The players: An angry and articulate Wachovia customer with the online handle haberschmidt; Wachovia Bank; Wesabe; PaymentsNews

Synopsis: According to an anonymous online posting, Wachovia charged a customer $245 in overdraft fees on seven transactions, at least a few of which were signature debit. The customer claims to be a practicing attorney with an undergraduate accounting degree and Ivy League law degree who deposits $8,000 per month into his Wachovia checking account. Unfortunately for the bank, he/she also took the time to research the incident and document it in a 1,500-word comment at personal fiance site Wesabe (see inset).

Synopsis: According to an anonymous online posting, Wachovia charged a customer $245 in overdraft fees on seven transactions, at least a few of which were signature debit. The customer claims to be a practicing attorney with an undergraduate accounting degree and Ivy League law degree who deposits $8,000 per month into his Wachovia checking account. Unfortunately for the bank, he/she also took the time to research the incident and document it in a 1,500-word comment at personal fiance site Wesabe (see inset).

In the pre-blog days of the Internet, the post would have been read by a few dozen readers and cost Wachovia nothing, other than the attorney's business. However, the so-called blogosphere can amplify these isolated incidents a thousand-fold.

Timeline:

???: Wachovia charges "haberschmidt" $245 in overdraft fees on seven low-dollar transactions, many made by signature debit (see note 1)

???: Haberschmidt spends an hour and half with Wachovia customer service reps to understand the process. Ultimately, he/she has the fees reversed by the branch.

April 27: Wesabe user "haberschmidt" documents Wachovia's overdraft policies in a 1,500-word comment to a thread on bank fees at Wesabe (here) (see inset above and note 2) and says he or she is closing their Wachovia accounts

April 27, 8 PM: Wesabe blogger Marc Hedlund highlights the issue in the Wesabe company blog (here) under the proactive title, "More on How Banks Maximize Your Overdraft Charges" and adds a few more digs on overdraft fees

April 28, 6 AM: Scott Loftesness, after seeing Wesabe's post, broadcasts it to the payments world via the PaymentNews blog (here)

Future: It's possible the story dies now, but with Google prominently displaying blog posts, the story will likely be visible through searches for years to come. However, the real damage occurs if the mainstream media picks up on this story, possibly precipitating one or more negative stories on debit card authorizations and/or creative engineering of transaction-processing algorithms to generate more fees.

Analysis:

Before the Internet, if a customer was really mad, 10 to 25 people might be told, and those people could pass it on, but the damage was likely limited to that close-knit group.

After the Internet, but before blogging, if a customer was really mad they might comment on a popular blog such as FatWallet, and hundreds or even thousands of people might see it. However, in an anonymous online forum, the reader wouldn't be able to readily discern a one-sided rant from an actual problem. So, even though a few hundred people might read it, few would be moved to action.

But today, the blogosphere can amplify a complaint a thousand-fold. Now, the number of readers could be in the tens or hundreds of thousands. The combined readership of Wesabe, PaymentsNews, and NetBanker is more than 10,000 already. And the blogs, with known authors, have far more credibility than random forum posts.

What a bank should do:

- I know this is going to hurt, but if you haven't done so already, take a hard look at your NSF/overdraft fee policies and program some common sense into the fee and check processing algorithms. As this incident shows, financial institutions risk a real backlash as the fees grow relatively larger and are applied to smaller dollar amounts, especially debit card charges that the bank had a chance to decline at the point of sale. Case in point: An article in Saturday's Wall Street Journal (here) had an example of a widow charged $30 for a $0.95 cent debit card overdraft AFTER her account was frozen (see note 1).

- Educate customers on the tools they can use to minimize overdrafts such as online banking, email alerts, and if possible, text-message alerts.

