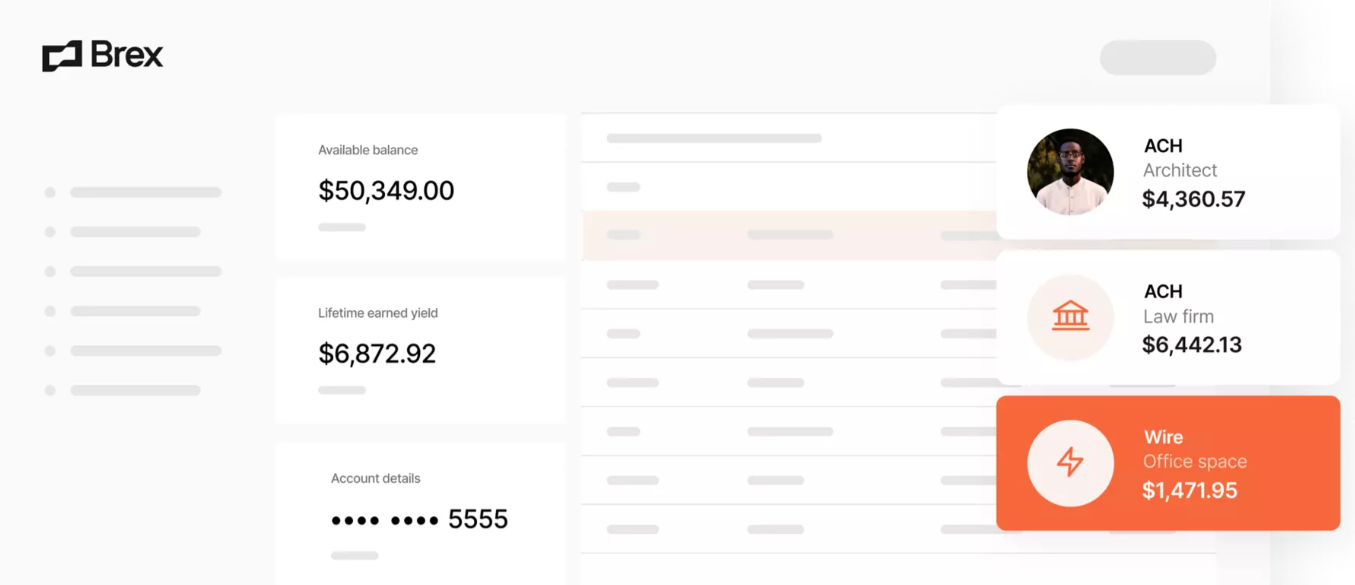

Credit card and cash management solutions company Brex closed a $300 million D-2 round today. The round, which values the company at $12.3 billion, was led by Greenoaks Capital and Technology Crossover Ventures (TCV).

Brex will use the fresh capital to expand its product portfolio to serve more of companies’ financial needs. The California-based fintech’s funding now totals $1.2 billion.

“Brex is a market disruptor and the opportunity to create economic opportunity for millions of people and businesses globally through innovation in financial products is incredibly exciting,” said Brex Chief Product Officer Karandeep Anand. “The opportunity ahead for Brex is expansive, and I’m grateful for the opportunity to create products that will help our customers grow their businesses.”

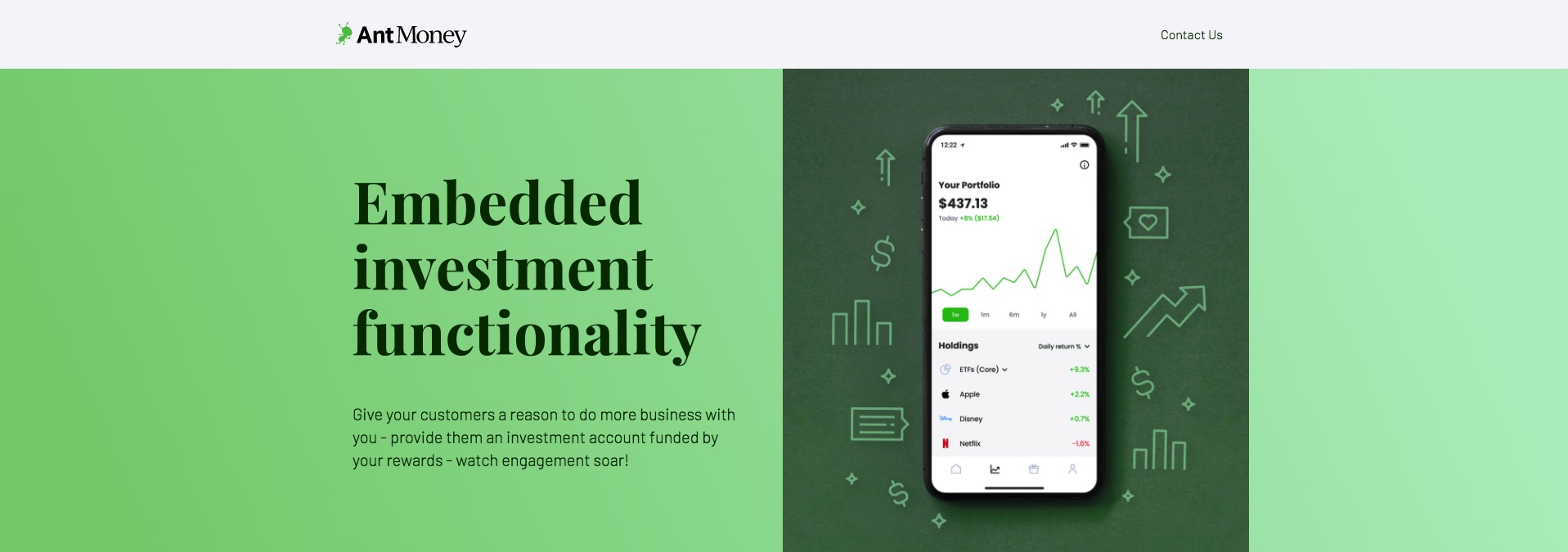

Brex was founded in 2017 to create a digital-first business banking solution. The company offers business bank accounts with credit cards that have built-in rewards, spend controls, and expense tracking. The accounts give businesses early access to their online revenue, billpay tools, and integration with popular accounting tools– all with zero fees. The company serves “tens of thousands of businesses” ranging from small private companies to large public brands, including Airbnb and Classpass.

“Brex has always moved fast. But as the company has scaled, they’ve managed to get even faster, accelerating their growth since our last investment,” said Greenoaks Founder and Managing Partner Neil Mehta. “Brex is building a full financial operating system that keeps getting more comprehensive, all of which will delight existing customers and attract new ones.”

In addition to the funding announcement, Brex is also highlighting a noteworthy personnel change. The company appointed Karandeep Anand as Chief Product Officer. Anand comes to Brex from Meta, where he led the business products group, which served more than 200 million businesses globally. Before his start at Meta, Anand spent 15 years at Microsoft leading the product management strategy for Microsoft’s Azure cloud and developer platform.

Photo by Hal Gatewood on Unsplash