Just in time for the weekend, your friendly neighborhood fintech blog has your back!

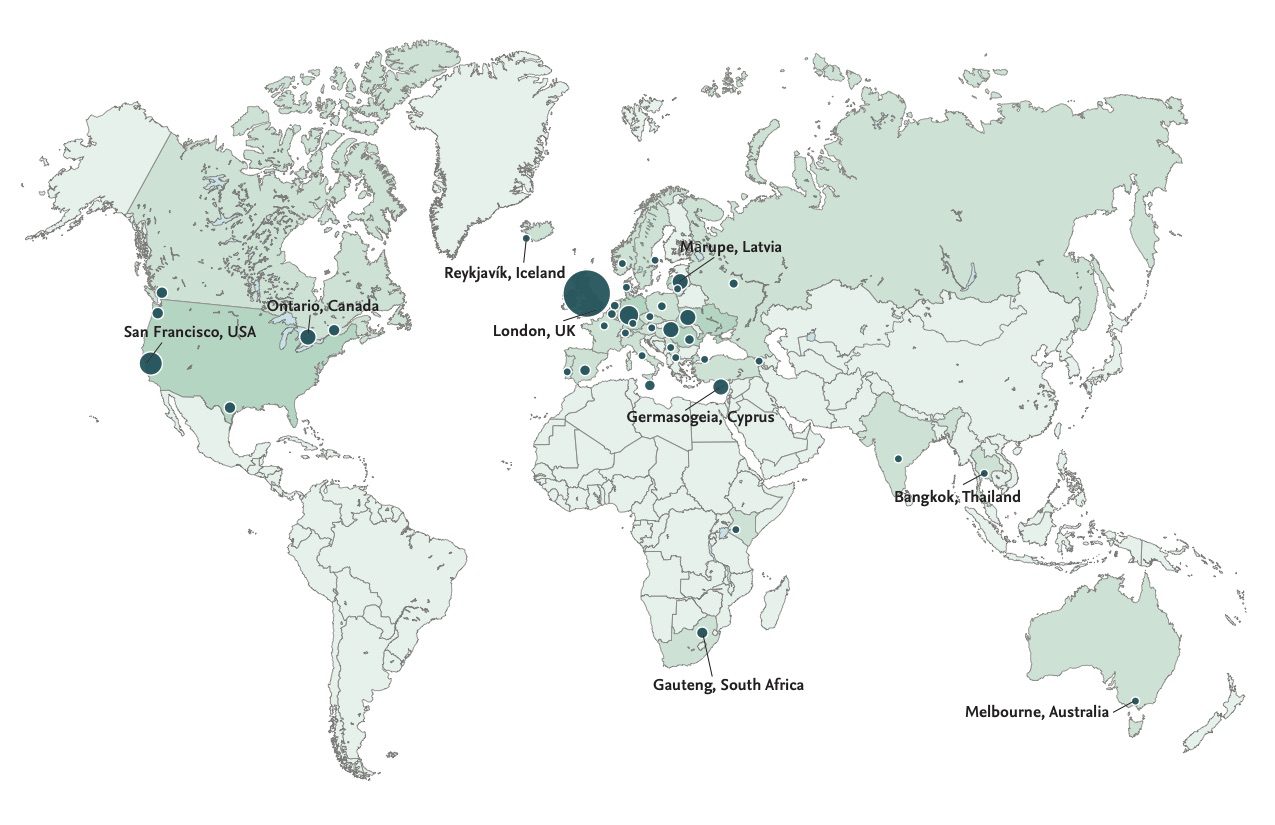

First off, the presentation videos from FinDEVr London are up. If you missed our developers conference in the U.K. earlier this month, this is a great opportunity to see every minute of every presentation from the show. Want to know the story behind the white hat hackers of HackerOne? Curious about what IdentityMind Global did to wow the Day Two audience and win a Crowd Favorite award? Our FinDEVr London 2017 video archives has everything you need.

Crowd Favorite: Day One – HackerOne

http://finovate.wistia.com/medias/z08tfovsna?embedType=iframe&videoFoam=true&videoWidth=640

Crowd Favorite Runner-Up: Day One – Trusted Key

http://finovate.wistia.com/medias/rga2ufs1n3?embedType=iframe&videoFoam=true&videoWidth=640

Crowd Favorite: Day Two – IdentityMind Global

http://finovate.wistia.com/medias/1uvs8nsetb?embedType=iframe&videoFoam=true&videoWidth=640

Crowd Favorite Runner-Up: Day Two – Streamdata.io

http://finovate.wistia.com/medias/v2k6hx0qi0?embedType=iframe&videoFoam=true&videoWidth=640

