- Alternative bank and payment data company RIBBIT has acquired risk mitigation and compliance solution provider ValidiFi.

- The amount of the transaction was not immediately available.

- ValidiFi made its Finovate debut at FinovateFall in 2019.

ValidiFi founder and CEO Oscar DiVeroli noted the “commonality of entrepreneurial grit and innovation” among upsides of the newly-announced acquisition of his company by RIBBIT, an alternative bank and payment data provider.

Reported late last week, the acquisition will combine RIBBIT’s predictive analytics and data assets with ValidiFi’s verification and compliance solutions. The goal is to create the largest alternative database of bank and payment data in the market. “I’m excited about the enormous opportunity to bring these two dynamic, industry-leading companies together,” RIBBIT CEO Greg Rable said. “The combination of talented people, robust data, and best-in-class products makes this a win-win for our customers and for us.”

Existing investor ABS Capital supported RIBBIT in the acquisition, along with new investor MissionOG.

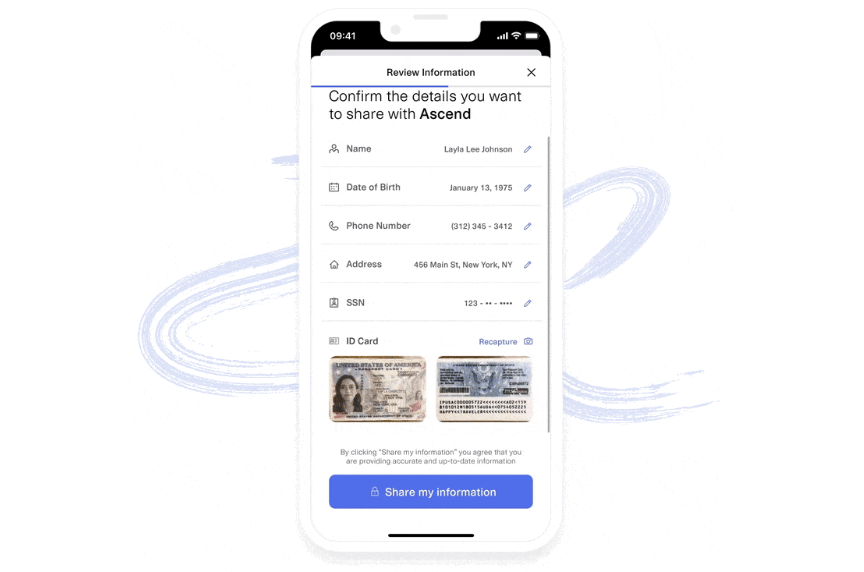

ValidiFi made its Finovate debut at FinovateFall in 2019. At the conference, the company demoed its Payment Risk Optimizer (PRO) technology. PRO is a Platform-as-a-Service solution that scrubs payment files for ACH and card payments. The technology leverages proprietary payment instrument data services to assess the likelihood of a successful payment. PRO can be used to schedule recurring payments for customers, or to create a subscription service, on-demand marketplace, retail store, or gateway.

“Today there are 22 billion dollars of bank overdraft and NSF fees that are charged to merchants and to consumers each and every year,” ValidiFi Chief Operating Officer Jesse Berger said from the Finovate stage in September. “The PRO all but eliminates NSF overdraft fees to consumers and return fees to the merchants. It uses automated workflows and real-time AI source data from the banks directly to verify and validate how much funds are available in the bank account. The PRO solves that age-old question of whether or not a payment transaction will go through successfully.”

Founded in March 2015, ValidiFi is based in Sunrise, Florida. The company began 2023 as a Nacha Preferred Partner for Account Verification, earning the certification in January.