Israel-based biometric security specialist BioCatch announced today that it had raised $10 million in an initial Series A funding round.

BioCatch Raises $10 Million in Series A Round

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Israel-based biometric security specialist BioCatch announced today that it had raised $10 million in an initial Series A funding round.

Taulia, a company that aims to ease cash flow issues faced by small and medium sized businesses, announced today it raised $27 million in Series D funding.

This newest installment, which brings Taulia’s total funding to $67.2 million, comes from QuestMark Partners, which led the round, and existing investors Trinity Ventures, Matrix Partners, Lakestar and DAG Ventures.

When Taulia launched in 2009, its primary service was Dynamic Discounting, a product that helps suppliers receive faster cash flow, and gives buyers more flexibility and discounts if they pay early. Now Taulia offers seven products, including einvoicing and supplier management tools that help small businesses interact with their suppliers.

Of the 225,000 suppliers on Taulia’s platform, 55 rank among the largest corporate companies. The San Francisco-based company plans to use the funding to sign more large corporate clients and expand into Asia.

Taulia is now valued at $200 million.

To learn more about Taulia, check out its FinovateSpring 2012 demo where it debuted its Early Payment Network.

We recently caught up with Jim Collas, founder, president, and CEO of OnBudget. The San Diego-based company made its Finovate debut at our Spring show, demoing its Budgeting Solution.

OnBudget takes the tried-and-true Envelope Budgeting System used by our parents and grandparents and updates it for the 21st century. The technology consists of a prepaid card for daily purchases and a mobile app that automatically sets up a budget.

Having just returned from an all-too-short vacation, I continue to believe that banks are missing a lucrative opportunity to help customers reduce their financial anxiety while away from home. Following are the financial travel services I’d love to buy as a package priced at under $10/mo (not including insurance which would likely be sold on as-needed basis).

Having just returned from an all-too-short vacation, I continue to believe that banks are missing a lucrative opportunity to help customers reduce their financial anxiety while away from home. Following are the financial travel services I’d love to buy as a package priced at under $10/mo (not including insurance which would likely be sold on as-needed basis).

Travel services not only could be a solid source of fee income, but also put the bank in a great position to sell add-on insurance and credit services to road warriors and frequent travelers.

__________________________________________________

1. Easy-to-set travel flags

__________________________________________________

Most travelers have been trained to inform their bank about international travel plans to avoid unnecessary declines. It’s a perfect feature for mobile banking, but many (most) banks still require a tedious phone call to the call center. I’ve written about this before (here and here) and I’m seeing some improvements, though I still had trouble earlier this month with my bank of 20+ years (see note 1 for details). I’d also like to receive an “all clear” notice upon expiration of the flag.

__________________________________________________

2. Financial management services

__________________________________________________

While spending like crazy on holiday, it would be nice to have the option of seeing a running total of all travel expenses (at least those that weren’t prepaid). That would help us pace ourselves to keep from overspending and/or running out of cash before before we get home. Ideally, it would be nice to set up the “vacation ticker” at the same time we set the travel flag (see #1). The info should also be emailed/texted to travelers at the start of each day.

__________________________________________________

3. Personal trip journal

__________________________________________________

There are already some great services for managing reimbursable expenses on the road such as Expensify. But I want the same thing for personal travel. Sure, my perfect self would keep a neat journal of all the cool places where we visited and dined. But realistically, that’s just not going to happen. But I’d love my card app to help me keep a “spending journal” that would be a good substitute. As each expense occurred, the app would prompt me to snap a photo and/or jot down a few words to annotate each expense as they happened. And the bank would store these “travel journals” within secure online/mobile banking for the life of the account, thereby creating a powerful retention tool.

__________________________________________________

4. Special travel service reps (concierge)

__________________________________________________

Normal customer service reps aren’t always that savvy on the nuances of card usage while on the road, especially overseas trips (case in point, see #1). Provide a special email/text/phone number to “financial travel specialists” to get questions answered and problems resolved.

__________________________________________________

5. Convenient travel insurance that covers financial transaction

__________________________________________________

Not all the opportunities are around spending. There are important avenues of risk reduction available to savvy FIs. Due to a previous bad experience, I’m always a bit concerned about the safety of my personal belongings on the road. So, I’d like to buy travel insurance that covers:

— My personal belongings at the hotel or on my person (includes lost luggage)

— Details re: fraudulent use of my card

— Rental cars’ damage (not covered by my existing auto policy)

And the whole area of travel interruption is another possible avenue (see previous post).

