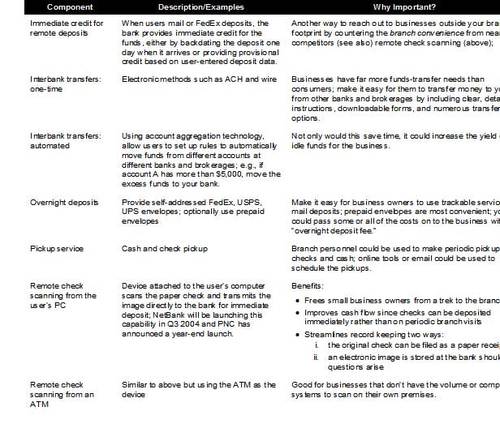

Small business attitudes are changing as online banking services become

easier to navigate and more useful. While it currently seems impossible to

eliminate the dependence on the branch for physical deposits, with the

widespread adoption of check imaging and electronic payments, most

non-cash-oriented businesses will be able to bank remotely. Both PNC Bank

and NetBank have announced plans to equip their business customers

with paper check scanners that will allow the remote deposit of paper

checks.

But even the best website and product offering cannot substitute entirely

for the human touch. Every business should have a contact available by

phone, email, or instant message. Small business owners should be treated

like private banking clients.

Recommended online products and services

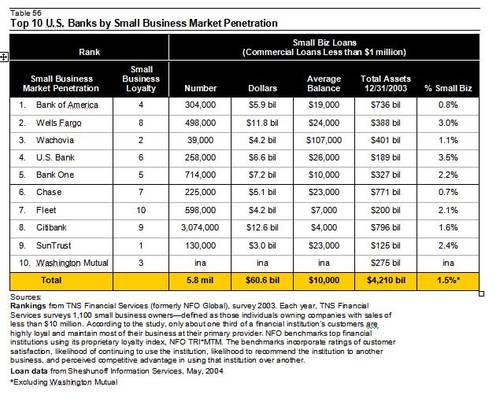

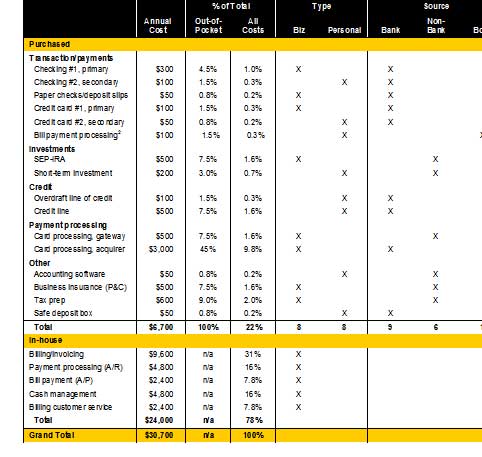

In theory, small and micro businesses represent one of the most

lucrative, and relatively untapped, sources of incremental business. The

reality is that businesses are difficult to reach unless you are competing

for their loan business. A product offering optimized for business will

differ somewhat from one built for consumers. The following sections detail

potential online features for various microbusiness products.

A. Transaction accounts: checking & cards

While the overall banking relationship may revolve around the

commercial loan, online banking is all about the transaction account(s),

e.g., checking and credit card accounts. Smaller businesses often track

their financial progress through their bank accounts, using them as a proxy

for sales, cash flow, and profits. Business users are also more likely than

consumers to value advanced features such as downloads, reporting, alerts,

and multiple authorization levels. Some of the more promising features:

