A few weeks ago, we sent some questions to Jumio CEO Stephen Stuut (pictured). The digital ID-verification company he runs made headlines a little over a month ago with news that it had raised $15 million from its new owner, Centana Growth Partners. A Best of Show winner from FinovateEurope 2015, Jumio fell on challenging times this spring when it filed for Chapter 11 protection. Stuut, who took the helm at Jumio in May  2015, struck a positive tone, saying that the “restructuring process will allow us to strengthen the company’s financial structure and extend our leadership position in ID verification.”

2015, struck a positive tone, saying that the “restructuring process will allow us to strengthen the company’s financial structure and extend our leadership position in ID verification.”

So far so good. In addition to its recent funding, Jumio has forged ID verification and KYC/AML partnerships with companies ranging from European online gaming operator, Tipico; to the Paris-based mobile scooter-sharing network, Cityscoot; to Spanish crypto-currency specialist Krypto Commerce—all in the past few months alone. Combined with Jumio’s summer announcement that it has completed more than 30 million ID verifications, and it looks like the comeback trail for Jumio is clear.

Here’s what CEO Stuut had to say about his company, its current initiatives, and what we can expect from the Palo Alto-based security specialist in the months and years to come.

Finovate: Where will ID scanning and technologies like FaceMatch make the biggest impact in terms of replacing passwords and security codes?

Stephen Stuut: With the rise of online and mobile transactions, the growth of banking transactions like mobile account opening, money transfer, and bitcoin, and the rapid adoption of shared services, individuals are at greater risk to protect their security, and companies are further challenged to provide processes that will both build trust with their customers, while ensuring safety and security by helping reduce fraud.

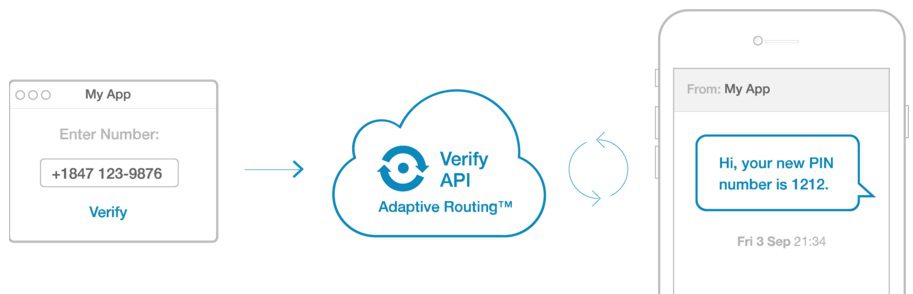

Multifactor-authentication methods are missing the mark; the use of a password or security code is not a secure enough way to verify an individual is in fact the owner of the account. Passwords and codes passed via mobile devices can be hacked, and there is no proof that the mobile device is in the possession of the owner.

A recent report from the National Institute of Standards and Technology referred to this process as insecure because the phone may not be in possession of the number and the SMS may be interrupted.

However, for a better approach, utilizing a combination of one or two government-issued IDs, with live photo and facial recognition, companies can ensure that an ID is valid and the person in possession of the ID is in fact the genuine ID owner.

Finovate: As much as most people hate passwords, they are a fairly embedded part of online and mobile culture. What will it take to start moving people away from passwords and toward these new technologies in significant numbers?

