For Sang Lee, co-founder and CEO of DarcMatter, capital markets are one of only a few areas to have avoided disruption. Every industry has been disintermediated except for capital markets,” he explained. “No one has ‘flung open the gates’.”

Gate opening for DarcMatter means building an online, institutional-grade investment platform that gives investors transparent access to investments in venture capital, private equity, and hedge fund products.

And more than just access, DarcMatter uses a self-learning algorithm to help investors find investments that are tailored to their needs. “Recommendations shouldn’t come from intermediaries, but from your behavior,” Lee said. He said that DarcMatter is less a traditional robo-adviser and more a platform that “streamlines the process to display the opportunities that would be best.”

Company facts:

- Headquartered in New York

- Founded November 2014

- Provides $1.5 billion in alternative investment opportunities

- Supports investment minimums of $25,000

- Clients include:

- Antecedent Ventures

- Eagle’s View Capital Management

- Exbury Capital Management

- White Star Capital

- Sang Lee is CEO and founder

From left: DarcMatter founder and CEO Sang Lee and CTO Stan Solodkyy demonstrated the DarcMatter platform at FinovateSpring 2015.

How it works

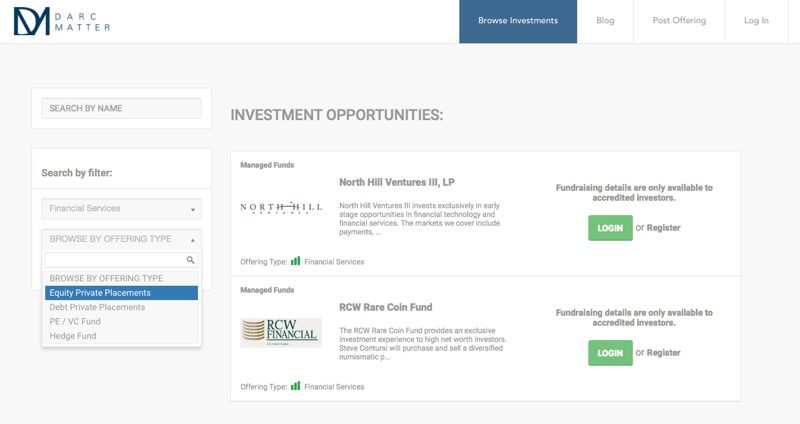

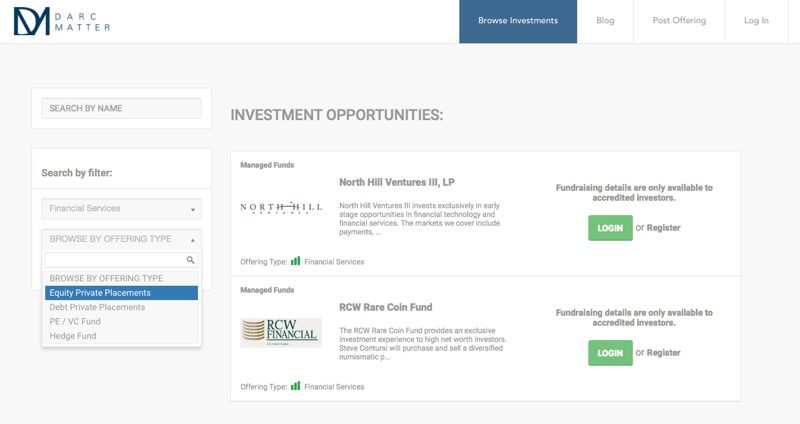

DarcMatter is currently available only to accredited investors. The kinds of investments available through the DarcMatter platform include:

- commercial debt offerings

- hedge funds

- private company equity offerings

- private equity funds

- startup offerings

- venture capital funds

How does an investor interact with the platform? Qualified investors register and log in to the platform where they see detailed information about the various investments that are available. Investors can search through the listings by industry, offering type and subtype (for example, “managed funds” and “private equity”) and region.

