Around the web

- Market Prophit unveils its social market sentiment smart beta index.

- Silicon India takes a look at Ayasdi’s plans to use the capital raised in its latest $55 million funding.

- Financial Advisor IQ highlights Betterment and Motif Investing in its discussion of millennials and machines.

- QuantConnect is now integrated with Interactive Brokers.

- ProfitStars celebrates surpassing 600 FIs using its Remote Deposit Anywhere technology.

- FIS wins Best Core Banking, Best Outsourcing Project honors at Asian Banker Technology Implementation Awards.

- TechCrunch: Yodlee’s Joe Polverari writes about LearnVest and its acquisition by Northwestern Mutual.

- ABC’s 7 On Your Side quotes IDTheft 911 founder Adam Levin on protecting your driver’s license from identity theft.

- Connect Financial Software Solutions to provide real-time, P2P payments courtesy of new partnership with Acculynk.

- Cortera announces new releases of eCredit Software.

- Zoho partners with Forte Payment Systems to offer electronic payments directly with Zoho Finance apps.

- Dexterity Ventures’ Place2Give releases GIVE_api v. 2.0.

- Pymnts interviews SimplyTapp president and co-founder Ted Fifelski.

- PayPal to be publicly traded on NASDAQ in Q2 2015 with its original stock ticker symbol PYPL.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Alpha Payments Cloud

Alpha Payments Cloud

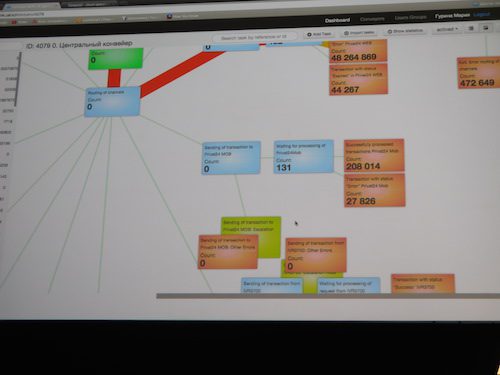

Corezoid is making its way to the stage now. The company is demonstrating its cloud-based platform to help FIs build better business processes.

Corezoid is making its way to the stage now. The company is demonstrating its cloud-based platform to help FIs build better business processes.