To see Finovate alumni company news in real-time, follow our feed on Twitter here.

American Express Wants to Power Your iTunes Purchases

How much does the average American Express cardholder spend in the iTunes store each month? A lot. And how often do you go to iTunes and change your default card? Never. Is it worth $5 to have your card powering an iTunes account? To American Express it is.

How much does the average American Express cardholder spend in the iTunes store each month? A lot. And how often do you go to iTunes and change your default card? Never. Is it worth $5 to have your card powering an iTunes account? To American Express it is.

I’m sure the card company’s spreadsheet shows a payback within a year or two on incremental interchange alone. But more important is the added stickiness these frequent Apple purchases give to the card. Plus, it can’t hurt to associate your brand with the most valuable tech company on the planet.

The fine print

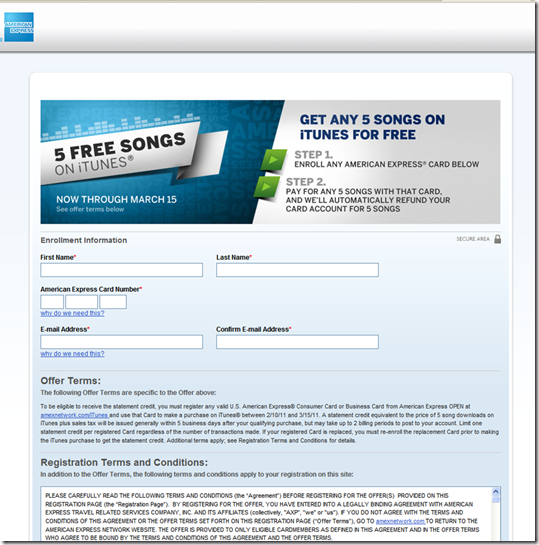

To earn the five-song credit, cardholders must make a purchase with their Amex card between Feb. 10 and March 15. That earns a statement credit equal to five song downloads. It doesn’t say which song price-point is used in the calculation, but I’m guessing the standard $0.99.

Relevance to Netbankers

It’s always good business to get your card installed as an automatic payment source. Interchange goes up, credit card receivables improve, and you’ve added one more electronic hook to the account. So consider taking a similar approach and offering a small bounty after your card is used with a new biller.

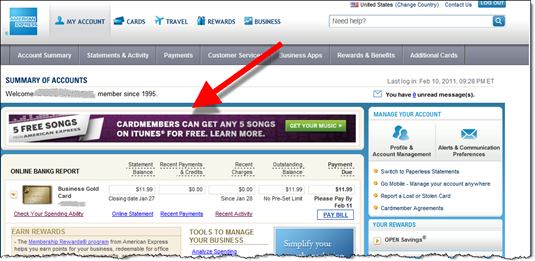

iTunes promo on main Amex account page (Business Gold, 11 Feb. 2011)

Enrollment screen (link)

The 43 Financial Sites With the Most Unique U.S. Visitors in January per Compete

Every month, Compete publishes a list of the 1,000 websites with the most U.S. monthly unique visitors. In January 2011, 43 were financial sites (banking, payments, brokerages, cards, credit reports, lending, or personal finance). Of the 43, 14 were banks (see note 1).

Every month, Compete publishes a list of the 1,000 websites with the most U.S. monthly unique visitors. In January 2011, 43 were financial sites (banking, payments, brokerages, cards, credit reports, lending, or personal finance). Of the 43, 14 were banks (see note 1).

For a little context, Google topped the list with 145 million. The largest banks were similar to Apple (34 mil), Twitter (28 mil), Flickr (21 mil), or Yelp (12 mil).