- Custom data delivery: Periodic summaries of account

activity whenever (daily, weekly, monthly) and wherever (text email, HTML

email, or fax) the client chooses

- Long-term archives: If

Google can provide 1GB of

storage for users of its FREE email service, banks should be able to provide

unlimited archives for a fee

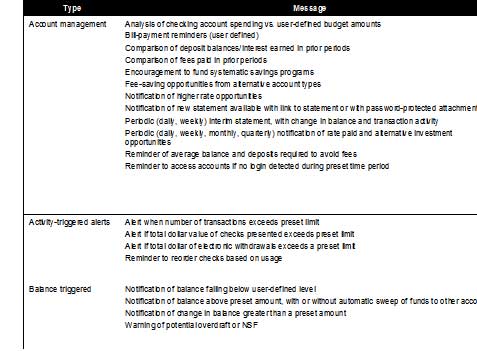

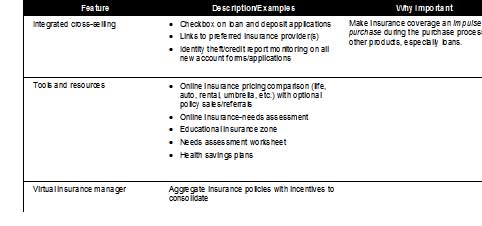

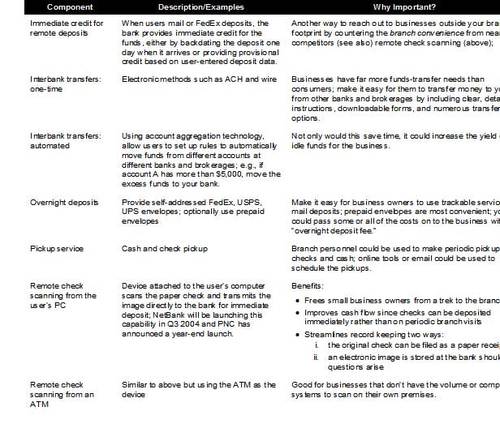

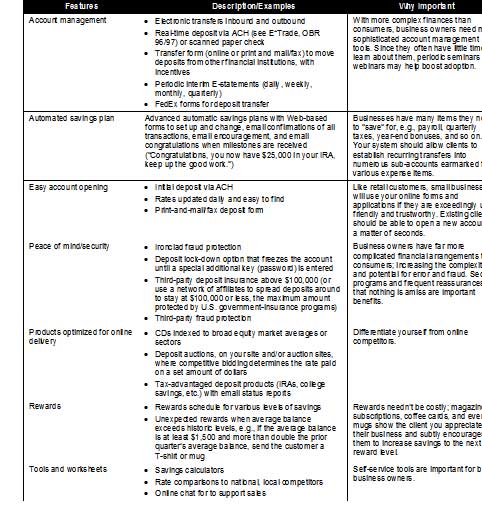

Table 27

Checking & Savings Account Deposit Options

Table 28

Online Features for Transaction Accounts: Data Display, Storage, and

Value Adds

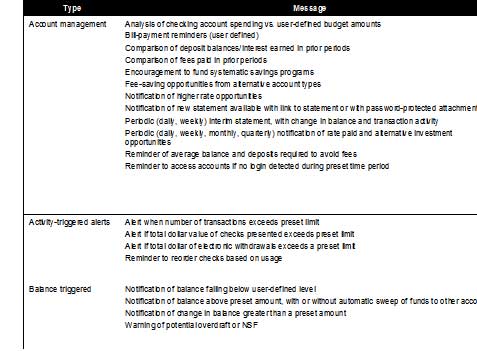

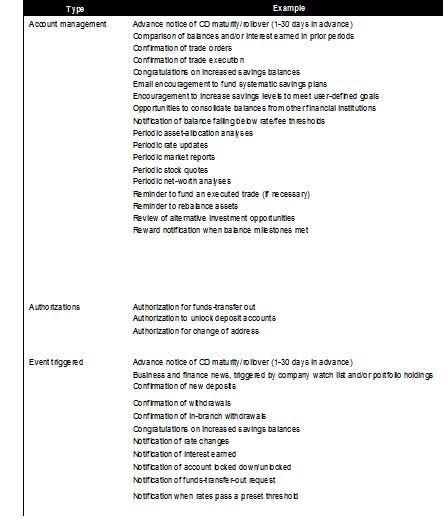

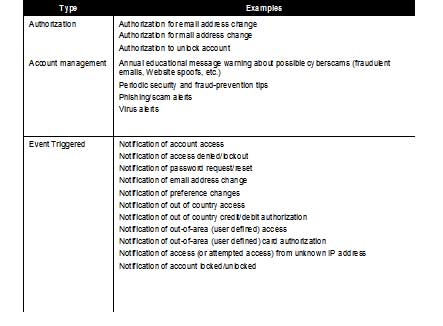

Table 29

Event Triggered Alerts & Authorization Messages to Support

Transaction Accounts

Table 30

Balance, Activity, & Account Management Messages for Transaction

Accounts

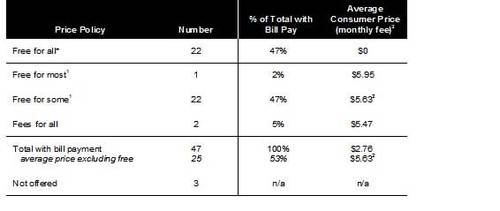

B. Payment and billing services

Next to statement information, epayment services are the second most

important drivers to the adoption of online banking by small businesses. And

unlike data access, epayments have the potential to become profit centers

and/or a significant source of online differentiation. Most businesses make

far more payments than consumers, so the importance of electronic

alternatives is magnified. On the other hand, existing businesses already

have a system for payment and billing, so it may be difficult to convert

them to a new one that requires changes in internal procedures or software.

Your best opportunities may be in less systematic services (i.e.

one-offs) such as electronic transfers between a business’s accounts at

other financial institution (account-to-account transfers) and the

occasional rush payment.

