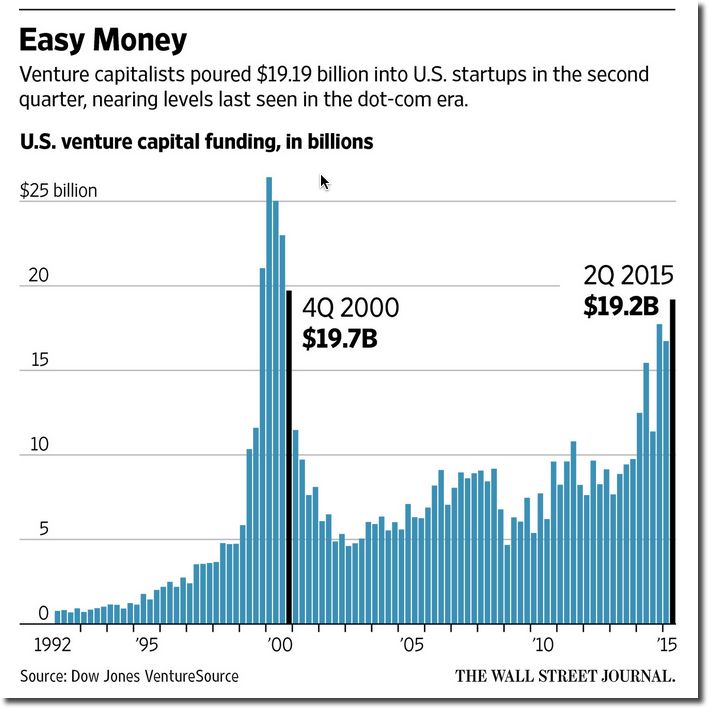

We published our first fintech unicorn list in April 2014 with a mere 11 companies. Just 15 months later, that number is up four-fold to 46. And it’s 11 more than our update two months ago (13 new unicorns less 2 falling out). Time will tell whether these valuation bets are temporary insanity from private investors or the beginning of a long cycle of re-imagining financial services. We’ll get back to you on that.

We published our first fintech unicorn list in April 2014 with a mere 11 companies. Just 15 months later, that number is up four-fold to 46. And it’s 11 more than our update two months ago (13 new unicorns less 2 falling out). Time will tell whether these valuation bets are temporary insanity from private investors or the beginning of a long cycle of re-imagining financial services. We’ll get back to you on that.

