Thursday night, as my son was Tivoing his way through the commercial breaks on The Office, I noticed a Key Bank logo at the end of the commercial break. I had him go back and play the 5-second spot which was teaser style with a brief voiceover, logo, and the URL:

KeyBank.com/saveday

Expecting to see an interesting web-based savings account marketing effort, I typed "key bank save" into Google and came up empty handed (see note 1). The first link was to a Key Bank loan application, and there were no sponsored results.

Next, I tried connecting directly to the bank using what I remembered of the URL show in the TV spot, <keybank.com/save>. I realized that was the wrong address when all I saw was an error page, which unfortunately contained no guidance on what to do next (see inset). Finally, I went to the Key Bank homepage and found a large banner announcing the program aimed at encouraging users to curtail their discretionary spending on a designated day (your "Save day") each week (see second screenshot below).

Next, I tried connecting directly to the bank using what I remembered of the URL show in the TV spot, <keybank.com/save>. I realized that was the wrong address when all I saw was an error page, which unfortunately contained no guidance on what to do next (see inset). Finally, I went to the Key Bank homepage and found a large banner announcing the program aimed at encouraging users to curtail their discretionary spending on a designated day (your "Save day") each week (see second screenshot below).

Analysis

I'm like the idea of creating an interesting program to spur savings. For example, even though I didn't much like it initially (see post here), Bank of America's Save the Change does have a certain amount of appeal, at least from a marketing standpoint (see note #2).

And Centra Credit Union's <centra.org> new prize-based savings plan deserves a second look (thanks Doug True for the original post on this, here; see screenshot in note #3 below).

However, there isn't much to like about Key Bank's Saveday effort. The television spots may work as image advertising, but the website execution left a lot to be desired. Not only did the bank fail to support its television buy with search advertising, the landing page has little of interest besides the standard suite of savings calculators (see screenshot in note #4 below). There are no incentives, contests, or benefits to motivate a consumer to do something as unpleasant as giving up their daily latte.

While the bank does offer a handy PDF worksheet that can be printed out to calculate a monthly budget, there are no links or discussions of automated savings plan. Putting savings on auto-pilot is a much more powerful saving system than trying to get customers to sacrifice their caffeine one day per week.

There's also no interactive elements that might help get someone started. For example, why not send customers a text message to their phone or email each Saveday to encourage them to save.

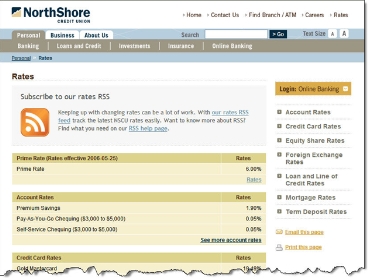

However, the biggest blunder, is calling attention to the bank's incredibly low savings rates. For example, for a $10,000 saving balance, a typical amount in high-yield savings accounts, Key's three options paid a paltry 0.10%, 0.20% and 1.24% (see note #5). And no, those are not typos, that's two-tenths of a percent, in the KeySaver account, or a grand total of $1.66 per month, before tax. Not even enough to buy that cup of coffee the bank wants you to forego on your Saveday.

It takes a $25,000 balance to get above 1.24% in any of Key's savings accounts (note #6). And anyone who's managed to stash away that much in liquid savings probably doesn't need a Saveday.

Notes:

1. Later we tried, "key bank saveday" and the first link was a press release on the promotion, but it was at a csrwire.com URL (see release here). Searching from a Seattle WiFi IP address in Seattle.

2. Bank of America has recently been touting the Save the Change debit card benefit in its usual excellent television ads.

3. Centra Credit Union Super Savings page

4. Key Bank Saveday landing page

5. Rates quoted on Keybank.com for zip code 98115 on 22 Jan 2007

6. Update Jan 30: According to a bank employee, a $25,000 deposit now pays 3% in Key Ultra Money Market which I confirmed online. And in markets where Key Bank doesn't have a branch presence, the rate is as much as 5.25% through Key Direct (see screenshot below).

Over at BankWatch (post

Over at BankWatch (post

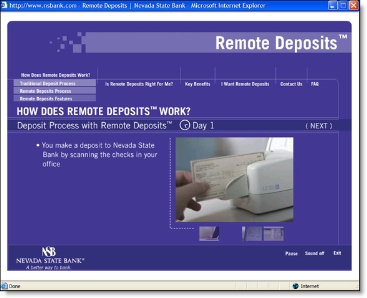

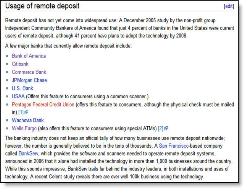

Recently, we've focused on one aspect of paper-check conversion, so-called remote deposit capture, where a business deposits paper checks by converting them into electronic items instead of driving them to the bank. It's an important new service that benefits both the bank and the end user.

Recently, we've focused on one aspect of paper-check conversion, so-called remote deposit capture, where a business deposits paper checks by converting them into electronic items instead of driving them to the bank. It's an important new service that benefits both the bank and the end user.

For example, Singapore's OCBC Bank has a WAP site at

For example, Singapore's OCBC Bank has a WAP site at