Table 31

Online Features for Billing, Payment Processing, & Funds Transfer

Services

Table 32

Online Features for Payment and Accounts Payable Services

Table 33

E-messaging to Support Epayments and Ebilling

C. Credit and loan accounts

Every small business relationship should include a credit component. It’s

the lifeblood of business, and a profitable product for financial

institutions. However, many banks have been reluctant to make commercial

loans to the microbusiness market. Average loan sizes, which are dwarfed by

typical commercial loans, make the effort seem fruitless. Yet profit margins

on the small business segment can be higher. Microbusinesses often use

personal credit, primarily credit cards and home equity secured loans, to

finance their businesses.

We believe every creditworthy microbusiness customer should

have a package of three or four credit lines with your financial

institution: an overdraft line of credit (connected to checking), a home

equity line of credit secured by their personal real estate (if applicable),

a business line of credit, and a business credit card. Even if the total

commitment is no more than $10,000 initially, it will make the business

owner feel like a valued customer; and each line can grow larger over time.

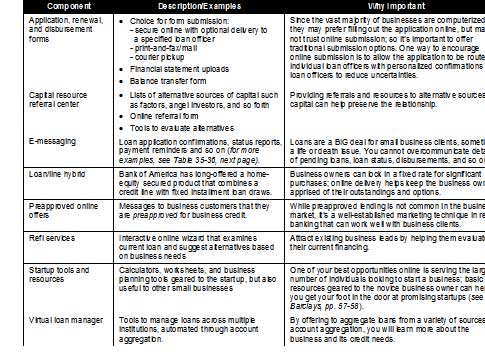

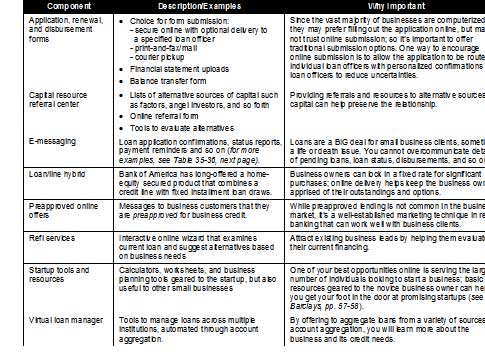

Table 34 contains a number of ways to use the online channel to

strengthen credit relationships with small businesses. Some of the more

important tactics:

- Loan/line Hybrid: A flexible financing vehicle that

includes an integrated line of credit and the ability to take out fixed

loans from the overall credit line.

- Startup Center: Information, tools, and resources geared

towards startup businesses.