| Company | Traffic | Type |

| 1. paypal.com | 30 mil | Payments |

| 2. chase.com | 25 | Bank (#1) |

| 3. bankofamerica.com | 24 | Bank (#2) |

| 4. intuit.com | 20 | Personal finance |

| 5. wellsfargo.com | 16 | Bank (#3) |

| 6. capitalone.com | 13 | Bank (#4) |

| 7. citibank.com | 12 | Bank (#5) |

| 8. hrblock.com | 12 | Tax |

| 9. lowermybills.com | 8.5 | Personal finance |

| 10. americanexpress.com | 8.4 | Cards |

| 11. taxactonline.com | 7.7 | Tax |

| 12. discovercard.com | 7.3 | Cards |

| 13. taxact.com | 7.3 | Tax |

| 14. wachovia.com | 6.2 | Bank (#6) |

| 15. fidelity.com | 5.6 | Investments |

| 16. usbank.com | 5.4 | Bank (#7) |

| 17. hsbccreditcard.com | 4.9 | Bank (#8)) |

| 18. netteller.com | 4.5 | Banking services (Jack Henry) |

| 19. pnc.com | 3.9 | Bank (#9) |

| 20. bankrate.com | 3.9 | Personal finance |

| 21. usaa.com | 3.8 | Bank (#10) |

| 22. progressive.com | 3.8 | Insurance |

| 23. creditreport.com | 3.4 | Credit reports |

| 24. allstate.com | 3.4 | Insurance |

| 25. freescore360.com | 3.2 | Credit reports |

| 26. freecreditscore.com | 3.2 | Credit reports |

| 27. turbotax.com | 3.2 | Tax |

| 28. orchardbank.com | 2.8 | Credit cards |

| 29. ingdirect.com | 2.7 | Bank (#11) |

| 30. hrsaccount.com | 2.7 | Credit cards (HSBC) |

| 31. salliemae.com | 2.7 | Student loans |

| 32. statefarm.com | 2.6 | Insurance |

| 33. mycheckfree.com | 2.6 | Payments |

| 34. suntrust.com | 2.4 | Bank (#12) |

| 35. vanguard.com | 2.3 | Investments |

| 36. speedpay.com | 2.2 | Payments (Western Union) |

| 37. regions.com | 2.2 | Bank (#13) |

| 38. tdbank.com | 2.1 | Bank (#14) |

| 39. sharebuilder.com | 2.0 | Investments |

| 40. bbt.com | 2.0 | Bank (#15) |

| 41. gemoney.com | 2.0 | Lending |

| 42. annualcreditreport.com | 2.0 | Credit reports |

| 43. bbandt.com | 1.9 | Bank (#16) |

—————–

Note:

1. There are 16 bank URLs in the top 1,000, but wachovia.com is part of Wells Fargo. And bbt.com and bbandt.com are both BB&T Bank.

American Express Now Offers Basic PFM Functions

I was pleasantly surprised today to find that American Express has slipped basic PFM (personal financial management) functionality into its online card management area (note 1). The company allows the user to tag transactions and view results in graphical format (see screenshots below).

I was pleasantly surprised today to find that American Express has slipped basic PFM (personal financial management) functionality into its online card management area (note 1). The company allows the user to tag transactions and view results in graphical format (see screenshots below).

According to the FAQ, each transaction can have up to five tags. And each user can create up to 200 unique tags to apply to transactions.

Significance: Combined with the categories automatically assigned to each transaction, American Express is now offering basic PFM services. Although a little clunky—a three-click process is required to add a tag—it’s a nice addition and something every online banking service should support.

How it works

1. Click the “Add Tags to Transactions” link on the right side of the Statements & Activity area (below):

2. Select a transaction(s) and apply an existing tag or create a new one, then click the Apply Tag button (lower right):

How it looks

After apply the tag “Personal,” it now shows up in the transaction listing:

Once tagged, users can view transactions by tag categories:

Or view graphs by tag:

Note:

1. The example shown is for a Business Gold account. I’m not sure how long it’s been available. The first mention I could find about it via Google was Nov. 2010, so we’ll go with that until someone chimes in with better info.

2. For more on online personal financial management (OFM/PFM), see our Online Banking Report.

FinovateEurope 2011 Guide Available (Free)

Our first Finovate Europe concluded a week ago today. It was personally a great experience, and from the feedback on our survey, it seemed to go over well with attendees and presenters alike. Thanks to everyone who made it possible.

Our first Finovate Europe concluded a week ago today. It was personally a great experience, and from the feedback on our survey, it seemed to go over well with attendees and presenters alike. Thanks to everyone who made it possible.

If you’d like a PDF copy of the attendee guide, it’s now available free-of-charge at our Online Banking Report website (registration required if you are not already an OBR subscriber).

The guide contains a one-page synopsis of each of the 35 demoing companies. We’ll also be posting full-length videos of each demo at Finovate.com later this month.