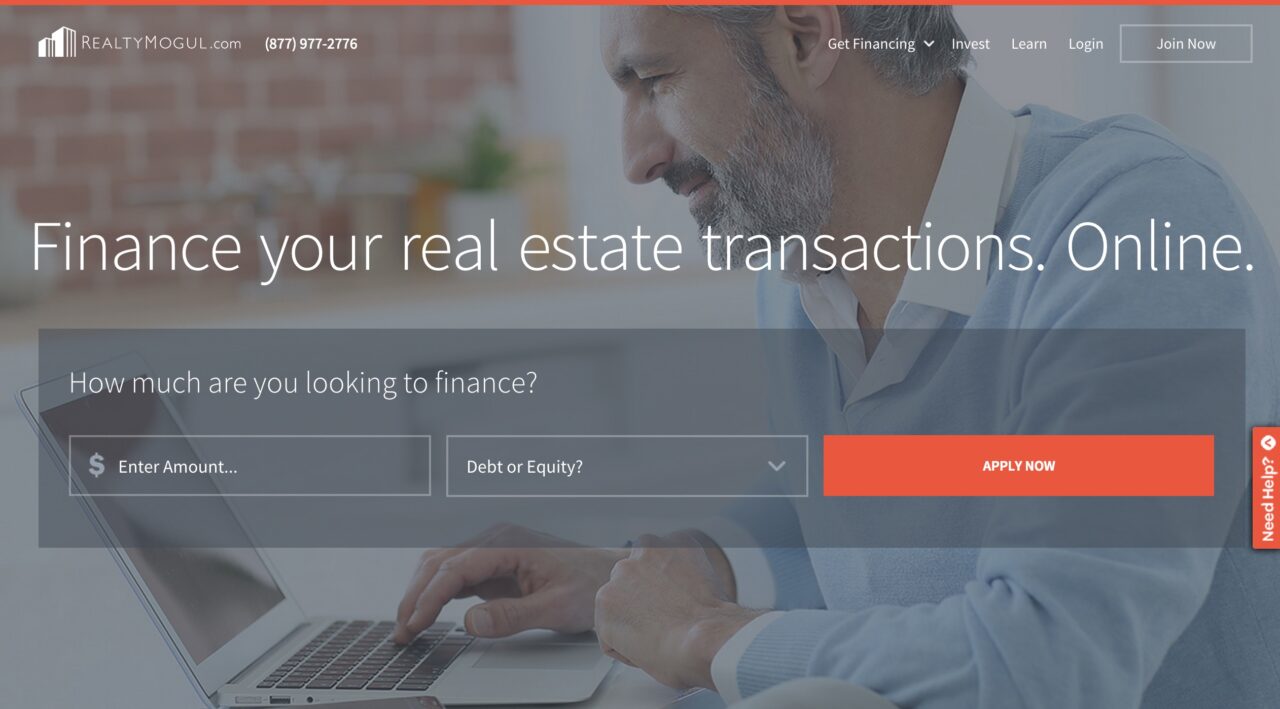

Please note: Our list includes financial technology companies (either direct services or software) founded since 2000 and valued at $900 million or more. Unlike other lists, we include exits (3 companies); public companies (5); real estate plays (2); and a few Finovate alums (3) that are not pure-play fintech, but do have substantial operations in that vertical. Without those additions, there would be 35 pure-play private fintech unicorns, or 29 if you used a strict $1 billion floor. See more caveats as the end of the post.

In addition to the 46 full-fledged unicorns, we’ve added 37 narwhals or semi-unicorns each with an estimated value of $500 million to $800 million. In total, there are 83 companies with a combined value of $121 billion, about 1/3 the most-valued bank on the planet.

Here is the breakdown by fintech sector:

| Sector | Unicorns | Semi-U | Total |

| Lending | 14 | 10 | 24 |

| Payments | 15 | 7 | 22 |

| Real estate | 2 | 5 | 7 |

| Insurance | 4 | 1 | 5 |

| Investing | 1 | 4 | 5 |

| Accounting | 3 | 0 | 3 |

| Security/Risk | 1 | 2 | 3 |

| Bitcoin/Block | 1 | 2 | 3 |

| Credit reports | 1 | 1 | 2 |

| Digital banking | 1 | 1 | 2 |

| Other | 3 | 4 | 7 |

| Total | 46 | 37 | 83 |

And the full list (*new arrivals; **previous unicorns):

| Company | Sector | Finovate Alum? | Value ($Bil) | Value Source |

| Lufax | Lending | No | 9.6 | WSJ June 2015 |

| Zhong An Online* | Insurance | No | 8.0 | WSJ June 2015 |

| Square | Payments | No | 6.0 | WSJ June 2015 |

| LendingClub | Lending | Yes | 5.6 | Public |

| Zillow | Real estate | No | 4.8 | Public |

| Zenefits | Insurance | No | 4.5 | May 2015 round |

| CreditKarma | Credit | Yes | 3.5 | WSJ June 2015 |

| Stripe | Payments | No | 3.5 | Dec 2014 round |

| Powa Technologies | Payments | Yes | 2.7 | Nov 2014 round |

| Klarna | Payments | Yes | 2.5 | Mar 2014 round |

| Xero | Accounting | Yes | 2.4 | Public |

| CommonBond | Lending | No | <1.0 | Valuation less than $1 bil per company (8/21/15) |