Table 34

Online Features for Lending and Credit

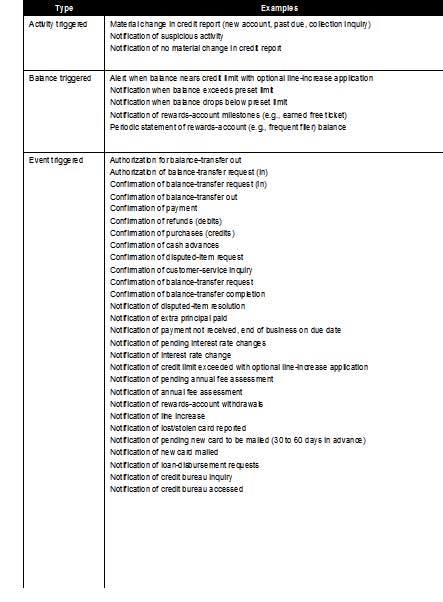

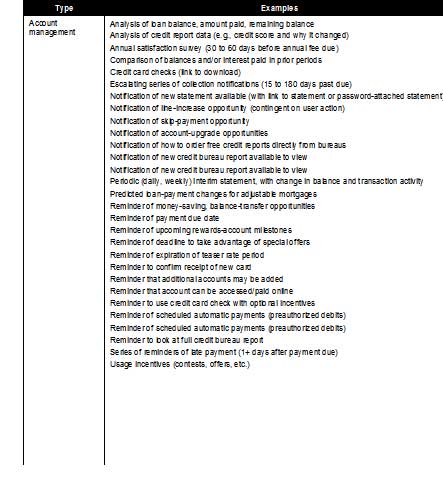

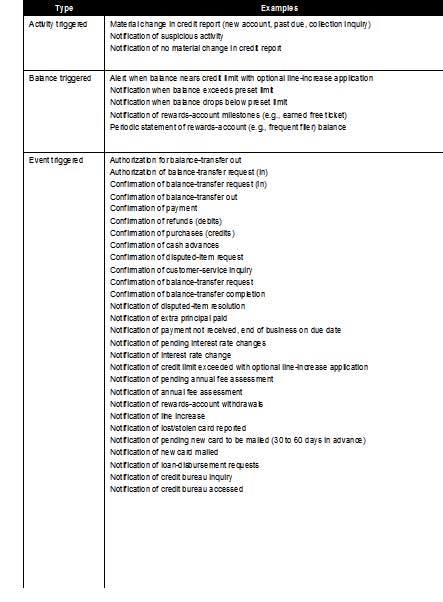

Table 35

Triggered Alerts for Credit and Loans

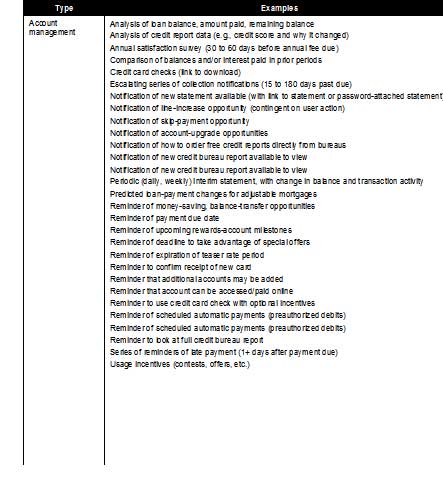

Table 36

Account Management Messages for Credit and Loans

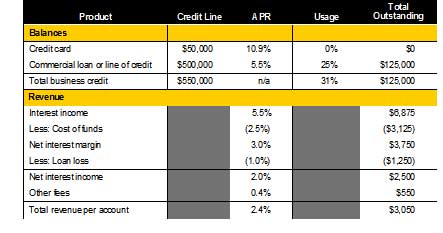

Table 37

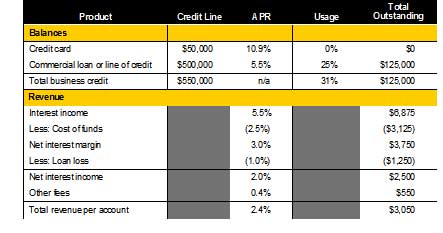

Example: Potential Annual Credit Product Revenue from a Microbusiness1

Source: Online Banking Report, 6/04

1Example for illustration purposes only, not based on actual

research results

Table 38

Example: Potential Annual Credit Product Revenue from a Larger Small

Business1

Source: Online Banking Report, 6/04

1Example for illustration purposes only, not based on actual

research result

D. Deposit and investment accounts

The online component of deposit and investment accounts is far less

important than for transaction and payment services. However, a robust

online offering can boost deposit-gathering initiatives and improve

retention. Key online components are listed below: Refer to the

Checking/Transaction section for more ideas.