#Finovate Tweet stream from @netbanker (1 Feb. 2011)

Following is my live tweet stream from the Feb. 1 event, rearranged into alphabetic order by demoing company:

- FinovateEurope kicks off with Chris Skinner doing 7 minutes on financial innovation; love the Susan Boyle tie-in

- AcceptEmail is showing its interactive ebilling platform; average recipient pays bill 15 days sooner

- AcceptEmail uses color to show if bill is paid; blue before it’s paid, green after payment; great user interface

- Backbase launch of Backbase Bank 2.0 portal, showing how easy it is to custom-build a financial dashboard

- Backbase showing personalization of marketing messages using drop-downs; also works cross-platform, online, tablet & mobile

- BOKU showing its payment system to buy virtual goods in Playfish (EA) soccer game within Facebook; uses mobile to authenticate

- Love it when the PC-to-mobile integration works live on stage; BOKU completed entire transaction in 30 to 40 seconds

- BusinessForensics is launching “dynamic trans profiling” integrated with forensic database; showing one-million transaction-database loading

- BusinessForensics doesn’t rely on rule-based algorithms, tracks behavioral patterns in real-time; dark-gray interface is an eye-pleaser

- Cardlytics showing its “transaction-marketing platform” wherein offers are embedded in statement and based on consumer’s actual spending

- Cardlytics rewards summary provides user feedback; shows offers outstanding, cumulative cash earned (can be $100+/yr), etc.

- Cardlytics merchants seeing response rates 50-100x higher than typical online marketing; earning advertisers $6 per $1 spent

- Cardlytics says more than 15 million HHs today, expecting 60 mil (50% of U.S. population) on system by mid-year

- Capital Access Network is showing the Spanish version of its Daily Remittance platform

- Capital Access “go beyond wait & hope” with daily info on how a loan client’s revenues are performing against initial projections

- Cortal Consors from BNP Paribas is launching “Hopee” social network for stock picking; adding 200-300 members per day

- Cortal Consors creating track record, like eBay sellers; create leaderboard; adding entertainment to platform

- eToro trading platform allows social networking/collaboration around trading currency and commodities; demoing on Facebook

- eToro launching OpenBook (CopyTrade & CopyTrader), allows users to follow & copy trades of other users; offering $100 to #finovate audience

- eWise announcing new “Payo” pay-by-bank system for United Kingdom; allows users to make online purchases directly through their online bank

- eWise is demoing mobile version, showing purchase via QR code printed in a magazine ad or on a billing statement

- Fidor Bank showing the Fidor Pay ewallet; includes ability to purchase precious metals & virtual currencies like Facebook credits

- Fidor Bank enabling “banking with friends” to make online banking social; “no law that says banks must bore customers”

- Figlo “financial globalization” is launching new product that breaks down complex financial advice process into simple steps

- Figlo unique user experience with drag-and-drop “financial cards;” works cross-platform including smartphone, iPad, etc.

- Finantix says one million financial advisors use massive amounts of paper when meeting with clients; iPad is better way

- Finantix launching suite of iPad applications for financial advisors; demoing how it works in a face-to-face client discussion

- Finantix will also be introducing a suite of apps for retail banking and commercial banking

- FriendsClear is showing first p2p lending site in France, has been live for one year; focuses on financing small businesses

- FriendsClear showing list of projects investors can fund; each has a full page detailing the business plan, financing needs, etc.

- FriendsClear project page integrates with the small business borrowers social networks, Twitter, Linked:In, Facebook, etc.

- FriendsClear launching investor dashboard “gauge of future,” predicts returns of portfolio & liquidity; advances state-of-the-art

- HelpMyCash.com is launching the first financial app store to purchase and/or find free custom analysis from experts

- HelpMyCash platform can be integrated into a bank site, either as a revenue producer or a way to differentiate themselves

- IND Group works on user experience; demo of great online banking search with natural language-based “transaction spotter”

- IND Group showing transaction-location mapping system, shows “map view” of where you spent money; great web 2.0 feature

- Ixaris launching OPN Card Guardian platform for developing payment solutions that use Visa, MasterCard, SWIFT networks

- Ixaris showing how to use “paylet components” to create virtual card product without programming

- Liqpay.com demoing its new “$hop app” to easily set up Facebook shop for ecommerce; includes affiliate programs

