Each year, in the weeks leading up to our fintech conferences, we take the time to highlight those companies that have demonstrated their innovations on the Finovate stage, and then gone on to raise significant funding, sign partnerships with impressive new customers, merge with tech/fintech leaders, or achieve other major wins.

We recently shared seven stories from alums of Finovate’s annual autumn event – FinovateFall – which kicks off this year on September 13th and runs through September 15th. We’ll continue exploring them here, in addition to looking at both returning alum all-stars and new companies hoping to make big fintech headlines in the future.

Last week’s list dated back to Finovate’s debut in 2007, when Yodlee joined 19 companies on stage at our inaugural fintech conference. Yodlee continued on to dominate the data aggregation and analytics space, as well as share product launches and updates at Finovate conferences annually. In 2015, Envestnet acquired Yodlee for a whopping $660 million.

The founders of POS platform Shopkeep started their incredible journey at FinovateFall 2012, rounding it out with an acquisition by Lightspeed for $440 million in 2020.

Malauzai — first demoing its digital banking platform in September 2014 — capped off four years of demos with an acquisition by fellow Finovate alum Finastra in 2018. FlexScore, also appearing in 2014, was snapped up by United Capital Financial Advisors in early 2016 for its gamified financial planning platform.

Since first demoing in 2015 as SaleMove, Glia continues to break ground with ten Best of Show wins, $98 million in funding, and massive improvements to customer experience.

And more recently, Eigen Technologies, which specializes in data extraction and business intelligence, raised $37 million in Series B funding just two months after debuting in September 2019. Monit, a mobile, predictive cashflow and financial optimization platform, raised $5.2 million in equity financing this April after winning Best of Show last September.

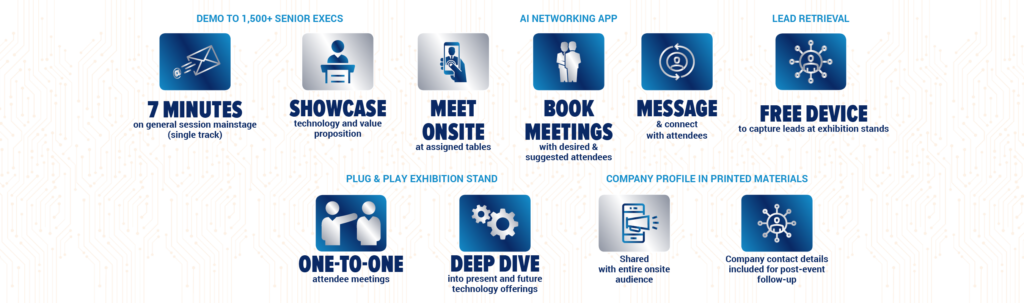

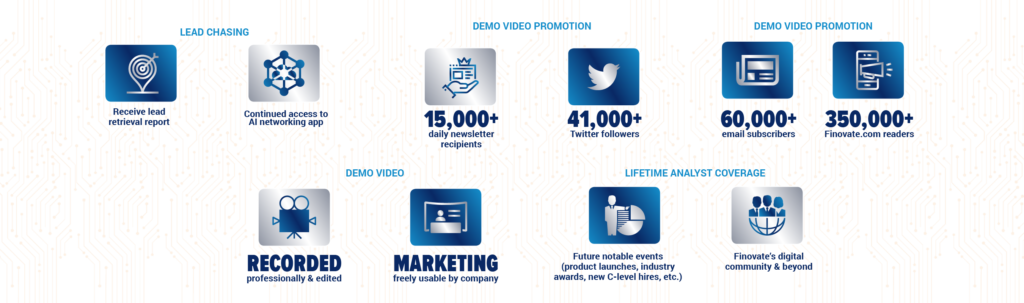

With Finovate’s return to New York this fall, these next few stories feature companies you’ll see on September 13th and 14th. If you can’t attend in person, join digitally to make sure you’re part of the moments that matter.

Ultimately, Finovate events are about creating moments that matter – in a few short minutes, companies can go from obscurity to fame, from two customers to 20, from a small Series A to a huge Series B, from promising startup to full-fledged unicorn.

Greg Palmer, VP Strategy, Finovate

Backbase debuted at FinovateFall 2009. Shortly after its demo, the company opened offices in New York; signed bank partners across Europe, North America, and beyond; earned several Best of Show awards; and grew to be the fintech giant we know today. Backbase will demo its North American offering next month.

Vymo, a 2018 alum, raised an impressive $18 million in Series B funding in June 2019. The company is back on stage this fall with its sales acceleration platform.

Based in New York City, Instnt made its Finovate debut in 2019 with its customer onboarding solution for businesses. The company began 2020 by raising $2.9 million in seed funding and ended the year partnering with phone intelligence technology company Prove.

And after their September 2019 demo, Breach Clarity agreed to be acquired by Sontiq the following spring. Next month at FinovateFall, the company will debut BreachIQ, a solution to protect the financial health of FIs and the consumers they serve.

Each year, companies aspire to follow in the footsteps of these and other alums that have made a huge impact in the fintech space. Here are some new companies representing the FinovateFall 2021 demo roster that are hoping to make headlines:

- Amplify‘s digital platform provides accessible, transparent, and convenient permanent life insurance products for Millennial and Gen Z consumers using an intelligent customer journey and instant underwriting capabilities.

- ASA‘s scalable platform removes all barriers to entry allowing unlimited partnerships between financial institutions and fintechs using an access controller for secure transactions.

- Atomic FI‘s payroll APIs supply financial service providers with better direct deposit services.

- BANYAN‘s global interchange for SKU-level receipt data allows consumers to connect their receipts to any app in a secure, safe and anonymized way.

- Berbix‘s ID validation solution utilizes machine learning and AI data-driven technology to reduce the friction and fraud in new account creation for fintechs that need to onboard new users online.

- Ellenby‘s end-to-end cash deposit accountability system allows financial institutions to efficiently manage frequent cash deposits by businesses using its Validating Smart Transport Bag (VSTB).

- Long Game‘s gamified finance app helps banks acquire new customers and increases engagement with their current customers in the Millenial and Gen Z demographics.

- Perch‘s free app tears down the barriers of the current credit system by reporting alternative data such as rent and subscription payments to build the credit of the underbanked.

- Posh‘s Conversational Interactive Voice Response technology targets the inefficiencies and expenses within financial institution contact centers using cutting-edge machine learning and natural language processing.

- Railz‘s single API connects to major accounting and ERP software and targets complicated and unstandardized SMB financial data using data normalization and insights for financial institutions.

- Sequretek simplifies cybersecurity for the financial service industry by offering a single AI-based solution for complete enterprise security.

- Soul Machines‘ Digital People humanize and personalize each engagement and offer rich and emotionally interactive experiences for banking and financial service customers.

- SpecTrust‘s no-code risk platform minimizes high costs and slow turnaround time to deploy solutions that help risk investigators, strategists, and engineering teams identify risk, orchestrate signals, and take mitigating actions.

- UNest‘s mobile application democratizes access to savings and investing solutions for parents and extended family.

- unitQ‘s quality monitoring platform is AI-enabled based on what your users say and do, so product, engineering, ops, and CX leaders at finserv companies can fix the right issues faster.

- Akouba by Velocity Solutions reduces the lengthy lending process for financial institutions using a cloud-based digital lending platform.