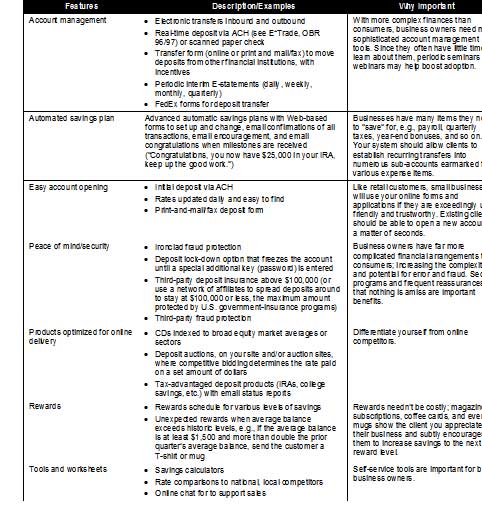

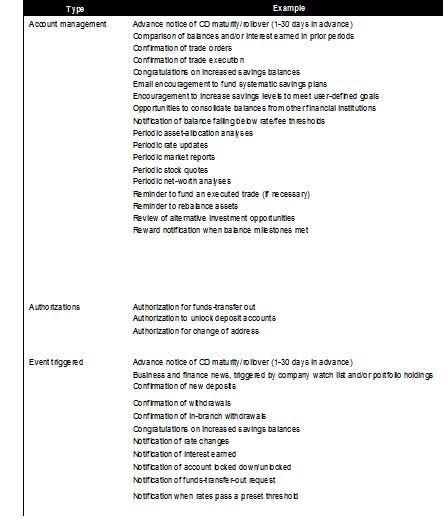

Table 39

Online Features for Investment and Deposit Products

Table 40

E-messaging for Deposits and Investments

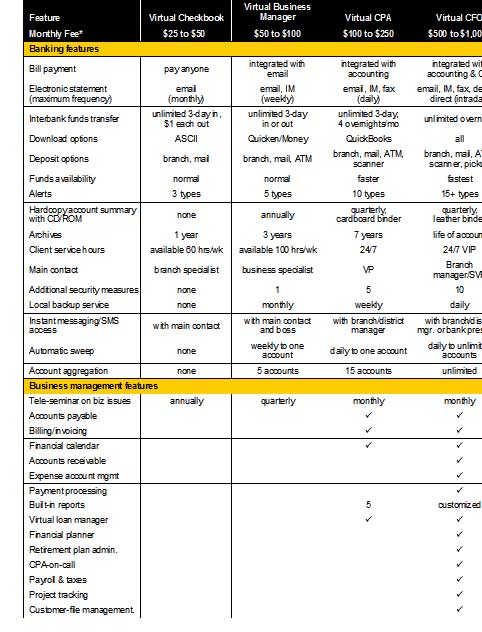

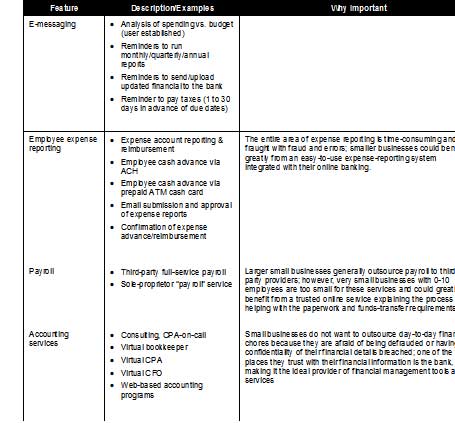

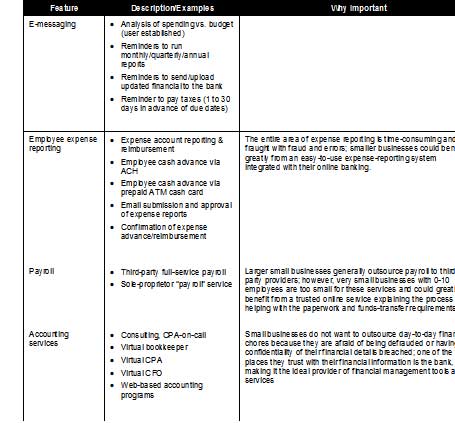

E. Financial management & accounting

Although automated accounting and financial management services offer the

biggest potential payback to small business owners, they are challenging to

deliver. However, working through third parties, financial institutions of

all sizes can help cement banking relationships with financial management

services such as:

- Visible and easy-to-use data downloading services

- Tools to make annual financial updates and tax prep simpler

- Online wrap accounts that handle all financial and accounting

needs for an annual fee, see the section on the Virtual CFO, CPA, and

Business Manager

Eventually, it won’t be enough to simply offer robust cash management and

online balance reporting to your business clients. Using the Web as a

platform to build industry- and customer-specific service offerings, we

expect a proliferation of specialized small business services during the

next few years. For example, several years ago QuickBooks opened its

code to developers

http://www.developer.intuit.com/ spawning numerous niche services

built on the small business accounting program. Check out the QuickBooks

Solutions Marketplace

http://www.marketplace.intuit.com/

As the economy continues to improve, big banks will aggressively court

small and mid-size businesses with creative financial management via

Web-based services. These innovations will help counteract the perception

that community banks provide better service. In turn, community banks will

fight back with online offerings that enhance personal service

delivered to local businesses. Luckily, vendor offerings will make even the

most complicated Web-based service affordable to the smaller financial

institution.

Intuit has already built impressive software-to-bank linkages for

QuickBooks and Quicken customers. To some extent, the shrink-wrapped

software is a Trojan horse, positioning Intuit-controlled links to its

partner banks right on the desktops of your best clients. You can fight back

by incorporating billing, accounting, and financial management functions on

your website using account aggregation, instant messaging, and “push”

publishing technologies. Although, it will take time, we think smaller

businesses will be very receptive to financial and management services

running on encrypted, secure, and trusted servers controlled by the bank..

