Paystand CEO Jeremy Almond knows a thing or two about business payments. Since co-founding the company in 2013, Almond has implemented numerous improvements to the company’s payments engine, taking full advantage of the blockchain.

Among Paystand’s most recent debuts are the company’s 2018 launch of a blockchain that ensures payment, storing an immutable record of every transaction the company processes. Earlier this year, Paystand launched the Assurety-as-a-Service API that leverages the company’s blockchain to prevent fraud. Paystand also unveiled Automated Receivables, a tool that leverages the blockchain to automate invoice collection.

Almond is a 15-year veteran of the tech industry, having served as a serial entrepreneur, startup advisor, and occasional investor. Almond helped co-found Paystand in 2013 and has since been at the helm of the company as CEO. We caught up with him in an interview earlier this month.

Finovate: What is Paystand and how does it differ from other online payment gateways?

Jeremy Almond: Paystand is a commercial payments platform that automates the entire cash cycle, from invoicing to reconciliation, to make payments an easy, effortless experience.

Today’s financial system is plagued by costly fees, inefficiencies, and paper-driven processes. We believe this broken system is holding businesses back, so we created Paystand to eliminate fees and build the payment framework for the digital era.

Much the same way that Netflix came along and completely re-thought consumption of media or how Tesla has come to market with not just a new vehicle but a business model and mission focused on energy independence, Paystand differentiates itself with its Payments-as-a-Service model. The outdated, inefficient, fee-based approach to commercial payments and money movement no longer makes sense. Instead of taking a cut from every customer sale, our customers pay a flat monthly rate to use our payment software. Essentially, it is unlimited “consumption” for payments with predictable costs. This means that as our customers’ businesses grow, their profits increase instead of their fees.

We’ve also built the most complete digital payment network available to businesses. Using the Paystand Bank Network, customers can move money electronically without paying any fees. It’s the industry’s first zero-cost rail, and the easiest way for businesses to get paid today. It’s also the only blockchain-based payments infrastructure that has been tested at scale with millions of transactions and enterprise volume.

Finovate: You’re a startup investor yourself. How does that influence how you’ve built Paystand?

Almond: Most venture-backed startups fail, especially the high-potential ones. Everyone is hungry to find the next Uber or Facebook, so it’s easier than ever to start a company and get funded. But building a startup that lasts isn’t easy. I think many founders underestimate that and end up spending their time and resources chasing quick exits and unicorn status.

That’s why we do things completely different at Paystand. We’re focused on building a sustainable business that solves real, meaningful problems. There’s a certain business pacing you have to keep up to attract the right investors and gather momentum around your vision. So driving that kind of sustainable growth is our top priority.

Over time, I believe we’re going to see a shift away from companies constantly raising equity to this sustainable growth approach. If you look at the market today, especially after Zoom’s IPO, there’s a real appetite for businesses with a clear path to profitability.

In many ways, being an investor has been an advantage to building Paystand.

Finovate: Tell us about Paystand’s new Fintech Advisory Council launched earlier this year. What was the impetus for this?

Almond: The need for the Fintech Advisory Council really came from our growth. We’ve nearly tripled our revenue this year, which is more than an 8x increase since raising our Series A round. So we built the advisory council to help us scale our product innovation and better meet this demand.

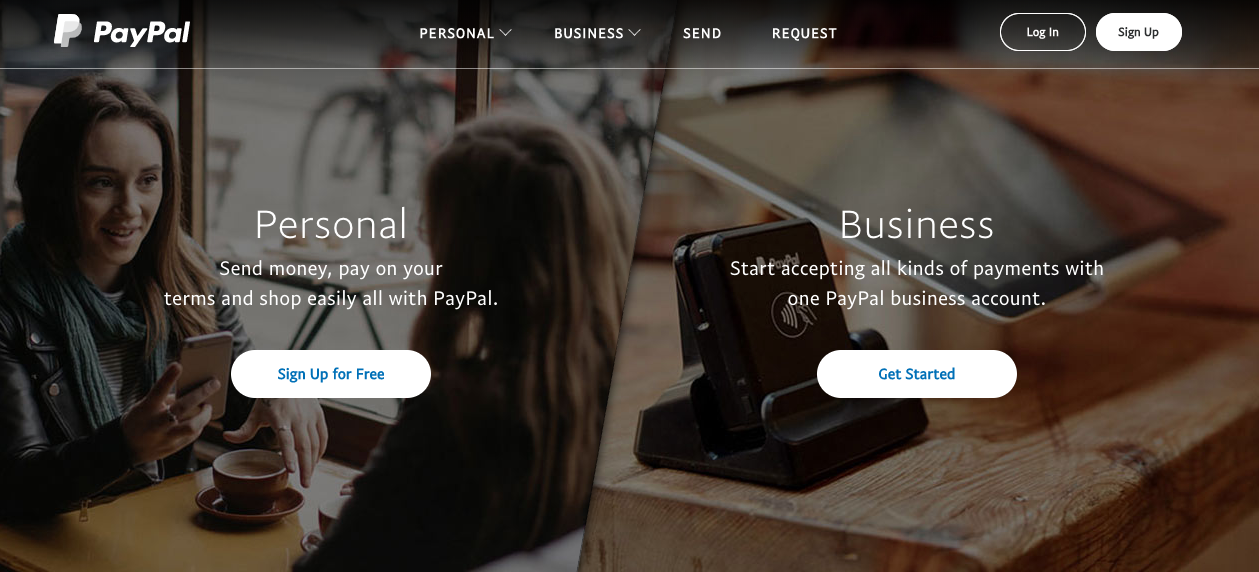

We didn’t make the appointments lightly. These are people who are literally the top of the top for financial services and B2B fintech. CheckFree founder Pete Kight, for example, made it possible to pay bills online with your bank account. Other advisors include the former president of Bill.com and the former president of PayPal. Having these pioneers on our side, guiding us, is going to be a massive value ad as we build the next chapter in commercial finance.

This is a huge mission we’re talking about — rebooting the financial system. Our Fintech Advisory Council is going to help us make that happen.

Finovate: Paystand recently surpassed 100,000 businesses using its platform. What new features does Paystand have in the works to garner its next 100,000 users?

Almond: Although we recently surpassed 100,000 businesses using the platform, we know we’re still just scratching the surface. There are over 6 million B2B companies in the United States alone. And 18 trillion dollars still moves between businesses via paper check every year in this country. That’s a staggering figure. Those businesses need a modern payment solution that doesn’t penalize growth via more and higher fees. So, we’re focused on continuing to deliver the best payment solutions to that market with our core payment platform. We plan on deepening our integrations and relationships with core systems of record like NetSuite to further provide seamless automation of accounts receivable workflows.

At the same time, we’re continuing to build innovative products to enable automation and reduce friction for the entire downstream network involved in payments. We recently launched Autopilot, our receivables automation product that helps companies reduce DSO, decrease late payments, and improve the customer payment experience. And our newly launched Payment Portal gives all of their downstream payers an intuitive interface to view their payments, payer history, and access our payment platform.

Every day, more businesses are making the shift to a more open, inclusive commercial payments infrastructure and are rejecting the outdated, fee-based model that no longer makes sense. We’re proud to help them on their journey.