- Make sure every creditworthy customer has an overdraft line of credit. If they are credit-averse, use a savings account. In the Wachovia example, the customer apparently had an overdraft setup between two deposit accounts, but it didn't work because "Wachovia recently monkeyed around making administrative changes to my accounts and lost track of the overdraft protection feature." Had the customer, who sounds like he makes a six-figure income, been covered by a line of credit, he'd simply be paying Wachovia a few bucks in interest, instead of costing the bank thousands of dollars in lost income.

- Use your CRM systems to apply logic to the overdraft-fee assessment. If you know a customer deposits his/her $8,000 paycheck on the 15th every month, don't ding them a $30 fee on the 14th for a debit card charge at Starbucks.

- Follow WaMu's approach and give customers an annual "get out of jail free" card that allows them to turn it in for a no-questions-asked fee reversal on an overdraft.

- Put your chronic NSF/overdraft customers into an account with a prepaid model that does not allow them to go over the amount in their account. Access can be by debit card and good-funds bill pay, but regular paper-check access would not be allowed (sounds a bit like a certain new account named after a fruit here).

Final word:

Banks need to voluntarily reign this in before the class-action lawyers and politicians campaigning for '08 make this into a public-policy issue with a raft of new regulations. Haberschmidt closed his forum post with this chilling paragraph:

Although the branch corrected the overdraft protection issue and reversed the fees, I am closing my accounts. I believe strongly in voting with my dollars and I don't want to belong to a bank that takes advantage of its customers in this way. It strikes me as a predatory practice, and the kind of thing of which Congress should be aware when it reviews regulation on the credit card companies and other financial industry practices.

<Stepping off the soap box>. Now back to your regularly scheduled "happy marketing blog."

Notes:

1. The Wall Street Journal article (here), about how bill collectors are abusing the garnishment order system, should be required reading at U.S. banks and credit unions.

2. "Haberschmidt" is the user's Wesabe public ID, he/she joined Wesabe the same day he posted the comment.

3. The forum comment appears to be a genuine beef with Wachovia. However, it's extremely unusual to see a 1,500-word, well-written comment online, and closing with a call for Congressional action to boot. So it's possible haberschmidt has an undisclosed agenda, especially given that he joined Wesabe the same day he posted the comment. However, he immediately posted another comment apologizing for his typos and implying that he composed the whole thing in Wesabe's online forum. That makes it very believable, although it's still possible that this followup was also a calculated move. Even if it is a fabricated post, the underlying issue still needs to be addressed.

Wells Fargo generally does a good job with its login product pitches. I like how the bank provides a "Remind me later" and "No thanks" option next to "Apply Now."

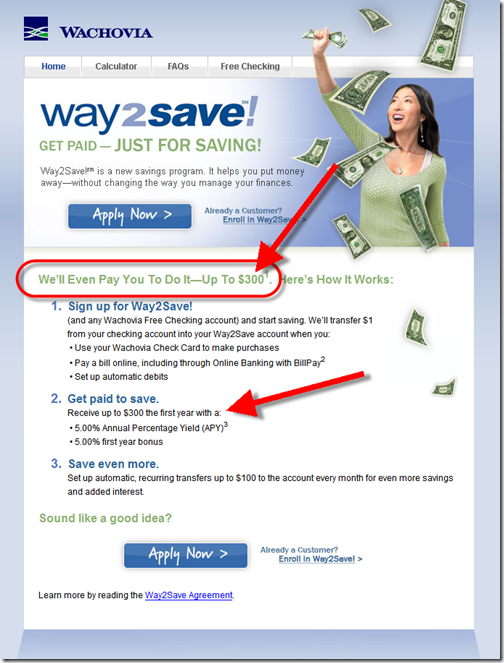

Wells Fargo generally does a good job with its login product pitches. I like how the bank provides a "Remind me later" and "No thanks" option next to "Apply Now."  1. Way2Save was inherited from Wachovia (previous posts). Here’s the cached 6 Nov page from Google. The page now redirects to Wells Fargo savings.

1. Way2Save was inherited from Wachovia (previous posts). Here’s the cached 6 Nov page from Google. The page now redirects to Wells Fargo savings.