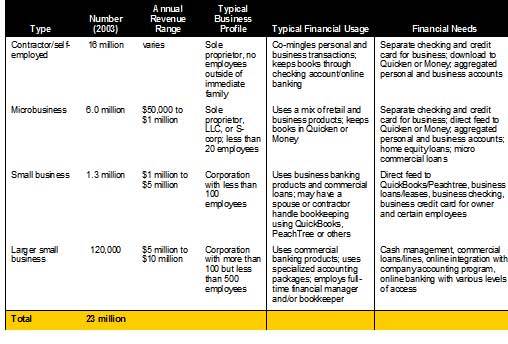

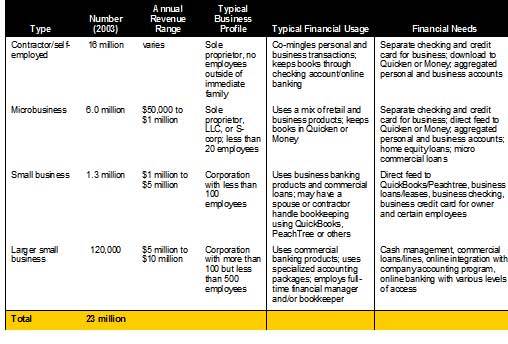

Types of Small Business

Small business means different things to different people. For the

sake of simplicity, in this report we’ll usually use the term “small

businesses” to refer to the following segments:

Two major classifications used in this report:

1. Microbusiness: Basic financial needs, such as Quicken

support, simple invoicing,

credit card processing, bill payment, home equity credit lines, and tax

reporting; usually sole proprietorships, partnerships, or S-corps (includes

self-employed); often with less than 20 employees; total revenue of $50,000

to $1 million annually; total credit lines of less than $250,000.

2. Small Business: More complex financial needs, such as

accounting support, invoicing, payment processing, bill payment, commercial

credit lines, tax reporting, and internal security and fraud controls; less

than 500 employees; total revenue of $1 to 10 million annually; total credit

lines more than $250,000.

Other business types included in above classifications:

· In-formation Business: Initially, may be more interested in

advice and information on credit, payment processing, and other banking

services; depending on many factors, may move rapidly towards launch and

need to quickly establish accounts and line up financing. Financial needs

vary depending on the business plan and funding.

· SOHO (small office, home office): Smaller, work-from-home

sole proprietorships. It can also be used to describe mobile workers such as

home-based salespeople in insurance and manufacturing. We classify these

companies as microbusinesses.

· Self–employed: Persons who primarily work for

themselves, either as contractors, consultants, or commission-based sales

reps. We classify these individuals as microbusinesses.

· SMB/SME (small and medium business/enterprise): Usually

refers to the largest segment of “small” businesses, companies with at least

several million in annual revenues. We classify these companies as small

businesses.

Primary Data Source

The primary data source for this report is TNS Financial Services

Group (formerly NFO WorldGroup-Financial Services, and before that,

PSI Global). Our thanks to EVP Maria Erickson and her staff for

answering our questions and making data from their Small Business and

SOHO studies available. For more information on purchasing financial

services research contact Ms. Erickson at (813) 227-8562.

The Small Business and the Affluent Entrepreneur 2003 Study

was fielded between April and May 2003; the owners of 3000 U. S.-based

small businesses with annual sales between $500,000 and

$10 million were contacted by telephone or mail to provide the most

accurate and reliable

information possible.

Using the same methodology, 900 small businesses were contacted for

the SOHO and the Entrepreneur Study 2002 between September and

October 2002.

The big picture in small business

Small businesses exist in all markets, in every town and at

every crossing. Using a broad definition that includes smaller part-time

business endeavors, there are more than 20 million businesses in the United

States, one of every five households. And that understates the market

potential. If you also include the personal product usage of the

“business-owning” segment, the total could be as much as 50% of your

revenues.

Depending on the definition, as many as 30 million business

entities exist in the United States, including self-employed or part-time

sideline businesses such as selling collectibles on eBay, or as few as 1.2

million if you only look at companies with at least $1 million in annual

revenues

. For the purposes of this report, we are defining the total small business

market as 23 million, a figure taken from U.S. Small Business Administration

statistics1.

The total includes

· 16 million self-employed/contractors

· 6.0 million microbusinesses with revenues less

than $1 million

· 1.3 million of that is the larger small business

with revenues of $1 to $10 million

Small businesses account for:

· 99% of all employers

· 51% of private sector employment

· 67% of net new jobs

· 52% of U.S. gross domestic product

Furthermore:

· 600,000 new businesses are started each year1

· 13% of U.S. households own privately held

businesses2

· Business-owning households had higher income, more

education, significantly higher net worth, and were led by individuals in

the prime age group 35-602

· Boeing Employees Credit Union’s recent

survey showed that 50,000 of its 350,000 (14%) members reported owning

businesses or being key decision-makers in one3

· IDC reports there are now 15 million U.S.

home-based businesses, 10 million full-time and

5 million part-time4

· More than 400,000 people make most or all of their

living from selling on eBay5

(1) SBA Research Summary #211, “Small Business Share

of Economic Growth,” Jan. 2002

(2) George W. Haynes, Assistant Professor at Montana

State, and Charles Ou, SBA Economist, presented an Advocacy Working Paper at

the Conference of Entrepreneurial and Financial Research in April 2002

(3) American Banker, 4/13/04

(4) 2004 estimates from IDC as cited in The Wall

Street Journal, 6/17/2004

(5) Estimate from AuctionDrop, a company that earns

commissions selling merchandise on consignment through Ebay, as cited in

The Wall Street Journal, 6/17/2004

Who wants to be a microbusiness?

