Micro-businesses, such as sole proprietors and gig workers, are an underserved group when it comes to financial management tools.

Seeing this need, and recognizing that more than 75% of small businesses in the U.S. are sole proprietors, Braintree-owned Venmo is releasing a new set of tools to help them connect, market, and grow their business.

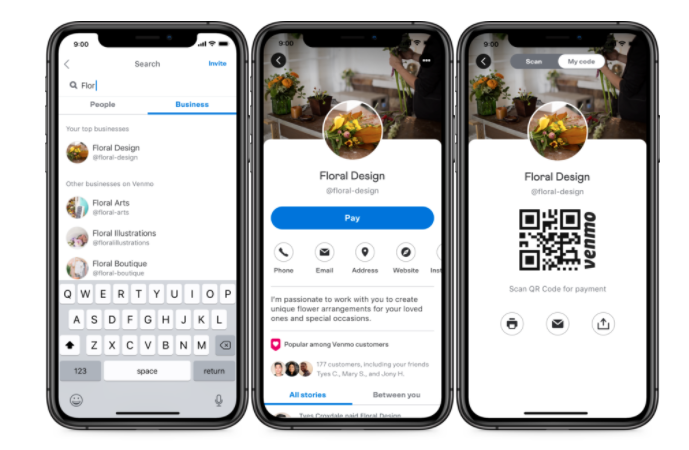

“Venmo was designed to be a place where friends and family can send, split and share purchases and experiences. Today, we are introducing a very limited pilot to extend that experience to allow sellers to access the benefits of Venmo’s platform through Business Profiles,” the company announced in a blog post.

Currently in a pilot phase, Business Profiles allow consumers to create a business profile (separate from their personal profile) on Venmo in order to accept payment for goods and services. Business users can also tap into Venmo’s community of 52+ million users to generate interest, referrals, and awareness of their brand.

At launch, Venmo will not charge businesses transaction fees. This is likely because the company recognizes that the micro-businesses it is targeting already use its P2P money transfer service to accept payments for their business. Venmo cautioned that it will eventually charge a per-transaction fee of 1.9% + $0.10, but did not mention when it will begin charging the fees.

Venmo’s Business Profiles launch today to a limited number of iOS users on an invite-only basis and will be available for Android users “in the coming weeks. The company plans to make the new service more widely available “in the coming months.”

Photo by Cesar Carlevarino Aragon on Unsplash