- Liqpay.com, founded with PrivatBank two years ago, has 1.3 million customers; showing its small biz online invoicing via Privatbank

- Linxo is first to launch account aggregation in France; live with a number of French banks

- Linxo demoing integrated ads triggered based on customer’s actual spending; can integrate merchant rewards directly into platform

- Lodo Software is launching dashboard to help FIs leverage PFM data for sales; showing how to get tangible ROI from PFM

- Lodo FI dashboard is multi-lingual; showing how to set up marketing campaign on the fly

- Lovemoney.com launching version 2.0 of its personal finance portal; showing social aspects to see what others are choosing

- LoveMoney.com is Yodlee powered, has 1 million members reached via email

- Meniga launched in Iceland in 2009, already have 6% national market share; helping users “spend more wisely”

- Meniga showing Facebook integration with shareable monthly quiz

- Meniga adding a gaming layer to PFM using humor + “social curiosity,” ie. comparing your spending to peers; important elements

- miiCard launching identity verification card, demoing how it would be used in a banking online account opening process

- miiCard links miicard identity to bank account identity; using Yodlee for account linkages; creating “digital passport”

- MPOWER Mobile launching Rev COIN to

turn mobile phone into POS device; World Bank says cash-only business costs 4% more to operate - Demoing Rev COIN kit, costs $15-20 includes swipe device for mobile, app and plastic payment card; can have text/email receipt

- NCore Systems is demoing remittance system with straight-through processing; cut down on friction typically costing 10%

- NCore Systems is demoing by sending a transaction to Indian Bank; looking for partners for $50 billion Indian remittance market

- SecureKey demoing its secure online payment method; users touch their contactless card to a USB device to buy

- SecureKey not only authenticates that card is present, it autofills the shopping cart info, saving 100 keystrokes

- SecureKey showing similar process that can be used for online banking login and per-transaction out-of-band authentication

- Silver Tail Systems discussing man-in-the-mobile attack (MITMO), security just gets more difficult with each new channel

- Silver Tail shows its usage monitoring, looks at areas such as IP address, speed of clicks (to discern robotic vs. human pacing)

- Silver Tail launching Forensics MT (multi tenancy) for banking service providers working with multiple banks

- Solidpass is demoing on iPad, showing good usability combined with extra authentication

- Solidpass generates QR bar code that can be scanned with iPhone to give user the response code to enter; very fast, very slick!

- StockTwits announced that is about to support international ticker symbols; focusing on curating and finding the best advise

- StockTwits launching @StockTwits Connect; showing how it powers third-party info providers including Yahoo Finance via API

- Strands launching its Personal Finance Business Intelligence solution to help banks use PFM data for sales

- Strands announcing major new client today, powering Bank of Montreal’s MoneyLogic, which is live now

- Striata introducing its next-generation interactive push-email billing

- Striata — “Security on a paper bill is its envelope, ours is its 256-bit encryption” —

so easy that 40% of customers pay within two days - Striata showing how the interactive PDF bill works like a mini-website with the bill; also integrates into Facebook

- Striata says some clients are up to 50% penetration of paperless, compared to 15% industry average

- Tagit is demoing its mobile platform; powers DBS Bank mobile banking and others; showing transfer function

- Tagit shows “virtual browser,” integration point in the back end for FI to build work flows; adds line to mobile app live—nice!

- Unience launching mobile iphone app for keeping in touch with financial advisor; showing how advisor sends info from PC to mobile

- Unience mobile is first app using its API; has added 5,000 users since Oct.; negotiating with NYC financial company for U.S. launch

- Voice Commerce is showing its new “KYC Secure” federated database to use biometrics to authenticate identity via voice

- Voice Commerce showing how easy it is to simply answer phone and repeat the code provided; no stopping and keying in numbers

- Voice Commerce demos how easy it is to simply answer phone and repeat the code provided; no stopping and keying in numbers

- Xero focuses on small business market; demoing dashboard to allow SMB to track real-time cash position, an eye-opening experience

- Yodlee has 600,000 users in Europe; several hundred developers are working through its app store

- Yodlee enabling monthly subscriptions in app store; new app “My Vault” available this summer with monthly revenue share with FI

- Yodlee is launching auto file uploader which automates the process of storing downloaded financial statements and bills

- That’s a wrap; 35 #finovate demos, no major glitches & done 6 minutes early! Thanks to Chris Skinner for hosting; on to networking & happy hour

———-

Note: Best of Show winners (eToro, Finantix, Liqpay.com, and Meniga) were announced in the blog later that night.

