Innovating in online marketing and delivery

Credit cards have

always fascinated me. From my first card in 1982, through my stint as a card

product manager in the late 80s, I’ve been a student of the industry,

watching and learning from the best: American Express, Citibank, First USA,

Capital One, and others.

As we entered the Internet era in the mid-to-late 90s, I fully expected

the credit card issuers to lead the financial services sector online. For a

while, it looked like a good prediction. Many of the early online banking

pioneers, NextCard, Providian/GetSmart, Wingspan Bank,

C2it, Juniper Financial, had their roots, and business plans,

centered on credit cards.

But a funny thing happened as that story was being written. Recession.

Whether it was an unseasoned portfolio (NextCard), problems at the parent

(Wingspan), or an over reliance on sub-prime (Providian), these pioneers

lost their funding and retrenched (Providian, Juniper) or disappeared (NextCard,

Wingspan, C2it).

But as card companies recover from the beating they’ve taken during the

past three years, we are seeing renewed innovation from the sector. For

example, after a decade of struggling to get traction, the card companies

have put online bill payment on the map with their convenient card-payment

options. As a result, card issuers have some of the largest registered user

bases in the financial services arena (Table 1 below):

Table 1

Top 5 Online Cardholder Bases, Year-end 2003

number of online cardholders

|

Issuer |

Online Users |

Cardholders (WW) |

% Online |

| American Express |

12 mil (e) |

60 million |

17% to 21% |

| Citibank |

10 mil (e) |

140 million |

6% to 10% |

| Discover Card |

9 mil (e) |

50 million |

17% to 20% |

| Capital One |

8 mil (e) |

47 million |

15% to 18% |

| MBNA |

6 mil (e) |

40 million |

13% to 16% |

| |

|

|

|

|

Source: Companies, (e) Online Banking Report estimates, +/- 25%, 2/04

We still believe that long-term you are better off wrapping your direct

banking efforts around plastic rather than paper ( “Will that be Paper or

Plastic?”). If NextCard had been more patient in building its portfolio,

they could have been a powerhouse today. So who will take their place as

The Internet Credit Card? It’s one of the more intriguing opportunities

of the decade.

Table 2

Top 5 Online Cardholder Bases, 2000 to 2003

number of online cardholders

|

Company |

2003 Dec |

2002 Dec |

2001 Dec |

2000 April |

| American Express |

12 mil (e) |

8.9 mil |

5.2 mil |

1.8 mil |

| Citibank |

10 mil (e) |

7.6 mil |

5.5 mil |

1 mil (e) |

| Discover Card |

9 mil (e) |

8.0 mil |

6.0 mil |

ina |

| Capital One |

8 mil (e) |

6.3 mil (d) |

3.5 mil (d) |

ina |

| MBNA |

6 mil (e) |

4.5 mil |

2.7 mil |

ina |

Total

% change |

45 mil

29% |

35 mil

52% |

23 mil

475% |

4 mil

— |

Sources: Companies except, (d) Dove, (e) Online Banking Report

estimates, +/-25%, 2/04

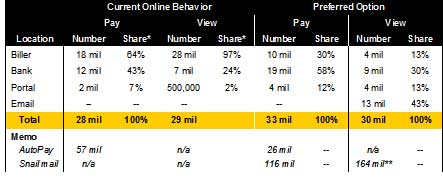

Online Card Usage

According to a recent Forrester report,1

75% of U.S. credit card customers have online access, and of those 36% (20

million) access their card statements online. More than 60% of those users

(12 million) accessed their account regularly. Fisite Research, a company

founded by ex-Gomez payments analyst, Paul Jamieson, found even higher

usage; with 57% of online cardholders saying they manage some aspect of

their card online2 (see Table 3, right). Whether the true

number is 20 million or 30 million or somewhere in between, we do know that

the use of online credit card management has exploded. Three years ago

(year-end 2000), fewer than five million households accessed cards online (see

full details, Table 5, opposite). Now, at least five individual card

issuers have online user bases of five million or more (see Table 2,

above).

There is even a greater disparity in estimates of the number of

cardholders paying their card bill online. Forrester found that just 36% of

online card statement viewers

(7 million HHs) pay their bill online, while Fisite reported 74% of online

card managers paid online.2 Gartner estimated that 22 million

adults pay their card bill online, either directly or through third-party

bill pay.3 Based on these estimates and usage numbers from

individual card issuers, we estimate 16 and 18 million households pay their

card bills online directly at the issuer, up nearly 20-fold since less than

one million users at the beginning of 2003.