Table 41

Online Features for Financial Management

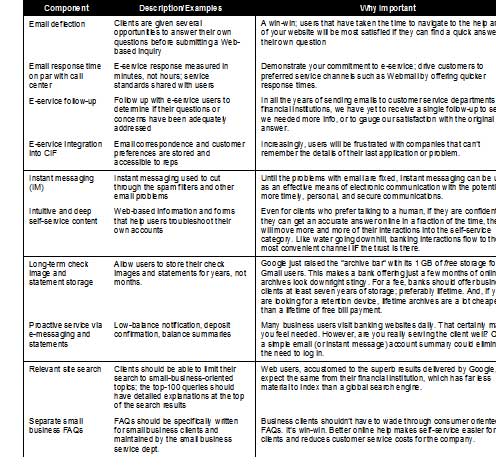

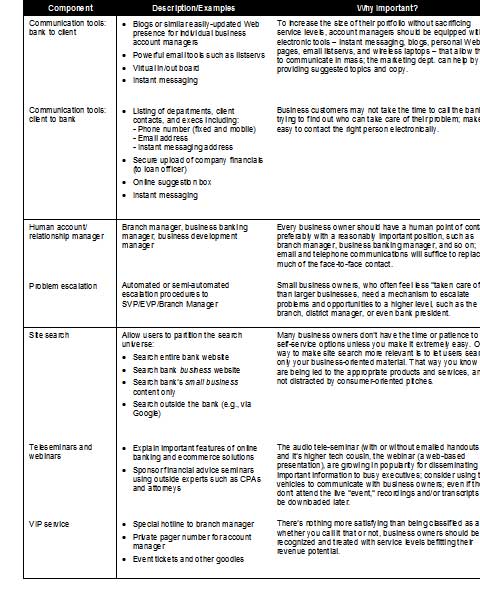

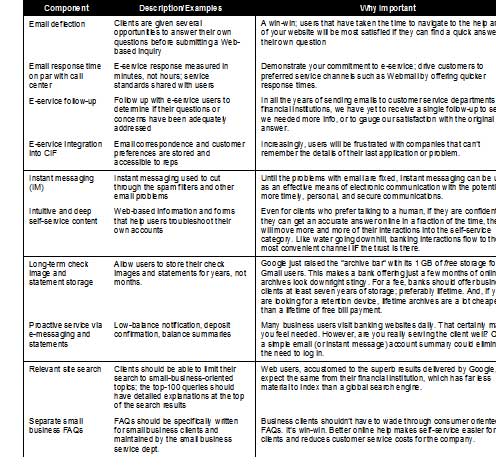

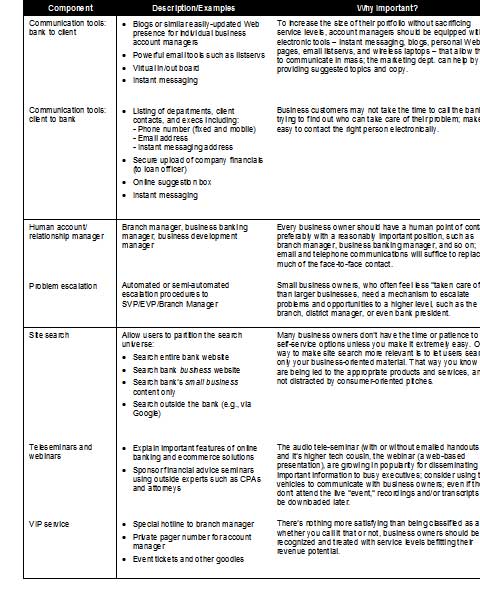

F. Service & client relations

Online services and other automation tools can be used to help

relationship managers service and cross-sell to small business clients. Used

judiciously, these tools can improve the perception of personalized service,

even while they improve the productivity of the relationship managers by

allowing him or her to handle a larger portfolio. Key components include (see

Table 42 below for more):

