FinovateSpring was a whirlwind of meeting new people, learning about new ideas, as well as seeing familiar faces and hearing new perspectives on old concepts. The show wrapped up last Thursday in San Francisco and I have a treasure trove of thoughts to share.

Before I explain the top five things I saw and heard at FinovateSpring this year, I’ll start with a disclaimer. Because of on stage and behind-the-camera speaking obligations, I only managed to watch about half of the content. Many of my takeaways stem from conversations I had–both on and off stage. One of my favorite things about Finovate is the seasoned and diverse base of attendees who are willing to openly answer questions.

That said, here are my top five takeaways from the event:

GenAI is everywhere

On stage: Many of the live demos centered around genAI. Each company emphasized that they were using a large language model (LLM) with guardrails to create a responsible, generative AI to save time and create efficiencies.

On the networking floor: While conversations surrounding genAI were generally positive, some people were more bearish on the topic, expressing concerns that human-in-the-loop does not offer enough accountability and that AI needs to be responsibly integrated into workplace organizational structures so that we do not eliminate all lower level employees. I learned that everyone has an opinion on the matter, but nobody can offer any accurate prediction on future applications of AI in financial services.

Third party risk management in BaaS

On stage: With all of the drama in the BaaS space, there was a lot to talk about when it comes to third party risk management. Much of the discussion centered around properly vetting third party providers, creating open and transparent communication between third parties and the bank, and having a clear exit plan for when the third party ceases operation.

On the networking floor: A lot of folks were talking about the Synapse bankruptcy case and the potential implications its collapse may have on For Benefit Of (FBO) accounts and BaaS in general. While some said that the FBO model is risky, others said that the issue lies in middleman providers such as Synapse, Unit, and Treasury Prime, and that BaaS will remain unharmed.

Future of regulatory constraints

On stage: Many speakers and panelists brought up the topic of regulation, as multiple fintech subsectors of fintech are dealing with volatile regulatory environments. During the panels and presentations, most speakers shared a positive outlook on the regulatory environment in the U.S.

On the networking floor: Similar to the speakers, many folks I spoke with on the networking floor had positive things to say about the U.S. regulatory environment. Even when discussing consent orders related to BaaS, the emphasis of these discussions centered around future proofing third party relationships and maintaining open communication with regulatory bodies.

Scenario planning

On stage: During my fireside chat with Brian Solis, the digital anthropologist and futurist emphasized the importance of scenario planning. He stressed that both banks and fintechs will have the most opportunities for success in today’s fast-paced, ever-changing environment if they are diligent about scenario planning. This is especially true in a highly regulated industry and when AI is taking over much of the heavy lifting.

On the networking floor: While none of my conversations centered around scenario planning, a handful of folks brought up the importance of planning as a general way to mitigate risk when it comes to leveraging new technologies, forming new partnerships, and remaining customer centric.

Embedded finance

On stage: I had the opportunity to host a panel discussion on embedded finance on the second day of the conference. Our 30 minute conversation highlighted the prevalence of embedded finance across the fintech sector. The panel participants also reviewed tips on maintaining third party partnerships and emphasized that, while the customer always belongs to the bank, the relationship is more likely to get watered down when leveraging third party technology.

Off stage: Embedded finance was present everywhere I looked. It is clear that, despite some risks and regulatory concerns, banks and fintechs will continue to leverage embedded finance.

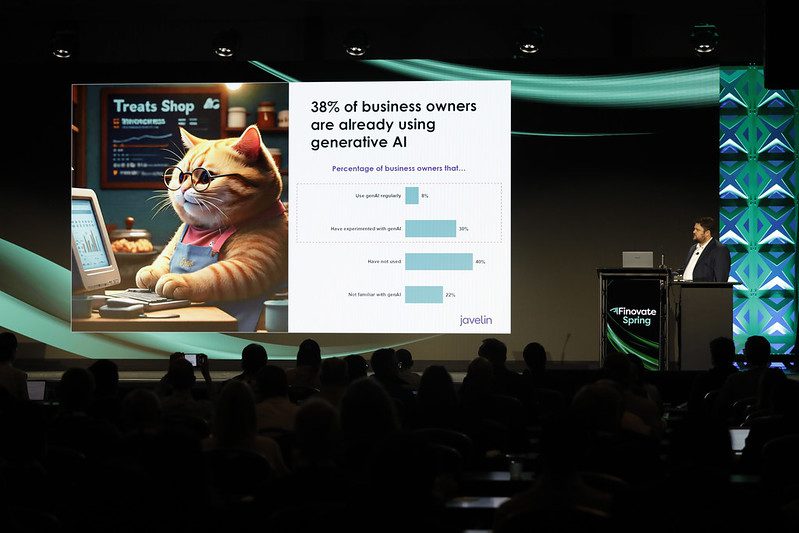

Honorable meow-ntion: J.P. Meowgan

My favorite session at every Finovate event is the Analyst All Stars, which features three or four analysts offering their seven-minute presentations on a top fintech theme. During his presentation, Ian Benton, Senior Analyst at Javelin Strategy & Research who gave a presentation on small business banking used an illustration of a cat he named Mr. Munchies who needed to visit J.P. Meogan to get a loan for his small business.