Here is third and final look at the companies that will demo at

FinovateFall September 12 &13 in NYC. Each company provided a short summary of the innovation they will debut on stage. In case you missed them, check out

Sneak Peek Part 1 and

Sneak Peek Part 2.

__________________________________________________________________

Web-based attacks have been on the rise, and financial services is one of the primary targets of criminal, political, and chaotic actors. These attacks can cost institutions millions in lost transactions and business productivity each year, and even higher losses in their brand value and reputation.

Akamai’s Kona Site Defender is the first cloud-based Web security solution to help financial services institutions protect against both large scale denial of service and sophisticated application-layer threats seeking to compromise their brands, applications, and associated data.

Innovation type: banking, online, security

Banno brings instant pre-transaction insights derived from location, historical spending outliers and upcoming bills to its mobile experience.

When looking at bank statements, people naturally perform regression analysis and predictive modeling to find outliers in spending. In other words, Where did my money go? We feel that everyone needs more absolute data points to help in this decision process. Grip’s dashboard provides easy access to your immediate historical financial perspective, allowing insight into spending over time while exposing anomalies with transaction level patterns ordered by what’s most important today.

Innovation type: Mobile, payments, PFM

Gift cards represent an estimated $110+ billion business in 2012. Consumers have $40 billion in unspent funds and are clamoring for digital solutions as well as connections to their favorite brands. Increasingly, these branded currencies are becoming a larger portion of the commerce cycle and consumer wallets. Retailers, merchants, financial institutions, digital wallets and marketers are all looking to capitalize and participate in this space.

At Finovate, Blackhawk is premiering its GoWallet Digital Services. These services help a host of digital players power deep engagement with consumers while creating new revenue streams through prepaid branded currencies.

Innovation type: Cards, mobile, rewards

CK Mack announces the debut of its innovative investment platform featuring an investment product based on a tangible, insured asset; Rented Real Estate.

Real Estate has been a haven for the wealthy investor since the dawn of time. Now anyone will be able to share in the cash flow of rental property without the high dollar buy-in previously needed to invest in this profitable market. Current low interest rates and market insecurity combine to make CK Mack an exciting option for portfolio diversification.

Innovation type: Investing

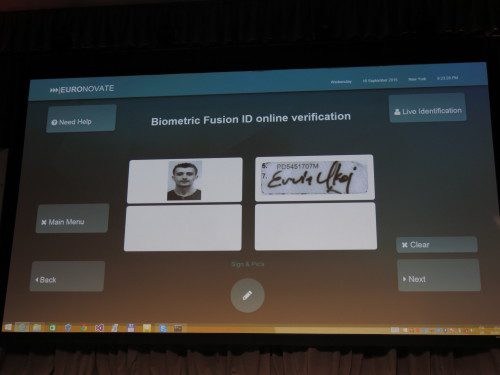

Euronovate is a “Zero paper company” aiming to transform every legal paper signed into an ab-origine electronic document with the same legal validity in all verticals worldwide. The new Pad Ensign10 and software platform ENsoft provide better legal and security management for electronic signature.

Euronovate is the first company to offer an end-to-end approach with legal support for electronic signature rules, process reenginering, system integration, hardware, software platform and digital archiving. Customers benefit from lower costs, a more efficient process, and an overall better experience.

Innovation type: Back office, sales, security

Finovera is your free personal bookkeeper. It is the easiest and most convenient way to receive, organize and manage household bills, financial statements and important family documents – all in one secure digital file cabinet. Users link their accounts once, and Finovera automatically brings in new bills and statements, making bil

l workflow management hassle-free.

Finovera disrupts the old way of dealing with paper documents and brings the simplicity, efficiency and convenience to household information management. Finovera helps banks and credit unions to reduce customer service costs, increase customer satisfaction and deepens relationships to maximize customer wallet share.

Innovation type: Mobile, payments, PFM

The CHOICE direct-to-consumer model allows retail customers to create individualized savings and/or investment solutions from the convenience of any channel and device by selecting the term, guaranteed minimum rate, liquidity and source of additional potential return, all with the security of FDIC insurance, in a completely transparent, clear and honest manner.

Innovation type: Back office, banking, investing, mobile, online

See the next generation in knowledge-based authentication – a SaaS solution that allows businesses to present custom, out-of-wallet questions to consumers using their own data.

IDology’s ExpectID Enterprise gives banks the ability to generate out-of-wallet questions using their internal proprietary customer transactional data located behind their firewall and without ever having to share that data with us. It is time to replace your shared secret questions (What is your mother’s maiden name?) with a higher security model that isn’t compromised by social media or vulnerable to account take overs. Be able to meet FFIEC compliance guidelines while creating a safer authentication method on high-risk transactions.

Innovation type: Identity, security

See how the vexing problem of cross-channel integration has finally been solved! Financial institutions can now seamlessly connect the online and branch experience for consumers as they shop for financial products.

A consistent consumer experience, easy ‘take your work with you’ cross channeling, best practice branch consultations, helpful product guidance, higher conversion rates, increased brand loyalty – just some of the many compelling benefits of Leadfusion’s new Cross Channel Selling solution. Unveiled publicly for the first time at FinovateFall 2012, from the leader in financial experience management.

Innovation type: Banking, marketing, sales

Manilla.com is a free, award-winning service that helps consumers manage everything in their lives in one place. Using just one password, consumers can track their financial accounts, household accounts and utilities, subscriptions, daily deals, and travel rewards, all through Manilla.com or Manilla mobile apps.

Manilla stores account documents, sends reminders to help avoid late fees, and gives consumers a complete overview of their accounts, all through a clean, simple interface. For businesses, Manilla decreases costs by moving customers to paperless billing, accelerates revenue by driving on-time payments, and offers a powerful marketing platform for businesses to engage their customers.

Innovation type: Communications, mobile, PFM

MShift presents AnyWhereMobile: a new payment network that enables Community Banks and Credit Unions to become the issuers of mobile wallets.

Simultaneously, the AnyWhereMobile payment network will multiply the net Interchange income of both debit and credit for Community Banks and Credit Unions, slash the merchant discount fees borne by merchants by more than half and eliminate the majority of fraud. The huge savings generated by AnyWhereMobile empowers merchants to generate more merchant-centric rewards and discounts for consumers.

Innovation type: Banking, cards, payments

PlayMoolah is on a mission to change the way kids and teens use their money! We design fun technologies for kids to experience money management to earn, spend, save, invest, and give. Through real dollars, real action, and real impact, we hope for kids to take control of their money, and become empowered by using it to live their dreams and create value for the world.

Innovation type: Marketing, online, PFM

A look at the companies demoing live at FinovateAsia on 8 November 2016 in Hong Kong. Pick up your ticket today and save your spot.

Presenters

Presenters Ervin Ukaj, R&D Software Director

Ervin Ukaj, R&D Software Director