Last week, 20 companies raised $175 million, including $25 million in debt. It was the sixth week in a row that the number of fintech fundings topped 20. And the dollar total has hit 9-figures ($100 mil) or more 12 weeks in a row now. Both of the streaks will likely stop during the holidays, but so far the sector has defied gravity for the past 12 to 18 months, so even December could surprise.

Last week, 20 companies raised $175 million, including $25 million in debt. It was the sixth week in a row that the number of fintech fundings topped 20. And the dollar total has hit 9-figures ($100 mil) or more 12 weeks in a row now. Both of the streaks will likely stop during the holidays, but so far the sector has defied gravity for the past 12 to 18 months, so even December could surprise.

Chinese P2P lender Meili Jinrong led the pack with a massive $65 million A round. But the most surprising funding was the $42 million to the Atlanta-based alternative credit bureau, FactorTrust. Two Finovate alums added capital: Roostify which picked up $500,000 from Wells Fargo’s startup accelerator to further its mission to streamline the mortgage process for consumers and Figo, a German-based firm, which banked “7 figures” to expand its suite of banking APIs.

This week’s funding puts the 2015 year-to-date total to $16.0 billion, or $22 billion if you add the two October IPOs.

Here are the rounds by size from 31 Oct through 6 Nov 2015:

Meili Jinrong

P2P lending

Latest round: $65 million Series A

Total raised: $65 million

HQ: China

Tags: Consumer, lending, loans, peer-to-peer, investing

Source: FT Partners

FactorTrust

Alternative credit bureau

Latest round: $42 million

Total raised: $42 million

HQ: Atlanta, Georgia

Tags: Enterprise, underwriting, lending, risk management

Source: Crunchbase

Expansion Capital Group

Small business alt-lender

Latest round: $25 million Debt

Total raised: $37.1 million (includes $35 million debt)

