This post is a part of our live coverage of FinovateEurope 2013.

Third,

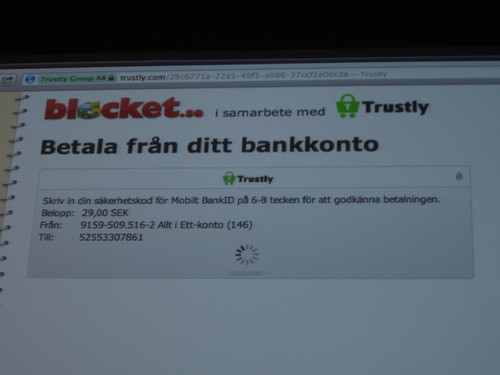

Trustly showed how its direct, person-to-person payment solution can help you pay and get paid for items sold online:

“Today there are many payment methods available for the e-commerce market, but there are no solutions solving the pain people experience when buying and selling on electronic person-to-person marketplaces – the risks and hassle of exchanging cash, and in the case of non-local deals where the goods have to be shipped – the risk that the buyer will not receive the goods or the seller will not receive the payment.

Trustly Direktbetalning removes these pains.

We’ll showcase how people from now on can safely pay and get paid for goods sold on Sweden’s largest marketplace, with an integrated fraud guarantee. Trustly Direktbetalning is a direct person-to-person bank payment solution embedded in the marketplace and does not require its users to learn any new behaviour or sign up to any new feature. It will (thanks to the combination of the following features) revolutionize the way people pay and get paid when purchasing goods from each other:

1. Direct and seamless payments embedded in the marketplace

2. Integrated instant identification – no false identities can be used

3. Fraud guarantee offered to both buyer and seller for complete peace of mind

Trustly Direktbetalning leverages Trustly’s proprietary direct bank e-Payment system. Its first marketplace partner is Blocket.se, Sweden’s largest marketplace with an aggregate value of ads posted in excess of €20B per year. It can, in principle, be embedded into any online marketplace in the world, or offered as a stand-alone service.”

Product Launch: Q1 2013

HQ: Stockholm, Sweden

Founded: April 2008

Metrics: Organically grown, Employees: 35+, Number of payments: 200,000+ monthly

Presenting Carl-Henrik Somp (COO)