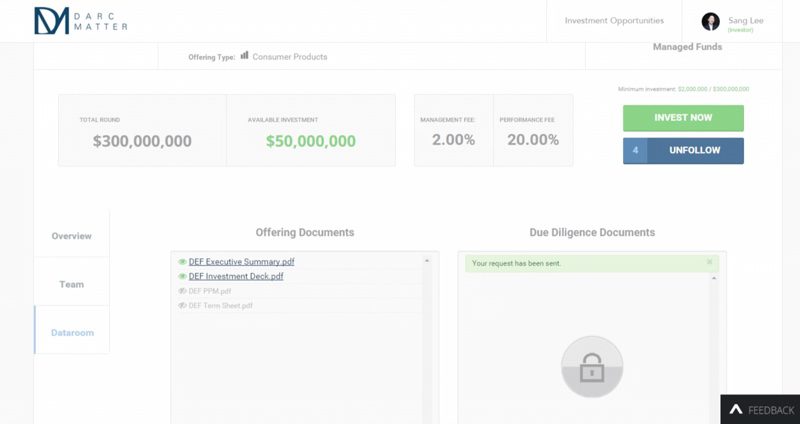

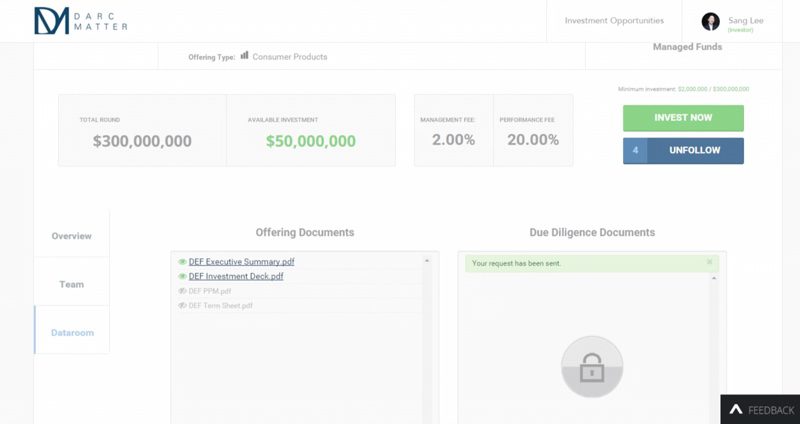

When investors find what interests them, they can dig deeper and conduct the necessary due diligence. DarcMatter provides information on everything from the capital-raise goal, amount available for investment, management and performance fees, information about the management team (including founders) and more. The platform also includes a secure data room where the owner of the offering can control access to any and all documentation.

Once the investor decides to invest in a given opportunity, DarcMatter’s “Invest Now” button allows them to seamlessly and instantly reserve his or her investment without having to leave the platform.