- Library of recommended preformatted emails that relationship

managers can easily customize and send to clients

- Private-banking-like service that treats small business owners

like VIPs

- Instant messaging for more private/secure connection between

the client and their business banking officer

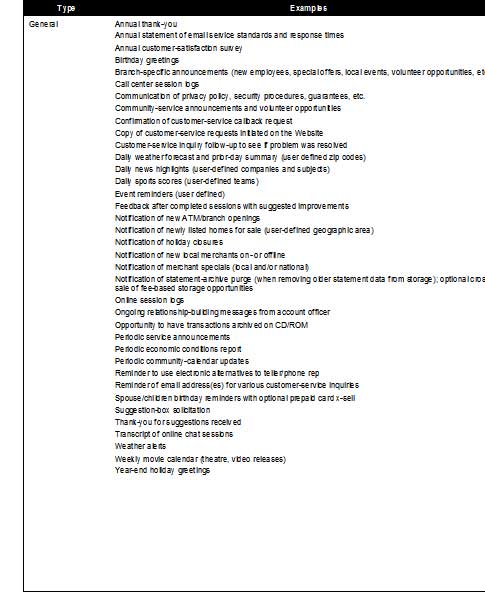

Table 42

Online Features for Self-Service

Table 43

Online Features for Client Relations

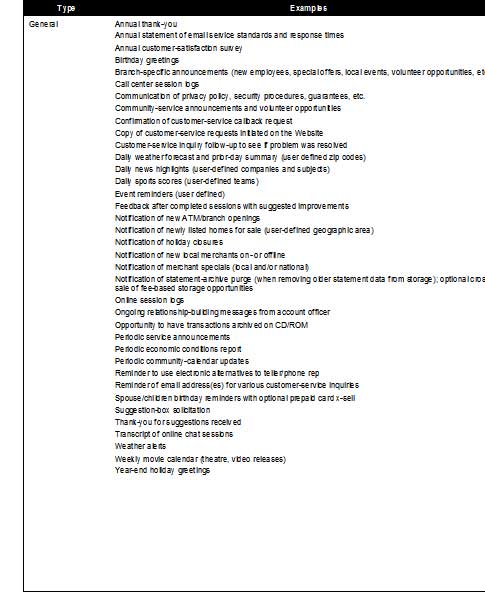

Table 44

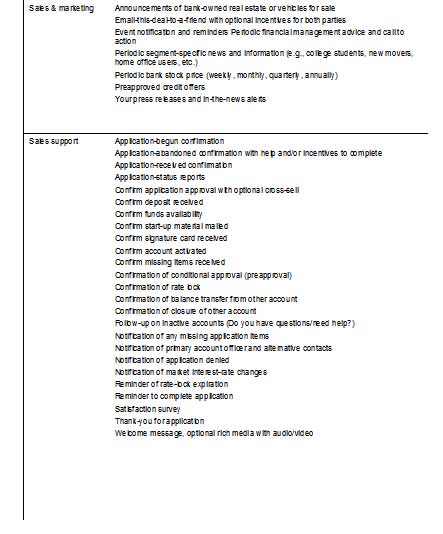

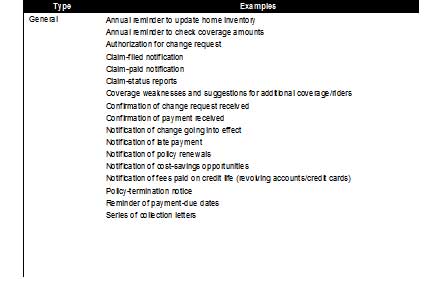

General E-messaging to Support Client Relationship Management

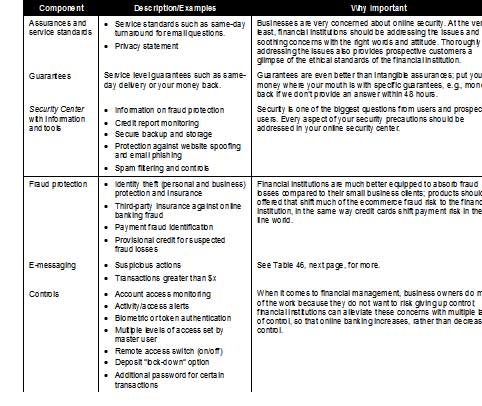

G. Security and privacy

Although business users may understand the tradeoff between convenience

and risk, the stakes are much higher. A breached small business bank account

could cause thousands of dollars of lost productivity and sales, in addition

to any funds that disappear. In addition, larger small businesses are always

up against the threat of insider theft and fraud. So business owners need,

expect, and will pay for more sophisticated security controls. For example:

- Additional authentication and/or authorization for outbound

funds transfers or payments

- Token- or SMS-based authorization to access the account’s

master level where new payees can be added, permissions can be granted, and

so on

- Frequent email messages tracking online account access and

alerting the business owner to any suspicious or out-of-character usage,

e.g., login from an IP address in Liberia

- Comprehensive assurances and guarantees that accounts will not

be compromised

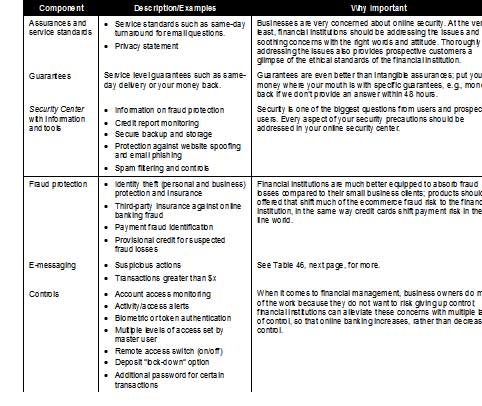

Table 45

Online Features for Security & Privacy

Table 46

E-messaging to Support Security & Privacy

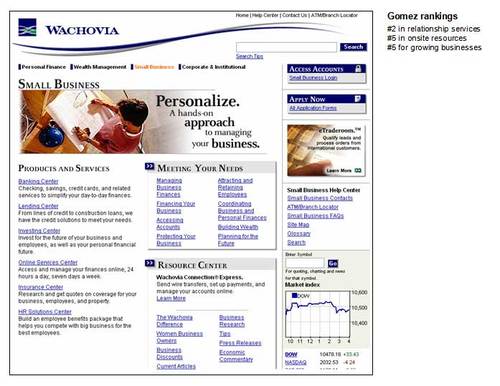

H. General website content/features

As branches are gradually replaced by websites as the place where most

banking business is conducted, your online presence will become a critical

part of your overall brand image. Branches will still have a role, but it

will be limited to account openings, cash deposits, and the occasional visit

to the safe deposit box. Websites catering to small businesses will become

far more sophisticated, yet highly customizable and easier to use. Important

features include:

