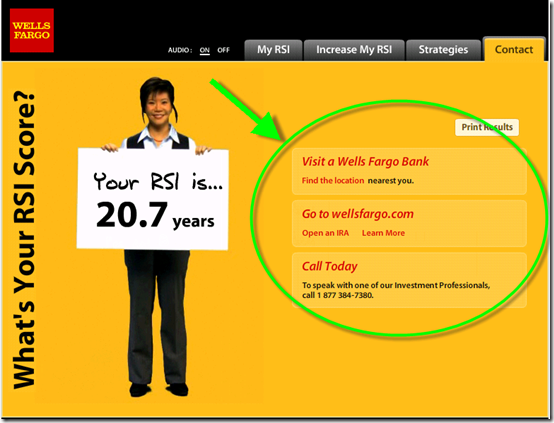

I still don’t understand why Google would risk antagonizing its financial advertisers by drawing traffic away from their ads and into the Google-powered comparison matrix. The company says its focus is on the user experience. So I guess they believe that long-term this approach will generate more traffic, more searches and ultimately more revenue, possibly from commissions for actual accounts generated, rather than just pay-per-click.

But in its current beta stage, there are some odd results. How would you feel if you are US Bank, bidding high enough to be number three on the search results page, but not shown until page three of the savings-account comparison page? Worse, three top-10 advertisers, BECU, Navy Federal CU, and TD Ameritrade aren’t even listed on the savings comparison page.

Which brings up a bigger question. How does Google determine which FIs are listed? The savings-product comparison indexes only 17 banks, of which five aren’t even playing the rate game at this point with rates of 0.25% or less (note 4). Furthermore, there’s not a single credit union and just one smaller bank (Bank of Internet) listed.

I understand this is just a trial balloon from Google and that product comparisons could make it easier for users to find the best rate. But right now it’s unfair to any financial institution not in the chosen 17, and it doesn’t allow users to easily choose from criteria other than rate, monthly fee, and whether a branch is nearby.

It also looks like the system could be gamed. What’s to prevent one of these banks from launching ten, or 20 or 30 different savings accounts, all with temporary teaser rates, to soak up more space in the matrix?

Sure, Google will eventually build algorithms to prevent that, but that will take time. Meanwhile, it’s an odd transition time for the search engine and its financial advertisers. But if you rely at all on Google to deliver new customers, you better pay close attention to developments with its product-comparison pages.

Google search for “savings accounts” (12 Jan. 2011, 4:00 PM Pacific, Seattle IP address)

Google’s “savings” comparison page

Offer details page for American Express High-Yield Savings

———————————

Notes:

1. According to MyBankTracker.com, Google started running the deposit-account comparisons in late December 2010 in the U.S. market.

2. We wrote about Google’s credit card comparison matrix in November.

3. Google’s savings-account matrix listed a total of 44 results, from 17 unique banks, displayed 10 per page

4. 14 of the 44 results, almost one-third of the matrix, were accounts paying 10 basis points or less.