| One97 | Payments | No | 2.0 | Feb 2015 round |

| Prosper | Lending | Yes | 1.9 | Apr 2015 round |

| Affirm* | Lending | No | 1.8 | Funderbeam |

| Biz2Credit | Lending | No | 1.7 | Funderbeam |

| Dataminr* | Analytics | Yes | 1.6 | Funderbeam |

| Lakala* | Payments | No | 1.6 | CB Insights |

| Adyen | Payments | No | 1.5 | Dec 2014 round |

| FinancialForce.com | Accounting | No | 1.5 | Funderbeam |

| Oscar | Insurance | No | 1.5 | WSJ June 2015 |

| Wonga* | Lending | Yes | 1.5 | Funderbeam |

| Zuora | Payments | No | 1.5 | Funderbeam |

| iZettle | Payments | No | 1.4 | Funderbeam |

| Housing.com | Real estate | No | 1.3 | Funderbeam |

| Qufenqi | Lending | No | 1.3 | Funderbeam |

| Revel Systems | Payments | No | 1.3 | Funderbeam |

| Social Finance (SoFI) | Lending | No | 1.3 | Feb 2015 round |

| Jimubox | Lending | No | 1.1 | Funderbeam |

| Q2* | Banking | Yes | 1.1 | Public |

| Coupa Software* | Accounting | No | 1.0 | CB Insights |

| Fenergo* | Onboarding | Yes | 1.0 | Funderbeam |

| FundingCircle | Lending | No | 1.0 | WSJ June 2015 |

| Kofax | Doc mgmt | Yes | 1.0 | Acquired (Lexmark) |

| Mozido | Payments | No | 1.0 | Finovate est |

| TransferWise | Payments | Yes | 1.0 | CB Insights |

| Trusteer | Security | No | 1.0 | Acquired (IBM) |

| Vanco Payments* | Payments | No | 1.0 | Funderbeam |

| Avant | Lending | Yes | 0.9 | Forbes (4/15) |

| ClimateCorp | Insurance | No | 0.9 | Acquired (Monsanto) |

| Coinbase | Bitcoin | Yes | 0.9 | Funderbeam |

| Dynamics* | Payments | Yes | 0.9 | Funderbeam |

| IEX Group | Investing | No | 0.9 | Funderbeam |

| LendingHome* | Lending | No | 0.9 | Funderbeam |

| On Deck | Lending | Yes | 0.9 | Public |

| RenRenDai

Xoom |

Lending

Payments |

No

No |

0.9

0.9 |

Funderbeam

Acquired (PayPal) |

| Total Unicorns | 98.1 | |||

Near Unicorns |

||||

| 21 Inc | Bitcoin | No | 0.8 | Funderbeam |

| BankBazaar* | Banking | Yes | 0.8 | Funderbeam |

| Betterment | Investing | Yes | 0.8 | Funderbeam |

| Braintree | Payments | Yes | 0.8 | Acquired (PayPal) |

| LifeLock** | Credit | No | 0.8 | Public |

| Rong360 | Lending | No | 0.8 | Funderbeam |

| Wealthfront | Investing | Yes | 0.8 | Funderbeam |

| Accurate Group | Real estate | No | 0.7 | Funderbeam |

| App Annie** | Mobile | Yes | 0.7 | Funderbeam |

| Auction.com* | Real estate | No | 0.7 | Funderbeam |

| Ayadsi | Analytics | Yes | 0.7 | Funderbeam |

| Oportun (Progreso Fin) | Lending | Yes | 0.7 | Finovate est |

| Taulia | Payments | Yes | 0.7 | Funderbeam |

| WorldRemit | Payments | Yes | 0.7 | Funderbeam |

| AnJuke | Real estate | No | 0.6 | Funderbeam |

| Circle Internet Finance | Bitcoin | No | 0.6 | Funderbeam |

| EzBob | Lending | Yes | 0.6 | Funderbeam |

| FangDD | Real estate | No | 0.6 | Funderbeam |

| Kabbage | Lending | Yes | 0.6 | Funderbeam |

| Bill.com | Payments | Yes | 0.5 | Finovate est |

| CAN Capital | Lending | Yes | 0.5 | Finovate est |

| Cardlytics | Marketing | Yes | 0.5 | Funderbeam |

| Credorax | Payments | No | 0.5 | Funderbeam |

| Financial Software Systems | Risk Mgmt | No | 0.5 | Finovate est |

| FreeCharge | Payments | No | 0.5 | Finovate est |

| Kreditech | Lending | Yes | 0.5 | Finovate est |

| Motif Investing | Investing | Yes | 0.5 | Funderbeam |

| Ping Identity | Security | Yes | 0.5 | Finovate est |

| PolicyBazaar | Insurance | Yes | 0.5 | Funderbeam |

| Radius | Marketing | Yes | 0.5 | Finovate est |

| Receivables Exchange | Lending | Yes | 0.5 | Finovate est |

| Snowball Finance | Investing | No | 0.5 | Funderbeam |

| Strategic Funding Source | Lending | Yes | 0.5 | Finovate est |

| U51 | Lending | No | 0.5 | Finovate est |

| Wepay | Payments | Yes | 0.5 | Funderbeam |

| VivaReal | Real estate | No | 0.5 | Funderbeam |

| Zopa Shopkeep |

Lending Mobile POS |

Yes Yes |

0.5 0.5 |

Finovate est Finovate est |

| Total Semi-U | 23 | |||

| Grand Total | 121 |

*New companies and/or new unicorns

**Falling from unicorn list (note: Lifelock was a unicorn until yesterday’s stock drop)

Updates:

July 24: Added Xoom to Unicorn list based on acquisition price paid by PayPal

July 28: Added Shopkeep POS to Near Unicorn list based on $60 million Series D funding and total of $97 million raised

Aug 21: CommonBond emailed to say that the Funderbeam valuation ($2.0 billion) is incorrect and they are currently valued at less than $1 billion (but declined to disclose current valuation).

More caveats:

1. For private companies (41 of the 47 unicorns), values are hugely dependent on the terms of the deal (read this), so they are not comparable to public company valuations.

2. About half the unicorn valuations are derived from public statements by the companies or investors during recent rounds or acquisitions. However, half are estimated by analysts/algorithms from tracking firms, especially Funderbeam, an Estonian startup that’s relatively new on the scene. So there is a lot of room for error in these valuations.

3. For the “near-unicorn” list we’ve added a number of companies that recently raised large rounds, but have not made public statements about valuation. We estimated most of those at $500 million, but those are simply educated guesses.

4. We are using a broad definition of fintech including real estate. Also, we’ve included a few Finovate alums that are not pure-play fintech, but that have a significant financial services business.

pany

pany