- Data privacy vault Skyflow has raised $30 million in an extension Series B round led by Khosla Ventures.

- The investment comes amid growth in the market for sensitive data protection for Large Language Models (LLMs).

- Founded in 2019, Skyflow made its Finovate debut at FinovateSpring 2022.

Data privacy vault Skyflow raised $30 million in an extension of its Series B funding round. The round was led by Khosla Ventures, and featured participation from existing investors Mouro Capital, Foundation Capital, and Canvas Ventures. The investment takes the company’s total equity capital to $100 million, according to Crunchbase. Valuation information was not immediately available.

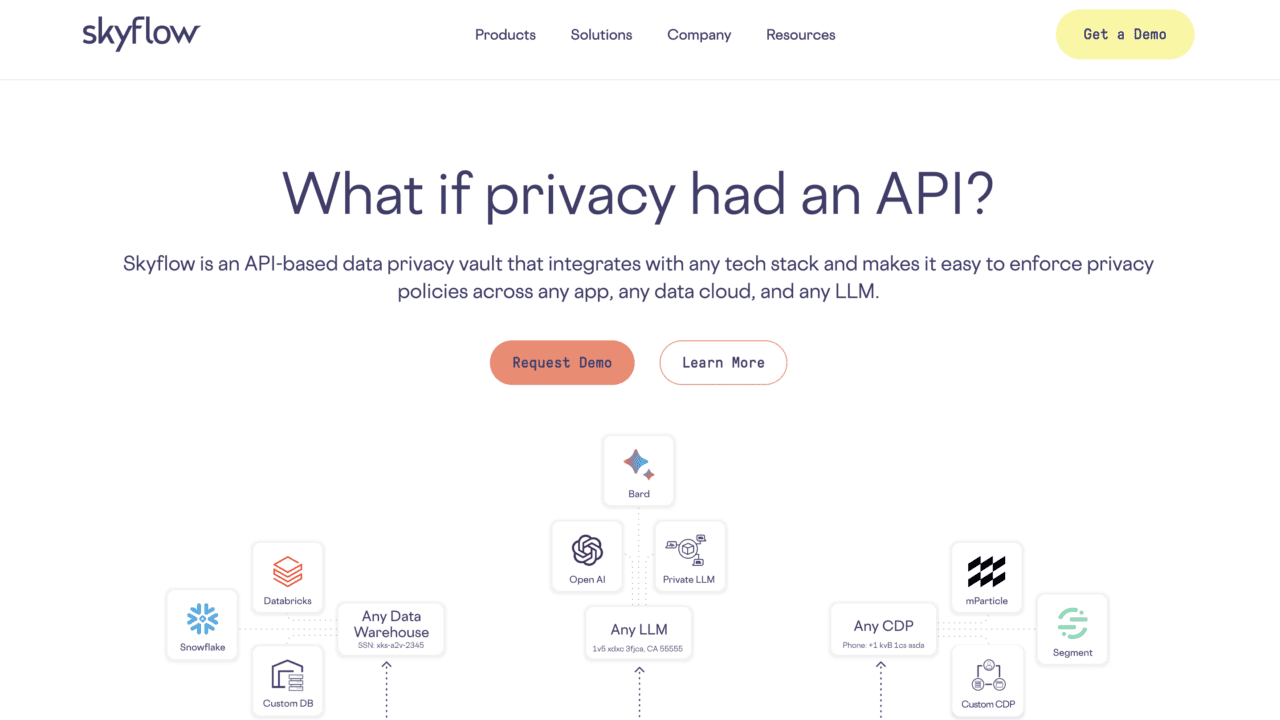

The investment in Skyflow arrives as the proliferation of Large Language Models (LLMs) raises the stakes when it comes to protecting sensitive data. Skyflow’s global network of data privacy vaults enables businesses to isolate, protect, and manage sensitive customer data across any app, data cloud, or LLM. Skyflow supports nearly a billion records of user data for its customers and processes more than two billion API calls a quarter.

“We see an urgent need for companies to make privacy a core part of their technology stack as LLMs and AI hurdle forward, ingesting more and more personal data,” Skyflow Co-founder and CEO Anshu Sharma said. “Skyflow is the only solution that allows companies to build privacy by design into their technological infrastructure without overhauling anything – anywhere in the world.”

Skyflow credits a proprietary technology – polymorphic encryption – for its ability to protect data without inhibiting its usability for critical business tasks. Skyflow’s technology serves as a “privacy trust layer,” blocking sensitive information from entering AI models, and making adoption of AI technology safer. Companies can personalize their own definition of “sensitive data” as needed, providing additional protection beyond PII, intellectual property, or other categories of critical information.

“With the advent of enterprise applications powered by AI, the need for trust and privacy infrastructure is key to protecting sensitive data,” Khosla Ventures founder Vinod Khosla said. “Skyflow is rethinking how data can be managed and protected across any app, cloud, or LLM, making it a company that will be vital for every enterprise business.”

Founded in 2019, Skyflow made its Finovate debut at FinovateSpring 2022. At the conference, the company showed how its technology helps financial services companies securely orchestrate sensitive data and exchange it with third party providers without having to directly handle the data itself.

Interested in demoing at FinovateSpring in San Francisco in May? We are happy to read applications from innovative companies with new solutions that are ready to show. Visit our FinovateSpring hub today to learn more.