(Rant alert: If you are tired of analyst/blogger whining over perceived personal service affronts, it would be best to hit delete now.)

I don’t think there is an actual name for this, but I am car-dealer phobic. Seriously. On more than one occasion, I’ve driven all the way to the dealer. Parked my car. And then driven away as soon as I saw the sales guy (they have all been guys) ambling over. It’s weird.

I don’t think there is an actual name for this, but I am car-dealer phobic. Seriously. On more than one occasion, I’ve driven all the way to the dealer. Parked my car. And then driven away as soon as I saw the sales guy (they have all been guys) ambling over. It’s weird.

But I found eBay Motors about 10 years ago and have been overall very happy with the three vehicles I’ve bought there. So that would be the end of the story, if I wasn’t married.

My otherwise wonderful wife greatly prefers vehicles with that new-car smell, not the ones that arrive needing an $1800 catalytic converter to pass the emissions test (my most recent eBay “deal”). And I can’t really complain, because she’s perfectly willing to drive the thing for a decade or more.

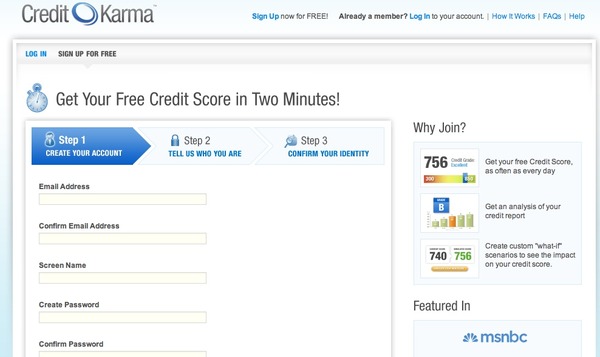

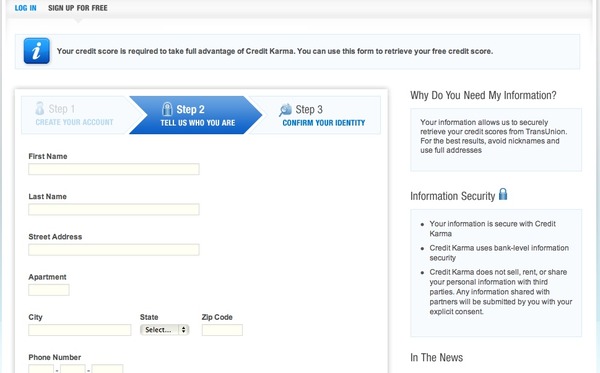

Good online application UX

So she ordered a new car and put me in charge of paying for it (does that sound familiar to anyone?). Being an online-only shopper, I went to my favorite car loan specialist (note 1) and completed their online app. The app itself was flawless and took only a few minutes.

While I was disappointed that I wasn’t approved in real-time, I received an email a few minutes later congratulating me on my loan approval. But there was a catch. In order to “to protect my privacy, (the bank) needed to verify some information.” So would I please call. That was 2 weeks ago.

Terrible income verification UX

So I called the next day. What I found didn’t totally surprise me. Despite being a customer of this financial institution (with an open credit line higher than the price of the car), and the fact that I’ve borrowed and paid back two car loans with them previously, and that I requested a 3-year loan which minimizes their collateral risk, and that I have good credit, the bank wanted to verify my income. And because I’m a business owner (not salaried), they needed 3 months of bank statements.

So I dug out the old statements, scanned them (note 2), and emailed them to the bank. There was no confirmation they were received, nor did the online loan-status indicator change (it simply said “approved”). I did that 12 days ago.

Then I waited for a week and heard nothing. So I called back and was told they hadn’t looked at the docs yet, but that they would expedite them. That was six days ago.

The next day, I received an email from the bank asking me to call again. You know that’s not good news. Here’s how that call went:

- Bank: We cannot verify your income because it shows as “Internet transfers” on your bank statement.

Me: But my business banking account is at the same bank as my personal one, so when I get paid, it’s called a “transfer” because it is one.

Bank: Sorry, we only consider it income if the bank statement says “deposit.”

- Me: OK, I can understand that, how about I send you my 2010 tax return?

Bank: Sorry, we don’t accept tax returns for income verification.

- Me: OK, how about if I send you the last 3 months of my business bank statements, then you can see the transfers leaving that account and landing in my personal account.

Bank: Sorry, we can’t accept biz-bank statements because we don’t make commercial loans.

- Me: Can we move this application to an exception processing area for manager review?

Bank: Sorry, we don’t do that.

- Me: Is there any way you can think of that I could verify my income?

Bank: Do you have a spouse with W-2 income?

Me: No

Bank: Then unfortunately, I don’t see any way that we can verify your income. Sorry.

- Me: Then what I hear you saying is that there is no way for me to get the loan you approved me for?

Bank: Sorry, but that’s the case.

With that we ended the conversation. Rather abruptly if I recall. (I will say, she was actually very nice throughout the whole call, so partial credit for that.)

After I’d cooled down a bit, I decided to call back and try my luck with another rep. Sure enough, after I explained the situation and offered to send the corresponding biz-bank statements to verify the transfers, he said, “That makes sense, let me check with my manager.” Within a minute or two he came back on and said that my solution should work and to please send the business banking statements. Which I did, right away. And again no confirmation that they were received. That was 4 days ago.

After hearing nothing for two more days (this is supposedly being “expedited”), I called back and was told it was under review and there was nothing they could do to speed it up. That was 2 days ago. I haven’t heard anything since.

The car dealer to the rescue

Because I had to pay for the car in full this week or forfeit the deposit, I gave up on my online bank and called the dealer. At their instruction, I completed their short online form, was approved by their indirect lender (thank you U.S. Bank!), and went in and signed the papers. Start-to-finish in just a few hours. There was no income verification. And I even got a better rate.

Lessons for Netbankers: Experiences like this is what gives online lending a bad name. This is the third time in a row I’ve had a really poor experience with an online loan app. I understand that my self-employment, even after 16 years, makes underwriting more difficult in these cautious times. But you need to have a process in place where denied applicants can request a quick review of their application, detailing the mitigating factors.

Simply leaving prospective customers hanging is not good business.

—————————————-

Notes:

1. My policy is to not to disclose the name of the financial institution if it’s about an issue or problem with my personal situation. But I will email you the name as long as you identify yourself and agree not to publicly post it (send to [email protected]).

2. Unfortunately, I couldn’t simply download estatements since my bank does not offer them, unless you give up your paper statement.

3. For more on online account opening, see Online Banking Report: Improving Online Account Opening ROI (published June 2009).

I’ve been accused of falling for the Bank Simple hype. Just to prove that I don’t discriminate, I bring you MoveNBank, a mobile-optimized banking startup founded by Bank 2.0 author and consultant Brett King.

I’ve been accused of falling for the Bank Simple hype. Just to prove that I don’t discriminate, I bring you MoveNBank, a mobile-optimized banking startup founded by Bank 2.0 author and consultant Brett King.