Prioritizing Financial Information Flow

I’m just finishing an enjoyable novel by Cory Doctorow, Makers. It chronicles two inventors operating in the United States 15 to 20 years from now (the actual time period is not revealed) after another economic/tech downturn, similar to the 1999/2000 dotcom crash.

I’m just finishing an enjoyable novel by Cory Doctorow, Makers. It chronicles two inventors operating in the United States 15 to 20 years from now (the actual time period is not revealed) after another economic/tech downturn, similar to the 1999/2000 dotcom crash.

Readers will recognize most of the technology and information services used, e.g., email, IM, blogs and Twitter. But Doctorow’s vision for these services a decade or two into the future is quite enlightening.

One area that’s much improved over today’s practices is the use of technology to prioritize the avalanche of information bombarding users. Here’s a passage from the book:

He’d been tuning his feed watchers…for nearly a decade, and this little PR item rang all the cherries on his filters, flagging the item red and rocketing it to the top of his news playlist, making all the icons on the sides of his screen bounce with delight.

All you news junkies out there, isn’t that how you want your email/RSS/Twitter/ Facebook streams to work? The most-important info pops to the top and alerts you at the same time. Google is doing great work along these lines with its Priority Mailbox introduced in August (previous post), which now works on mobile phones as well (see inset).

All you news junkies out there, isn’t that how you want your email/RSS/Twitter/ Facebook streams to work? The most-important info pops to the top and alerts you at the same time. Google is doing great work along these lines with its Priority Mailbox introduced in August (previous post), which now works on mobile phones as well (see inset).

Opportunity for Netbankers: I’m looking forward to the time when my bank, card issuer and/or third-party aggregator does the same for my finances and alerts me to odd transactions, excessive charges, and potential savings. And more importantly, helps me take action to resolve the issue.

But it can’t be delivered in a pile of email alerts sent every day. I tune those out. Just tell me about the IMPORTANT transactions triggering the “financial alarms” and keep mum about everything else. Thanks.

eToro, Finantix, Liqpay.com and Meniga Win Best of Show at FinovateEurope

It was a fantastic day at the first FinovateEurope as 35 banking and financial technology companies debuted their latest innovations in front of a packed house. It was the first Finovate without at least one demo blowing up, though there were a couple close calls.

It was a fantastic day at the first FinovateEurope as 35 banking and financial technology companies debuted their latest innovations in front of a packed house. It was the first Finovate without at least one demo blowing up, though there were a couple close calls.

At the end of the day, attendees voted for their three favorite products. The four leading vote getters were named FinovateEurope “Best of Show” (see notes on methodology).

Every company that presented was named Best of Show by some portion of the audience. But the ones that ended on top today were as follows (in alphabetic order):

- eToro launched OpenBook (CopyTrade & CopyTrader) which allows

users to follow & copy trades of other users - Finantix introduced a suite of iPad applications for financial

advisors to use in face-to-face client discussion - Liqpay.com showed its new “$hop app” which allows a bank’s small business customers to easily set up a Facebook shop for ecommerce

- Meniga

Normal

0false

false

falseMicrosoftInternetExplorer4

demoed its personal financial manager with an added gaming layer that combined humor with “social curiosity,” for example, to compare spending to peers

Congratulations! And thanks to everyone who presented, sponsored, attended and followed the @finovate tweets.

——————————

Notes on methodology:

1. Only audience members not associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites as the day went on. Ballots were turned in at the end of the last demo session. The exact written instructions given to attendees:

“Please rate (the companies) on the basis of demo quality and potential impact of the innovation they demoed. Note: Ballots with more than three companies circled will not be counted.”

Continue reading “eToro, Finantix, Liqpay.com and Meniga Win Best of Show at FinovateEurope”

Ebilling Update: Doxo Adds Payment Capabilities

Striata and AcceptEmail delivered two of my favorite demos this week at FinovateEurope. Both are working on ways to help move consumers away from antiquated and wasteful (but easy to use) paper billing and into the 21st century with interactive PDF versions delivered via email (also see ActivePath’s FinovateFall 2010 demo video).