|

Table 3

Number of U.S. Home-based Businesses

|

Type |

Number |

Change 2004 vs. 1999 |

|

2004 |

1999 |

Number |

% |

| Full-time |

9.9 million |

9.6 million |

+300,000 |

+3.1% |

| Part-time |

5.2 million |

6.9 million |

(1.7 million) |

(32%) |

| Total |

15.1 million |

16.5 million |

(1.4 million) |

(8.5%) |

Source: IDC, as cited in The Wall Street Journal, 6/17/04

|

Everyone it seems. While American attitudes towards big business have

declined markedly during the past four years thanks scandals at Enron,

MCI, and others, the small business remains on a pedestal. Its

human nature to root for the underdog, and the smaller the business the

bigger their perceived disadvantage.

As you plan your business offerings, keep in mind that a majority of

Americans aspire to run their own business; fully two-thirds (67%) profess a

longing to be in business for themselves. And thanks to computers and the

Internet, there are 15 million home-based businesses in the U.S., 400,000 of

which make their living from selling on eBay. Surprisingly, though, the

number of part-time, home-based businesses has fallen dramatically in the

past five years, probably victims of the flat economy

(see Table 3, above).

Since most tax experts recommend separate personal and business

transaction accounts for even the smallest business, companion

personal/business checking, savings, and card products can be a lucrative

niche for financial institutions. Once you’ve convinced retail households

running businesses from home to add a business transaction account, you can

cross-sell credit and accounting services as the businesses grow.

Channel Preferences

|

Table 4

Primary Banking Channel Among Businesses

using Online Financial Services

|

Traditional |

16% |

|

Online banking |

33% |

|

Equal mix |

51% |

|

Total |

100% |

Source: Gartner G2, 2002

|

When it comes to financial matters, small businesses want it all, every

channel, all the time, at the lowest cost. Even among online business

banking users, only one-third say that the online channel is primary

(see Table 4, right). Although businesses may want it all,

they often do not have the resources or inclination to shop aggressively for

the lowest-cost source. The smaller the business, the likelier it is the

principal or a spouse handles banking matters. And these owners are unlikely

to make it a priority to wring every last dollar out of the cost of their

financial services. The story is quite different if the business has a

dedicated bookkeeper or financial manager on staff. This person may have

both the time and motivation to comparison shop; it’s a feather in their cap

if they find cost savings. So you may want to segment your business

customers, not

on total revenues, but on whether the owner handles the banking. And shower

special

attention on staffers hired to handle the

business’s financial affairs.

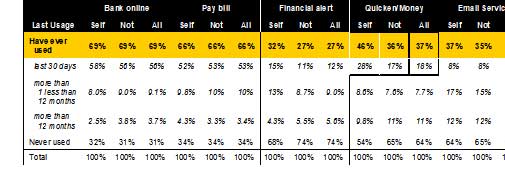

Table 5

Number of U.S. Small Businesses by Annual Revenues

Source: TNS Financial Services Group, Small Business data 4/03, SOHO/Entrepreneur

data 10/02, updated to year-end 2003 by Online Banking Report, +/- 20%

Table 6

U.S. Businesses Entities by Annual Revenues

not including self-employed/contractors

Source: TNS Financial Small Business Market Study 2002, 4/03

(commercial banking numbers from 4/00); updated to year-end 2003 by Online

Banking Report, =/- 20%

1The person at the company that handles the majority of

banking activities

2Could be serviced by commercial banking department depending

on circumstances

Table 7

U.S. Small, Micro, and Self-Employed Businesses Using Online

Banking and/or Bill Pay

millions, n = 23 million (2003)

Source: Online Banking Report estimates 6/04; accuracy estimated at plus or

minus 30% U.S.

All = All small businesses including self-employed, n = 23 million (2002)

Larger = Small and microbusinesses with annual revenues between $50,000 and

$10 million, not including self-employed and contractors, n = 7.3 million

(2003)

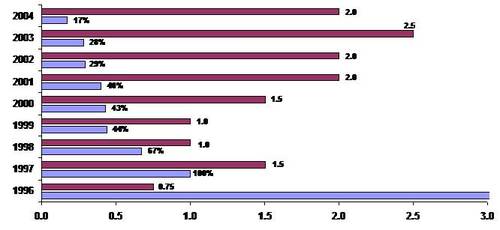

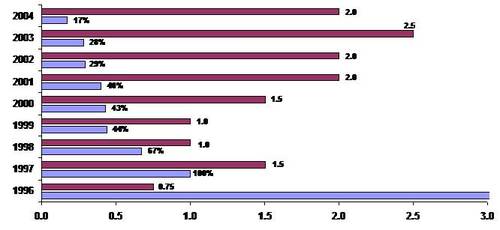

Table 8

Annual Growth Rate of Small, Micro and Self-Employed Businesses

Using Online Banking

millions of net new U.S. small business online banking users and

percent change from previous year

&

Source: Online Banking Report estimates, 6/04; accuracy estimated at plus or

minus 30%