This is a part of our live coverage of FinovateSpring 2013.

![]()

Closing out FinovateSpring for us this afternoon,

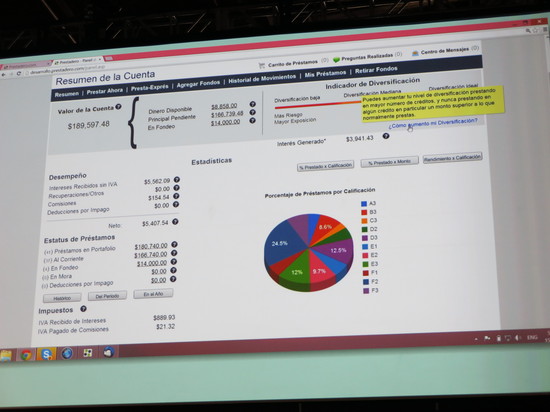

Prestadero demoed its peer-to-peer lending platform:

“Prestadero uses its proprietary management software to originate loans in an extremely efficient way. Our platform allows us to parse out declined loans in seconds and determine rates for approved loans in less than 1 minute.Our web interface allows lenders to view their entire portfolio in detail. Lenders can also view specific graphs and scorecards that allow them to make better investment decisions, even if they are not investment professionals. We provide lenders with tools, such as our “diversification index,” which quickly and comprehensively lets them know their risk exposure depending on the diversification of their loans. Our software also enables lenders to select multiple loans at once by filtering through the user’s selected criteria. They can also choose to reinvest their returns based on the same or a different set of criteria.Through their online account, borrowers have full control over their loan’s entire process, from filling out the application to paying it off completely. We also charge the borrower’s bank accounts directly when their payments are due, diminishing delinquencies and providing a better service for our customers. The entire process is streamlined and coded with peer-to-peer finance in mind, reducing human interaction on the back-end of the technology and providing more accurate, up-to-date information on our front-end.”

Product Launch: June 2012

HQ: Mexico City, Mexico

Founded: April 2011

Metrics: 4,000+ registered users, $70M pesos in loan requests, $400K raised

Website: prestadero.com

Twitter: @prestadero

Presenting Gerardo Obregon (CEO & Founder) and Alejandro Ramos (Partner)