Striata and AcceptEmail delivered two of my favorite demos this week at FinovateEurope. Both are working on ways to help move consumers away from antiquated and wasteful (but easy to use) paper billing and into the 21st century with interactive PDF versions delivered via email (also see ActivePath’s FinovateFall 2010 demo video).

Unlike certain personal finance products which have more intangible benefits, ebilling stands to drive tens of $ billions of wasted expense out of the system while at the same time making consumers’ lives simpler. That’s worth paying attention to.

And I like the Striata/AcceptEmail/Activepath approach. Migrate consumers to an interactive email bill which is far superior to its paper ancestor and is aggregated within a familiar interface, the email client (see note 1). This is the most likely method of gaining mass adoption.

Ebilling hubs

But email inboxes are notoriously messy and over-crowded making it easy to overlook emailed bills (note 2). So I really like the idea of an ebilling hub, a place where all my bills are stored so I can review the history, communicate with billers, and make sure everything was paid on time (note 3).

That’s why I’ve been following the developments at Doxo; Volly from Pitney Bowes; and Zumbox, which all have very different ideas on how to pull this off. But one thing they’ll all need is payment capabilities. It’s not enough to just view a stack of ebills, you have to be able to complete the task with payment.

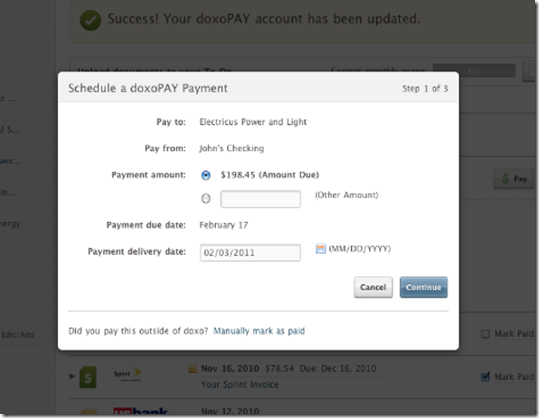

So it was good to see Doxo add payments to its ebilling hub this week. The Seattle startup, which moved into public beta late last year (see previous post), now allows users to pay any bill received into the hub (currently only Sprint and KCPL).

Users press the Pay button displayed by the bill in the “to do” section (see first screenshot). A popup screen is used to schedule the payment.

Bottom line: There’s plenty of opportunity here for multiple approaches. Email bills are a pretty safe bet, while the ebill hub is a longer shot. But ultimately, we believe there’s a place for both models.

Doxo’s ebilling hub now includes a Pay button (3 Feb. 2011)

Popup payment-scheduling screen

————————-

Notes:

1. See our recent reports: Paperless Billing and Banking and Email Banking: Revitalizing the Channel.

2. Also at FinovateEurope, Yodlee demoed a clever solution to help organize bills. It’s new app will automatically search your hard drive to find downloaded bills and statements and automatically upload them into the Yodlee PFM where they can be aggregated and stored in the cloud.

3. You can do this with individual billers by logging into their sites, but that is a time-consuming chore best avoided.

eToro, Finantix, Liqpay.com, and Meniga Win Best of Show at FinovateEurope

It was a fantastic day at the first FinovateEurope as 35 banking and financial technology companies debuted their latest innovations in front of a packed house. It was the first Finovate without at least one demo blowing up, though there were a couple close calls.

It was a fantastic day at the first FinovateEurope as 35 banking and financial technology companies debuted their latest innovations in front of a packed house. It was the first Finovate without at least one demo blowing up, though there were a couple close calls.

At the end of the day, attendees voted for their three favorite products. The four leading vote-getters were named FinovateEurope Best of Show (see notes on methodology).

Every company that presented was named Best of Show by some portion of the audience. But the ones that ended on top today were as follows (in alphabetic order):

eToro launched OpenBook (CopyTrade & CopyTrader) which allows users to follow & copy trades of other users

eToro launched OpenBook (CopyTrade & CopyTrader) which allows users to follow & copy trades of other users  Finantix introduced a suite of iPad applications for financial advisors to use in face-to-face client discussion

Finantix introduced a suite of iPad applications for financial advisors to use in face-to-face client discussion  Liqpay.com showed its new “$hop app” which allows a bank’s small business customers to easily set up a Facebook shop for ecommerce

Liqpay.com showed its new “$hop app” which allows a bank’s small business customers to easily set up a Facebook shop for ecommerce  Meniga demoed its personal financial manager with an added gaming layer that combined humor with “social curiosity,” for example, to compare spending to peers

Meniga demoed its personal financial manager with an added gaming layer that combined humor with “social curiosity,” for example, to compare spending to peers

Congratulations! And thanks to everyone who presented, sponsored, attended and followed the #finovate tweets.

