While many fintechs were working on digital transformation, Linqto was focused on complete transformation. That’s because the San Francisco-based company recently made a major pivot.

Linqto was founded in 2010 as a digital banking technology company that provided software-as-a-service to fintechs. Perhaps most notable during the company’s first few years of operation was the launch of its Otter API which, along with a partnership with LEVERAGE, powered Linqto’s App Store for Banks, a marketplace where banks could select from new apps to brand them as their own and launch them in app stores for their end customers to download.

“By working with Linqto, credit unions are still able to offer their traditional services, but now they can also pair those services with premium technology from branded apps, enhancing mobile strategies and changing their members’ mobile experience,” said LEVERAGE President and CEO Patrick La Pine when the deal was announced in 2016. “This brings a dramatic shift in the relationship members have with their credit union and their mobile devices.”

Fast forward two years and Linqto had raised $1.6 million in two funding rounds and transformed itself into an investment service with its Global Investor Platform. Key to this transition, the company acquired investment trading platform PrimaryMarkets for $33 million in December 2018.

“Linqto is acquiring PrimaryMarkets, an established global trading platform, to launch its platform as part of the Global Investor Platform,” said Linqto Founder and CEO Bill Sarris. “The Takeover will allow the establishment of an inclusive trading platform and the capability for the Linqto Platform to broaden our revenue model from a strictly SaaS model to a transaction-based model, whereby Linqto will share in commissions and broker fees realized by the Platform.”

PrimaryMarkets a global online marketplace that enables users to conduct secondary trading of existing securities and investments, manage secondary securities trading on behalf of companies, and assist unlisted companies in raising new funds.

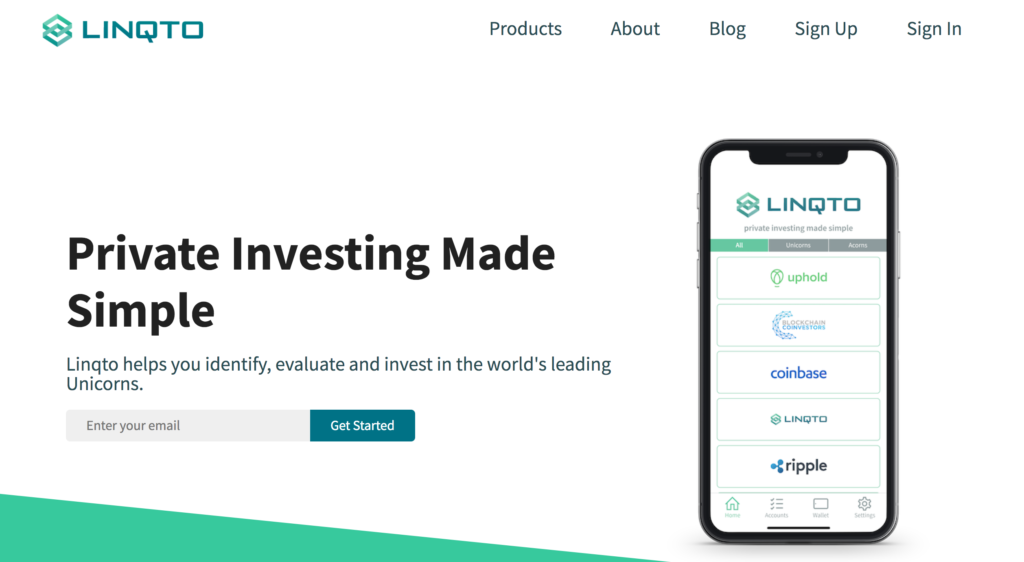

In February of this year, while the world’s attention was consumed with the threat of the then-epidemic-now-pandemic coronavirus, Linqto announced Equity in Unicorns, a new investing platform for private securities. Equity in Unicorns is designed to help accredited investors invest in the private market via a simple, quick, and relatively inexpensive platform.

“Small Accredited Investors now have the opportunity to participate in the growth and superior returns of private markets, as large institutional investors have done over the past 30 years,” said Sarris. “Private investing made simple.”

Since its pivot, Linqto now counts more than 100,000 accredited investors in its global network. Currently, Linqto allows these users to invest in a range of pre-IPO startups, including Upgrade, Uphold, Ripple, SoFi, Blockchain Coinvestors, Kraken, and even in its own company.

Linqto was slated to debut its new platform at FinovateSpring earlier this year. However– thanks to COVID– the conference, along with Linqto’s demo, will be featured at FinovateWest on November 23 through 25.

Photo by Filip Mroz on Unsplash