HQ: Sioux Falls, South Dakota

Tags: SMB, financing, credit, loans, commercial lending

Source: Crunchbase

Invoice2Go

Invoicing solution

Latest round: $15 million Series C

Total raised: $50 million

HQ: Redwood City, California

Tags: SMB, invoicing, accounts receivables, billing, accounting

Source: Crunchbase

Mercatus

Energy-project financing

Latest round: $6.7 million

Total raised: $10.4 million

HQ: San Jose, California

Tags: Enterprise, SMB, investing

Source: Crunchbase

inov8

Mobile payments technology

Latest round: $5.4 million

Total raised: $5.4 million

HQ: Lahore, Pakistan

Tags: Consumer, mobile, payments

Source: FT Partners

POKKT

Rewards and alt-currency platform

Latest round: $5 million Series B

Total raised: $7.5 million

HQ: Mumbai, India

Tags: Consumer, payments, rewards, gaming

Source: Crunchbase

Compeon

Finance portal for small businesses

Latest round: $2.74 million

Total raised: $2.74 million

HQ: Emsdetten, Germany

Tags: SMB, lead gen, financing, commercial lending, price comparison

Source: Crunchbase

Eagle Alpha

Alternative data platform for asset managers

Latest round: $1.8 million Seed

Total raised: $6.3 million

HQ: Dublin, Ireland

Tags: Advisers, trading, investing, wealth management

Source: Crunchbase

Ingage

Investor relations platform

Latest round: $1.7 million

Total raised: $4.6 million

HQ: London, England, United Kingdom

Tags: Enterprise, investing, compliance, information management

Source: FT Partners

BTL Group

Blockchain technology

Latest round: $1.5 million

Total raised: Unknown

HQ: Vancouver, British Columbia, Canada

Tags: Blockchain, bitcoin, cryptocurrency, enterprise

Source: FT Partners

Change Labs

Personal finance tracking

Latest round: $800,000

Total raised: $800,000

HQ: Caesarea, Israel

Tags: Consumer, PFM, financial management, messaging, savings

Source: Crunchbase

Roostify

Home buying application

Latest round: $500,000

Total raised: Unknown

HQ: San Francisco, California

Tags: Consumer, Wells Fargo (investor), Finovate alum

Source: FT Partners

Call Levels

Financial markets monitoring and notifications

Latest round: $500,000

Total raised: $500,000

HQ: Singapore

Tags: Consumer, investing, trading, securities

Source: Crunchbase

TawiPay

International remittances price-comparison site

Latest round: $400,000 Seed

Total raised: $500,000

HQ: Lausanne, Switzerland

Tags: Consumer, payments, remittances, lead gen, price comparison

Source: Crunchbase

ZapChain

Bitcoin trading community

Latest round: $350,000

Total raised: $350,000

Tags: Consumer, investing, trader, cryptocurrency, social network

Source: Crunchbase

Loanbaba.com

Consumer loan marketplace

Latest round: $320,000 Seed

Total raised: $320,000

HQ: Mumbai, India

Tags: Consumer, lending, lead gen, loans, small business loans, mortgage

Source: Crunchbase

Wirex Limited

Bitcoin debit card (e-coin)

Latest round: $187,000 Crowdfunding

Total raised: $187,000

HQ: London, England, United Kingdom

Tags: Consumer, debit card, payments, cryptocurrency

Source: Crunchbase

Figo (formerly known as LeanBanking)

Banking APIs

Latest round: “7 figures” (exact amount undisclosed)

Total raised (previously): $780,000

HQ: Hamburg, Germany

Tags: Consumer, API, developers, Finovate alum

Source: Finovate

Scout Finance

Next-generation financial research

Latest round: Undisclosed

Total raised: $1.7 million (prior to latest round)