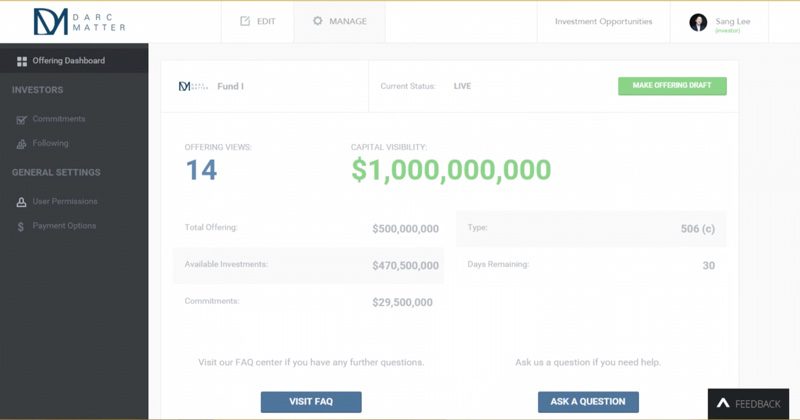

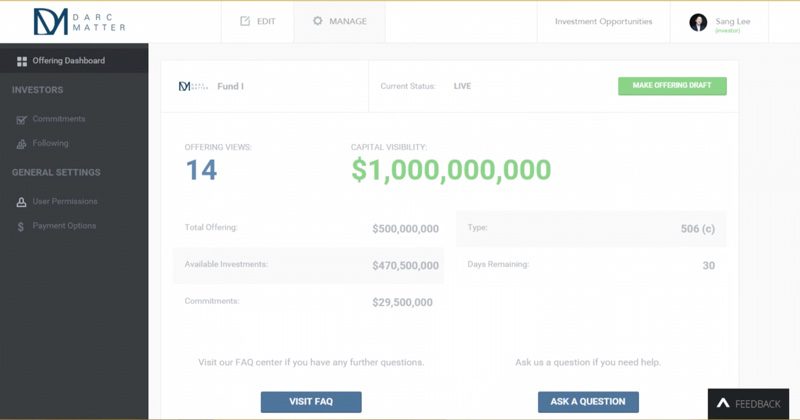

For asset managers, after a short application process, the dashboard enables them to see all the investment offerings they have listed. The dashboard shows a variety of statistics, importantly including how many people have viewed the offering, as well as the amount of capital up for investment. Owners of the offering can adjust the amount of information to be displayed, varying the privacy setting, as well as track the behavior of interested investors. They can find out which have added the offering to be tracked, which have conducted due diligence, and so on.

For DarcMatter, this represents the kind of transparency between owners of offerings and investors—particularly in cutting out the middlemen—a transparency that Lee says has helped shape other industries in fintech for the better. Investors not only benefit from the transparency of the platform, but also the opportunity to improve their portfolio diversification through investments in alternative financial products, especially those with low correlations to systematic market risk.

At the same time, DarcMatter offers asset managers a broader range of potential investors, including family offices and individual accredited investors. Capital-raising costs are lower, investor logistics easier to manage, and the platform provides fully integrated tools to ensure regulatory compliance.

The future

DarcMatter is one of the first movers in the market to make alternative investments available to investors. Lee sees it as a matter of being “at the right time with the right idea at the right place.” He credits his experience in investment banking as alerting him to the possibilities of making a difference for those interested in participating in alternative investments.

“Coming from investment banking,” Lee said, “you figure there must be a better way, a streamlined way, without middlemen.” All that was necessary was a platform to deliver the information that investors need, and the technology to make everything happen in a transparent, efficient, cost-effective and compliant way.

Lee says while it’s critical to be on the right side of regulations, he yet understands that the “biggest disruptions (will) have you running along the edge of the regulatory line.” Regulators are often confused by new, innovative ideas and technologies, Lee said, and that can actually represent an opportunity for startups. “Incumbents are often hamstrung by regulation,” he added, saying that startups can gain an edge “by develop(ing) best practices early on.”

Lee is optimistic about the future of alternative investments and the prospects for DarcMatter. “Capital markets is the last frontier in financial innovation,” he said. “It’s the hardest and biggest to move and will take the longest.” But when innovation in capital markets gets going, he added, “it will develop efficiencies like we’ve never seen.”

Check out our video of DarcMatter’s live demonstration at FinovateSpring 2015 in San Jose.

![]() ID Connect validates identity with a minimal amount of information, helping businesses increase conversions and lower abandonments. The solution auto-fills application fields and risk assesses the user in seconds. The SaaS technology can be combined with ID Connect Photo, which uses a government-issued ID card to populate fields.

ID Connect validates identity with a minimal amount of information, helping businesses increase conversions and lower abandonments. The solution auto-fills application fields and risk assesses the user in seconds. The SaaS technology can be combined with ID Connect Photo, which uses a government-issued ID card to populate fields. Payfone Signature is a deterministic, trusted mobile identity that, according to the company, “cannot be forged, cloned, spoofed, or hacked.” The technology uses data from the mobile network operator level to “permanently bind, verify, and subscribe” mobile identity at the account level. The result is what Payfone calls “a persistent mobile ID.” Identity Certainty leverages the Signature technology to provide organizations with the ability to provide seamless yet secure access to sensitive business information.

Payfone Signature is a deterministic, trusted mobile identity that, according to the company, “cannot be forged, cloned, spoofed, or hacked.” The technology uses data from the mobile network operator level to “permanently bind, verify, and subscribe” mobile identity at the account level. The result is what Payfone calls “a persistent mobile ID.” Identity Certainty leverages the Signature technology to provide organizations with the ability to provide seamless yet secure access to sensitive business information.