- Resources and discounted banking packages for start-up

businesses

- Separate URL that business clients can enter to skip the

consumer section

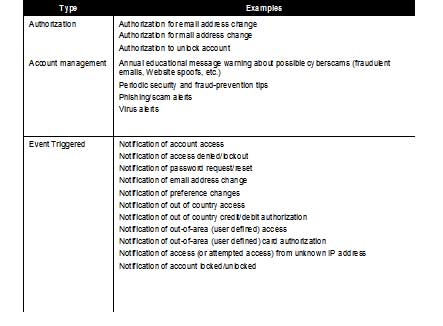

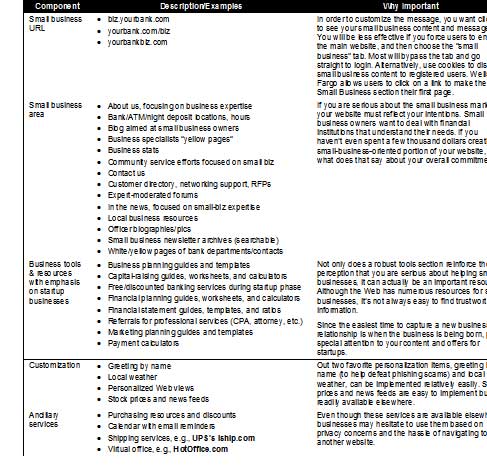

Table 47

General Website Features to Support Small Business

I. Insurance

Compared to consumers, small businesses buy a lot of insurance compared

to consumers. While banks may not be “top of mind” when it comes to

supplying insurance, financial institutions can use their online presence to

change that perception.

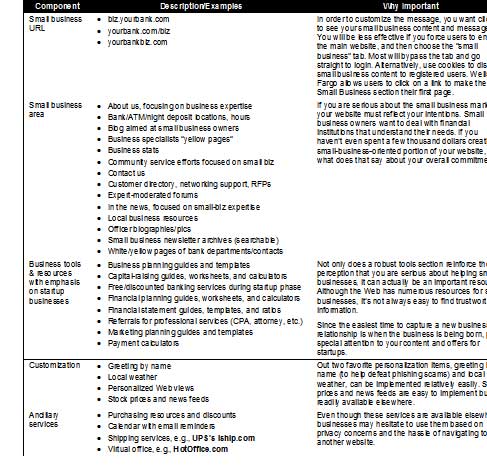

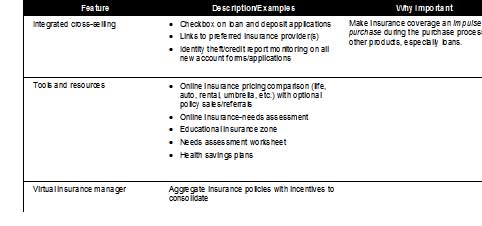

Table 48

Online Features for Insurance

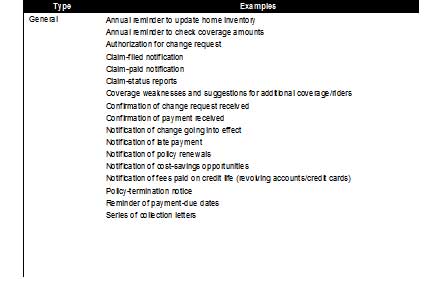

Table 49

E-messaging to Support Insurance

J. Online sales and marketing

Even though microbusinesses are difficult to reach through traditional

direct marketing, we believe they will readily seek you out if you provide

credit and payment solutions targeted specifically to them, especially when

in startup mode.

It’s important to make sure everyone, especially the line staff,

understands that microbusinesses are to be actively courted, not avoided.

Typically, bankers roll their eyes and trot out horror stories about past

“nightmares” with flaky microbusinesses. Staff must be educated to the

facts: Microbusinesses can be risky, but with proper pricing and risk

management, the segment provides an excellent source of incremental profits.

In sales efforts, leverage the cachet of the branch manager. A single

telephone call or visit with the local branch manager could be enough to

land an entire microbusiness account. This all-important relationship with a

human must be nurtured after the initial sale. Email, instant messaging, and

other electronic tools can be effective in keeping the communication

channels open.

Some other effective ways to increase your share of the microbusiness

market:

- Uncover microbusinesses within your own retail customer base by

looking for random and fluctuating deposit activity.

- Develop Web content

that caters directly to the small business segments you are targeting, such

as

- – Part-time businesses

- – Self-employed (including full-time sales) or 1-person business

- – Micro employers with fewer than 5 employees

- Use professional copywriters familiar with small business

terminology to create website copy, including FAQs.

- Give business bankers “ownership” of the business part of your

Web site to make sure it is up-to-date and speaks to the target markets.

- Enlist business owners to evaluate your website and other

marketing material

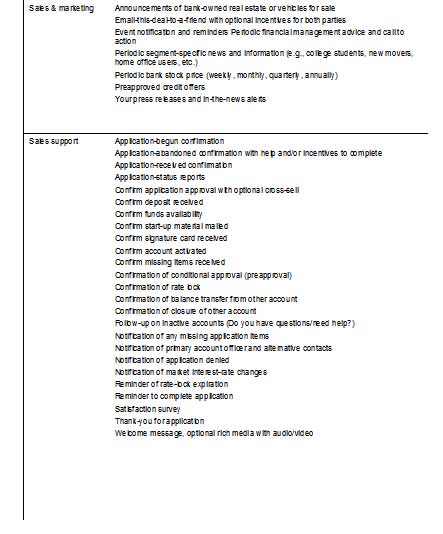

Table 50

Online Marketing & Sales Tactics for Small Business Acquisition and

Retention

Table 51

E-messaging to Support Small Business Sales & Marketing