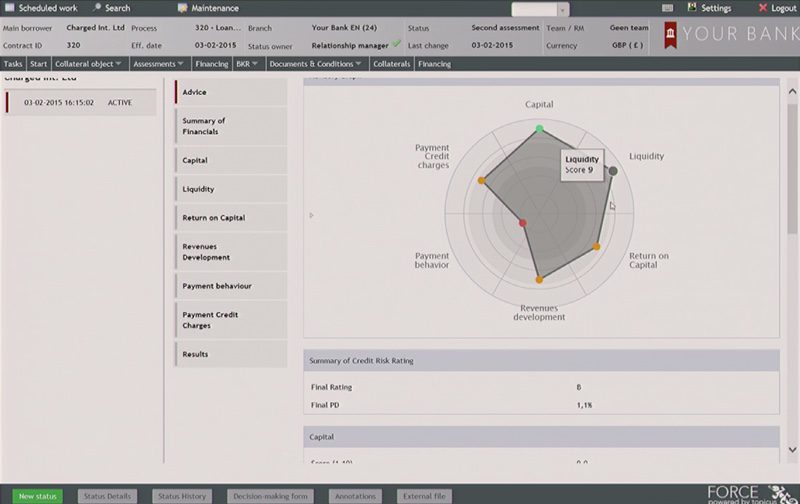

Stuut: To enable these markets to foster, regulations are being put in place that force compliance with KYC (know your customer) and address AML. These issues are driving the need for more robust ID-verification models that move beyond common passwords and security codes to more robust verification like ID scanning with Face Match.

Finovate: What is unique about Jumio’s approach to ID verification?

Stuut: Jumio replaces laborious and unreliable systems including knowledge-based authentication (KBA), inferred verification, and in-person verification by untrained individuals. The Jumio technology platform is industry-leading, providing computer vision technology, and face-match with human ID experts. This process provides the optimal combination of accuracy and user convenience while providing KYC requirements.

In addition, Jumio is PCI Level 1 compliant and regularly conducts security audits, vulnerability scans and penetration tests to ensure compliance with security best practices and standards. To ensure our security remains PCI compliant year after year, we have a yearly on-site validation assessment by a Quality Security Assessor (QSA).

Finovate: What are the advantages to working in so many different verticals—from financial services to travel to online gaming—beyond the opportunities for growing the company?

Stuut: Our work with companies in varying verticals has led to many opportunities for Jumio, but this opportunity, most notably and arguably most importantly, has allowed us to transform a more robust solution.

As varying industries seek ID-verification solutions to aid their business processes, success via these technologies may look different. For example, many of Jumio’s customers in the travel vertical use our ID-verification solution to deliver great mobile customer experiences with mobile check-in. Conversely, Jumio customers in the financial services vertical utilize our solution to help verify customer identity while also improving remote account-opening completion rates.

Because Jumio is focused on meeting the requirements and regulations of specific verticals, each industry benefits from the added expertise gained across these major markets. As a result both our platform and our customers have immensely benefited. Instead of a solution that is adequately built to address needs in one industry, Jumio’s solution is built to meet the needs of varying verticals, allowing for a more robust solution.

Finovate: You’ve been on the job as CEO for Jumio for just over a year. What accomplishments in this time are you most proud of and what do you hope most to accomplish in your second year?

Stuut: Over this past year I have been exceptionally proud to work with the talented individuals across the Jumio organization. Our team of highly skilled developers and seasoned executive team have been leading the industry, delivering on our vision of the next generation of digital ID-verification solutions.

The team is delivering great success and we recently closed out Q2 2016 with a greater than 65% growth in recurring revenue year-over-year, and a record 30 million transactions completed to date. Jumio’s customer base continues to expand, closing more deals than at any other time in company history, with Q2 2016 resulting in a more than 50% increase in deals year-over-year. This high momentum has been fueled by continued growth across every aspect of its business.

In addition, in August of 2016, Jumio continued its momentum, securing a $15 million round of financing from Centana Growth Partners LP and Millennium Technology Value Partners. The investment will enable us to continue to lead the digital ID verification space, aggressively expand sales and marketing, and accelerate product development and international expansion.

Check out Jumio’s Best of Show demonstration from FinovateEurope 2015.

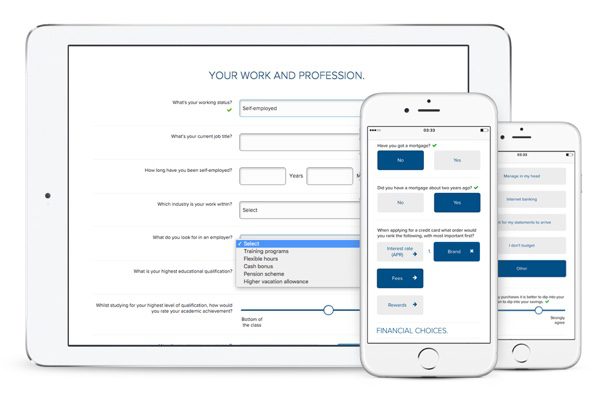

Aire’s multichannel application form

Aire’s multichannel application form