1How To Right-Channel Credit Card Customers, by

Catherine Graeber, Forrester Research, Jan. 2004, $675,

http://www.forrester.com/ ,

fielded, Q2, 2003

2The TSYS Summer 2003 Executive Online Credit Card Survey,

Finite Research, $2495,

http://www.fisiteresearch.com/ fielded May/June 2003; the numbers

may be higher because respondents included pay-anyone third-party

payments in their answers

3EBPP Future Blends Direct Bank Aggregation Models,

Jan 13, 2004, by Avivah LItan, Gartner,

http://www.gartner.com/ $95,

fielded May ‘03

Table 3

U.S. Online Credit Card Usage Estimates

|

Metric |

Forrester

HHs |

Fisite

HHs* |

Gartner

Adults |

| Credit card households |

75 mil* |

75 mil* |

— |

| % of cardholders online |

75%

56 mil |

— |

— |

% of online cardholders using online card account

management |

36%

20 mil |

57%

32 mil* |

— |

| % of online card managers using it regularly |

60%

12 mil |

— |

— |

| % of online card HHs paying their card bill online |

36%

7.2 mil |

74%

24 mil* |

—

22 mil** |

Source: Companies, Online Banking Report, 2/04

*OBR estimates, Fisite reported usage as a percent of cardholders responding

to its online survey fielded summer 2003, household extrapolations by OBR

**Includes online payment direct at card issuer or through third-party bill

pay

Table 4

Online Card Evolution

|

Phase |

Period |

Product Positioning |

Primary Market |

| Beta |

1997 to 1999 |

Easy way to apply for a card |

Geeks and scam artists |

| Version 1.0 Novelty |

2000 to 2001 |

Cool to check your card online |

Early adopters |

| Version 2.0 Utilitarian |

2002 to 2003 |

Easier way to pay your card bill |

Early mainstream |

| Version 3.0 Value-add |

2004+ |

Save time and money with total credit

management |

50% of U.S. households |

Source: Online Banking Report,

2/04

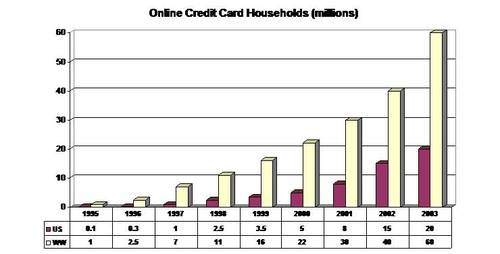

Forecast

The convenience and reliability of paying card bills

online will continue to drive online credit card growth. For 2004, we

project overall growth of five million new online credit card households

(range: 4 to 7 million), the same number of newcomers as in 2003. However,

the rate of growth will slow slightly to 25% compared to 33% last year. Ten

years from now, online credit card penetration is projected to grow to 47

million, 40% of U.S. households, compared to 19% today.

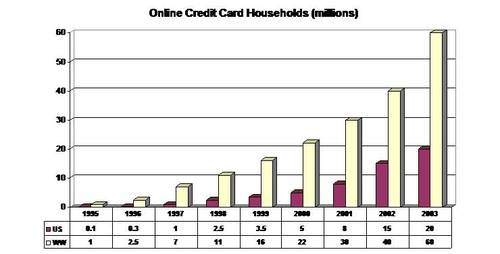

Table 5

Online Credit Card Forecast

U.S. households using online credit cards at

year-end*

Source: Online Banking Report projections based on industry data (+/-

30%), 2/04

Table 6a

Consumer Households Using Online Credit Cards: U.S. vs.

Worldwide

millions of households actively using online banking and/or

online bill payment

Source: Online Banking Report estimates 2/04, accuracy estimated at plus

or minus 30% U.S., 40% worldwide

Table 6b

Annual Growth Rate of U.S. Credit Card Households

millions of U.S. households and percent change from

previous year

Source: Online Banking Report estimates, 2/04; accuracy estimated at

plus or minus 30%

Table 7

OBR Definition: Online Credit Card Household

-

Someone in the household must have done at least ONE of the

following during the past 6 months:

-

Viewed balance/available credit or transaction data

online1 for a general purpose2 credit or charge card

-

Authorized a card payment at the site of the card issuer

(not at a third party such as a bank’s pay-anyone bill-pay service)

Does not include:

-

Online point-of-sale

transactions using a credit card

-

Debit or prepaid card account management, application,

or purchase

(1) Any connection from home, work, school, or other place where data can be

viewed through any device (Web phone, browser, proprietary software,

Quicken, Money, etc.)

(2) Visa, MasterCard, American Express, Discover

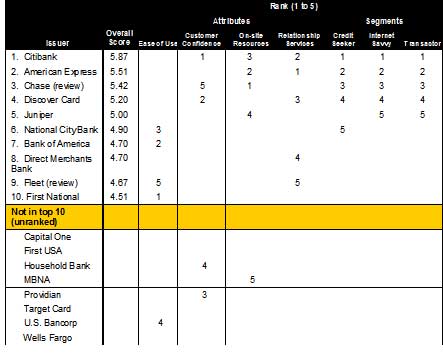

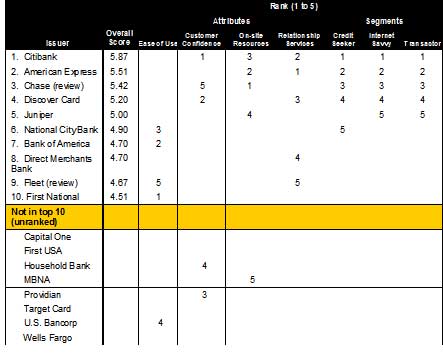

Table 8

Gomez Top Card Companies

Q3 2003 Scorecard

Source: Gomez, 1/04