This post is part of our live coverage of FinovateSpring 2015.

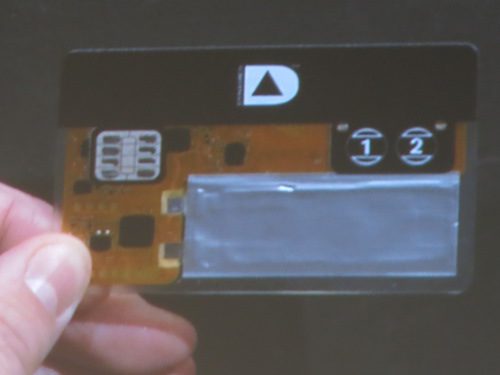

Kabbage showed how its Kabbage Card enables small businesses to carry a line of credit in their pocket.

Kabbage showed how its Kabbage Card enables small businesses to carry a line of credit in their pocket.

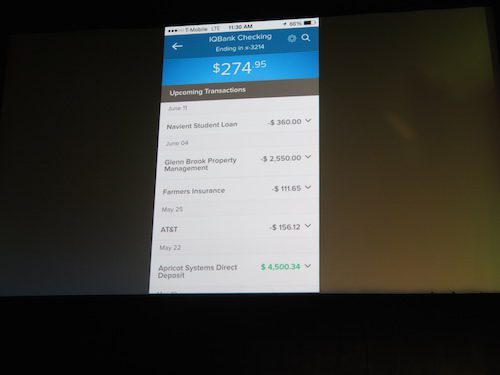

Kabbage is introducing the Kabbage Card, the company’s first tangible product that allows small businesses to carry their Kabbage credit line in their pocket to pay for inventory, office supplies, and anything needed to keep a business running. Kabbage customers will gain immediate access to their Kabbage loan without having to transfer funds into their PayPal or business checking account. Swiping their Kabbage Card will immediately deduct the transaction amount from the customer’s available funds. In addition, customers will immediately have access to view all transactions within their Kabbage account, as well as receive transaction confirmation via SMS text. This new initiative is part of a broader “Kabbage Everywhere” product expansion that includes the ability to sign up through a mobile-responsive site, access funds through mobile devices, and take 12-month loans in addition to the traditional 6-month loans.

Presenters: Michelle Sirpak, director of payment operations; Jason Dell, head of product

Product Launch: May 2015

Metrics: Approximately 170 employees, $106M in equity raised

Product distribution strategy: Direct to Business (B2B)

HQ: Atlanta, Georgia

Founded: February 2009

Website: kabbage.com

Twitter: @kabbageinc