——————————

Notes on methodology:

1. Only audience members not associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites as the day went on. Ballots were turned in at the end of the last demo session. The exact written instructions given to attendees:

“Please rate (the companies) on the basis of demo quality and potential impact of the innovation they demoed. Note: Ballots with more than three companies circled will not be counted.”

Finovate Europe Kicks Off Feb. 1

![]() We’re in London putting the finishing touches on the first FinovateEurope. With a sold-out crowd of more than 400, it is sure to be a high-energy day with 35 product/company launches.

We’re in London putting the finishing touches on the first FinovateEurope. With a sold-out crowd of more than 400, it is sure to be a high-energy day with 35 product/company launches.

I just sat through the six-hour dress rehearsal and it was impressive. Lots of new ideas, usability improvements, and advanced user interfaces.

The demos begin at 8:45 AM (London time) after a brief overview of the state of financial innovation by guest host Chris Skinner.

You can follow the community Twitter and Flickr streams at our conference website or follow the #finovate hashtag from your favorite Twitter access point. We’ll be live tweeting from #netbanker. While there’s no live video stream, full-length videos of each demo will be posted within a few weeks.

FinovateEurope presenters (links)

Please note: The conference is 100% sold out, so we will not be able to accommodate new registrants the day of the show.

Last Chance to Save $300 on your FinovateSpring 2011 Ticket!

This time of year is always nice — the days are getting longer and the prospect of spring is just around the corner. For us, that means there is (slightly) less rain in Seattle and that we’re hard at work on our FinovateSpring event, held each May in San Francisco.

This year the event will take place on May 10th & 11th with an expanded 2-day format and a new, larger location (since the show last year sold out after growing 50% over the previous year).

Amazingly, we’re already wondering whether the new location is big enough since 100+ financial/banking executives, venture capitalists, industry analysts and tech entrepreneurs have registered since we announced the event shortly before Christmas last year.

A few of the organizations already registered are:

|

|

If you’re interested in watching the future of financial and banking technology unfold live on stage at FinovateSpring then get your super early-bird ticket by this Friday (the 28th of January) and save $300 off the list price. If you’re a fintech company or financial institution that might like to demo your latest innovation, please email us today at [email protected]. One way or another, we hope to see you in May!

FinovateSpring 2011 is sponsored by: The Bancorp and more great companies to be announced.

FinovateSpring 2011 is partners with: BankInnovation.net, BankerStuff, CardWeb, Filene Research Institute, Finance on Windows, PYMNTS.com, and Mercator Advisory Group

Last Chance to Save $300 on your FinovateSpring 2011 Ticket!

This time of year is always nice — the days are getting longer and the prospect of spring is just around the corner. For us, that means there is (slightly) less rain in Seattle and that we’re hard at work on our FinovateSpring event, held each May in San Francisco.

This year the event will take place on May 10th & 11th with an expanded 2-day format and a new, larger location (since the show last year sold out after growing 50% over the previous year).

Amazingly, we’re already wondering whether the new location is big enough since 100+ financial/banking executives, venture capitalists, industry analysts and tech entrepreneurs have registered since we announced the event shortly before Christmas last year.

A few of the organizations already registered are:

|

|

If you’re interested in watching the future of financial and banking technology unfold live on stage at FinovateSpring then get your super early-bird ticket by this Friday (the 28th of January) and save $300 off the list price. If you’re a fintech company or financial institution that might like to demo your latest innovation, please email us today at [email protected]. One way or another, we hope to see you in May!

FinovateSpring 2011 is sponsored by: The Bancorp and more great companies to be announced.

FinovateSpring 2011 is partners with: BankInnovation.net, BankerStuff, CardWeb, Filene Research Institute, Finance on Windows, PYMNTS.com, and Mercator Advisory Group