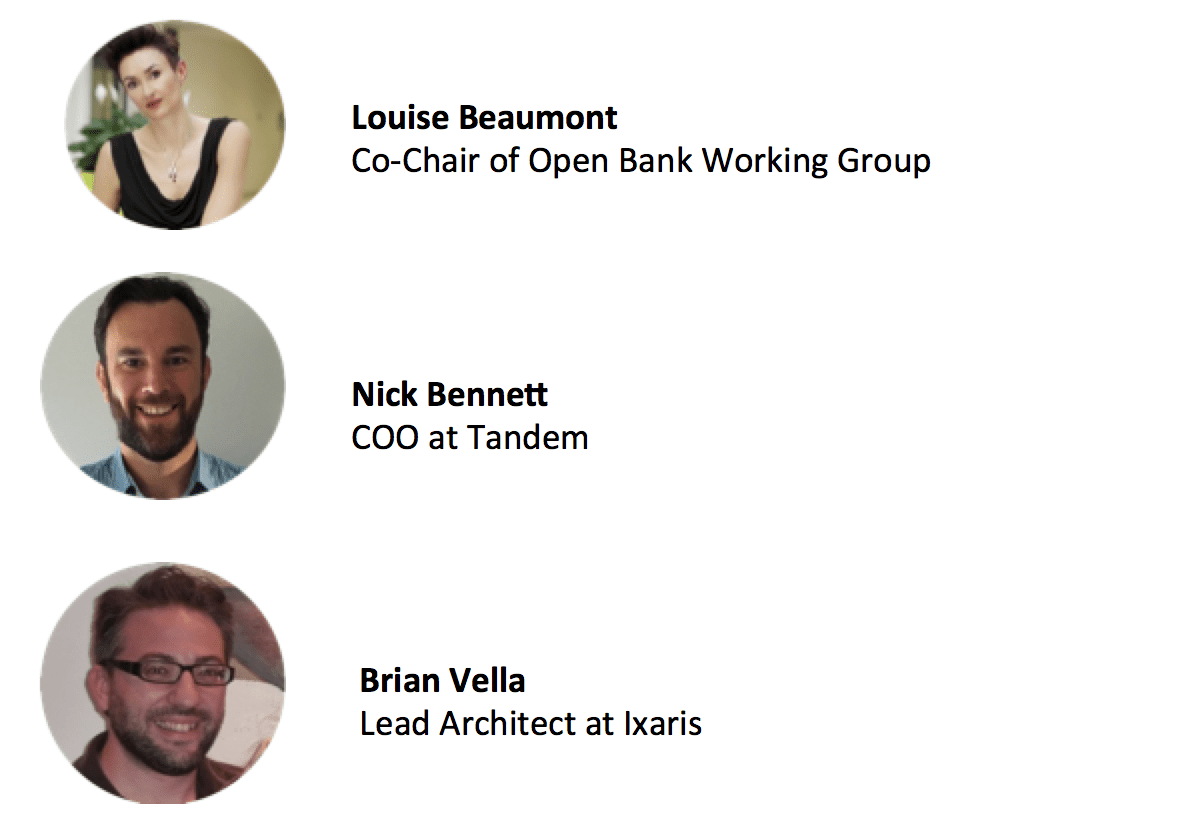

Second, have you seen the video of our panel on Open Banking featuring Louise Beaumont of the Open Banking Working Group, Tandem Money Chief Operating Officer Nick Bennett, and Brian Vella, Lead Technical Architect for Ixaris Systems? Panel discussions are new to our conferences, but if the audience response was any indication, there is good reason to make them a permanent part of our events. Thanks to everyone who attended – especially those who participated in our Q&A via Slido – and thanks to our trio of panelists for an engaging discussion on a timely topic.

http://finovate.wistia.com/medias/49488sgbv7?embedType=iframe&videoFoam=true&videoWidth=640

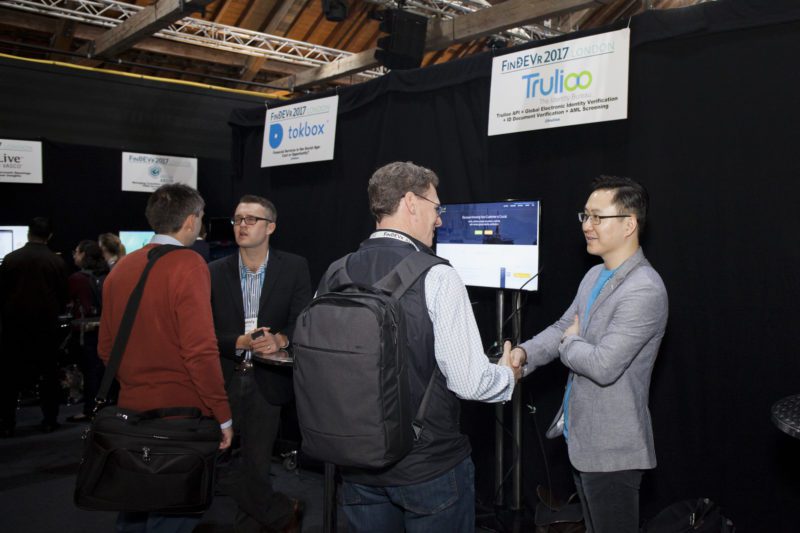

Third, we would also like to thank the journalists, bloggers, and other press folks who came out to cover our developers conference. It is always interesting to compare the media’s take on FinDEVr with the impressions and observations from those in attendance. Below we’ve included a smattering of the press coverage from the show; if you wrote an article, blog post, or other media about FinDEVr that you would like us to include, please let us know.

Benhamou Global Ventures – Portfolio News

IdentityMind Takes Crowd Favorite Award, FinDEVr London 2017

eSignLive Blog

Instant Replay: eSignLive at FinDEVr London 2017

by Rahim Kaba

Rangle.io Blog

FinDEVr Q&A with Rangle

by Douglas Riches

TestDevLab Blog

5 Interesting Companies We Met at FinDEVr London 2017

by Kristaps Skutelis

Trusted Key Blog

FinDEVr London

by Prakash Sundaresan

Virtual Strategy Magazine

Harborx Presentation “When Trading Meets Gaming” Well Received at FinDEVr London 2017

And finally we’re including a sample of top tweets from the FinDEVr Twitterverse. Thanks to our informed community of fintech tweeters for sharing their insights on two days of fintech innovation.

they’re the best, really (these guys, not the pics).”

they’re the best, really (these guys, not the pics).”