___________________________________________________

BONUS: Chip-and-PIN prepaid cards for USA cardholders traveling abroad

___________________________________________________

Last week, I was that guy at the A9 toll booth making everyone back up to get over to the cash lane since none of my U.S. cards would work in the card reader (though they had worked earlier in the day). This included my fancy new BofA chip-and-signature card. We had more trouble than ever with U.S. credit cards in our latest trip across the Atlantic. So, please U.S. card issuers, sell me a prepaid card that really works in Europe. I’d pay a $100 fee (at least) just to avoid another toll-booth incident.

——————

Note:

1. I called my bank from the airport departure lounge to inform them I’d be using their ATM/debit card in Europe. The CSR insisted that I had to provide the last 4-digits of my checking account number before she could place a travel notice on my account. Since I was sitting at the airport without that info, we were at a standstill. Only after I asked for a supervisor did she come back and agree to do it for me.

MasterCard announces strategic partnership with Saigon Thuong Tin Commercial Joint Stock Bank to support card payments.

MasterCard announces strategic partnership with Saigon Thuong Tin Commercial Joint Stock Bank to support card payments.

Congratulations to four Finovate alums that took home top honors at the Mobile Innovations Awards.

The Mobile Innovations Awards “pay tribute to those pushing the boundaries of what is possible using a mobile device.” Focused on innovation in the EMEA (Europe, Middle East, and Africa) region, the awards are designed to help companies raise their profile in the area, as well as network with peers and potential partners.

ACI Worldwide announces plans to acquire fraud prevention specialist, Retail Decisions (ReD).

ACI Worldwide announces plans to acquire fraud prevention specialist, Retail Decisions (ReD).

It’s summer here in Seattle. But here at Finovate, we’re already looking forward to the fall.

FinovateFall 2014 will return to New York City on September 23 and 24 to showcase an interesting blend of bold startups and industry veterans.

![]()

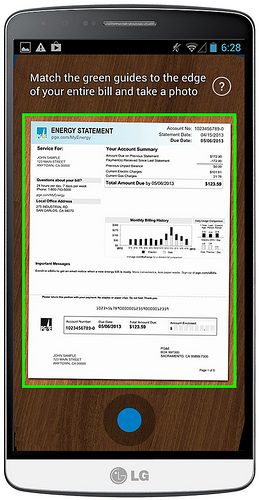

Less than a month after being acquired by Intuit, Check has announced that it is expanding the beta program for its latest innovation: photo bill pay.

Starting this week, tens of thousands of Android users will have the opportunity to take Check’s photo bill pay technology for a trial run. The company hopes to have its photo bill pay solution available on all platforms by the end of the year.

How does Check’s photo bill pay work? Start with an Android smartphone, an installed Check app, and an unpaid bill. Users open the camera icon on the app, and then take a photo of the bill with their smartphone. The next screen provides the user with some basic information, as well as a scanned copy of the bill.

Innotribe finalists include early stage companies CurrencyTransfer and LendingRobot.

Innotribe finalists include early stage companies CurrencyTransfer and LendingRobot.Password management platform Dashlane recently released an update that will give organizations more control over accounts that need to be shared across team members.

The New York-based company’s latest release will include three major upgrades:

1) Sharing Center, a dashboard that displays all of a user’s accounts synched with Dashlane. It enables them to share the passwords with others, automatically informing all users when a shared password changes.From the Sharing Center, users can also manage access levels, giving others full rights or limited rights to the password.2) Emergency Contacts gives users the ability to provide a trusted emergency contact with access to select accounts in case of emergency.3) View Password History gives users a comprehensive view of all of the passwords they have previously held in Dashlane.

In addition to the new sharing functionality, it is also releasing an upgrade to its user interface.

Dashlane was founded in 2009. At FinovateEurope 2013 it demoed how its online and mobile interfaces make online transactions easier and faster.

PaySimple to enable SMBs to accept payments and automate billing under Zen Planner’s software solution.

PaySimple to enable SMBs to accept payments and automate billing under Zen Planner’s software solution.