HQ: New York City, New York

Tags: Consumer, investing, information, trading

Source: Crunchbase

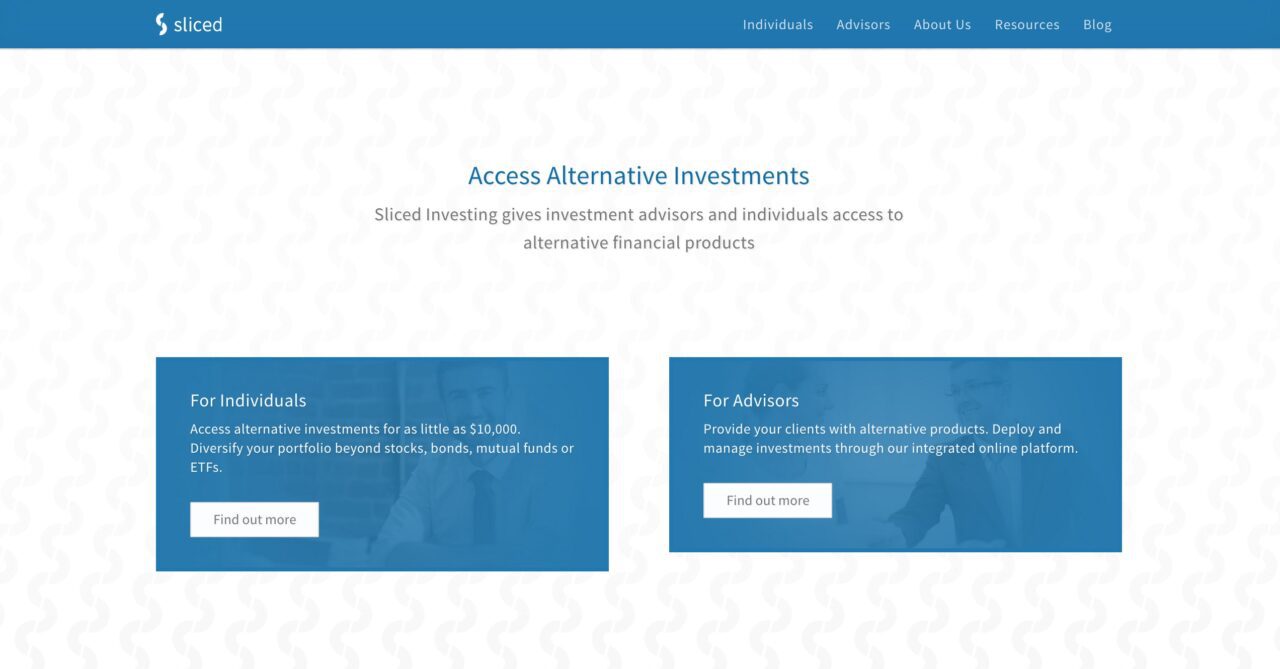

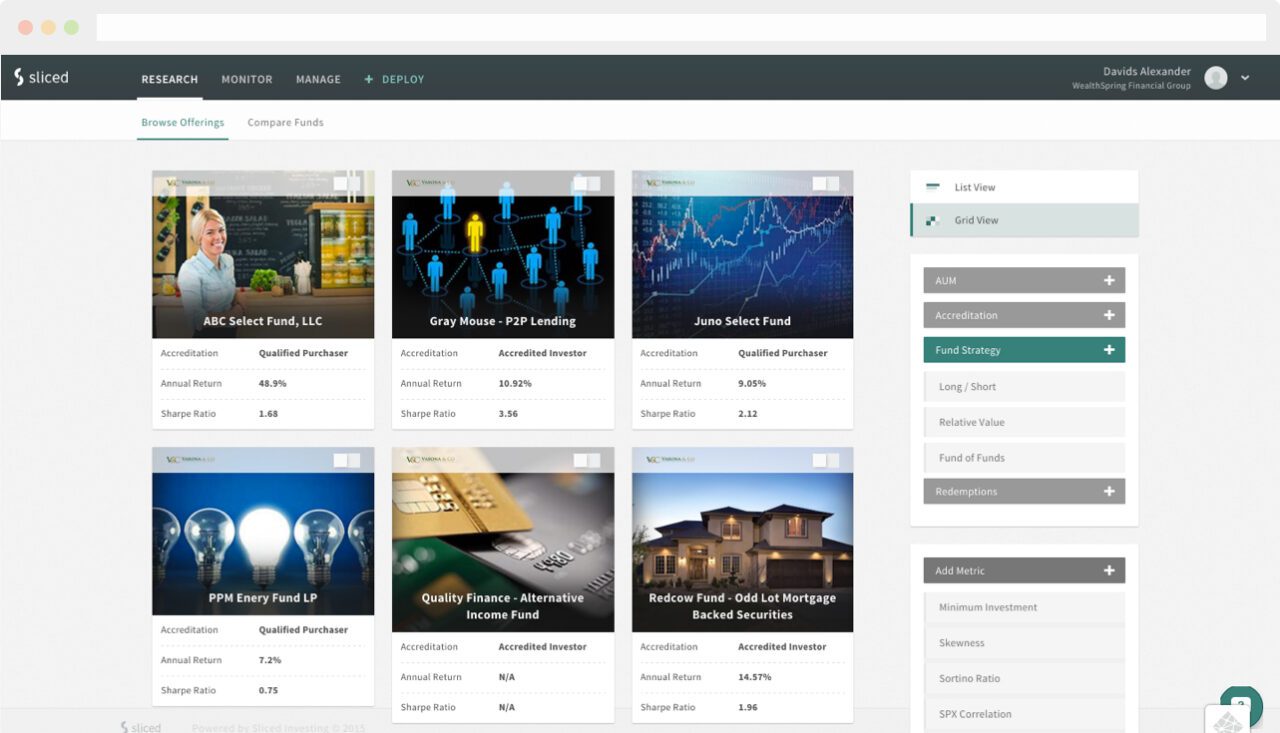

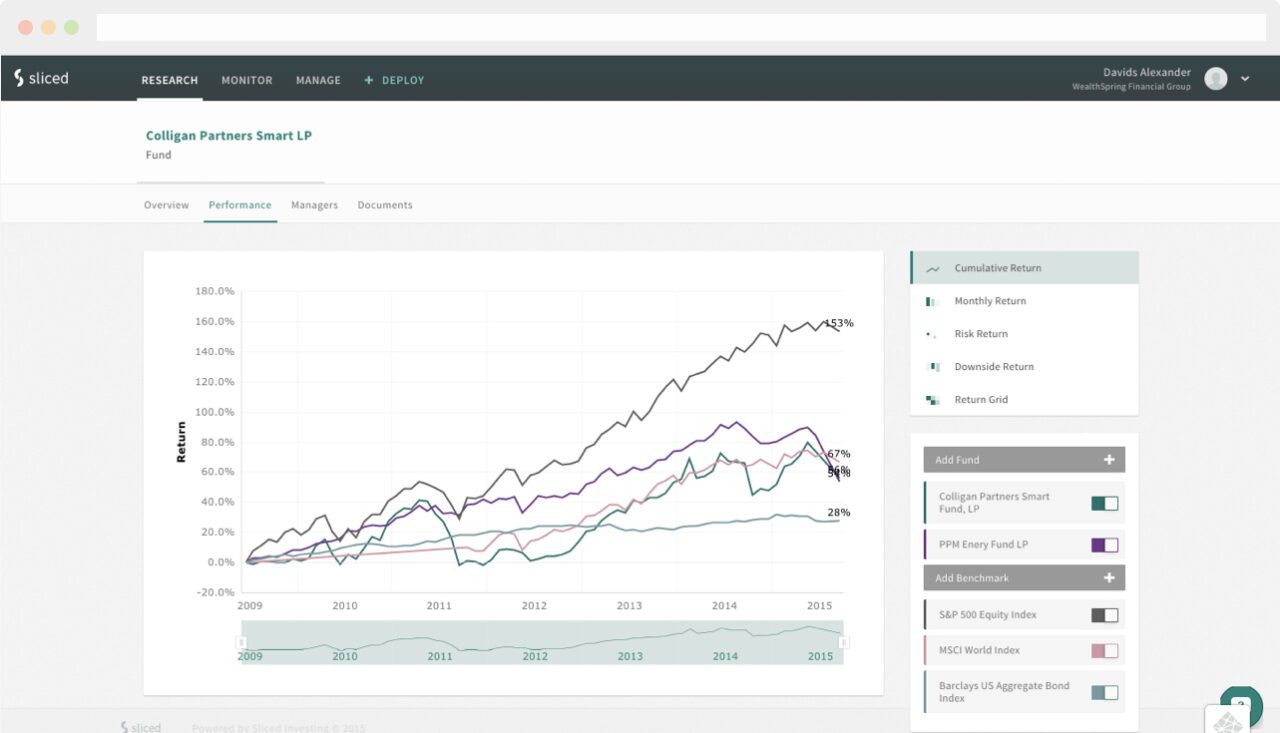

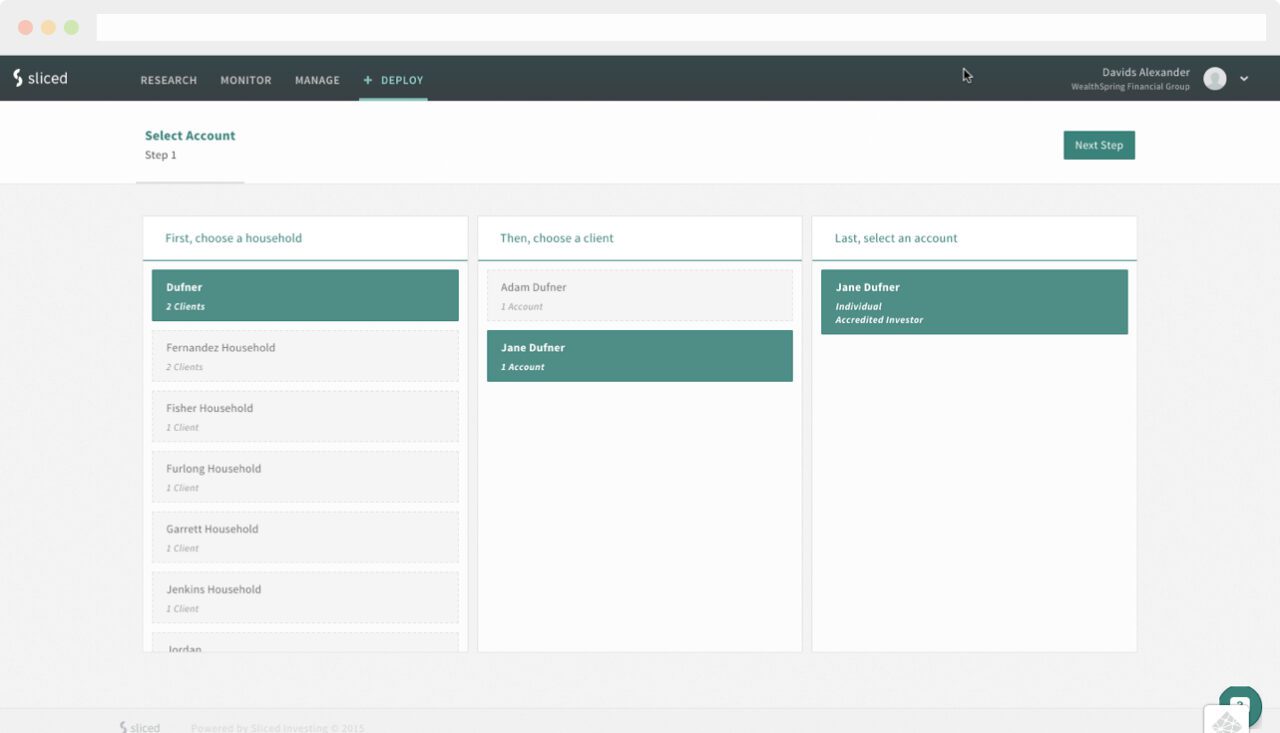

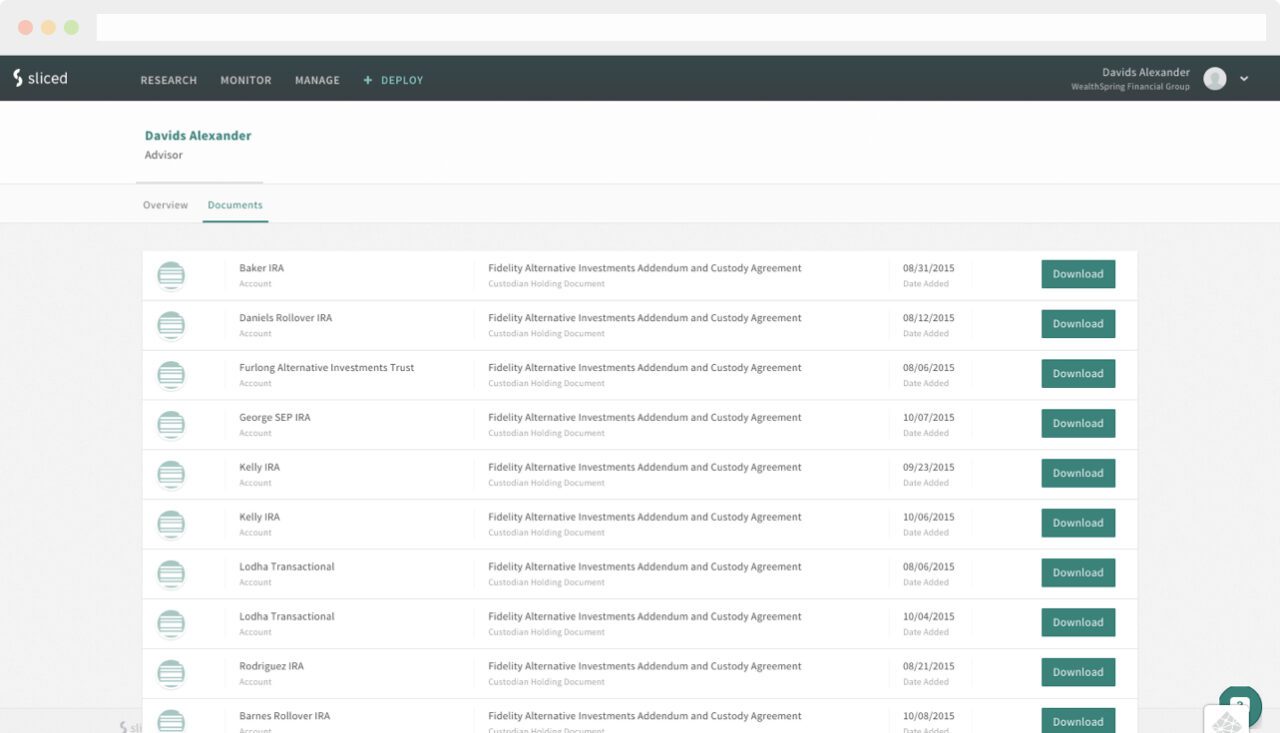

In the past few years there has been much disruption in the wealth management space especially with the influx of robo-advisers. Sliced Investing takes a different approach, offering registered investment advisors access to alternative investments.

In the past few years there has been much disruption in the wealth management space especially with the influx of robo-advisers. Sliced Investing takes a different approach, offering registered investment advisors access to alternative investments.

Arxan

Arxan Kabbage

Kabbage Socure

Socure SplitIt (formerly PayItSimple)

SplitIt (formerly PayItSimple) Are you building new financial technology? Be sure to

Are you building new financial technology? Be sure to